Contents

Crypto Inheritance Update: DC Blockchain Summit

Vault12’s monthly update on regs, the industry, and crypto inheritance management

Special Update from DC Blockchain Summit 2025

Peirce: The SEC's approach has put innovators in 'straightjackets'

Thanks for reading Vault12 Crypto Inheritance Newsletter! Subscribe for free to receive new posts and support my work.

DC Blockchain Summit was a terrifically ebullient event, with attendees feeling enthusiastic having survived the last administration’s attempts to strangle crypto innovation in the United States.

The Summit is put on by the Digital Chamber of Commerce, which is a lobbying group that Vault12 has been a member of and has participated actively in working groups to shape bills and legislation.

Key Takeaways:

- We have a clear timeline for new bills and regulations regulating crypto in the U.S.

- First up is the Stablecoin bill, which is expected to pass and be signed into law this Spring. This is important for Vault12 customers as it means that dramatically more retail investors will be exposed to cryptocurrency and therefore the need to safeguard their digital assets.

- Second is the Market Structure Bill (aka FIT21), a comprehensive bill that will define how crypto markets are regulated, the roles of security and utility tokens, and other market-defining capabilities that will eventually become the standard for worldwide crypto regulation. This is widely expected to be signed into law in August 2025.

Impact: While these bills and regulations are being worked on, attitudes and behaviour towards crypto assets may start to change; however, it is important to note that since no laws have changed, until the Market Structure Bill is in place, we remain in nebulous territory with respect to how tokens can be freely disseminated.

Further Reading:

- In remarks at the DC Blockchain Summit, Commissioner Hester Peirce said, “The Crypto Task Force has had many helpful meetings with outside parties, and we already have received approximately fifty thoughtful written submissions. The Task Force’s first public roundtable last Friday was a productive conversation among thoughtful experts with varied views. Additional roundtables are on the schedule. All of this engagement is extremely helpful, as we consider how the Commission and its staff can provide clarity about what is outside of our jurisdiction and practical compliance solutions for activities that are within our jurisdiction. For example, as the discussion at our recent roundtable highlighted, the Commission needs to think separately about transactions and assets that are the subject of transactions. Many crypto assets themselves are not securities, but primary offerings of crypto assets for capital raising purposes are securities transactions. Accordingly, staff is open to inquiries about how to conduct such offerings as either registered or exempt transactions. And the Task Force welcomes well-reasoned requests for no-action letters or exemptive relief that can be finalized quickly to allow activity to start soon. Lessons learned from these short- and medium-term efforts can inform longer-term regulatory and legislative efforts.” (Remarks)

- Rep. Tom Emmer (R-MN) tweeted, “Today, RepDarrenSoto and I reintroduced the bipartisan Securities Clarity Act to codify, once and for all, that, like the orange groves in SEC v. W. J. Howey Co., a digital asset is separate and distinct from an investment contract through which it may be offered. American prosperity, ingenuity, and opportunity demand legal clarity. The Securities Clarity Act is one piece of that puzzle.”

This short bill simply legally separates a digital asset from the offering in which it is sold. Therefore, despite being sold as part of a securities offering, the underlying digital asset can still be deemed a commodity (or otherwise not a security) if it has utility on a network or is decentralized, etc. This bill was part of last-year’s FIT21 Act. So, presumably, when this year’s version of the FIT21 Act is written, it will also contain this bill. Congress can therefore pass it as a stand-alone or as part of the bigger bill.

The reason this bill is still important is that by incorporating this separation directly into federal law, subsequent administrations cannot unilaterally go back to the Gensler position. The Vault12 legal team also had separate meetings with the SEC Crypto Taskforce and is excited to continue to give feedback to the team as these regulations are formulated to optimize the crypto industry in the US.

We will issue another roundup in a couple of weeks, currently in Paris, where we are attending the Finance and Blockchain Summit held at the French Ministry of Economy and Finance during Paris Blockchain Week.

We are also trying to locate a Vault to record a podcast in.

New to Crypto Inheritance? Start here.

Worried about leaving your crypto on exchanges?

Maybe February’s massive ($1.4 Billion USD) Dubai-based Bybit exchange hack caught your attention. Fortunately, it seems that client assets are guaranteed … although this by no means implies that all future hacks of exchanges will end so neatly. The main lesson for digital asset owners might be that even professionals are susceptible to being tricked by sophisticated attackers. The concept of self-custody versus third-party custody of assets is important to understand: there are common pitfalls in trusting others to protect your assets and pitfalls of doing it yourself, as explained at a high level in “Why should you care about cryptocurrency security?”

