Contents

Crypto Inheritance: Roundup - February 2025

Vault12’s monthly update on regs, the industry, and crypto inheritance management.

- Regs Update

- Vault12 Guard Product Updates

- Industry Updates

- New to Inheritance? Start here.

Regs Update

The SEC Crypto Task Force has spoken. In a posted statement, Commissioner Hester Peirce revealed her priorities for the immediate upcoming Task Force work.

Our analysis here focuses on how this work affects Vault12.

The first thing to note is that no regulations or laws have changed (other than rescinding the controversial SEC Bulletin SAB 121, which now enables Banks to conduct crypto custody). Until SEC policies actually change, or new bills are written and submitted to Congress, or pending lawsuits are finalised, everything that happens is simply directional, with no mandates. Therefore, companies must be careful to avoid straying into grey territory and potentially creating legal jeopardy - especially this close to the finishing line.

Let’s look at the top three key items:

- Security Status: This is a fundamental item of policy that needs clarification, and everything else will hang off the definitions used here. Are crypto tokens issued by software developers utilities, or are they securities?

- Coin and Token Offerings. What happens if, out of an abundance of caution (and lack of clarity), a token was issued as a security but in fact is used as a utility token? This was the subject of Commissioner Peirce’s “Safe Harbour 2.0” initiative under the previous administration.

- Special Purpose Broker Dealer: Under the last administration, the definition of “broker-dealer” was expanded, leading to a fundamental conflict with crypto trading platforms: centralised exchanges, decentralized exchanges (DEXs), smart contracts, etc. This expanded definition is misguided and unworkable, and currently the subject of active legal proceedings. These lawsuits needs to be settled so that the industry can get on with innovating and releasing financial products.

Once these items are sorted out, crypto companies will be free to conduct their business and have their tokens freely trading.

With the 2024 election behind us, this year is pivotal for #crypto policy and innovation. That's why I'm excited to take the stage at DC Blockchain Summit 2025 on March 26! Join top regulators, policymakers, and industry leaders as we discuss what's next for blockchain and digital assets in this new era.

Don't miss your chance to be part of the conversation driving a better tomorrow! https://bit.ly/DCB25 Discount Code:VAULT1220

Vault12 Guard Product Updates

We are excited to announce that Release 2.6.0 is coming soon:

- Now on Mac and iPad – Full official support through the App Store.

- Drag and drop on Mac – Instantly add assets to your Vault with a simple gesture.

- Smoother navigation – A refreshed Dashboard with a smarter layout helps you find what you need faster.

- Expanded search for more crypto wallets – Now compatible with 20+ more wallets.

- Enhanced Address Explorer – Now supports all major Bitcoin address formats, such as Segwit and Taproot.

- Performance improvements – Faster, smoother, and more reliable than ever.

Industry Updates

Earlier this month, we saw the Presidents’s Crypto and AI Czar, David Sacks, hold the first Crypto Press conference. In attendance were industry leaders and politicians — most of whom were affiliated with the CFTC through their committee assignments.

This has sparked rumours that any cryptocurrency not deemed a security will fall under the jurisdiction of the CFTC — a marked change. This is a simply a rumour at this stage.

The highlights of the conference were:

- Keeping crypto innovation onshore to ensure crypto innovation in financial technology keeps the US ahead.

- Formation of a bipartisan and bicameral working group to drive new legislation across SEC and CFTC.

- The role of stablecoins ensuring dominance of the US dollar, including a new bill with well-defined regulations bringing much-needed clarity to industry participants.

New to Crypto Inheritance? Start here

Have you been tracking a 2025 New Years resolution to get more organized with your digital life? If yes, then you are probably using a password manager to keep track of your passwords.

But hopefully you're not storing your digital wallet seed phrase in your password manager! And where are you storing the password to your password manager? It might be time for you to consider using a Digital Vault.

Are you growing more concerned about your online privacy? Is it possible for you to keep track of which third parties are giving others access to your data ... including data stored in encrypted Clouds? A new UK push for access to Apple iCloud data is leading even more people to think about how to protect their online privacy.

