DC Blockchain Summit | The Mindset of Retail Investors

Presented at DC Blockchain Summit 2025 in Washington D.C.

🎙 Featured Panelists:U.S. Rep. Shri Thanedar, Andrew McCormick, eToro, Tarek Mansour, Kalshi

Moderated by: Wasim Ahmad: Wasim Ahmad, Vault12

Livestream: livestream

Youtube: https://www.youtube.com/@TheDigitalChamber/videos

*** Special Offer for Podcast listeners ***

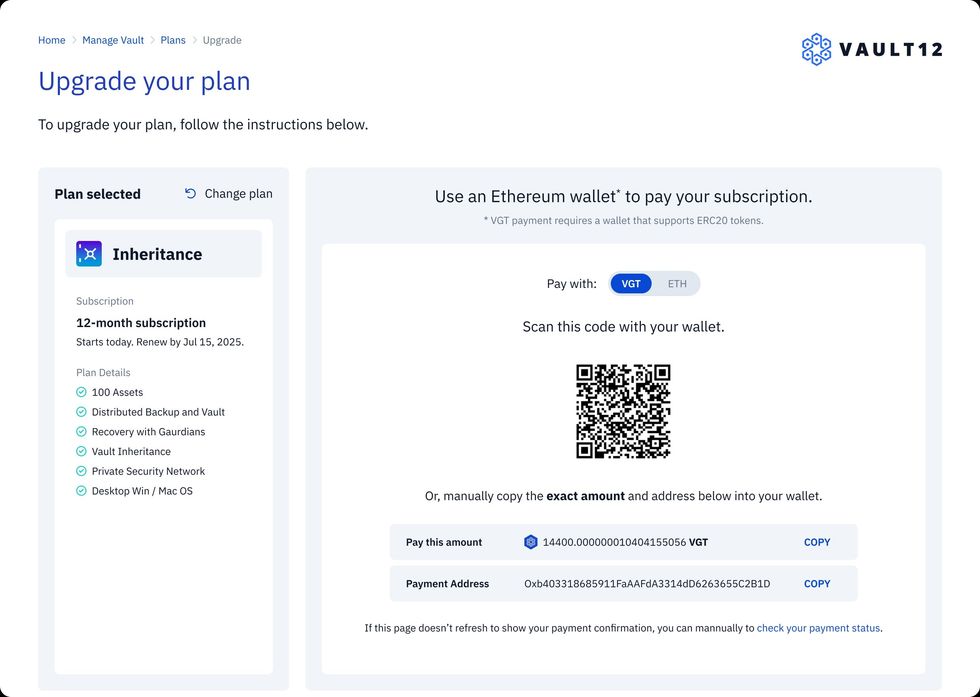

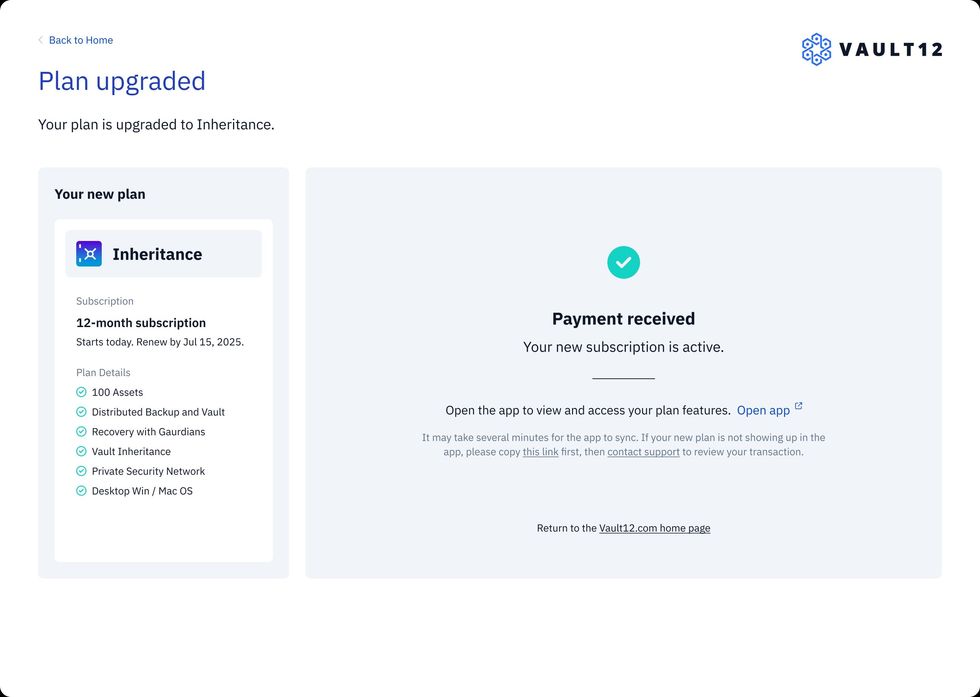

Promo codes for Vault12 Guard

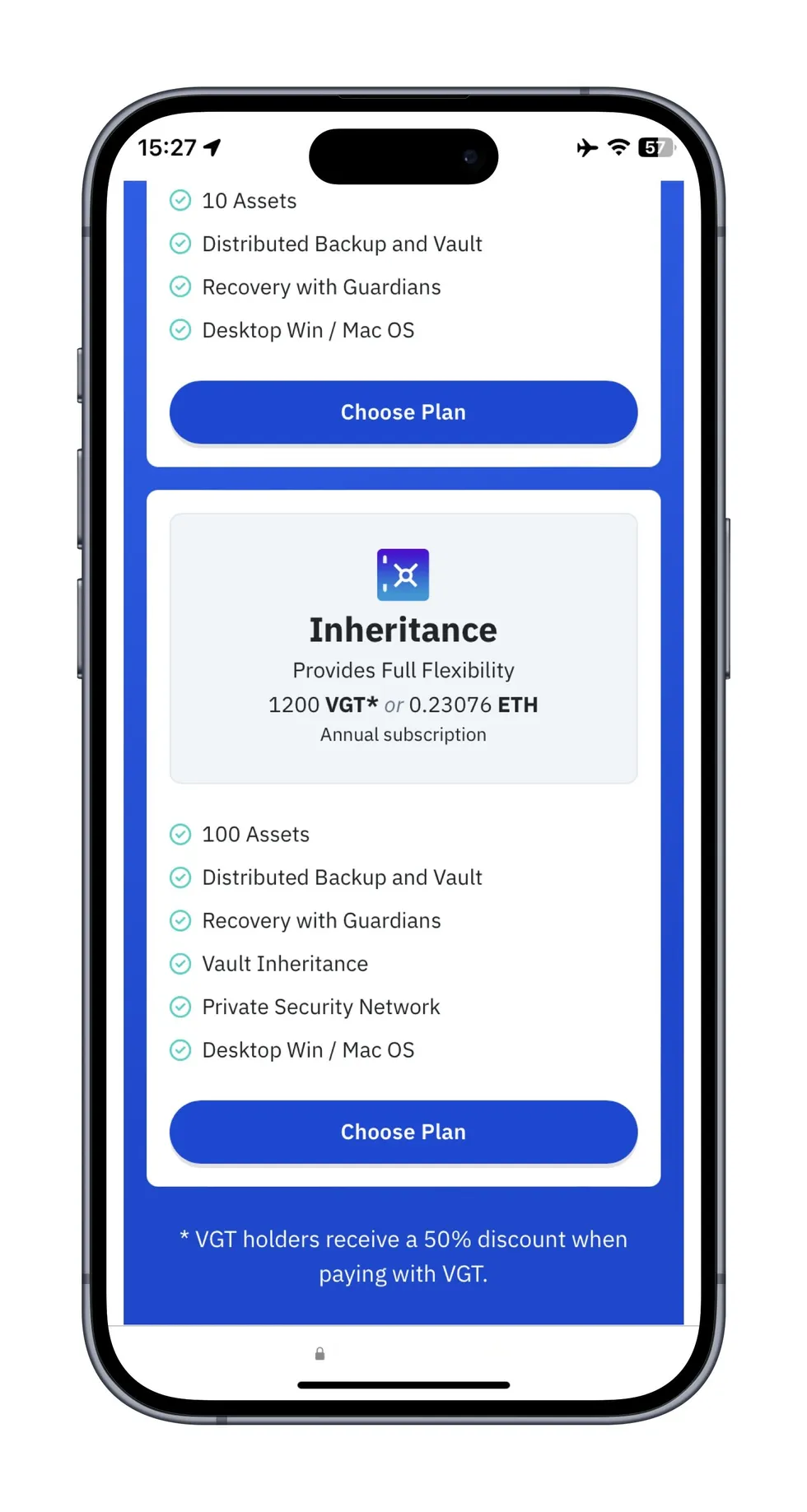

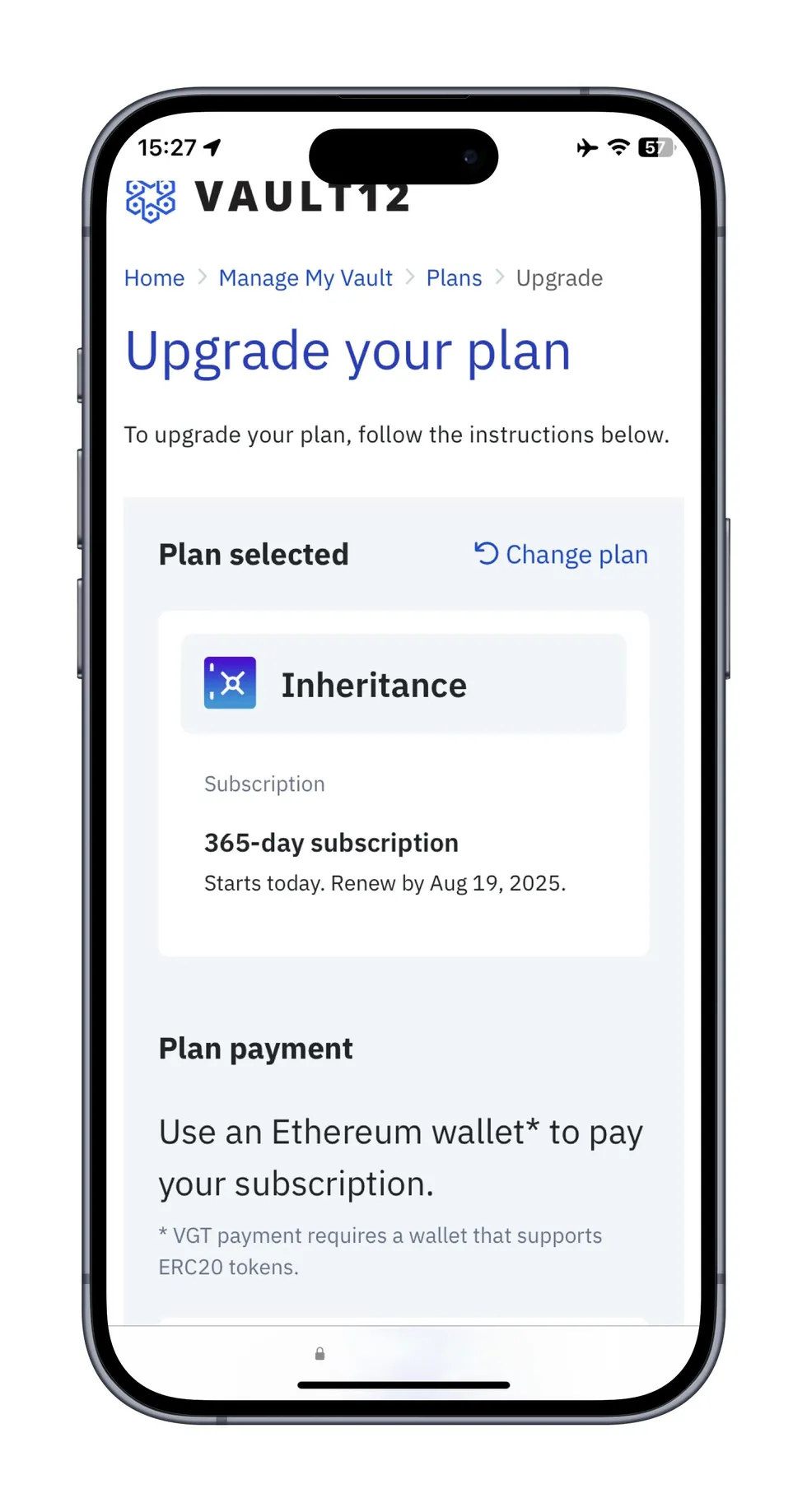

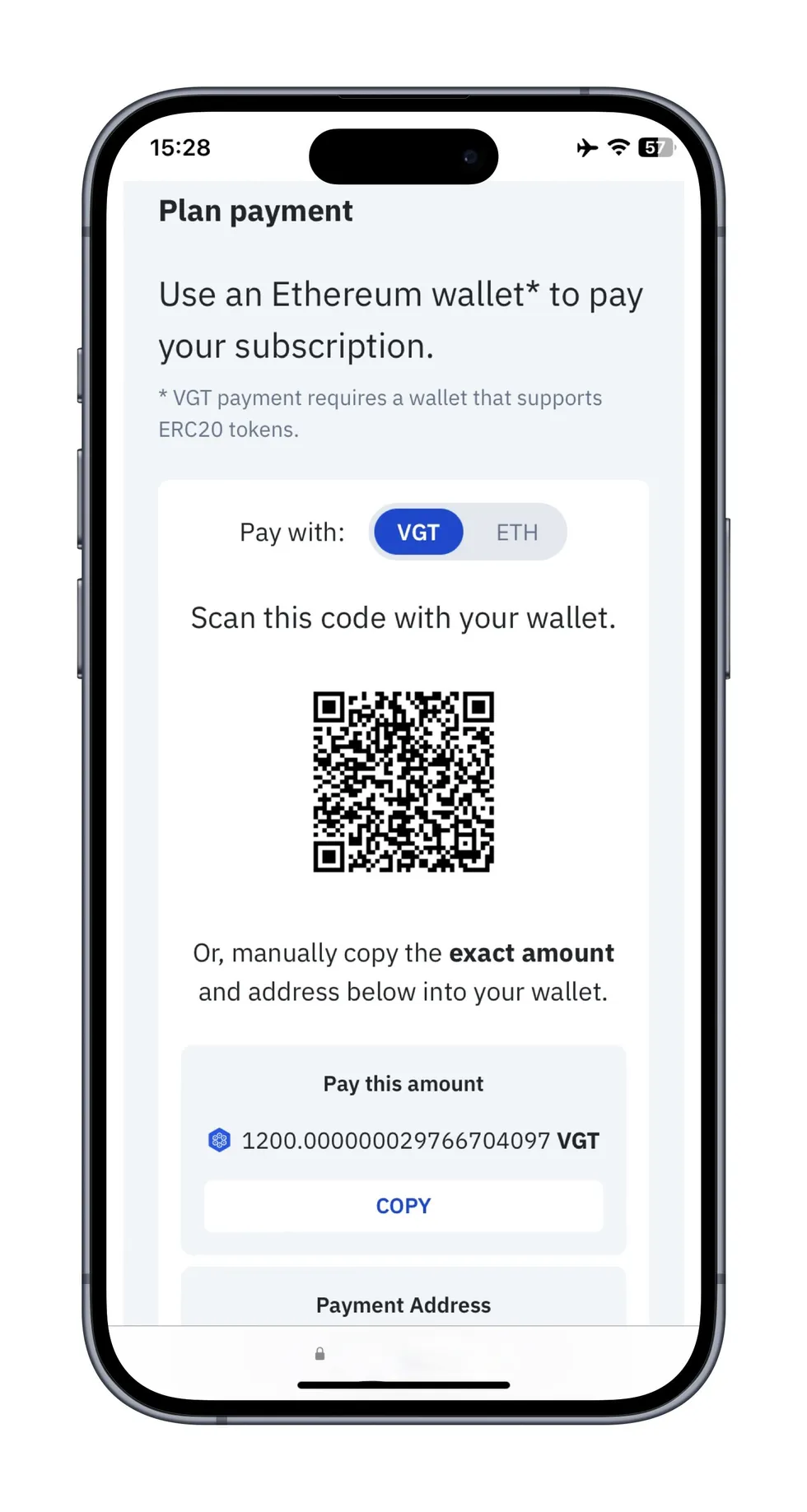

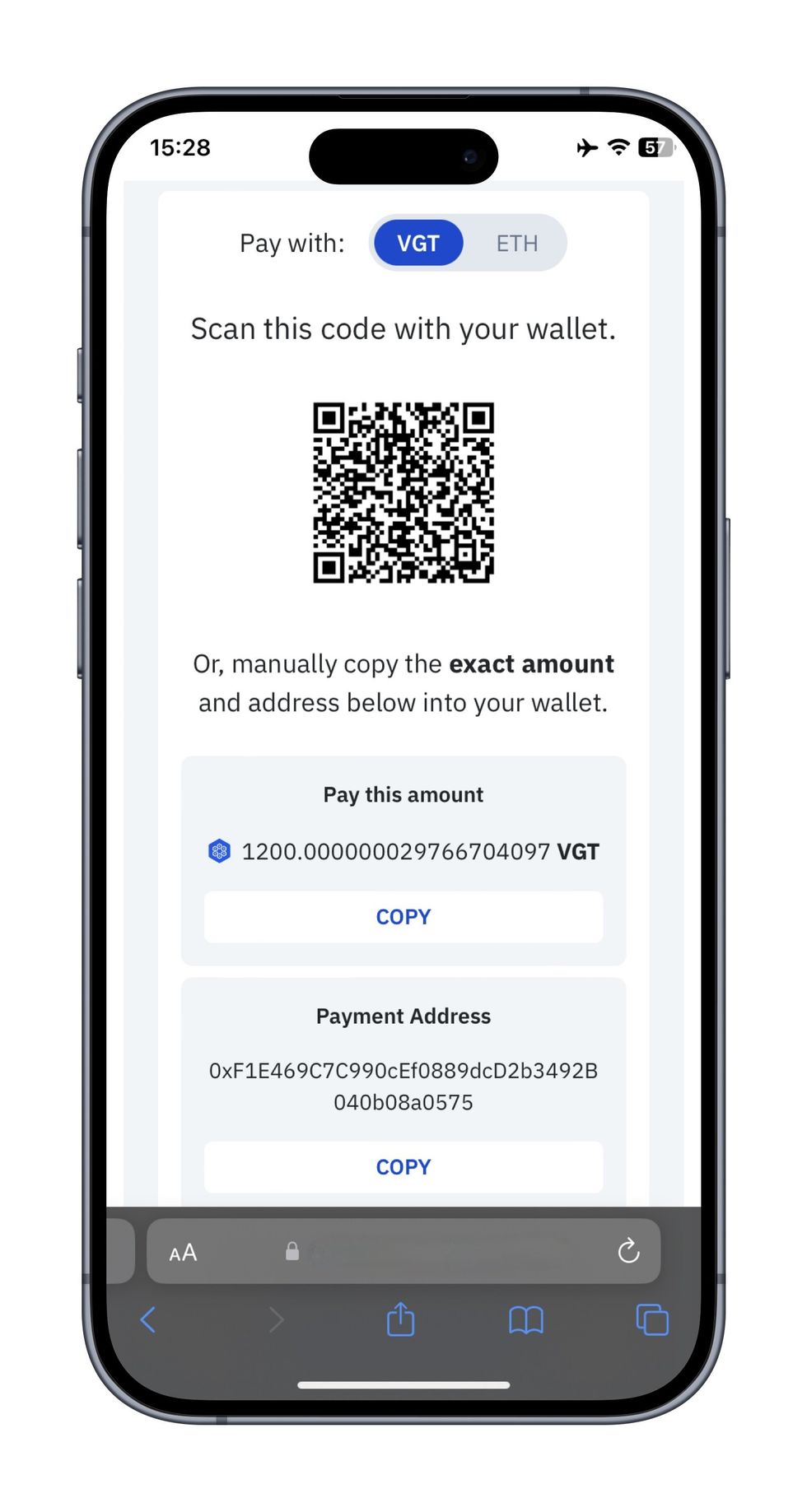

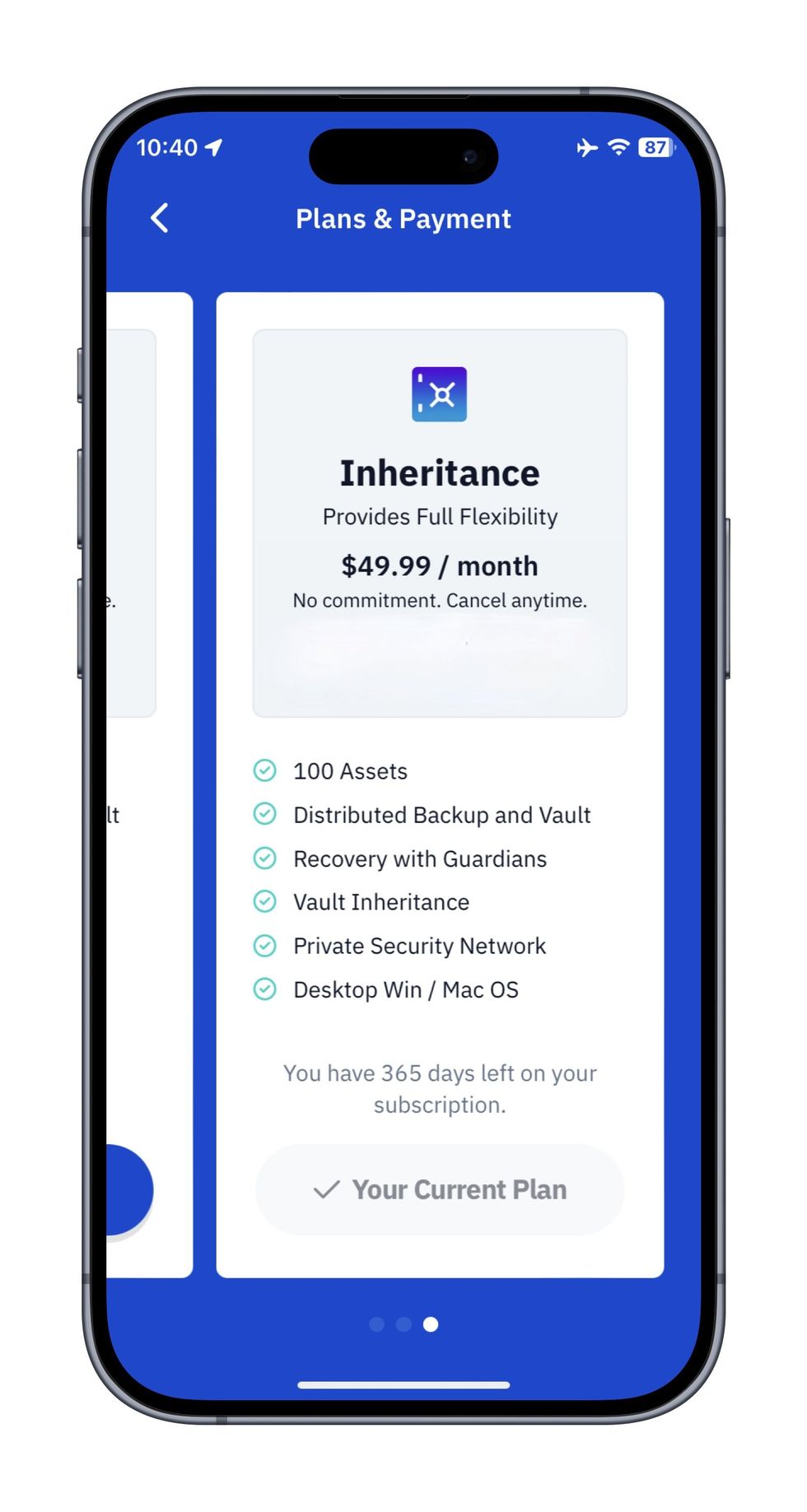

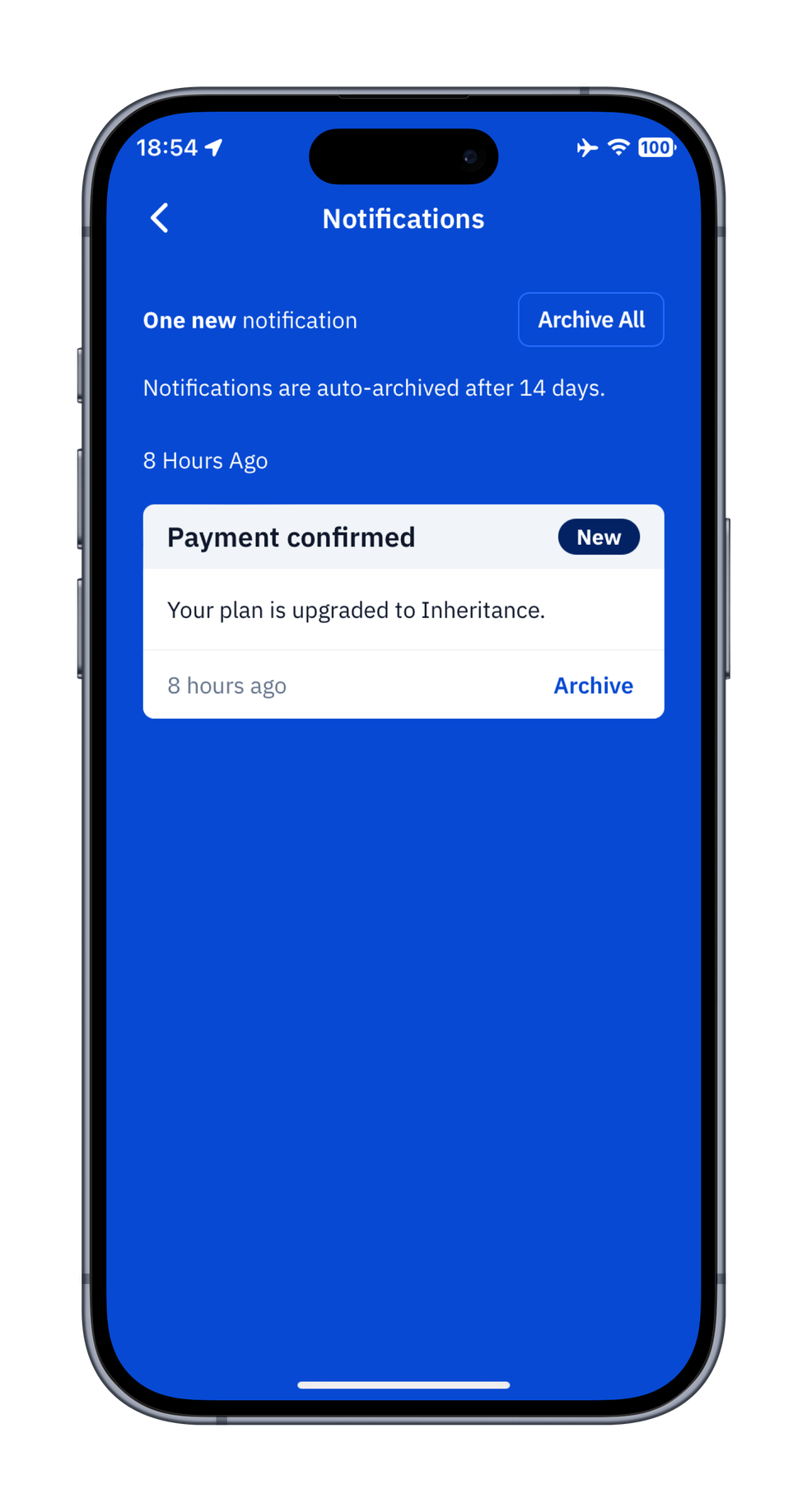

The iOS codes are good for 1 year subscription at no cost, then will revert to standard price for Inheritance plan. iOS codes can be redeemed in the Apple App Store.

The Android codes are good for 90 days subscription at no cost, then will revert to standard price for Inheritance plan. Android codes are redeemed when selecting and paying for the Inheritance plan in the app.

Instructions for how to redeem here.

Code: CMNYC25

iOS: https://apps.apple.com/redeem?ctx=offercodes&id=1451596986&code=CMNYC25

Android: Enter code CMNYC25 when you select the Inheritance plan

Transcript

Wasim Ahmad:

Hey, everyone. My name is Wasim Ahmad. I'm one of the co-founders of Vault12, which helps retail investors do cryptocurrency inheritance, something that everyone needs to think about because no one's going to do it for you. And then, joining me on the panel today is Tarek Mansour from Kalshi, Andrew McCormick from eToro and Congressman Shri Thanedar from Michigan.

Shri Thanedar:

Michigan. Yeah.

Wasim Ahmad:

Wonderful. Great. Okay, so we're going to jump into it straight away. So my first question is for Andrew and Tarek really to define for us the conversation around retail investors. So who have they been and how is that evolving? Do you want to take it away?

Andrew McCormick:

Yeah. I'd love to jump in. Thanks, everyone, for being here. So I think we've seen some incredible and really cool trends in the last couple years. Historically, the stereotypes is investing is for older, rich people, and that's it. In the last couple of years, we're seeing all those barriers fall down. In the US in traditional markets, we've seen 50% of Americans typically own stocks. That's now more like 60%, 65%. A percentage of Americans holding crypto assets in the last two to three years has doubled. And I think what's especially cool is there's more people investing, but also at a younger age. And at eToro, we are retail trading platform serving millions of customers around the world and a majority of our users are millennials and younger, which we classify as young investors, which brings joy to my heart, because I'm barely a millennial. So technically I am still at age 42, a young investor.

And so what we see more people are investing, at younger ages and it's having a very interesting impact because younger folks have a longer time horizon so they can take more risk. Stereotypically, that's like the YOLO trades people talk about in the news, meme stocks, meme coins, but it goes beyond that. We've seen ETF assets more than double in the last five years. And I think it's cool because if you're a young investor and you're starting at 20 instead of 45, you can take more risk, you have a longer time horizon. I think that's really, really healthy and really exciting and will seem relevant to your world. An amazing trend we're going to see in 20 years is where just 80 plus trillion dollars are going to pass from older generations to millennials and younger by 2050.

Wasim Ahmad:

And 7 trillion of that is going to be in crypto assets.

Andrew McCormick:

That's a great commercial for you. And what's amazing, most of those assets today are probably in advisory accounts where people go into an office, they meet with a financial advisor once or twice a year. And younger investors, I don't think that's our jam. That's not what people are going to do in the future. And so mobile trading apps where people are doing these trades on their phone, I think are going to be a recipient for a lot of these types of assets. And maybe that's crypto, maybe that's meme stocks, maybe that's really cool binary futures platforms where today, older folks aren't really down with it, but in the future, it's going to be the norm. So more people investing and younger, and I think that's a powerful force.

Wasim Ahmad:

So Tarek, you started your company at the age of 22. So your retail customer's older or younger?

Tarek Mansour:

We have the full spectrum. So it's definitely concentrated. It's a curve that just goes down as the age goes up. But maybe just a little bit of context on how we started the company. So what we do at Kalshi, we're a prediction market in the US, the leading one. If you didn't hear the name of the company, you probably heard that we were forecasting Trump winning the election leading up to the election. What we do is we list derivatives, we're regulated by the CFTC, and these derivatives are yes or no question about anything that could happen in the future. Who is going to win an election? Will it rain tomorrow? What is the Fed going to do at the next meeting, and is a hurricane going to hit a certain city? So I actually started the company after spending some time at Goldman and Citadel, and the key insight that we saw when I was there, the clients were not retail clients, they were institutional clients actually. They were asking very simple questions about the future. It's like, "Hey, we want to hedge against Brexit or get exposure to Brexit." That was actually 80% of the flow we used to get at the desk at Goldman.

And what we would do is we would use traditional assets to give them that exposure they were looking for. But there were a few problems. One, it was a proxy. So a lot of people actually put on an S&P short ahead of the 2016 Trump election because they thought that was a Trump hedge. Trump did indeed win. So they were right, but they lost money because the S&P went up. And then number two is kind of opaque, it was OTC, the banks would decide the price, and there wasn't sort of a dynamic transparent marketplace for these things. That's where we came from to build this marketplace.