Digital asset privacy still controversial

Privacy is one of the challenges that lingers unresolved in the digital assets space. Digital privacy is multi-faceted: what should government agencies, crypto exchanges, and the general public know about your digital asset ownership and transactions? There is a balance of arguably legitimate “need to know” by financial regulators, as well as a vast assortment of illegitimate interests that sophisticated bad actors can abuse. One aspect of this delicate balance became clearer on March 12, 2025, when the United States Congress declared that DeFi protocols do not have an obligation to report taxpayer proceeds from crypto sales to the Internal Revenue Service. (Of course, U.S. citizens still have to!) If you’d like to review and refresh your memory about protecting your privacy as a digital asset owner, don’t miss our article “Why Does Privacy Matter?” that explores related issues and offers practical recommendations.

The cat-and-mouse evolution of crypto scams and hacks

On March 10, 2025, the California Department of Financial Protection and Innovation (DFPI) updated its catalog of crypto threats, reporting on numerous scam websites that it took down in 2024, and issued renewed warnings to digital asset owners to remain vigilant against trickery of all kinds. Stay aware of the evolving landscape of threats, and follow best practices to reduce your risks. Reconsider your protective habits with the help of our actionable recommendations in “11 things you need for a safer crypto environment.”

Crypto Inheritance Update: DC Blockchain Summit

Vault12’s monthly update on regs, the industry, and crypto inheritance management

Wasim Ahmad

Wasim is a serial entrepreneur and an advisor in the fields of AI, blockchain, cryptocurrency, and encryption solutions. At Vault12, the pioneer of crypto inheritance, he led the private and public fundraising efforts and focuses today on expanding the Vault12 ecosystem. His crypto experience began with AlphaPoint, where he worked with the founding team to launch the world's first crypto trading exchanges. Previously he was a founding member of Voltage Security, a spinout from Stanford University, that launched Identity-Based Encryption (IBE), a breakthrough in Public Key Cryptography, and pioneered the use of sophisticated data encryption to protect sensitive data across the world's payment systems. Wasim serves on the board of non-profit, StartOut, and is a Seedcamp and WeWork Labs global mentor.

Wasim graduated with a Bachelor of Science in Physics and French from the University of Sussex.

You will lose your Bitcoin and other crypto when you die...

...unless you set up Crypto Inheritance Management today.