Crypto Inheritance: Roundup - February 2025

Vault12’s monthly update on regs, the industry, and crypto inheritance management.

Wasim Ahmad

Wasim is a serial entrepreneur and an advisor in the fields of AI, blockchain, cryptocurrency, and encryption solutions. At Vault12, the pioneer of crypto inheritance, he led the private and public fundraising efforts and focuses today on expanding the Vault12 ecosystem. His crypto experience began with AlphaPoint, where he worked with the founding team to launch the world's first crypto trading exchanges. Previously he was a founding member of Voltage Security, a spinout from Stanford University, that launched Identity-Based Encryption (IBE), a breakthrough in Public Key Cryptography, and pioneered the use of sophisticated data encryption to protect sensitive data across the world's payment systems. Wasim serves on the board of non-profit, StartOut, and is a Seedcamp and WeWork Labs global mentor.

Wasim graduated with a Bachelor of Science in Physics and French from the University of Sussex.

You will lose your Bitcoin and other crypto when you die...

...unless you set up Crypto Inheritance Management today.

It's simple — if you don't worry about crypto inheritance, nobody else will — not your software or hardware wallet vendors, not your exchanges, and not your wealth managers. So it's up to you to think about how to protect the generational wealth you have created, and reduce the risks around passing that crypto wealth on to your family and heirs. What are the challenges with crypto inheritance?

- Crypto Wallets are difficult to use and do not offer crypto inheritance management. In fact, most of them tell you to write down your seed phrase on a piece of paper, which is practically useless.

- Some people back up their wallet seed phrases or private keys on paper, local devices like hardware wallets or USBs, or in the cloud. All of these options have severe drawbacks that range from hacking to accidental loss to disrupted cloud services.

- Software wallets operate onspecific blockchains, yet your crypto assets span multiple blockchains. For inheritance to work, you must be able to manage inheritance across every blockchain — now and forever.

Crypto Inheritance Management: Secure, Self-Custody Crypto Inheritance and Backup

Vault12 is the pioneer in Crypto Inheritance Management, offering a simple yet powerful way to designate a legacy contact and pass on your crypto assets—like Bitcoin (BTC), Ethereum (ETH) and Solana (SOL) —to future generations. Built for everyday users yet robust enough for the most seasoned crypto enthusiasts, Vault12 Guard ensures your wallet seed phrases and private keys are preserved in a fully self-sovereign manner, across all Blockchains.

At the heart of Vault12 Guard is quantum-resistant cryptography and a decentralized, peer-to-peer network of trusted Guardians. Your critical information is never stored in the cloud, on Vault12 servers, or even on local devices—dramatically reducing the risk of a single point of failure. By fusing a powerful software layer with the Secure Element of iOS devices (Secure Enclave) and Google devices (Strongbox), Vault12 Guard locks down your private keys against present and future threats.

Our innovative approach harnesses social recovery, enabling you to appoint one or more trusted individuals or mobile devices as Guardians. These Guardians collectively safeguard your protected seed phrases in a decentralized digital Vault—so there’s no need for constant lawyer updates or bulky paperwork. Should the unexpected happen, your chosen legacy contact can seamlessly inherit your crypto assets without compromising your privacy or security.

Preserve your digital wealth for generations to come with Vault12 Guard—the simplest, most secure way to manage crypto inheritance and backup.

Take the first step and back up your crypto wallets.