So going back to the question about retail, what we see with Kalshi, so we spent years getting regulated, we've grown a lot now, we have millions of customers. And these customers are actually generally speaking, people that have traditionally not been in financial markets. Our average customer, if you ask them, "Do you trade in options and derivatives?" Their usual answer is actually, "No because I don't gamble." And the reason they answer that way is because what we've built is we've built a tool, a financial instrument that a much vaster and wider range of people relate to. A lot of people may relate to things around culture and what's going on there or the weather. Most people relate with the weather, because they can see if it's rainy or sunny or politics, which a lot of people... I mean, I don't need to tell you about how much people relate with politics and a variety of other things, but they didn't really have a mechanism to actually express opinions on these types of topics that they relate to or have views on or hedge risk with respect to these things. And it's so interesting because if you're a person that's worried about Brexit, how it's going to impact your business, you actually understand that very, very well and intricately. You may not understand a lot of the traditional assets.

So we see kind of this rising class of people that are entering financial markets, but really through prediction markets, through Kalshi, and it's this sort of idea of... I like the analogy at the time Uber was like the pitch to a lot of drivers was like you have extra time, how about you monetize it? And this rising class of people that... And it's really beautiful. You read the news a lot. You know a lot about the economy, you have a lot of views, you go to trivia night and argue with your friends on Twitter. You have a lot of knowledge, how about you monetize it? And that's really what we're seeing at least on our end. And I find that very, very exciting because the playing field now is pretty level. Citadel is not actually the dominant force in our types of markets. It's retail.

Wasim Ahmad:

Great. Great. So Congressman, I want to turn to you. You represent a district in Michigan. You were the only democratic co-sponsor of a bill that focused on removing the IRS from being able to kind of mess around with CeFi and DeFi corporations. What is your vision for how crypto can help retail investors?

Shri Thanedar:

Well, look, thank you for having me on the panel, Wasim.

Wasim Ahmad:

Of course.

Shri Thanedar:

My name is Shri Thanedar. I represent Michigan's 13th Congressional District, and I was proud to vote for the FIT21 and as well as Resolution 25. Again making it easier, in my district now, my district is one of the fifth poorest district in the country, and I'm starting to see Bitcoin ATMs popping up especially in the low income areas, something that is charging 20% premium on purchasing Bitcoin. So from that, how do we go to a position where crypto is in every wallet and people, not just the wealthy and accessible, but people at the low income area, how would they start using this as their daily currency? How would my small mama-papa businesses would use this to do business across the world? And then, how does Congress come in and make it easier? How do we make sure that the innovators and entrepreneurs aren't going to UAE and aren't going to Singapore and everywhere else, that we have meaningful guidelines that the innovators and the entrepreneurs feel comfortable setting up their shop in the US because they could go take their laptop and go anywhere they want to go. And how do we keep them here in the US? How do we make this, just make sure that crypto is in every wallet?

Wasim Ahmad:

Great. So I'm going to delve into those questions a little later.

Andrew McCormick, eToro

Wasim Ahmad:

So before we get there though, I would like the panelists to talk about what are the biggest challenges facing retail investors today.

Andrew McCormick:

So there's certainly challenges. I'm a lawyer by trade, so I'll give a disclosure at the beginning because lawyers love disclosures, that there's no better time in American history to be an investor than today. So typically, you would need to know a financial advisor. Just to place a trade, you need $20 to pay a commission. You'd have to buy a full share. And if you want to do that for G&E or something, you might need $300 to place a single trade. Today, you can get started with $10. Whether that's a stock, ETF, crypto. And so there's no better time to be an investor than today. It's never been easier. At the same time, there's never been so many educational resources out there, so many platforms that are making cool, innovative, engaging products that help people build better lives for them and their families.

Some challenges though with that is there's persistent news out there, right? So years ago, if there's a huge drop in the stock market, you read about it the next day in the newspaper, you go to work. Now you're getting alerts on your phone, your friends are talking about it, you see it on TV, social media, emails, so it's easy to freak out and get scared. And there's probably nothing worse as an investor to do is to panic, to make an emotional sell, emotional trade. And I think that's hard in today's market because there's just information everywhere, which is really great and empowering and breaks down barriers but can cause an emotional drain on you, whether it's finance or politics or your sports team is not performing how you want, you see it all the time. So I think that information overload is a challenge, so I think it's important as an investor to stay committed and don't freak out and just plan for the future one step at a time.

Wasim Ahmad:

So eToro is like the Robinhood of Europe, and then you have a footprint now in the US that's growing. Really what is it that you're delivering that addresses the challenges of retail investors? Is it a smoother on ramp into a variety of different financial products? Is that kind of your mission?

Andrew McCormick:

So one is diversity of products, right? We're not just crypto, we're not just stocks. We have crypto, stocks, ETFs. In the future, we'll probably have futures and investment accounts and advisory accounts. So the diversity of offering is number one. Number two, we're very passionate about education. So we have a whole content called the eToro Academy with hundreds, maybe thousands of articles, videos in what we call snackable content. It's like not some long thesis that no one's ever going to read, like a two-minute video on key topics. What's an ETF? What's day trading? Things like that, where people can digest it in the way we digest news and information today.