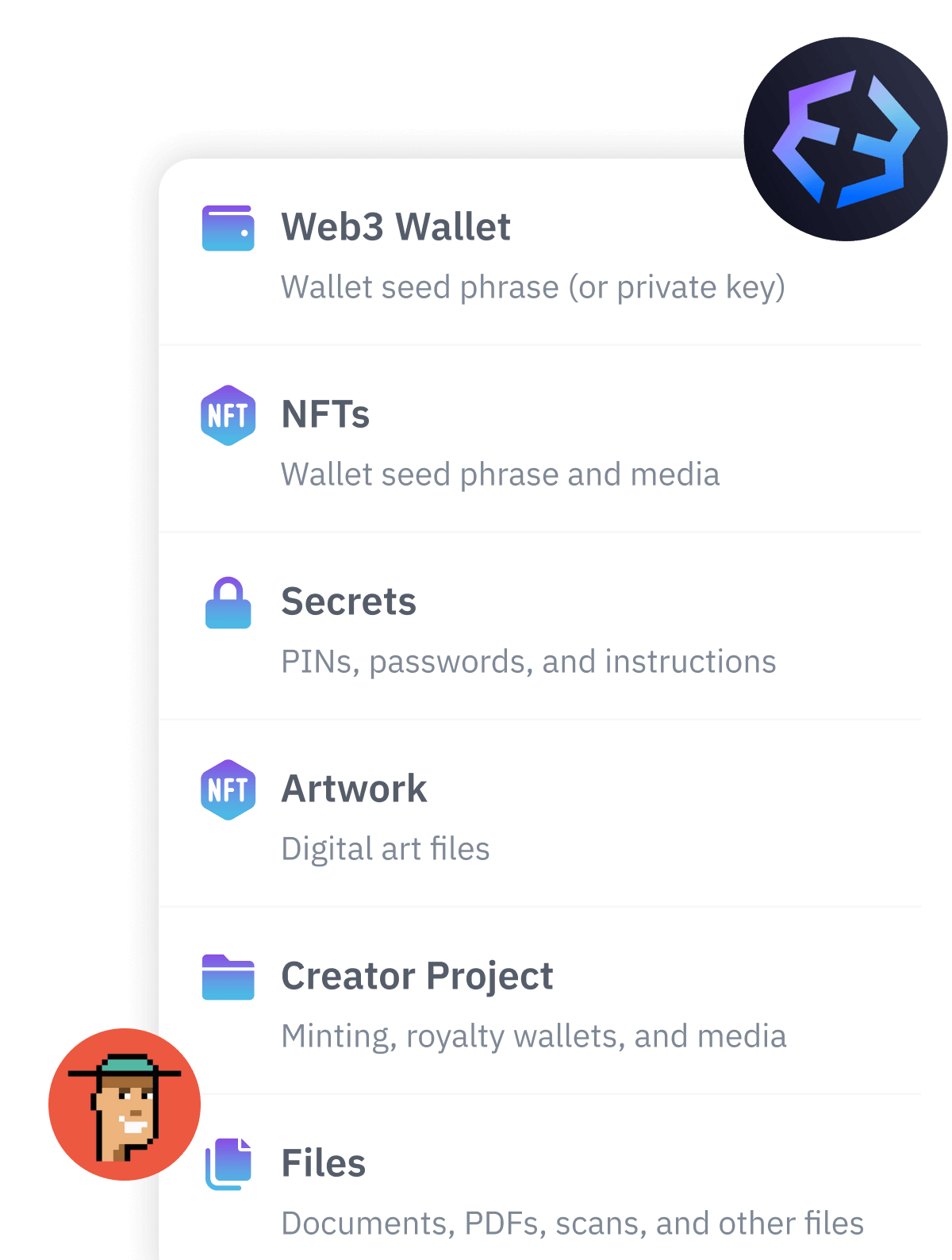

It's simple — if you don't worry about crypto inheritance, nobody else will — not your software or hardware wallet vendors, not your exchanges, and not your wealth managers. So it's up to you to think about how to protect the generational wealth you have created, and reduce the risks around passing that crypto wealth on to your family and heirs. What are the challenges with crypto inheritance?

- Crypto Wallets are difficult to use and do not offer crypto inheritance management. In fact, most of them tell you to write down your seed phrase on a piece of paper, which is practically useless.

- Some people back up their wallet seed phrases or private keys on paper, local devices like hardware wallets or USBs, or in the cloud. All of these options have severe drawbacks that range from hacking to accidental loss to disrupted cloud services.

- Software wallets operate onspecific blockchains, yet your crypto assets span multiple blockchains. For inheritance to work, you must be able to manage inheritance across every blockchain — now and forever.

Crypto Inheritance Management: Secure, Self-Custody Crypto Inheritance and Backup

Vault12 is the pioneer in Crypto Inheritance Management, offering a simple yet powerful way to designate a legacy contact and pass on your crypto assets—like Bitcoin (BTC), Ethereum (ETH) and Solana (SOL) —to future generations. Built for everyday users yet robust enough for the most seasoned crypto enthusiasts, Vault12 Guard ensures your wallet seed phrases and private keys are preserved in a fully self-sovereign manner, across all Blockchains.

At the heart of Vault12 Guard is quantum-resistant cryptography and a decentralized, peer-to-peer network of trusted Guardians. Your critical information is never stored in the cloud, on Vault12 servers, or even on local devices—dramatically reducing the risk of a single point of failure. By fusing a powerful software layer with the Secure Element of iOS devices (Secure Enclave) and Google devices (Strongbox), Vault12 Guard locks down your private keys against present and future threats.

Our innovative approach harnesses social recovery, enabling you to appoint one or more trusted individuals or mobile devices as Guardians. These Guardians collectively safeguard your protected seed phrases in a decentralized digital Vault—so there’s no need for constant lawyer updates or bulky paperwork. Should the unexpected happen, your chosen legacy contact can seamlessly inherit your crypto assets without compromising your privacy or security.

Preserve your digital wealth for generations to come with Vault12 Guard—the simplest, most secure way to manage crypto inheritance and backup.