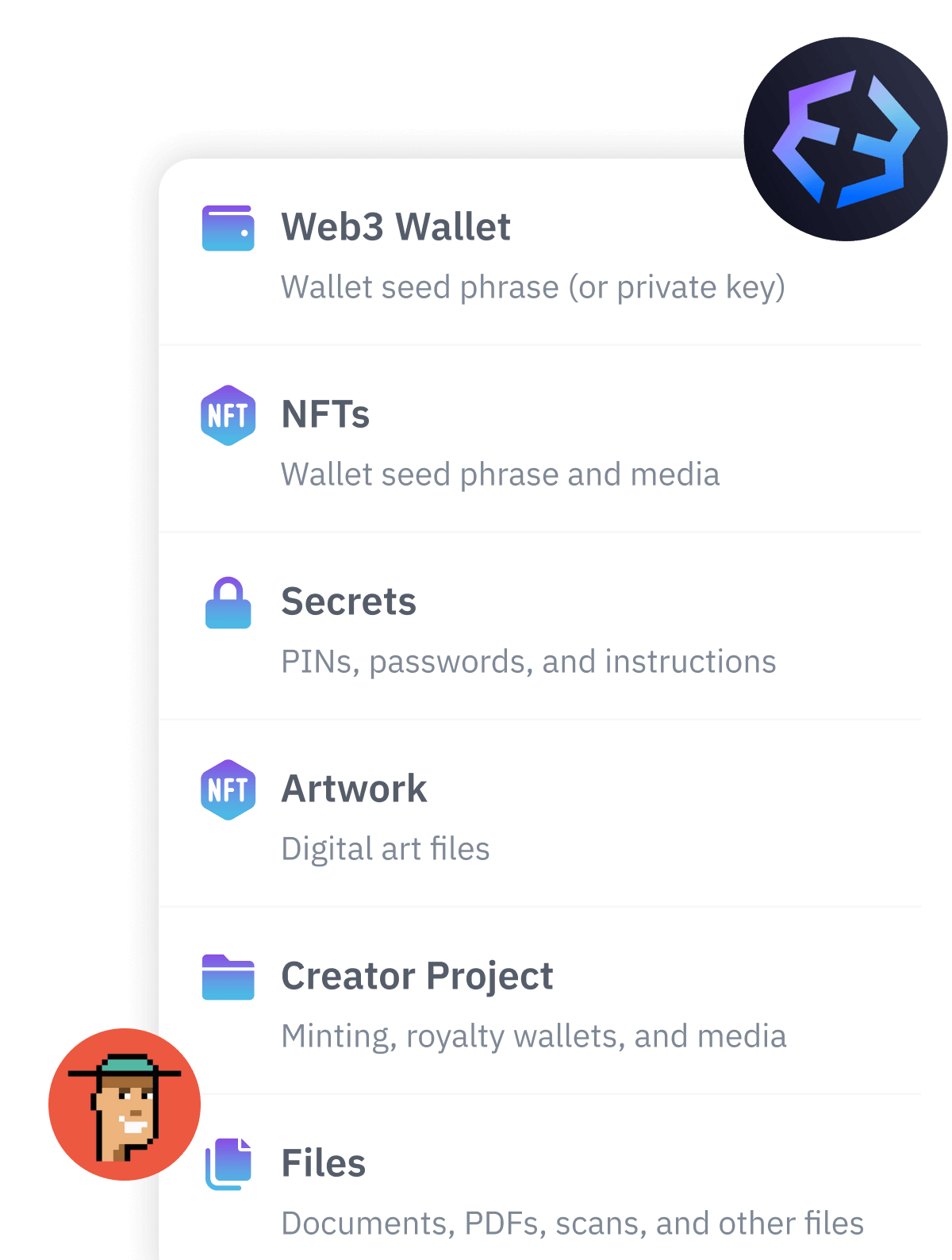

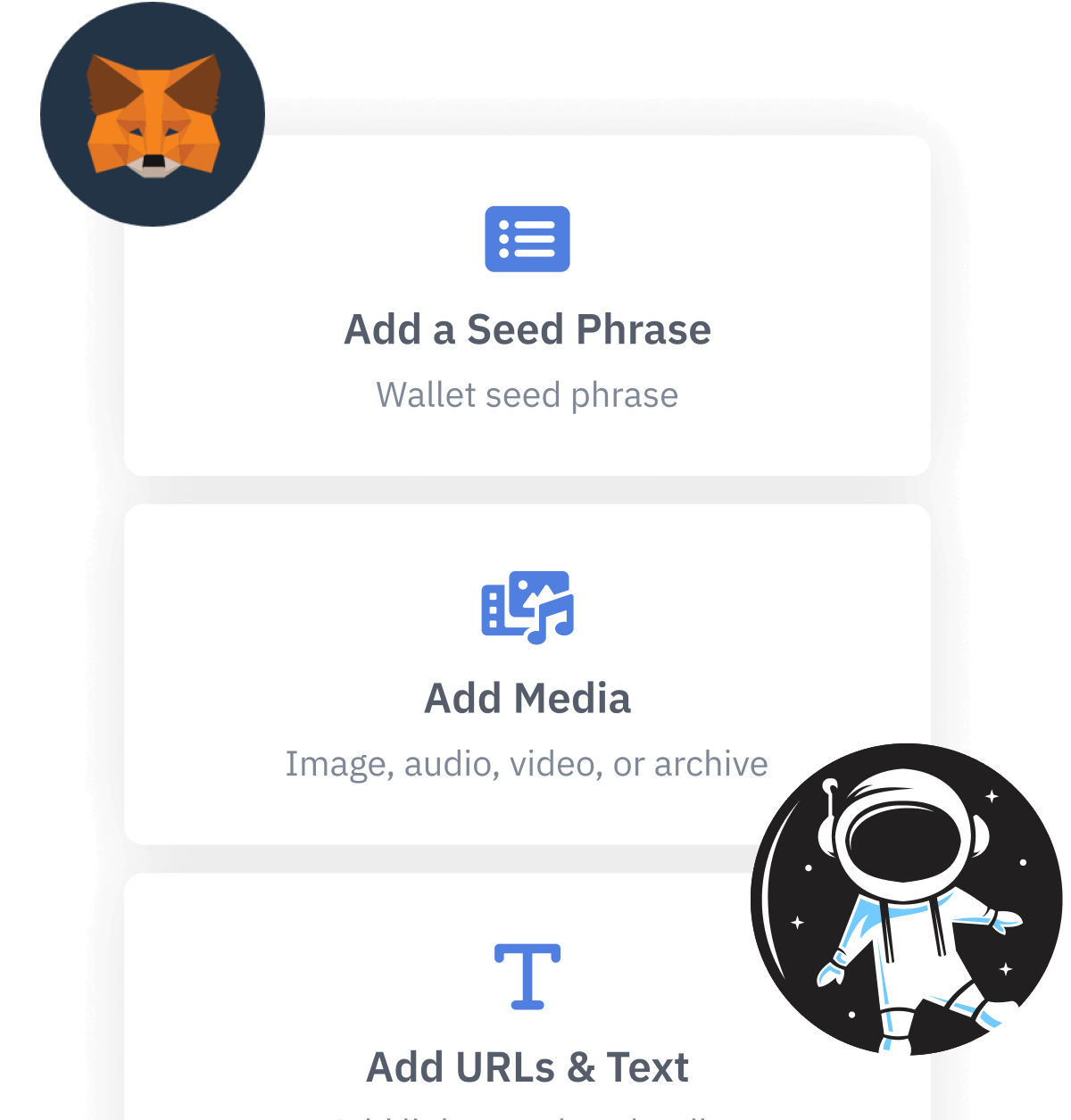

Designed to be used alongside traditional hardware and software crypto wallets, Vault12 Guard helps cryptocurrency owners back up their wallet seed phrases and private keys (assets) without storing anything in the cloud, or in any single location. This increases protection and decreases the risk of loss.

The first step in crypto Inheritance Management is making sure you have an up-to-date backup.

The Vault12 Guard app enables secure decentralized backups, and provides inheritance for all your seed phrases and private keys across any blockchain, including Bitcoin, Ethereum, and others, and for any crypto wallet.

Note: For anyone unfamiliar with cryptocurrencies, Vault12 refers to wallet seed phrases and private keys as assets, crypto assets, and digital assets. The Vault12 Guard app includes a software wallet that works alongside your Digital Vault. The primary purpose of this is to guard your Bitcoin (BTC) and Ethereum (ETH) wallet seed phrases, private keys, and other essential data, now and for future generations.