And then, just trying to make it super easy to get started. No commission on stock trading. You can make investments for as little as $10. So my family, we're passionate about Chipotle. So one thing that like all our kids eat, and historically you might need $500 to buy a share of Chipotle. Now if you're passionate about Chipotle and you're like, you know what? I don't want to be just a customer there, I want to be an owner, $10. And you can start building that platform, and that innovative $10 entry point is not something that most firms offer.

Tarek Mansour, Kalshi

Wasim Ahmad:

That's great. So Tarek, you have upwards of 2 million downloads, billions of dollars in the market, and then you have partnered with Robinhood and Webull. Is that right?

Tarek Mansour:

Yeah. With more in the pipeline.

Wasim Ahmad:

Right, right. So what are you seeing as either challenges or just things that retail investors are overcoming in the rush to jump on top of prediction markets?

Tarek Mansour:

Yeah. I mean, I think, yeah, we now have, I would say one of the largest ecosystems in terms of retail presence in the US. I'll talk a little bit about the challenges because I do think it's an interesting question. I think of them as sort of two buckets. One of them is regulation and the second one is let's call it like short attention spans, which I think is a real problem in retail today. The thing with regulation, and I'm talking a bit more strictly about CFTC world, which is the world that we live in. I mean, historically retail has generally been a bit left off the conversation. They're kind of always lagging, generally they're underestimated. And I think the world has woken up now to like, yeah, actually retail can propel a stock to multi-trillion dollar market caps these days. That's something that was totally not possible 10 years ago. It is today. And I think there is a lot of work to do on creating...

One example is in our world in CFTC, there's actually no real consensus definition of what a retail investor is. When you're asking about retail, I'm thinking like, I actually don't really know what that is. Or a general definition, it's a dude trading, but like what is retail, and how do you think about that? Because there's sophisticated retail, there's extremely informed flow, there's less informed flow, and how do you differentiate between these? And I think so that's one challenge. I think there's a lot of work to do and I think it's been very encouraging over... In recent history, we're seeing a lot more willingness and discussion around retail in our world, in the CFTC world.

The second thing is, I think the world is short. Like we talk a lot about retail, sort of short attention span with people, but you're not seeing kind of changes that fit that. But the reality is like people can't really read anymore. The average 25-year-old cannot read a blog post. They just can't. They have to get something in 10 seconds, and if it's less than 10 seconds, they're gone. As we think about that, it's like you need to restructure the marketplace. You need to restructure education. You need to restructure the entire journey that a retail customer goes through when they experience any financial service with that core principle in mind. Like you cannot actually go force people to go read long blog posts or long terms and conditions and then tell them like, "Hey, it was there. You should have known." You have to kind of integrate that into your UX, and that's a lot of the work we do at Kalshi.

Wasim Ahmad:

Great. So Congressman, you touched on this. So how do you see crypto helping the average ordinary investor? You talked about it, you touched on it in your opening remarks, and I know Senator Cory Booker has talked about this, but it's not a general conversation that's out in the media or anywhere. So having seen poverty and all of those kinds of things, where do you see crypto helping the average person, the everyday person?

Shri Thanedar:

Well, look, the small businesses. Doing business across the world is so difficult through the current banking system, the long delays that are happening, the rejections of wires and transfer of money, the cost. As opposed to through crypto, transactions can happen in a matter of seconds. And to having that access, low cost or no cost access to be able to transact quickly, efficiently, without having to go through the bureaucracy of a bank or without having to go through the fee structure. I do a lot of business myself with India, and when it's sending small amounts of dollars to Indian vendor become so difficult because invariably, they get caught into the banking structure, and I get almost half of my wires get rejected when I go through the bank.

Whereas having that access to do business, it would mean a lot to have that access for a small business. It would mean a lot to have that access for person of low income transacting. And the blockchain just takes this further with all kinds of opportunities outside of crypto. That all need to be explored. And we in the United States, need to be the leader of the world in this. And this is where most of the innovation must happen. Unfortunately, currently, the crypto transaction, 90% of them are outside of the US, so that has to change. And that's what something I want to look at it from the Congress's perspective, how can we change regulations? How can we change things to make it easier for people to do business?

Wasim Ahmad:

Okay. So unlike a lot of Congresspeople, you are actually a businessperson, a scientist, and an entrepreneur prior to taking your place in Congress. So how are you working with your colleagues? Earlier today, there was a session with Representatives Sarah McBride, Don Davis and Sam Liccardo, talking about how they were working with Congress. So I'd love to hear from you, what are you doing to further your vision?

Shri Thanedar:

Well, currently, as we look at the voting on the first FIT21, only about 45 Democrats voted for it. The last resolution were about 72 Democrats. So a very small group of Democrats do support this at this time. I am a part of a Congressional Progressive Caucus, and there is a lot of suspicion in the Progressive Caucus about and crypto is looked at as a tool of the rich and the powerful. However, the Progressive Caucus and members of Progressive Caucus who care about access to financial markets, access to transactions, financial empowerment for people at low means, this is really the tool that [inaudible 00:19:03]. So it's going to take a long time to turn people around, but education is the key, education of members of Congress. They need to really understand about the powerful technology this is, and how this is going to help average everyday Americans.

Andrew McCormick, eToro

Wasim Ahmad:

Great. Now, let's hear from the other side. So both of you have platforms, target investors, everyday investors. How are you going to work with policymakers? What do you need the policymakers to do? How do you get better outcomes for your customers as far as working with people in Congress, people in the Senate, etc.?

Andrew McCormick:

I'd say clarity is helpful. It's interesting, in the United States and with our platform, we offer stocks and ETFs and options, but also crypto assets. And what that means, we have over a hundred different regulatory jurisdictions. 50 states all have different says on the security side, stocks, ETFs, as well as the SEC and FINRA. And on the crypto side, 50 different states have opinions on that and all different standards and rules. And when you're trying to run and build a lean, innovative FinTech, a startup that's trying to help empower customers, it's really, really hard when you have over a hundred different regulatory regimes you have to navigate. And we have operations in over 75 different countries, so we always have this very interesting AB test of like how things operate in other countries. And when we talk with our AML and compliance colleagues in the UK, for example, this all sounds crazy to them. They have one regulator, stocks, crypto-

Wasim Ahmad:

I've been working with them. It's insane what they're not doing.

Andrew McCormick:

Yeah. It's just much more efficient. And of course, there's Dubai and Singapore where they're breaking new ground and everything is very clear and certain and welcoming. I mean, this is the best place of capital markets in human history. And the money's here, the talent's here, the brilliance is here. We just need that regulatory clarity. It doesn't need to be perfect legislation, perfect regulations, but just something that's progressing and it's just clear, I think would be helpful.

Wasim Ahmad:

We're going to hear from Commissioner Peirce on the main stage, so hopefully we'll start to see some of that clarity. Tarek, what do you have to add?

Tarek Mansour:

I think we might be out of time.

Wasim Ahmad:

No, no. We have two minutes.

Tarek Mansour:

Okay. I'll do two minutes then. I'll do it fast. And it's pretty simple. I actually think my perspective is slightly different. So I think we're talking about the CFTC, the Commodity Futures Trading Commission. Obviously, CFTC is becoming more and more famous and popular these days. That's pretty cool to be CFTC-regulated because of crypto, which is awesome. I actually think the CFTC has structurally been a very... I mean, the difficulty is always kind of how do you balance sort of innovation and bringing things on shore and having the US capital markets or derivatives markets thrive, and then making sure that you don't let things explode, basically and be diligent and [inaudible 00:22:01]. Actually, my perspective after working with CFTC for I think close to five or six years now, I think that regulator has actually done a pretty good job at kind of towing that balance. And in some ways like, maybe it's one of those rarest things, like we don't have much to complain.

I mean, we have our disagreements with the CFTC. This guy from a company that has sued that regulator two years ago. And sometimes we disagree on certain issues. On that specific issue, we ended up winning. But on most issues, I think it's been a regulator that's been sort of very pro-listening to new entrants and innovation. And maybe the TLDR here is just kind of this sort of bi-directional dialogue. That's I think, pretty critical. It's for companies to actually educate regulators and vice versa for companies to listen to regulators. And so yeah, I think that's probably my perspective on this.

Wasim Ahmad:

Great. Thank you very much. I think we are now out of time. Thank you, panelists. Thank you so much for sharing your insights today.

DC Blockchain Summit

Ledger vs Trezor: Which Hardware Wallet is Best in 2025?

Looking for a comparison of Trezor and Ledger hardware wallets? Let's review all of the popular models.

Ledger Nano X

- Bluetooth connectivity — works with or without a cable (at least with smartphones).

- Wider interoperability with wallets, coins, and apps.

- Compact. User input is via buttons, not touchscreen.

- Has Secure Element.

- Price Point: Reasonable.

Trezor Model T

- No Bluetooth connectivity. iOS app is view-only.

- Smaller set of wallets, coins, and apps.

- The touchscreen and input are very well-thought-out experiences.

- Missing Secure Element.

- Price Point: About the same.

Ledger Nano X vs Trezor Model T

Ledger Nano X

- Bluetooth connectivity — works with or without a cable (at least with smartphones).

- Wider interoperability with wallets, coins, and apps.

- Compact. User input is via buttons, not touchscreen.

- Has Secure Element.

- Price Point: Reasonable.

Trezor Safe 5

- No Bluetooth connectivity. iOS app is view-only.

- Smaller set of wallets, coins, and apps.

- The touchscreen and input are very well-thought-out experiences.

- Has Secure Element.

- Price Point: About the same.

Ledger Nano X vs Trezor Safe 5

Comparison of Ledger Stax and Trezor Safe 5

Ledger Stax

- Bluetooth connectivity — works with or without a cable (at least with smartphones).

- Wider interoperability with wallets, coins, and apps.

- Posh design with according price level.

- Has Secure Element.

- Large but potentially irritating display.

Trezor Safe 5

- No Bluetooth connectivity. iOS app is view-only.

- Smaller set of wallets, coins, and apps.

- The touchscreen and input are very well-thought-out experiences.

- Has Secure Element.

- Price Point: About half of Ledger Stax.

Ledger Stax vs Trezor Safe 5

Comparison of Ledger Stax and Trezor Model T

Ledger Stax

- Bluetooth connectivity — works with or without a cable (at least with smartphones).

- Wider interoperability with wallets, coins, and apps.

- Posh design with according price level.

- Has Secure Element.

- Large but potentially irritating display.

Trezor Model T

- No Bluetooth connectivity. iOS app is view-only.

- Smaller set of wallets, coins, and apps.

- The touchscreen and input are very well-thought-out experiences.

- Missing Secure Element.

- Price Point: About half of Ledger Stax.

Ledger Stax vs Trezor Model T

More comparisons coming soon...

Missing comparison for any model not mentioned?

Genzio Podcast | Vault12 Crypto Inheritance and Wealth Management | Toronto

"It's one of those things everyone needs to think about; but often doesn’t." -@wasima, @_vault12__, joins @DogecoinZack to talk about digital asset inheritance, the inspiration behind Vault12, and what real adoption looks like when it comes to securing wealth for the next generation.

0:23 – What Is Vault12?

1:44 – The Story Behind the Name

2:05 – What Types of Crypto Are Being Passed Down?

3:50 – What Adoption Really Looks Like

5:48 – Wild Inheritance Stories (Yes, a dog ate the seed phrase)

6:39 – Will Crypto Language Ever Simplify?

7:39 – Thoughts on Stablecoin Wealth Storage

9:17 – What Brought Vault12 to @Futurist_conf

Listen to the entire podcast

*** Special Offer for Podcast listeners ***

Promo codes for Vault12 Guard

The iOS codes are good for 1 year subscription at no cost, then will revert to standard price for Inheritance plan. iOS codes can be redeemed in the Apple App Store.

The Android codes are good for 90 days subscription at no cost, then will revert to standard price for Inheritance plan. Android codes are redeemed when selecting and paying for the Inheritance plan in the app.

Instructions for how to redeem here.

Code: GENZIO25

iOS: https://apps.apple.com/redeem?ctx=offercodes&id=1451596986&code=GENZIO25

Android: Enter code GENZIO25 when you select the Inheritance plan

Transcript

Zack:

Hey, what's up? Zack here with Genzio. Excited speaking with Wassim from Vault12 co-founder. For our audience who doesn't know, tell us about Vault12.

Wasim:

Thanks for having me, Zach. Vault12, we do crypto inheritance. It's one of those things that everyone needs to think about, but they don't.

Zack:

I agree completely. Actually, I got my mom to buy crypto when Bitcoin is like 7,000 bucks. She has quite a bit of crypto. She's very young, I think she'll live a long time. But I can imagine a scenario where if you didn't have the right thing set up, it could get problematic.

Wasim:

There's lots of cases of people doing all kinds of very, very secure things like putting their seat phrases inside mountains and different places. The Winklevoss' split up their private keys and put them in safety deposit boxes, 30 minutes from a set of six regional airports around the country. They flew off and did that. You can't find safety deposit boxes anymore. They're going out of business. If you don't have a way for your family or your heirs to access that, if you're incapacitated or you passed away, then it's gone.

Zack:

I completely agree, and I think it's really important to be thinking about these things proactively because we're Genzio, there's a lot of young people in crypto, but they're going to grow up. We all get older. It's part of life. And having plans like that in place I think are incredibly important. Where does the name come from?

Wasim:

Vault12?

Zack:

Yeah.

Wasim:

It's from a video game called Fallout.

Zack:

Of course, a great game.

Wasim:

Absolutely.

Zack:

Very cool. And what would you say is the biggest crypto that people are passing down? Is it Bitcoin, mostly ETH? And do you guys support all different crypto or how does that work?

Wasim:

We're completely independent of any blockchain. I can't tell you the answer to that because we don't know what assets are getting saved or stored. You can store a seed phrase, you can store a private key, but you can also make a video of a riddle of the 12 words that go into your wallet. We don't know. And I'm sure it's Bitcoin, but I don't actually know.

Zack:

That's a great answer.

Wasim:

I don't know who the owners are and I don't know what assets are going in.

Zack:

Privacy is important.

Wasim:

It's a completely decentralized, distributed, peer-to-peer solution.

Zack:

Why do you think that now is the time that this is getting adoption?

Wasim:

I think the risks around cryptocurrency are being lowered slowly but surely with all the lawsuits going away, the banks can now do custody. There's stuff going through Congress and the Senate hasn't quite passed yet, but it's going to happen. Once that market structure bill is in place in August, a lot of the risks will go away. It'll be very clear what happens in the US and then the rest of the world is going to follow that model. And for banks, for retail institutions, because we're a retail company, they will start exposing their customers to crypto. And then after a while, they're going to want to talk about insurance and inheritance and life insurance and all these other things that go hand in hand when you're trying to sort out and manage your finances because your finances will include digital assets.

Zack:

I think this is really interesting too because globally different countries do inheritance differently. I know you said I understand privacy is a huge part of this. Where would you see from what you can observe in the world this is getting the most adoption?

Wasim:

Definitely in the US. We're independent of whatever legal vehicles you use to state your wishes. You should go talk to a lawyer, talk to a trusted state attorney, figure out what the right type of legal agreement is. This is the transportation mechanism to transfer in a private and secure way the details that will allow your heirs to access the assets. It can be different to the executor. It's probably going to be someone technical. It doesn't have to be, the solution was designed for non-technical people. We're independent. Even the states in the US have different laws about inheritance. It doesn't impact what they do with Vault12 or how they use it and abroad, it's the same.

Zack:

Why use Vault12 versus maybe another competitor or you a first mover in this space?

Wasim:

We are the pioneers. We've doing this since 2015.

Zack:

Wow.

Wasim:

10 years.

Zack:

Congratulations.

Wasim:

Thank you. Probably a little early to doing it, but it was obvious back even back in 2013, 2014, when my CEO was thinking about starting this company.

Zack:

When you look at the adoption now, I don't know if you can tell me how many users do you guys have? Have you seen a spike recently? What's that growth been like over the past 10 years?

Wasim:

We've had like 400,000 downloads. The bulk of them have happened in the last two years. We went live in the app store in 2019, sitting four years.

Zack:

Wow. You're really going.

Wasim:

And I think this next wave of, with the regulation, retail institutions coming into it will make that more ubiquitous, which is what should happen.

Zack:

Have you seen some crazy stories over people who have not set up their inheritance mail?

Wasim:

Oh yeah.

Zack:

Tell me something crazy you've seen.

Wasim:

The craziest one was the Galaxy Digital Trader who set up a new wallet and then wrote the seed phrase on a post-it note, went home, or maybe he was working from home, had it on the dining room table, eating some food, something drops on the post-it note and the dog jumps up and eats the post-it note.

Zack:

Literally, dog ate your homework.

Wasim:

The dog ate his seed phrase.

Zack:

Crazy.

Wasim:

I don't think there was a lot of stuff in that wallet, but it just goes to show, that was unnecessary.

Zack:

Do you think there will be a world in the future where we're getting away from terms seed phrase or these more crypto terms or do you think that they're going to stick around like seed phrases?

Wasim:

I think the more technical terms are going to start to subside because consumers, they're not going to deal with the, what's the difference between a private key and a seed phrase. I think the term crypto keys will stay. I think that's the right level of term. There's a lot of wallets out there that are not what you and I would call a crypto wallet, and they're starting to be everywhere. We all have wallets on our phone. It might be the Apple Wallet or I think Google has one too. And I think these wallets will also start to adopt the ability to record assets. But they will, for those digital assets, have to have some way of exporting that key. They're going to have to give it a name. We're going to see, I think wallets are going to be everywhere. It's just not necessarily going to be the crypto wallets that we have today. They're very difficult to use. They're very complicated. They're way too many options. There's going to be some changes there for sure.

Zack:

It's very interesting. And I know right now we just came from a big stablecoin conference in San Francisco. Pantera Capital is there, a16z crypto, biggest names. And we're just really excited about the idea of holding people's wealth in stablecoins. And I can imagine you said Bitcoin now, but I'm sure people are also storing a lot of stablecoins of cash.

Wasim:

I think stablecoins is going to be the wave that pulls in because that's something that consumers, I think can relate to because it is that bridge, it's that transition from the old world to this new world. Absolutely. I think it's going to happen from this moment on last year in stablecoins.

Zack:

Will you guys allow yield, like yield in your vaults?