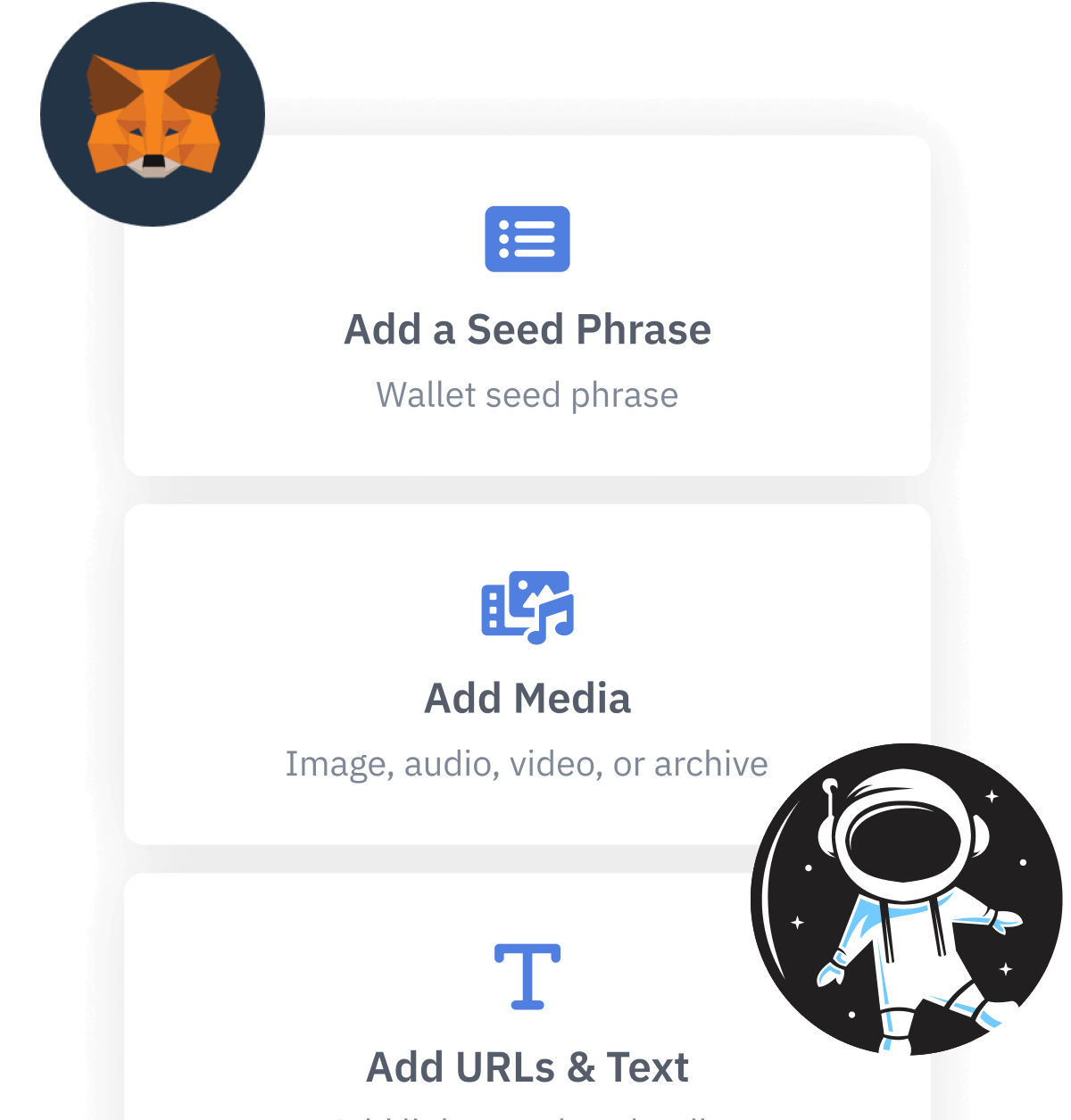

Take the first step and back up your crypto wallets.

Designed to be used alongside traditional hardware and software crypto wallets, Vault12 Guard helps cryptocurrency owners back up their wallet seed phrases and private keys (assets) without storing anything in the cloud, or in any single location. This increases protection and decreases the risk of loss.

The first step in crypto Inheritance Management is making sure you have an up-to-date backup.

The Vault12 Guard app enables secure decentralized backups, and provides inheritance for all your seed phrases and private keys across any blockchain, including Bitcoin, Ethereum, and others, and for any crypto wallet.

Note: For anyone unfamiliar with cryptocurrencies, Vault12 refers to wallet seed phrases and private keys as assets, crypto assets, and digital assets. The Vault12 Guard app includes a software wallet that works alongside your Digital Vault. The primary purpose of this is to guard your Bitcoin (BTC) and Ethereum (ETH) wallet seed phrases, private keys, and other essential data, now and for future generations.