Wasim:

The definition of a vault is that you're storing something and there's no transactions going on. A wallet is something where you store something and there's transactions. We've tried to be very strict about that difference. We're not competing with the wallets, we're integrating them. But in a new world with crypto regulations that allow free and easy use of crypto, sure, maybe there'll be trading, maybe there'll be other things. But right now, we're a vault. There's no transactions going. It's how you're storing your assets for the future.

Zack:

You can literally imagine a big bank vault, goes and locks the door.

Wasim:

And then, except it's on your phone, it's protected using distributed cryptography so that if you lose your phone, you can recreate the vault on a new phone.

Zack:

Very cool. And why did you guys decide to come to Futurist?

Wasim:

We heard that it was like the kickoff for Canada Crypto Week. And look at it, it's so lively and so fun. I think we did the right thing.

Zack:

Awesome. Thank you so much for the fantastic interview. I encourage everyone watching this to give Vault12 a follow, really interesting stuff. And if you need a place to store your assets securely, make sure that they're transferable to your future generations, you know exactly where to look.

Wasim:

And we have a code for your viewers.

Zack:

What's the code?

Wasim:

The code is GENZIO25.

Zack:

Very cool.

Wasim:

It's good for iOS and it's good for Android. And you can go to our website to find all the instruction. Thank you so much. Fantastic. Great interview.

Zack:

Cheers.

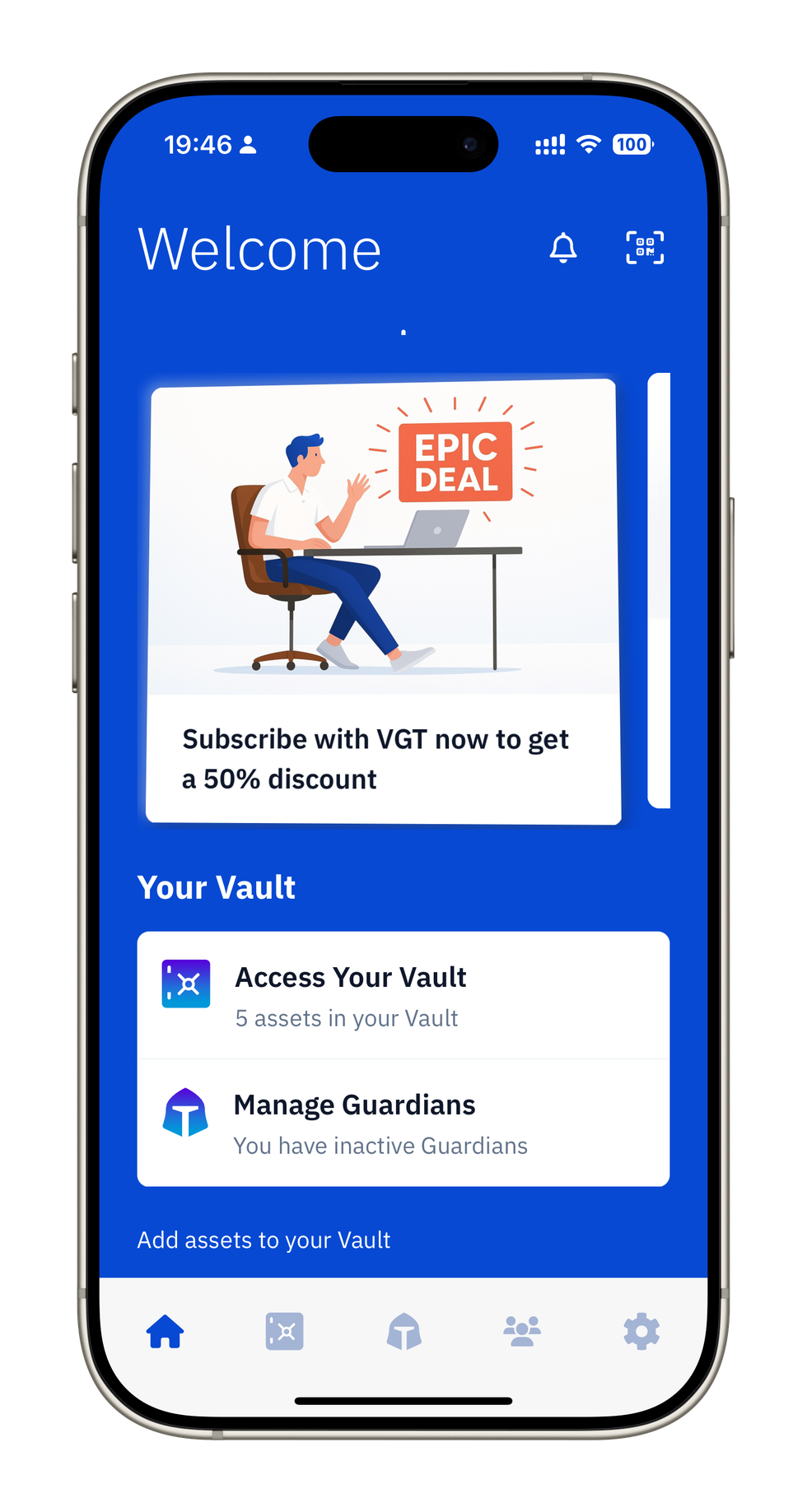

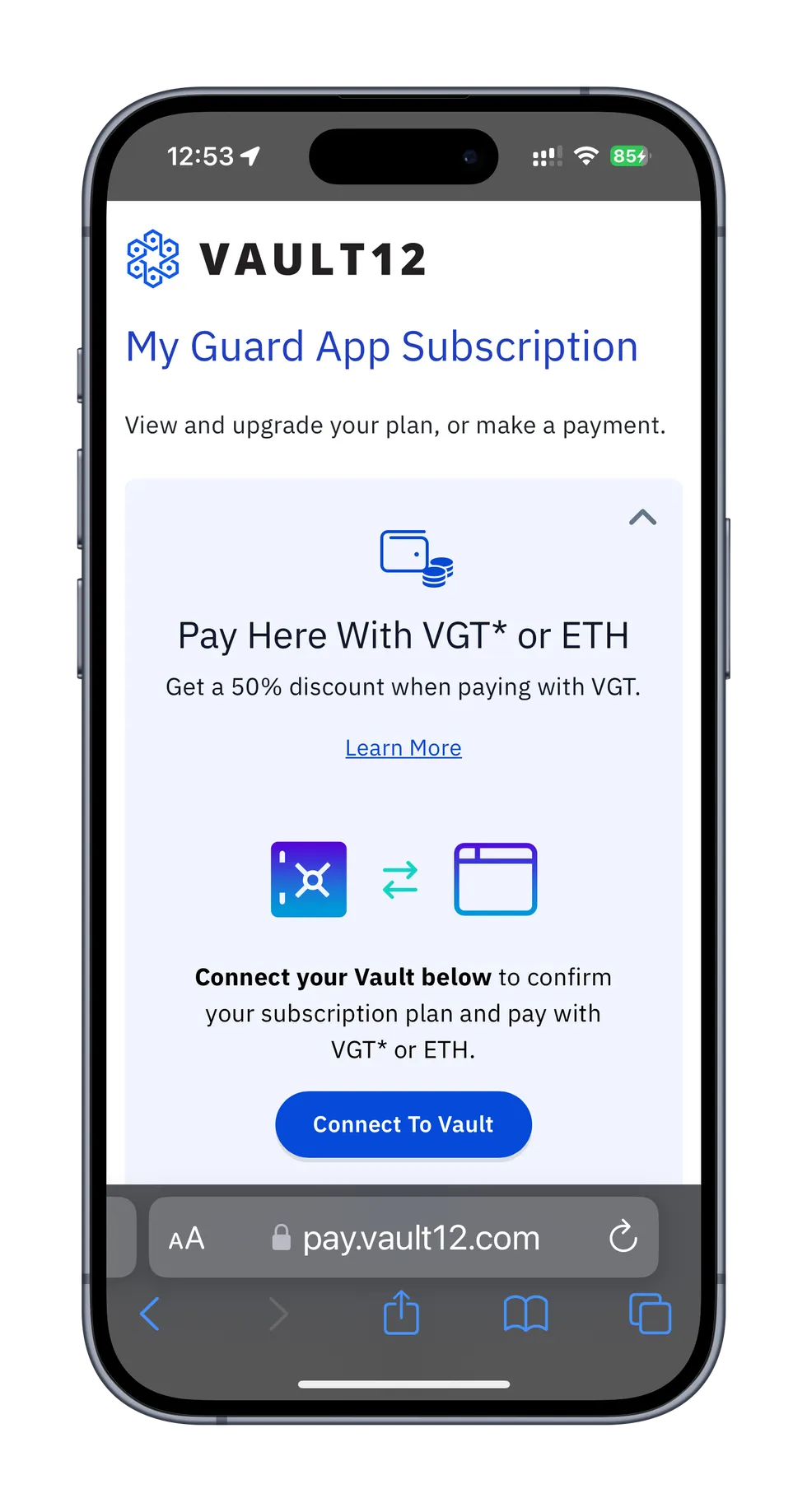

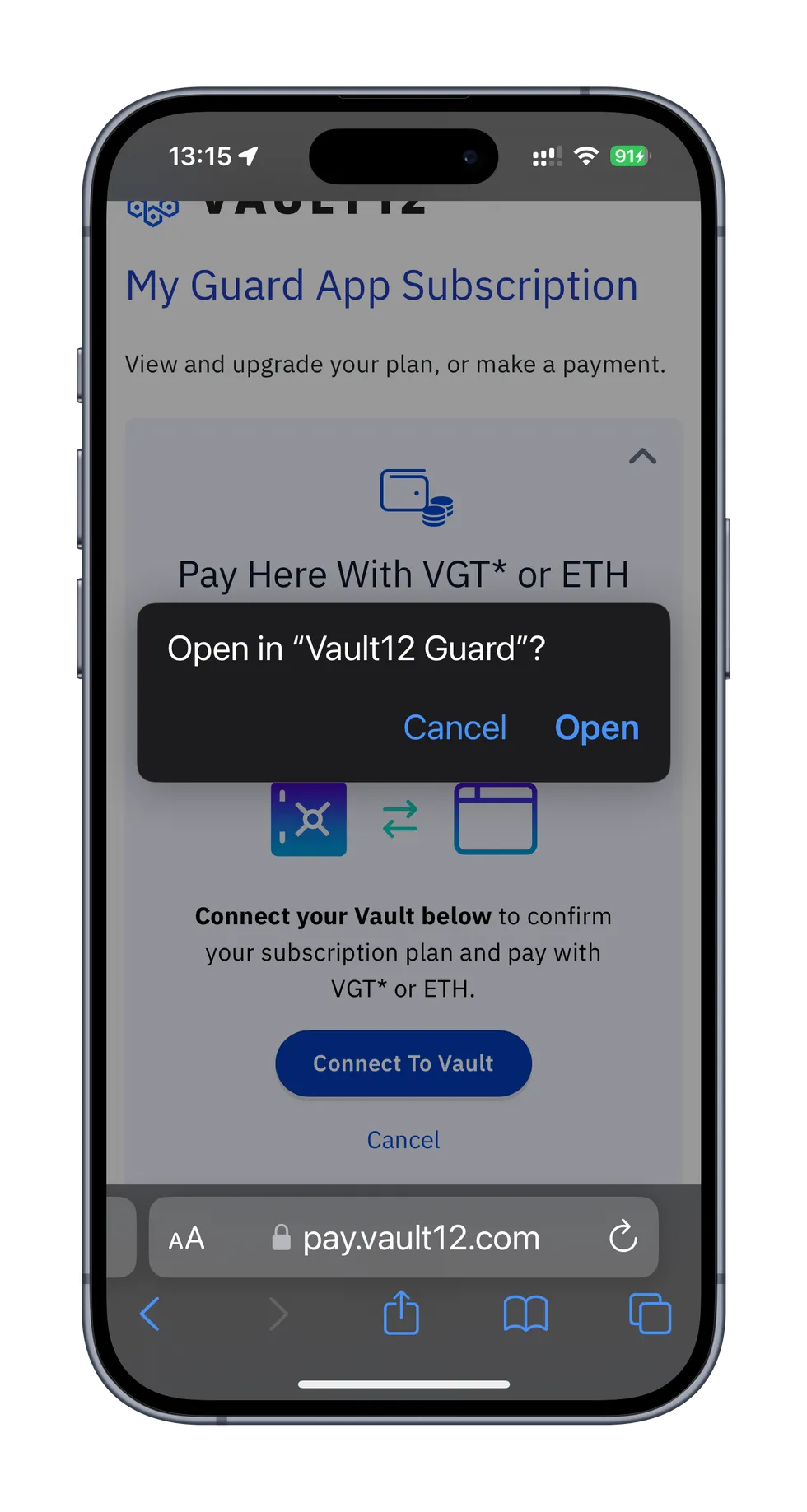

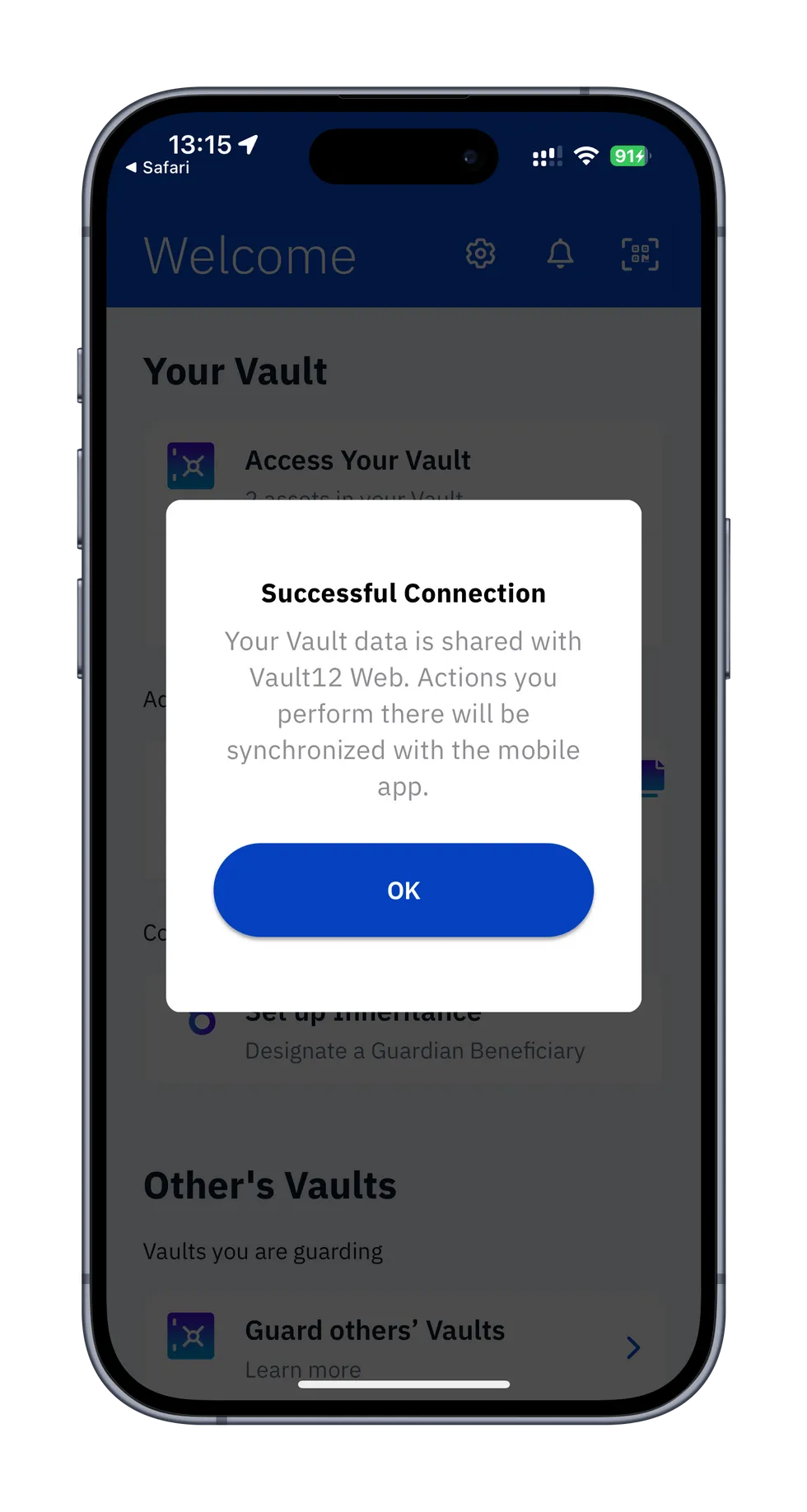

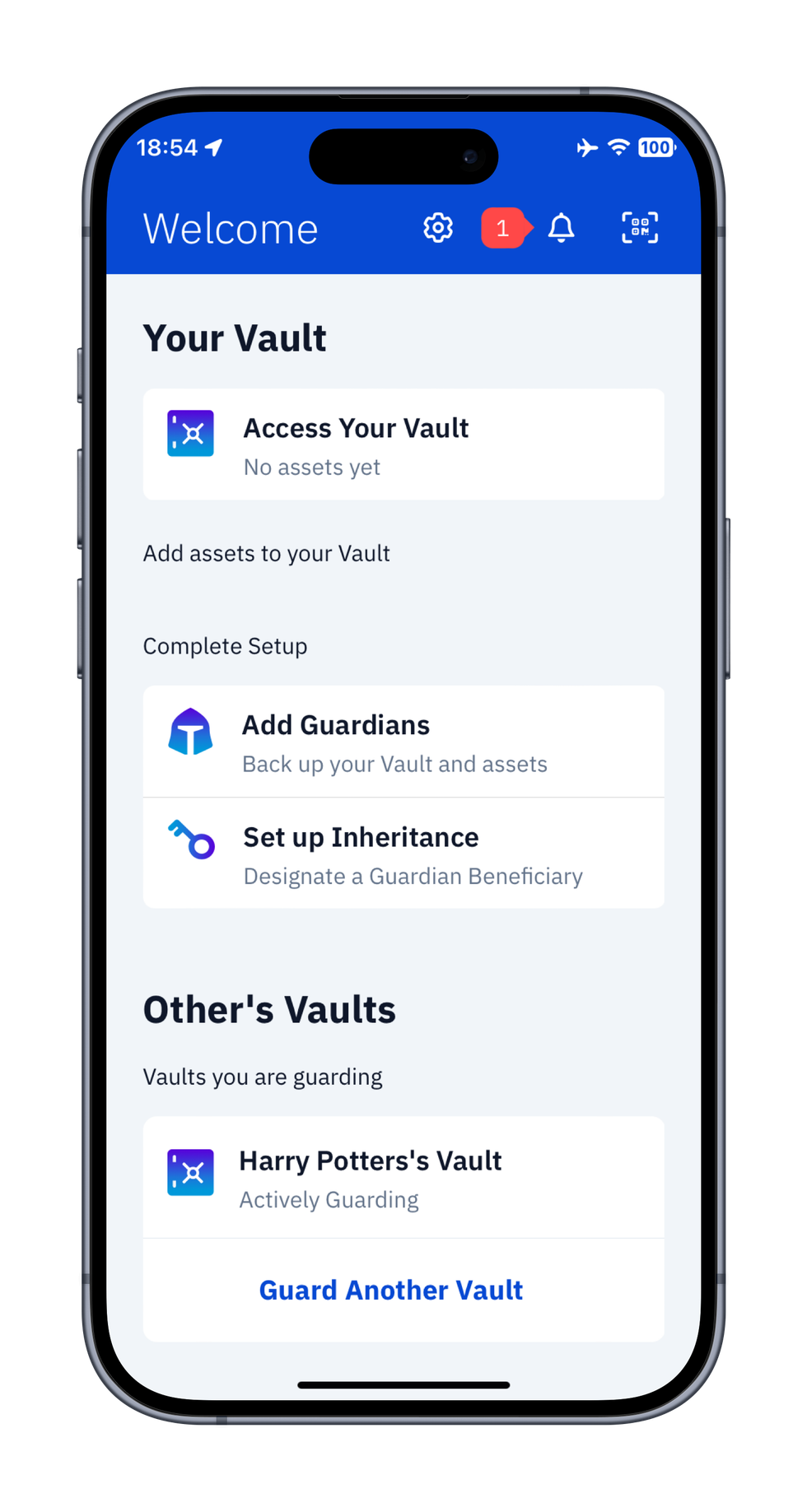

How to claim your Vault12 Guard Promo Codes for iOS and Android

Instructions for how to redeem your promo / offer codes for the Vault12 Guard app on Android and iOS

Follow these steps to activate your custom promo code or offer code for Vault12 Guard

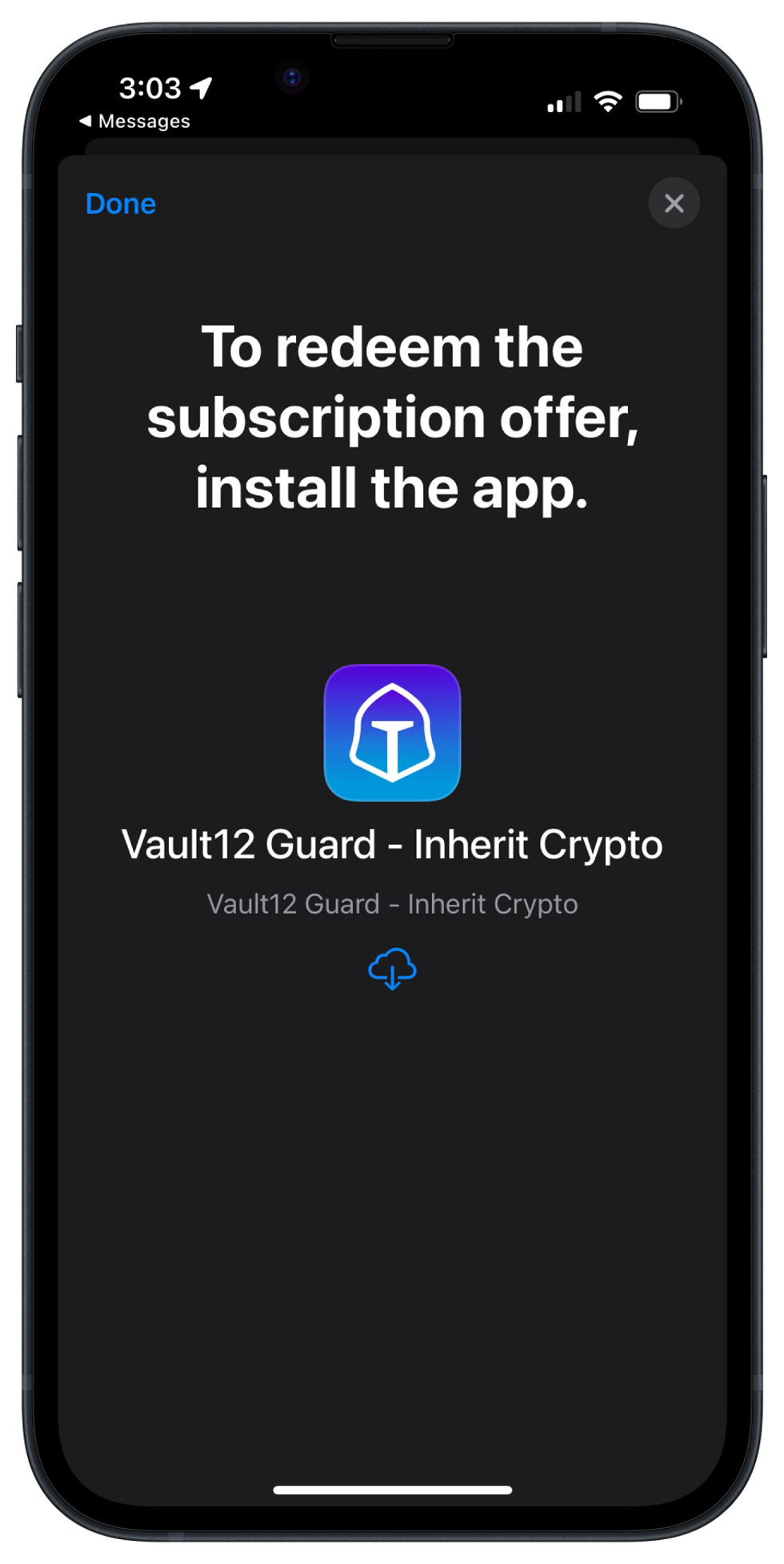

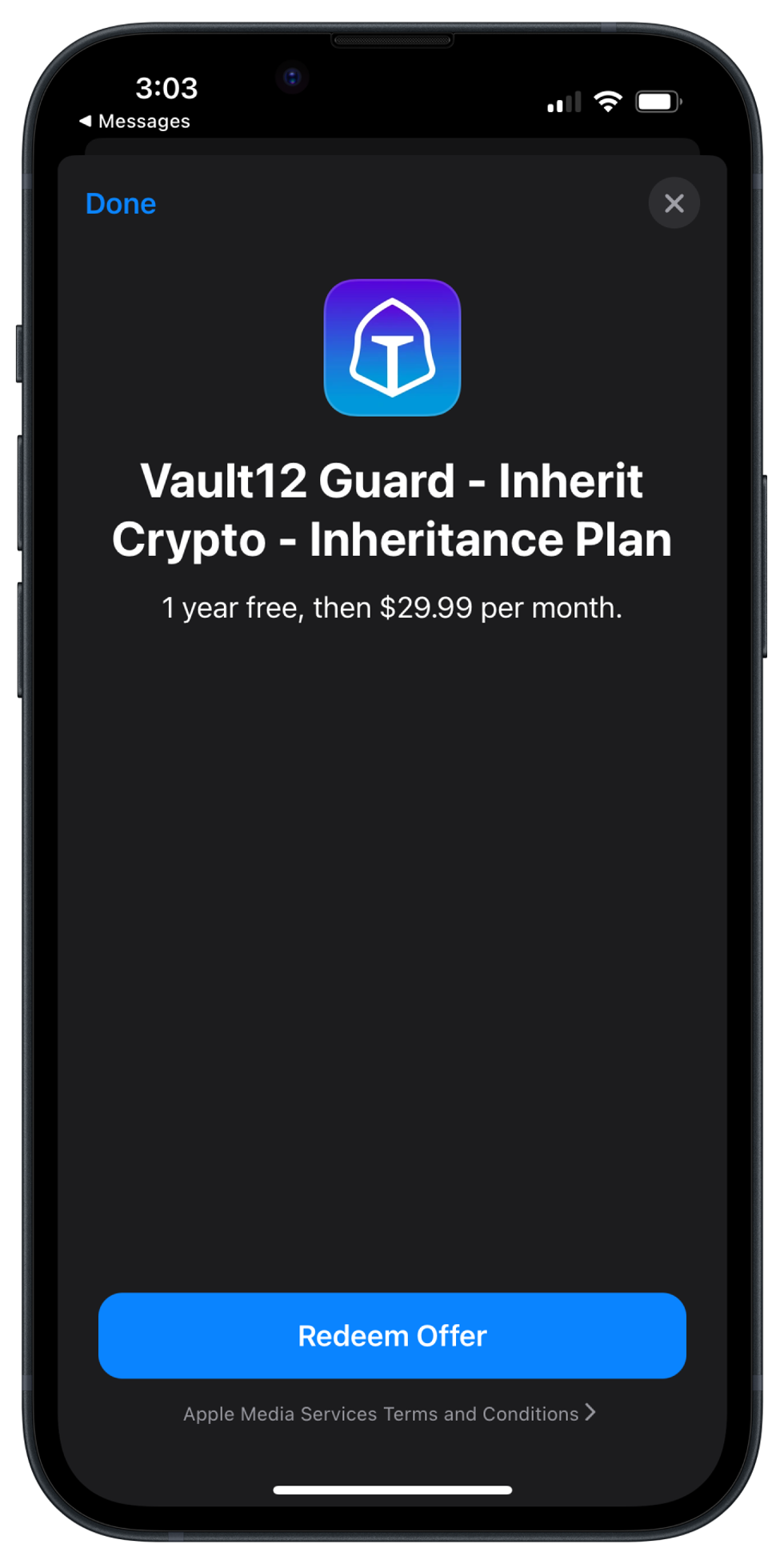

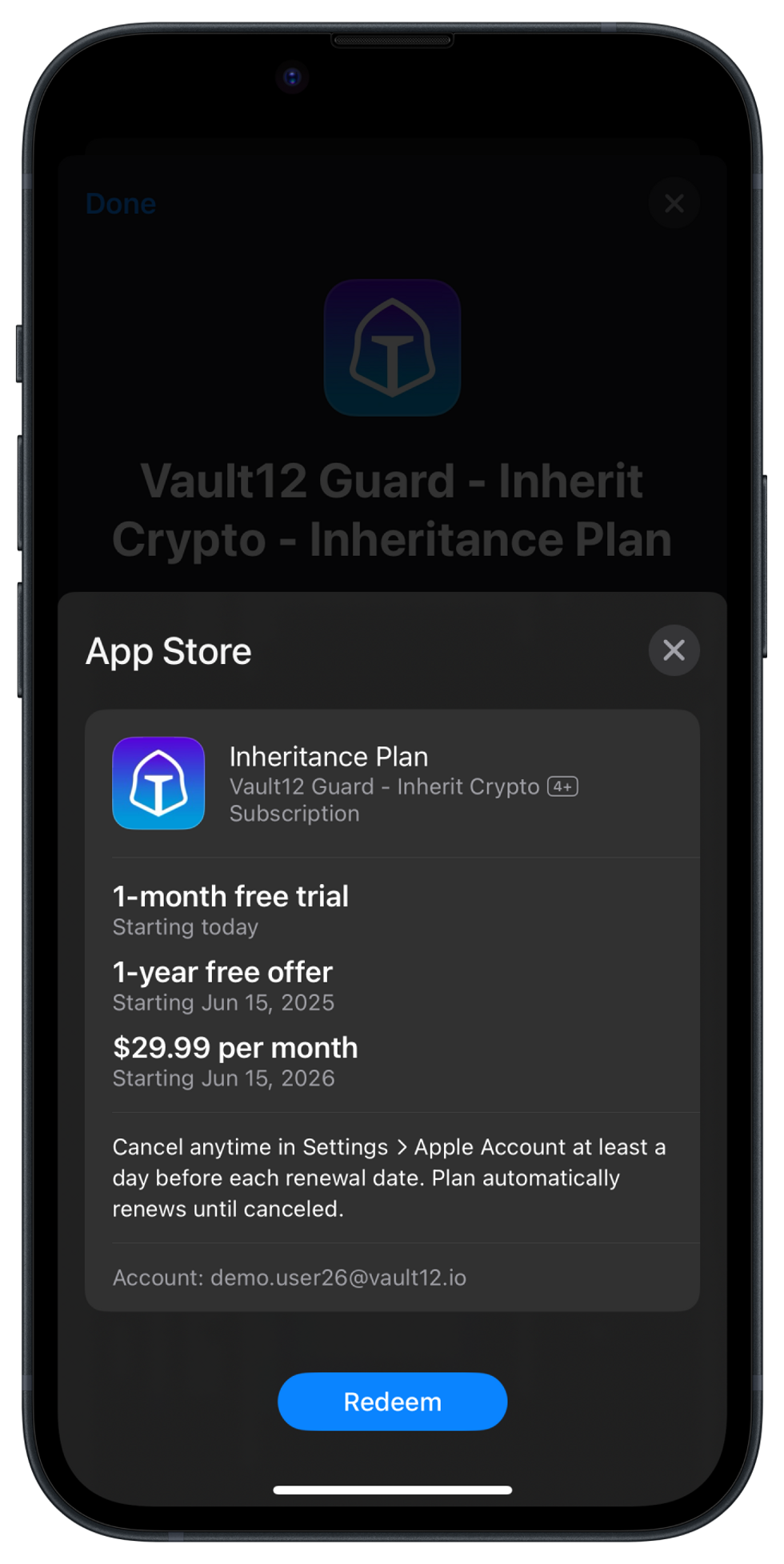

How to claim your Vault12 Guard Promo Code for iOS

The iOS codes are good for 1 year subscription at no cost, then will revert to standard price for Inheritance plan. iOS codes can be redeemed in the Apple App Store.

- If you just have a code e.g.XXXXX, you will need to construct the URL to click on, just add the code onto the end of this URL

e.g. https://apps.apple.com/redeem?ctx=offercodes&id=1451596986&code=XXXXX

- If you have a link, just click on the link e.g.

Detailed instructions below:

Follow these detailed steps to activate your custom offer code for Vault12 Guard on iOS:

- If you just have a code e.g.XXXXX, you will need to construct the URL to click on, just add the code onto the end of this URL

https://apps.apple.com/redeem?ctx=offercodes&id=1451596986&code=

e.g. https://apps.apple.com/redeem?ctx=offercodes&id=1451596986&code=XXXXX

- If you have a link, just click on the link e.g.

https://apps.apple.com/redeem?ctx=offercodes&id=1451596986&code=XXXXX

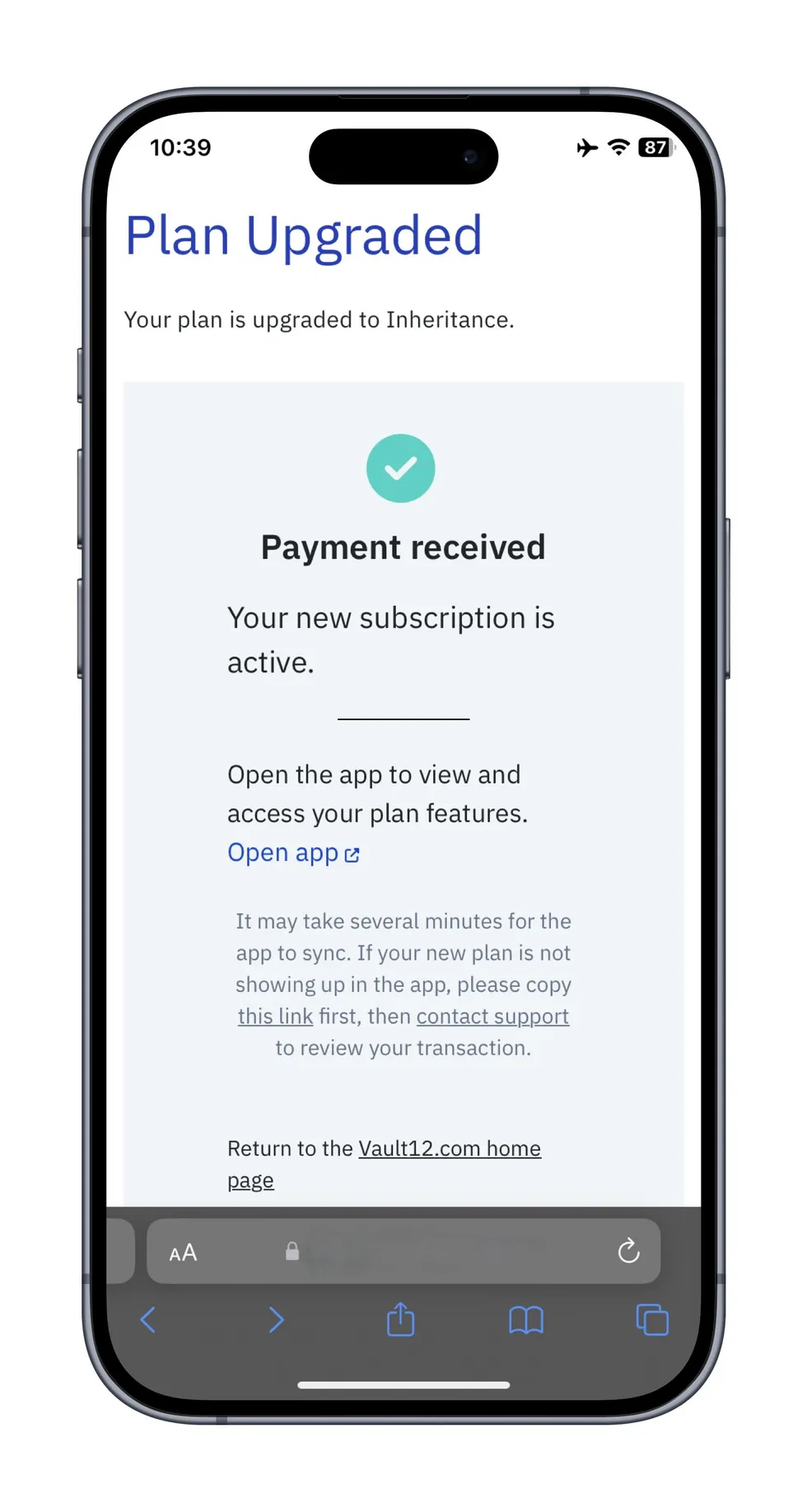

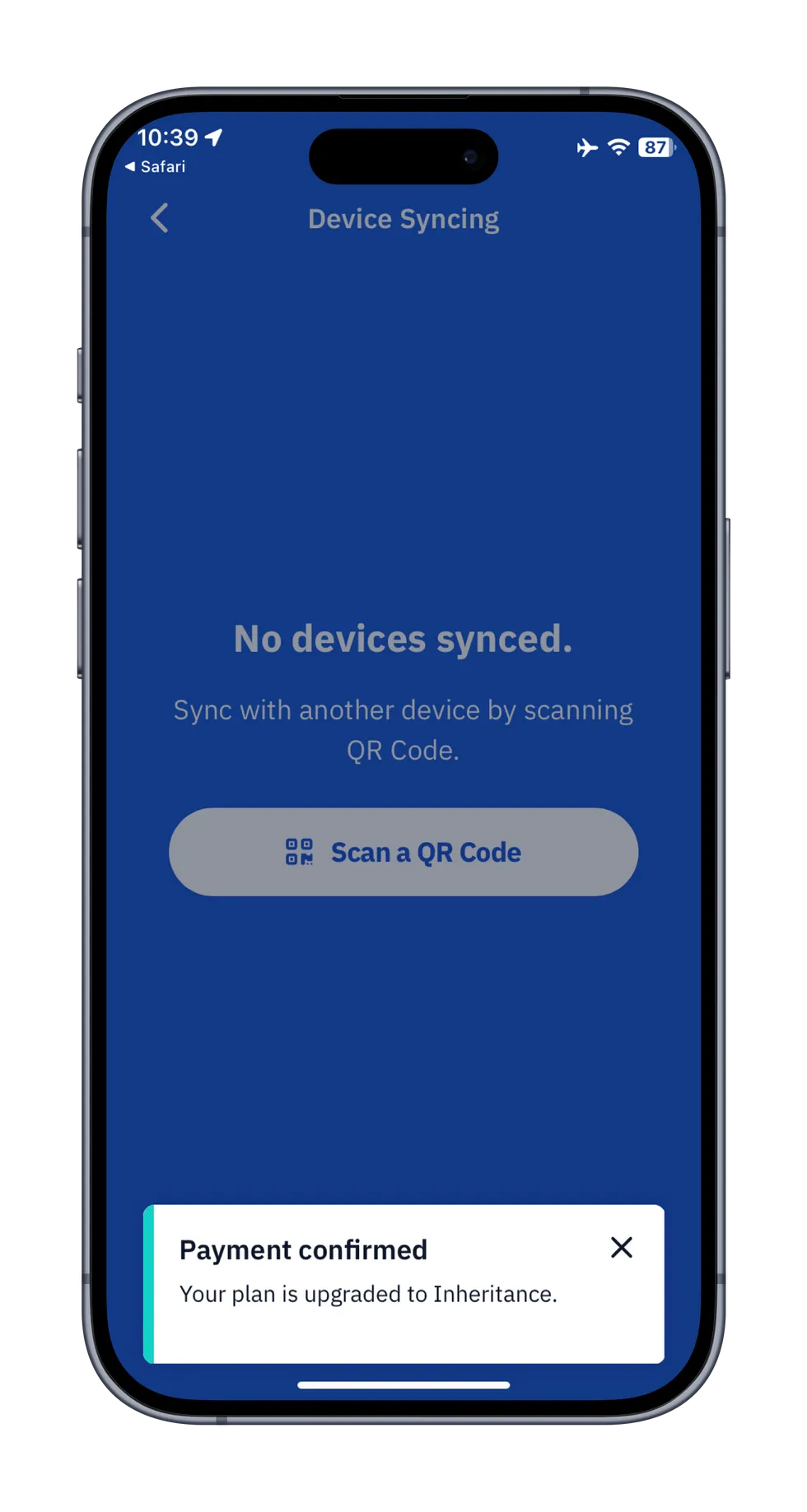

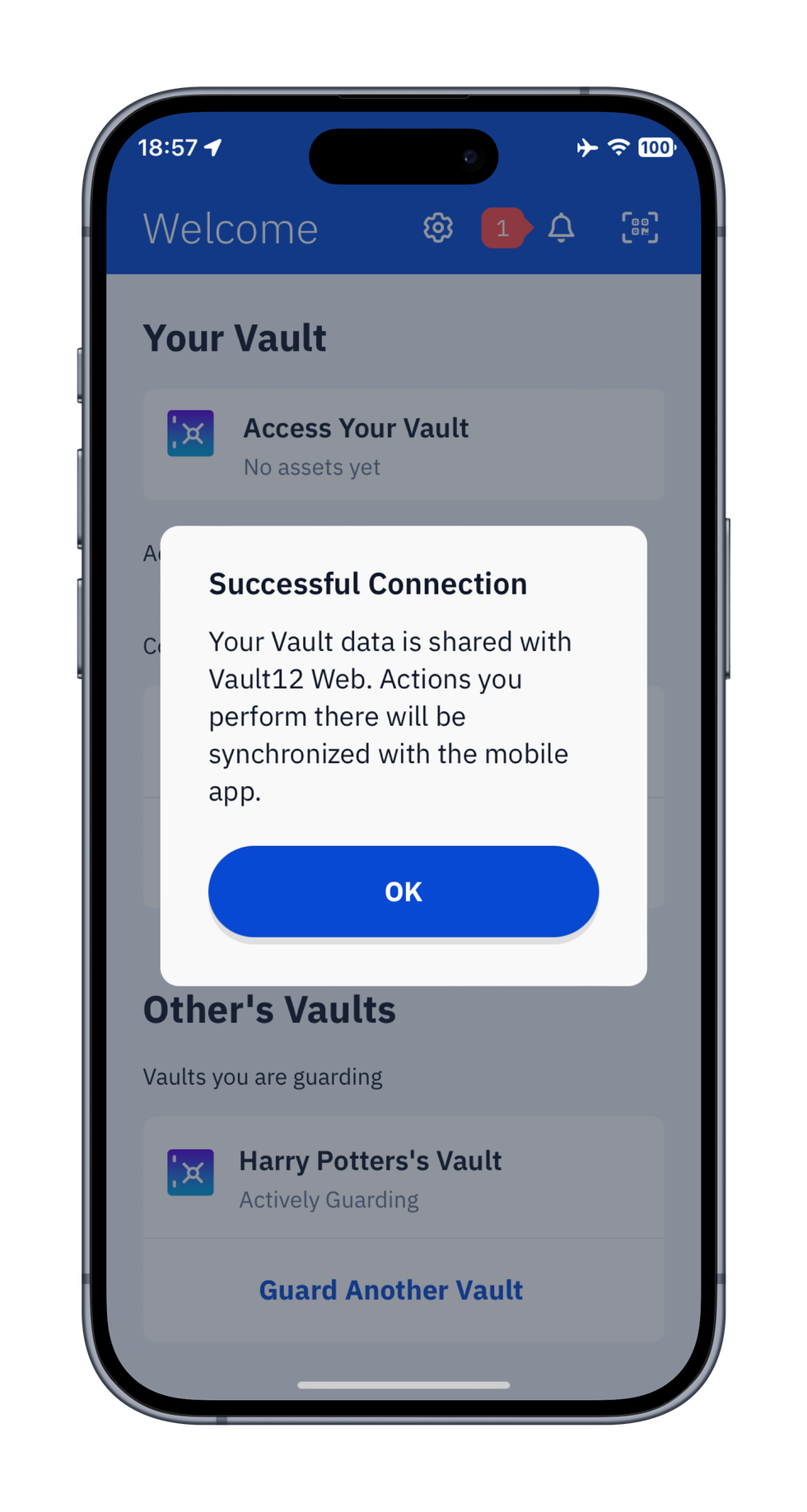

1. Click on your Offer link or scan the QR code. This will open the Vault12 Redeem page.

2. If you don't have Vault12 Guard app installed, you will be prompted to download the app first.

3. After installing the app, you can redeem the offer — just tap the corresponding button.

4. Confirm the 1-year free offer to connect with your Apple ID. Your premium subscription or promotional access will be applied automatically — you are good to go! Open the app and set up your Vault and Inheritance plan with your choice of Guardians.

💡 Note: Offer codes can only be redeemed once per Apple ID and must be used before their expiration date.

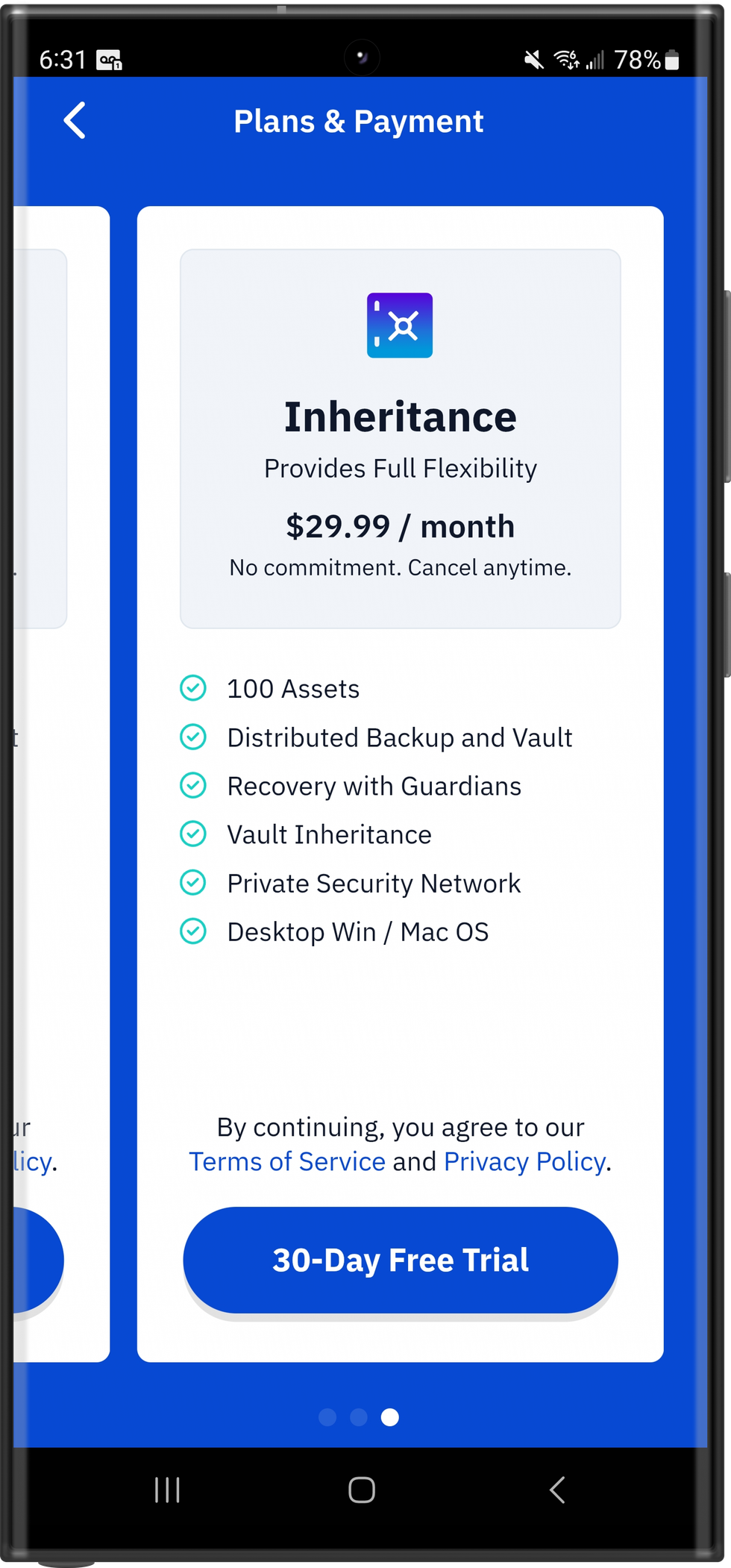

How to claim your Vault12 Guard Promo Code for Android

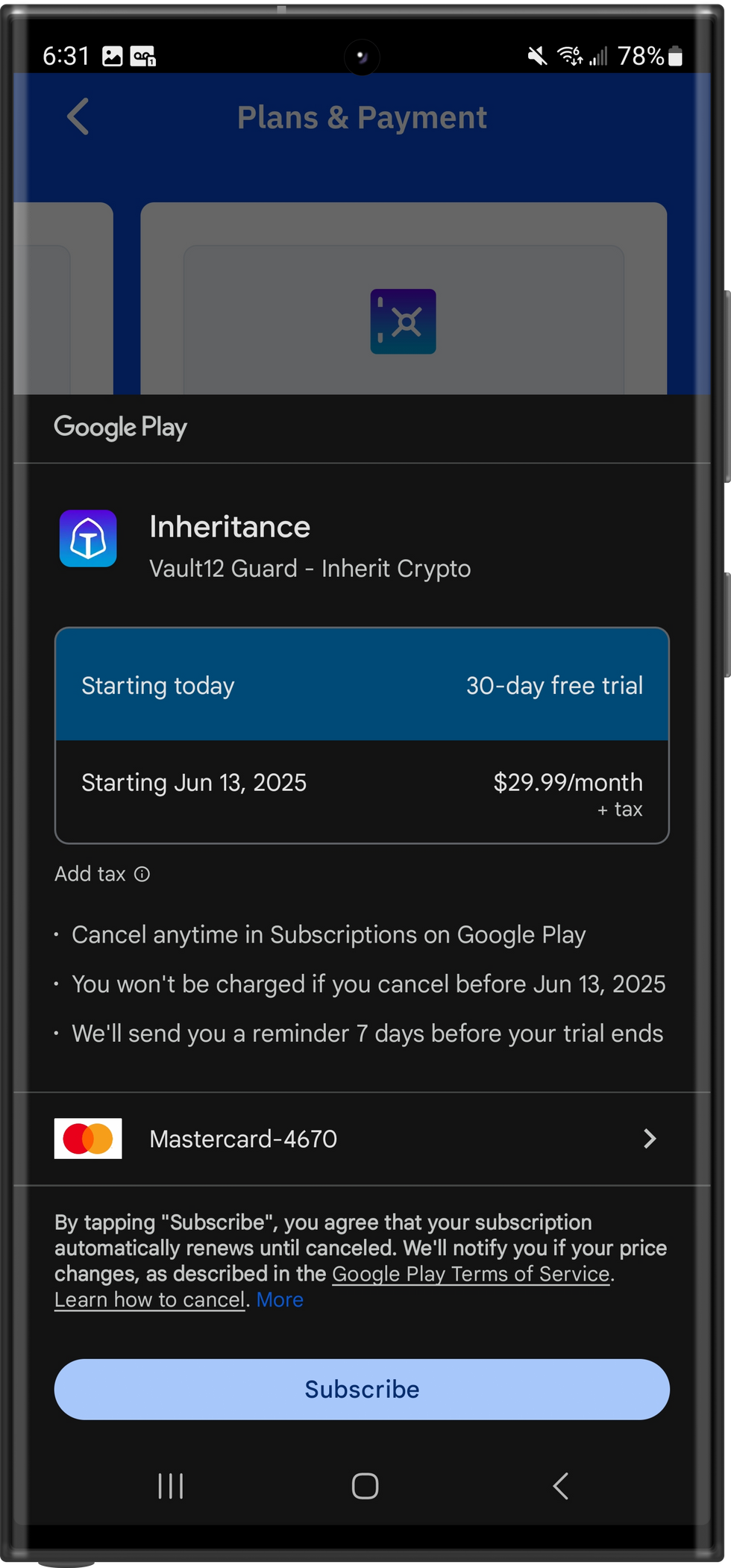

The Android codes are good for 90 days subscription at no cost, then will revert to standard price for Inheritance plan. Android codes are redeemed when selecting and paying for the Inheritance plan in the app.

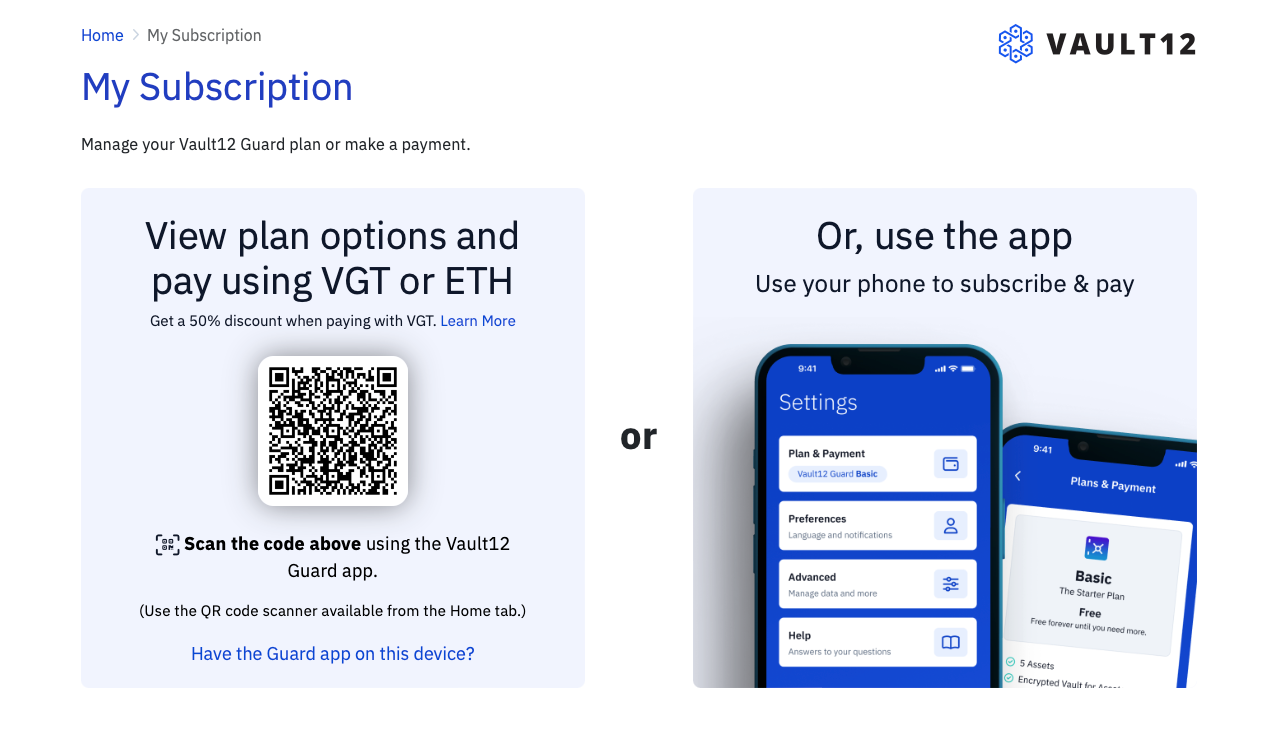

Enter your code when you select the Inheritance plan

e.g. XXXXX

Detailed instructions below

Follow these detailed steps to activate your custom promo code for Vault12 Guard on Android:

1. Open the Google Play Store, Download the Vault12 Guard app, and open it.

2. Follow the prompts in the app to Create Your Vault.

3. Tap the Settings button in the footer.

4. Select Plan & Payment.

5. Swipe to the Inheritance card.

6. Tap 30-Day Free Trial.

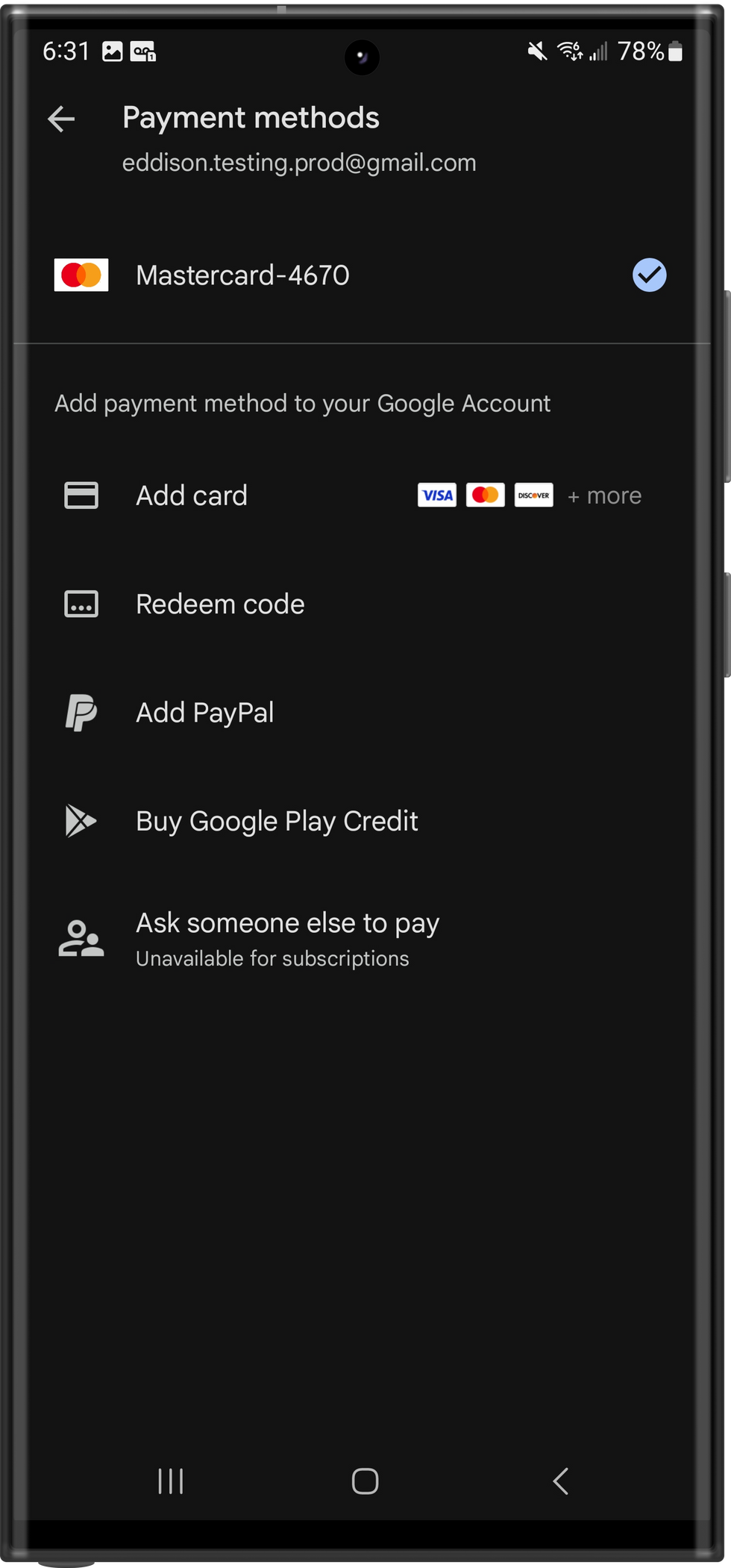

7. In the Google Play payment screen, click on your default funding source to access the Payment methods screen.

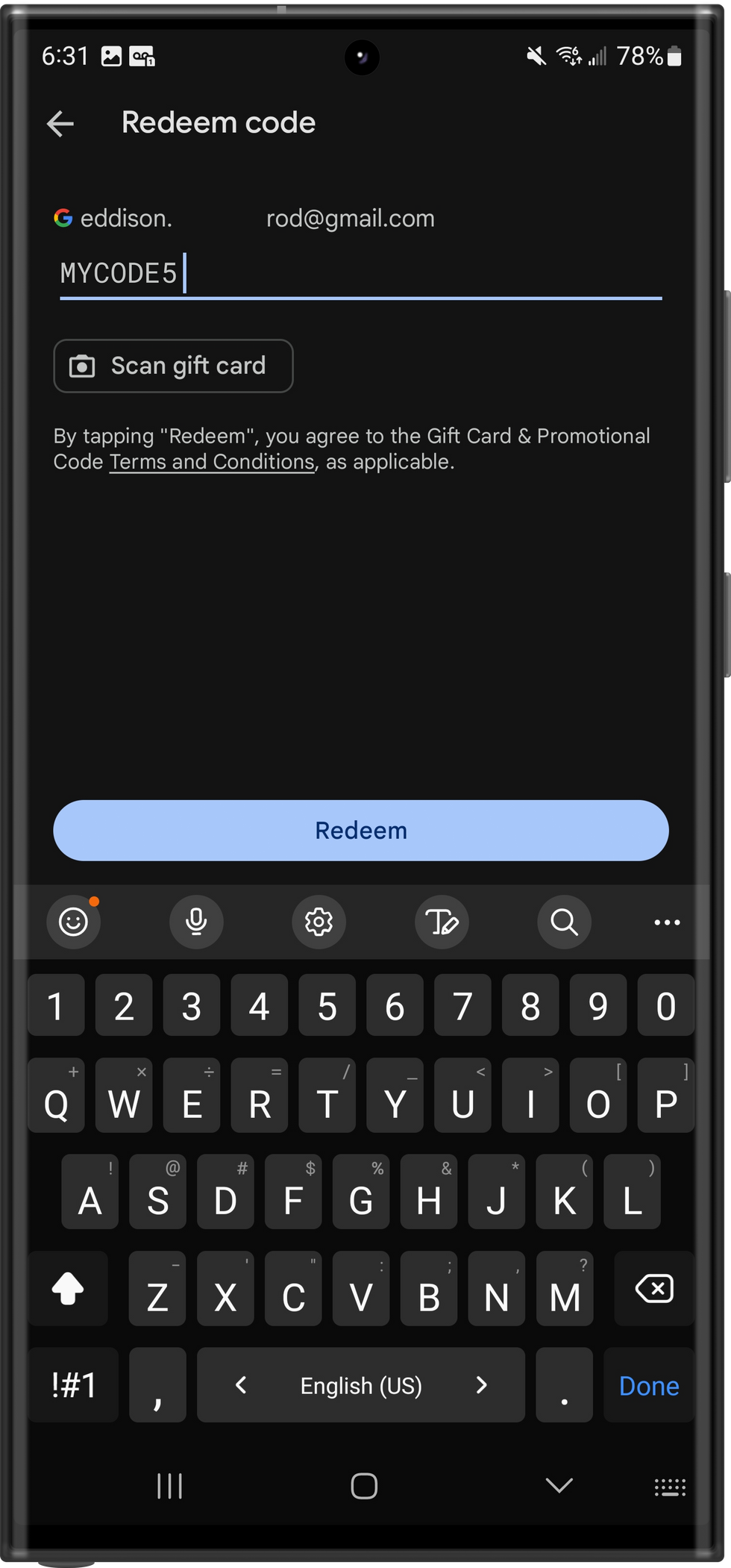

8. Choose the Redeem Code option.

9. Enter your promo code, click the Redeem button, then Continue.

9. Back in the Google Play screen, click Subscribe.

That's it! Your promotional code has been applied, and your trial subscription has begun. You can manage your subscriptions from the Google Play Store.

💡 Note: Promo codes can only be used once per account and must be redeemed before their expiration date.

.

Voice-Level Security: A New Dimension of Digital Trust

Personal Voice Memos add a new layer of protection to your Digital Vault recovery requests

Expanding the ever-evolving landscape of digital security, Vault12 has enabled Voice-Level Security for the Vault12 Guard app. This innovative feature adds another mechanism to the ways that Vault12 Guard users can authenticate to each other. Now Vault Owners can use personal voice memos during Vault recovery requests. Voice memos can be used in multiple simple but powerful ways for better safety during recovery requests, adding a new layer of protection to your Digital Guardianship.

Simple Voice Authentication: Added Security for Vaults

Incorporating simple voice authentication as an additional security layer ensures that only the Vault Owner can initiate recovery requests. This method verifies identity through unique vocal characteristics.

Benefits:

- Enhances security by including the Vault Owner's voice message for verification

- Adds an extra layer of protection to recovery processes

The Canary Protocol: Your Early Warning System

The Canary Protocol acts as a subtle security measure, embedding a familiar verbal cue into your voice memos for recovery requests. An agreed-upon phrase, known only to you and your Guardian, serves as a covert password. Its absence suggests a compromised request, signalling an unauthorized recovery attempt.

How it Works:

- Record a voice memo with a pre-agreed verbal cue

- Use this cue in all recovery requests or safety checks

- Guardians recognize the cue, ensuring the request's authenticity

Example:

A friendly greeting or inside joke could serve as the Canary, seamlessly integrated into your communication, adding a layer of fun and security.

Emergency Words: Discreet Alerts

Emergency words provide a discreet method to alert Guardians of potential threats. These phrases, understood only by the recipient, can signal a call for specific behavior (e.g., to avoid confirming recovery requests, or to implement an emergency plan).

Key Features:

- Pre-agreed phrases that indicate distress

- Only recognizable by trusted Guardians

- Prevents unauthorized recovery confirmations, and may help signal for assistance

Example:

A subtle phrase within a memo can alert a Guardian to halt the recovery process, protecting you and your Vault contents.

The backbone for Voice-Level Security implementation

Voice memo data is transferred over the secure and decentralized messaging protocol Zax, developed by the Vault12 team as a foundation of the Vault12 Guardian app. This means that in the case of a private Zax relay, your communication and voice memos will be transferred only by your own private network.

Privacy and Ethical Considerations for Voice-Level Security

Vault12 is committed to maintaining the highest standards of privacy and user consent. All voice authentication data is:

- Encrypted end-to-end

- Stored exclusively on user devices

- Never shared with third-party services

- Fully under user control

Summary: Enhancing Security with Voice-Level Authentication

By treating your voice as a unique, dynamic authentication tool, Vault12 is creating a more intuitive, secure, and human-centric approach to safeguarding digital assets. Voice-Level Security, with its innovative use of voice memos and verbal cues, provides a robust, personalized security solution, ensuring your digital assets are protected with an additional layer of trust.

This additive security function complements the existing high-security measures of Vault12 Guard, such as end-to-end threshold encryption and decentralized messaging. By integrating voice authentication, Vault12 enhances the robustness of its security framework, providing users with personalization tools to ensure that only the legitimate Vault Owner will be able to recover assets from the Vault, thus protecting digital assets with an additional layer of confidence.

How to use Voice memos?

Have questions on how to use voice security? Proceed with our step-by-step help article:

Upgrade your phone and transfer your Vault12 Guard app data

Changing devices is simple for both Digital Vault Owners and Guardians.

Summary

Upgrading your phone can be an exciting time, whether you are buying a new phone, switching your operating system from Android to iPhone, or upgrading your tablet. Beyond the many positive changes you'll experience, the last thing you want to do is to invest a lot of effort in migrating individual apps from your original device.

Vault12 is pleased to announce that it's now easier than ever to safely transfer all your Vault information to your new device — whether you're a Vault Owner, or the Guardian of someone else's Vault.

- Vault Owners with a new device can complete the transfer without involving Guardians or spare devices.

- Guardians with a new device can upgrade without interrupting the security of the assets they protect.

- Settings, subscriptions, and preferences will seamlessly transfer along with your data to the new device.

Read our step by step guide here.

Time to Upgrade

For various reasons, you might consider upgrading your phone every year or so. The process can be pretty simple by using cloud backups/restores from Apple and Google. Nevertheless, people always wonder whether everything has been transferred correctly — especially when digital assets are involved.

Vault12 has always had a seamless upgrade process between phones for Vault Owners. For Vault Guardians, historically, you have had to go through one extra step of notifying the Vault Owner that you changed phones. With this new update, no one needs to notify anyone, and the transfer process ensures that all information is transferred from the old device to a new device, with no need to bother Vault Owners or Guardians.

Time to Transfer

The most common scenario is of course buying a brand new phone with nothing on it. In this scenario, you can easily initiate the Transfer process by simply installing the Vault12 Guard app.

Other scenarios include switching device types (e.g., switching to an iPhone from an Android, or vice versa). With the new Transfer function, you can ensure that everything is cleanly and safely transferred to your new device, without the need to call Guardians and Vault Owners.

Follow the steps from our Help portal, here.

How To Back Up Your Crypto Wallet

Backing Up Your Crypto Wallet With Vault12 Guard Preserves Your Personal Crypto Security

Crypto can be difficult to store securely, but backing up your crypto wallet is essential so you can recover funds if your crypto wallet is ever lost, stolen, or damaged. A proper crypto wallet backup is also important for inheritance purposes so your assets live on, even after you die.

Why should you back up your crypto wallet?

Proper crypto wallet backups protect you from threats ranging from criminal actors and accidents to natural disasters and damage. Once securely backed up, you can recover your assets in times of need.

A proper backup of your crypto wallet involves recording:

- Each crypto wallet asset

- Seed phrases and passphrases

- Any supporting files for your assets

All crypto backup solutions should be physically secure, digitally secure, and resilient to degradation – but unfortunately, not all of them are.

What are some limitations of common crypto backup methods?

These are some common backup methods, but each has drawbacks:

- Back up to metal plates - This method sounds simple, but to do it right takes some planning, cost, and time.

- Back up to a local drive - This method is quick, but fraught with risks!

- Back up to the Cloud - This method is also quick, but it has significant risks related to the involvement of third parties.

- Back up to “brain wallet” - This method is slow, unreliable, and only justifiable in cases of extreme limitation or duress.

- Back up to paper - This method is extremely vulnerable and surprisingly subject to error.

How does Vault12 back up your crypto wallet?

The video demo below shows you how Vault12 Guard is used to back up a crypto wallet, making sure your assets live on, even after you pass:

YouTube

Vault12 Guard crypto backup is decentralized, resilient, and secure.

Vault12 Guard allows you to breathe easy, as it avoids the pitfalls of other backup methods:

- Guard's backups are decentralized. There is no single point of failure, allowing you to recover even if your phone is lost or stolen.

- Guard does not rely on Cloud servers. Your assets remain private from third parties and resilient to Cloud outages.

- Guard implements post-quantum encryption - giving your assets the highest possible level of security.

Vault12 Guard is the most advanced yet simple crypto backup solution

Not only is Vault12 Guard secure and resilient, but it is also simple to use. It allows you to back up all types of wallets, as well as NFT-related files, to construct a full inventory of your crypto assets. This includes multi-wallet management, which Vault12 simplifies with an integrated backup and inheritance solution. When you need to restore your Vault, Vault12 makes the process easy by requesting access from your most-trusted Guardians.

Of all your choices for backing up a crypto wallet, Vault12 Guard uniquely backs up your crypto wallets in a manner that is physically secure, digitally secure, and passes the test of time.

How Vault12 Guard Helps You Manage Your Crypto Inheritance

Managing digital assets like cryptocurrencies can be complex, especially when it comes to inheritance—but it doesn’t have to be. Vault12 Guard ensures that your digital inheritance is securely managed, and that only the right people—your chosen Guardians—can approve your beneficiary’s access at the right time.

Implement Your Inheritance Plan

Vault12 encourages you to create a carefully considered inheritance plan that covers all of your digital assets. Once your inheritance plan is set, Vault12 Guard will help you manage access to these assets and ensure everything is handled as you intended.

A Comprehensive Digital Vault

Vault12 Guard isn’t just for backing up crypto wallets. It’s a comprehensive solution for backing up all types of digital assets and storing sensitive information:

- Seed phrases from any type of wallet and even private keys including Bitcoin, Ethereum, and other cryptocurrencies. Vault12 Guard allows you to select from a pre-determined list of wallets or add your own.

- Non-fungible tokens (NFTs).

- Digitized copies of legal documents, medical records, or any other personal records.

- PINs and instructions for accessing devices and password managers.

Vault12 keeps everything safe and organized in one digital vault.

Backed up and Protected By Trusted Guardians

Your digital assets are protected by your most trusted people: your chosen Guardians, who can use Vault12 Guard for free.

In the event that you lose a device like your mobile phone that holds crypto wallets, Vault12 Guard offers you and your Guardians a straightforward process to restore your assets.

In the case of inheritance, your Guardians must approve the beneficiary’s request to access your Digital Vault.

Manage your Digital Inheritance with Vault12 Guard

Vault12 Guard is available on iOS, Android, MacOS, and Windows. For detailed guidance on setting up your digital inheritance with Vault12 Guard, including step-by-step app screenshots, check out our guide here.

Here’s a brief overview of the essential steps after you download the app:

- Set Up Your Vault: Implement your digital inheritance plan by adding your digital assets and designating Guardians (including your beneficiary).

- Manage: Use Vault12 Guard to do the heavy lifting:

- provide truly high-security storage for your data

- add or remove wallet seed phrases and other digital assets

- add or replace Guardians, and verify their “active” status

- securely transfer access to your Digital Vault with your Guardians’ approval.

Regular Asset Reviews

As with all assets, it’s a good idea to periodically review your digital assets to check for legal or regulatory changes that may affect your holdings, related technology or product updates, and current market value. Adjust your digital inheritance management strategies as needed.

Check in with your Guardians, too, to confirm their continued readiness to help guard your digital assets.

Vault12 Guard makes managing and inheriting digital assets simple and secure. Whether you’re new to cryptocurrency or looking to safeguard your digital legacy, Vault12 provides an easy-to-use solution for modern estate planning and inheritance.

Managing Multiple Crypto Wallets with Vault12 Guard

An Easy Solution To Securely Manage Access To Your Diverse Portfolio, Including Backups & Inheritance

It’s not uncommon for investors these days to juggle multiple wallets for their cryptocurrency. Most crypto investors (and creators) have multiple wallets, whether they like it or not, because different wallets are compatible with different digital assets. There are also benefits of managing multiple wallets, such as risk management, better organization, and more granular security.

At times, handling multiple wallets can seem overwhelming. Vault12 Guard simplifies this with an easy solution to securely manage access to your diverse digital portfolio. The Vault12 approach for backups and inheritance ensures that you can access your wallets in the future, even if your phone or laptop is stolen, lost, or damaged. It also means that all of your assets, across all your wallets regardless of blockchain, can be inherited. Vault12 Guard helps you keep an inventory of all your wallets so that you don’t forget any, and your beneficiaries won’t lose any assets after you pass.

Why Manage Multiple Crypto Wallets

There are several advantages to multiple wallets, including risk management and organization. You might own multiple wallets in order to:

- Organize your crypto based on different transaction tracking needs: you might choose to separate high-privacy transactions from low-privacy ones, or individual wallets for unique NFT collections.

- Limit the maximum value of each wallet to reduce risk.

- Invest across different blockchains such as NFTs that are built on different blockchains and not supported by the same wallet.

- Maintain separate hot wallets and cold wallets which might be both custodial and self-custody types.

- Try new wallets to explore new features.

- Duress/Dummy wallets for use when criminals try to hijack your crypto or even worse, attempt a “$5 Wrench Attack.”

Challenges of Multiple Crypto Wallets

Keep in mind the following before making the decision to use multiple wallets:

- You need to make sure that you can recover each and every wallet. You must have a backup for everything - otherwise your assets can easily be lost.

- Remember to record every seed phrase so you can access all wallets in the future.

- You must practice good Key Management- or else you could forget or lose access to your wallet seed phrases.

- You could forget that you even have some wallets in your inventory. To avoid this risk, keep your wallet inventory up to date.

- It is complicated to communicate information about multiple wallets to beneficiaries, especially keeping access private until the time comes to transfer that knowledge.

- For inheritance, your assets must be backed up and documented to pass on properly.

How Vault12 Guard Simplifies Multi-Wallet Management

What's needed is an integrated backup and inheritance solution, so that everything is backed up, recoverable, and can be passed on. Vault12 does all of this: it gives you the ability to generate, back up, and restore seed phrases. It’s easy to use for the person setting up the Digital Vault, the Guardians protecting it, and also for the beneficiary of the inheritance.

With multiple wallets, inheritance can become complex. Vault12 Guard simplifies multiple wallet management so that you can designate your choice of beneficiary and Guardians and ensure that the transition of your assets after your passing is seamless. Vault12 Guard helps you satisfy the following goals:

- Create an inventory of multiple wallets with associated seed phrases and passphrases.

- Designate a technical beneficiary who can manage assets in the event of your passing or incapacitation.

- Provide a simple and easy-to-use process both for the crypto asset owner and the beneficiary.

- Be independent of the legal process in any jurisdiction, but part of the overall trust and estate plan.

Managing Multiple Crypto Wallets with Vault12 Guard

The process to set up multiple wallets in Vault12 Guard couldn’t be easier.

Vault12 can optionally be used to generate seed phrases which can be imported into your wallets and stored in your Digital Vault for easy organization.

Whether you used Vault12 Guard to generate your seed phrases or another method, Vault12 Guard can back up your seed phrases as described in step-by-step detail with screenshots in the guide “Back up your Recovery Phrase or add an asset using Vault12.”

Do this for each wallet and you’re all set. Now everything is in one place and you can rest easy – Vault12 Guard is ready to distribute the encrypted backup of your assets to all of your Guardians.

When you need to restore your Digital Vault (whether it holds one or multiple wallets) follow the simple steps to restore your Vault. In the case of inheritance, your Digital Vault beneficiary will use the Vault12 Guard app to request and receive approval from your chosen Guardians to access your Digital Vault’s inventory of wallets.

Once set up, Vault12 Guard offers you peace of mind and the confidence of knowing that your assets are secure, organized, and ready to pass on.

DC Blockchain Summit | The Mindset of Retail Investors

Presented at DC Blockchain Summit 2025 in Washington D.C.

🎙 Featured Panelists:U.S. Rep. Shri Thanedar, Andrew McCormick, eToro, Tarek Mansour, Kalshi

Moderated by: Wasim Ahmad: Wasim Ahmad, Vault12

Livestream: livestream

Youtube: https://www.youtube.com/@TheDigitalChamber/videos

*** Special Offer for Podcast listeners ***

Promo codes for Vault12 Guard

The iOS codes are good for 1 year subscription at no cost, then will revert to standard price for Inheritance plan. iOS codes can be redeemed in the Apple App Store.

The Android codes are good for 90 days subscription at no cost, then will revert to standard price for Inheritance plan. Android codes are redeemed when selecting and paying for the Inheritance plan in the app.

Instructions for how to redeem here.

Code: CMNYC25

iOS: https://apps.apple.com/redeem?ctx=offercodes&id=1451596986&code=CMNYC25

Android: Enter code CMNYC25 when you select the Inheritance plan

Transcript

Wasim Ahmad:

Hey, everyone. My name is Wasim Ahmad. I'm one of the co-founders of Vault12, which helps retail investors do cryptocurrency inheritance, something that everyone needs to think about because no one's going to do it for you. And then, joining me on the panel today is Tarek Mansour from Kalshi, Andrew McCormick from eToro and Congressman Shri Thanedar from Michigan.

Shri Thanedar:

Michigan. Yeah.

Wasim Ahmad:

Wonderful. Great. Okay, so we're going to jump into it straight away. So my first question is for Andrew and Tarek really to define for us the conversation around retail investors. So who have they been and how is that evolving? Do you want to take it away?

Andrew McCormick:

Yeah. I'd love to jump in. Thanks, everyone, for being here. So I think we've seen some incredible and really cool trends in the last couple years. Historically, the stereotypes is investing is for older, rich people, and that's it. In the last couple of years, we're seeing all those barriers fall down. In the US in traditional markets, we've seen 50% of Americans typically own stocks. That's now more like 60%, 65%. A percentage of Americans holding crypto assets in the last two to three years has doubled. And I think what's especially cool is there's more people investing, but also at a younger age. And at eToro, we are retail trading platform serving millions of customers around the world and a majority of our users are millennials and younger, which we classify as young investors, which brings joy to my heart, because I'm barely a millennial. So technically I am still at age 42, a young investor.

And so what we see more people are investing, at younger ages and it's having a very interesting impact because younger folks have a longer time horizon so they can take more risk. Stereotypically, that's like the YOLO trades people talk about in the news, meme stocks, meme coins, but it goes beyond that. We've seen ETF assets more than double in the last five years. And I think it's cool because if you're a young investor and you're starting at 20 instead of 45, you can take more risk, you have a longer time horizon. I think that's really, really healthy and really exciting and will seem relevant to your world. An amazing trend we're going to see in 20 years is where just 80 plus trillion dollars are going to pass from older generations to millennials and younger by 2050.

Wasim Ahmad:

And 7 trillion of that is going to be in crypto assets.

Andrew McCormick:

That's a great commercial for you. And what's amazing, most of those assets today are probably in advisory accounts where people go into an office, they meet with a financial advisor once or twice a year. And younger investors, I don't think that's our jam. That's not what people are going to do in the future. And so mobile trading apps where people are doing these trades on their phone, I think are going to be a recipient for a lot of these types of assets. And maybe that's crypto, maybe that's meme stocks, maybe that's really cool binary futures platforms where today, older folks aren't really down with it, but in the future, it's going to be the norm. So more people investing and younger, and I think that's a powerful force.

Wasim Ahmad:

So Tarek, you started your company at the age of 22. So your retail customer's older or younger?

Tarek Mansour:

We have the full spectrum. So it's definitely concentrated. It's a curve that just goes down as the age goes up. But maybe just a little bit of context on how we started the company. So what we do at Kalshi, we're a prediction market in the US, the leading one. If you didn't hear the name of the company, you probably heard that we were forecasting Trump winning the election leading up to the election. What we do is we list derivatives, we're regulated by the CFTC, and these derivatives are yes or no question about anything that could happen in the future. Who is going to win an election? Will it rain tomorrow? What is the Fed going to do at the next meeting, and is a hurricane going to hit a certain city? So I actually started the company after spending some time at Goldman and Citadel, and the key insight that we saw when I was there, the clients were not retail clients, they were institutional clients actually. They were asking very simple questions about the future. It's like, "Hey, we want to hedge against Brexit or get exposure to Brexit." That was actually 80% of the flow we used to get at the desk at Goldman.

And what we would do is we would use traditional assets to give them that exposure they were looking for. But there were a few problems. One, it was a proxy. So a lot of people actually put on an S&P short ahead of the 2016 Trump election because they thought that was a Trump hedge. Trump did indeed win. So they were right, but they lost money because the S&P went up. And then number two is kind of opaque, it was OTC, the banks would decide the price, and there wasn't sort of a dynamic transparent marketplace for these things. That's where we came from to build this marketplace.

So going back to the question about retail, what we see with Kalshi, so we spent years getting regulated, we've grown a lot now, we have millions of customers. And these customers are actually generally speaking, people that have traditionally not been in financial markets. Our average customer, if you ask them, "Do you trade in options and derivatives?" Their usual answer is actually, "No because I don't gamble." And the reason they answer that way is because what we've built is we've built a tool, a financial instrument that a much vaster and wider range of people relate to. A lot of people may relate to things around culture and what's going on there or the weather. Most people relate with the weather, because they can see if it's rainy or sunny or politics, which a lot of people... I mean, I don't need to tell you about how much people relate with politics and a variety of other things, but they didn't really have a mechanism to actually express opinions on these types of topics that they relate to or have views on or hedge risk with respect to these things. And it's so interesting because if you're a person that's worried about Brexit, how it's going to impact your business, you actually understand that very, very well and intricately. You may not understand a lot of the traditional assets.

So we see kind of this rising class of people that are entering financial markets, but really through prediction markets, through Kalshi, and it's this sort of idea of... I like the analogy at the time Uber was like the pitch to a lot of drivers was like you have extra time, how about you monetize it? And this rising class of people that... And it's really beautiful. You read the news a lot. You know a lot about the economy, you have a lot of views, you go to trivia night and argue with your friends on Twitter. You have a lot of knowledge, how about you monetize it? And that's really what we're seeing at least on our end. And I find that very, very exciting because the playing field now is pretty level. Citadel is not actually the dominant force in our types of markets. It's retail.

Wasim Ahmad:

Great. Great. So Congressman, I want to turn to you. You represent a district in Michigan. You were the only democratic co-sponsor of a bill that focused on removing the IRS from being able to kind of mess around with CeFi and DeFi corporations. What is your vision for how crypto can help retail investors?

Shri Thanedar:

Well, look, thank you for having me on the panel, Wasim.

Wasim Ahmad:

Of course.

Shri Thanedar:

My name is Shri Thanedar. I represent Michigan's 13th Congressional District, and I was proud to vote for the FIT21 and as well as Resolution 25. Again making it easier, in my district now, my district is one of the fifth poorest district in the country, and I'm starting to see Bitcoin ATMs popping up especially in the low income areas, something that is charging 20% premium on purchasing Bitcoin. So from that, how do we go to a position where crypto is in every wallet and people, not just the wealthy and accessible, but people at the low income area, how would they start using this as their daily currency? How would my small mama-papa businesses would use this to do business across the world? And then, how does Congress come in and make it easier? How do we make sure that the innovators and entrepreneurs aren't going to UAE and aren't going to Singapore and everywhere else, that we have meaningful guidelines that the innovators and the entrepreneurs feel comfortable setting up their shop in the US because they could go take their laptop and go anywhere they want to go. And how do we keep them here in the US? How do we make this, just make sure that crypto is in every wallet?

Wasim Ahmad:

Great. So I'm going to delve into those questions a little later.

Andrew McCormick, eToro

Wasim Ahmad:

So before we get there though, I would like the panelists to talk about what are the biggest challenges facing retail investors today.

Andrew McCormick:

So there's certainly challenges. I'm a lawyer by trade, so I'll give a disclosure at the beginning because lawyers love disclosures, that there's no better time in American history to be an investor than today. So typically, you would need to know a financial advisor. Just to place a trade, you need $20 to pay a commission. You'd have to buy a full share. And if you want to do that for G&E or something, you might need $300 to place a single trade. Today, you can get started with $10. Whether that's a stock, ETF, crypto. And so there's no better time to be an investor than today. It's never been easier. At the same time, there's never been so many educational resources out there, so many platforms that are making cool, innovative, engaging products that help people build better lives for them and their families.

Some challenges though with that is there's persistent news out there, right? So years ago, if there's a huge drop in the stock market, you read about it the next day in the newspaper, you go to work. Now you're getting alerts on your phone, your friends are talking about it, you see it on TV, social media, emails, so it's easy to freak out and get scared. And there's probably nothing worse as an investor to do is to panic, to make an emotional sell, emotional trade. And I think that's hard in today's market because there's just information everywhere, which is really great and empowering and breaks down barriers but can cause an emotional drain on you, whether it's finance or politics or your sports team is not performing how you want, you see it all the time. So I think that information overload is a challenge, so I think it's important as an investor to stay committed and don't freak out and just plan for the future one step at a time.

Wasim Ahmad:

So eToro is like the Robinhood of Europe, and then you have a footprint now in the US that's growing. Really what is it that you're delivering that addresses the challenges of retail investors? Is it a smoother on ramp into a variety of different financial products? Is that kind of your mission?

Andrew McCormick:

So one is diversity of products, right? We're not just crypto, we're not just stocks. We have crypto, stocks, ETFs. In the future, we'll probably have futures and investment accounts and advisory accounts. So the diversity of offering is number one. Number two, we're very passionate about education. So we have a whole content called the eToro Academy with hundreds, maybe thousands of articles, videos in what we call snackable content. It's like not some long thesis that no one's ever going to read, like a two-minute video on key topics. What's an ETF? What's day trading? Things like that, where people can digest it in the way we digest news and information today.

And then, just trying to make it super easy to get started. No commission on stock trading. You can make investments for as little as $10. So my family, we're passionate about Chipotle. So one thing that like all our kids eat, and historically you might need $500 to buy a share of Chipotle. Now if you're passionate about Chipotle and you're like, you know what? I don't want to be just a customer there, I want to be an owner, $10. And you can start building that platform, and that innovative $10 entry point is not something that most firms offer.

Tarek Mansour, Kalshi

Wasim Ahmad:

That's great. So Tarek, you have upwards of 2 million downloads, billions of dollars in the market, and then you have partnered with Robinhood and Webull. Is that right?

Tarek Mansour:

Yeah. With more in the pipeline.

Wasim Ahmad:

Right, right. So what are you seeing as either challenges or just things that retail investors are overcoming in the rush to jump on top of prediction markets?

Tarek Mansour:

Yeah. I mean, I think, yeah, we now have, I would say one of the largest ecosystems in terms of retail presence in the US. I'll talk a little bit about the challenges because I do think it's an interesting question. I think of them as sort of two buckets. One of them is regulation and the second one is let's call it like short attention spans, which I think is a real problem in retail today. The thing with regulation, and I'm talking a bit more strictly about CFTC world, which is the world that we live in. I mean, historically retail has generally been a bit left off the conversation. They're kind of always lagging, generally they're underestimated. And I think the world has woken up now to like, yeah, actually retail can propel a stock to multi-trillion dollar market caps these days. That's something that was totally not possible 10 years ago. It is today. And I think there is a lot of work to do on creating...

One example is in our world in CFTC, there's actually no real consensus definition of what a retail investor is. When you're asking about retail, I'm thinking like, I actually don't really know what that is. Or a general definition, it's a dude trading, but like what is retail, and how do you think about that? Because there's sophisticated retail, there's extremely informed flow, there's less informed flow, and how do you differentiate between these? And I think so that's one challenge. I think there's a lot of work to do and I think it's been very encouraging over... In recent history, we're seeing a lot more willingness and discussion around retail in our world, in the CFTC world.

The second thing is, I think the world is short. Like we talk a lot about retail, sort of short attention span with people, but you're not seeing kind of changes that fit that. But the reality is like people can't really read anymore. The average 25-year-old cannot read a blog post. They just can't. They have to get something in 10 seconds, and if it's less than 10 seconds, they're gone. As we think about that, it's like you need to restructure the marketplace. You need to restructure education. You need to restructure the entire journey that a retail customer goes through when they experience any financial service with that core principle in mind. Like you cannot actually go force people to go read long blog posts or long terms and conditions and then tell them like, "Hey, it was there. You should have known." You have to kind of integrate that into your UX, and that's a lot of the work we do at Kalshi.

Wasim Ahmad:

Great. So Congressman, you touched on this. So how do you see crypto helping the average ordinary investor? You talked about it, you touched on it in your opening remarks, and I know Senator Cory Booker has talked about this, but it's not a general conversation that's out in the media or anywhere. So having seen poverty and all of those kinds of things, where do you see crypto helping the average person, the everyday person?

Shri Thanedar:

Well, look, the small businesses. Doing business across the world is so difficult through the current banking system, the long delays that are happening, the rejections of wires and transfer of money, the cost. As opposed to through crypto, transactions can happen in a matter of seconds. And to having that access, low cost or no cost access to be able to transact quickly, efficiently, without having to go through the bureaucracy of a bank or without having to go through the fee structure. I do a lot of business myself with India, and when it's sending small amounts of dollars to Indian vendor become so difficult because invariably, they get caught into the banking structure, and I get almost half of my wires get rejected when I go through the bank.

Whereas having that access to do business, it would mean a lot to have that access for a small business. It would mean a lot to have that access for person of low income transacting. And the blockchain just takes this further with all kinds of opportunities outside of crypto. That all need to be explored. And we in the United States, need to be the leader of the world in this. And this is where most of the innovation must happen. Unfortunately, currently, the crypto transaction, 90% of them are outside of the US, so that has to change. And that's what something I want to look at it from the Congress's perspective, how can we change regulations? How can we change things to make it easier for people to do business?

Wasim Ahmad:

Okay. So unlike a lot of Congresspeople, you are actually a businessperson, a scientist, and an entrepreneur prior to taking your place in Congress. So how are you working with your colleagues? Earlier today, there was a session with Representatives Sarah McBride, Don Davis and Sam Liccardo, talking about how they were working with Congress. So I'd love to hear from you, what are you doing to further your vision?

Shri Thanedar: