Contents

- Unprecedented Asset Transfer via Inheritance by 2045

- The Bank of America Private Bank Study

- Crypto and Digital Asset Allocations

- Crypto, Inheritance, and Wealth Management in Younger Generations

- Inheritance and Estate Planning "Strain Points"

- What you need to know about Crypto Inheritance Planning

- Why Choose Vault12 Guard for Crypto Inheritance Management?

- Key Product Features of Vault12 Guard

$6 Trillion of Crypto Assets to Be Inherited by 2045

How will you manage your crypto inheritance?

Over the next two decades, up to $6 trillion in crypto could be inherited, as younger investors favor digital assets over traditional stocks and bonds. Learn how this shift is reshaping wealth transfer and the future of investing

Unprecedented Asset Transfer via Inheritance by 2045

A recent report, the 2024 Bank of America Private Bank Study on Wealthy Americans, reveals key trends related to inheritance, and particularly how younger generations view the future of wealth, including crypto and estate planning.

An astounding $84 trillion of wealth transfer is projected over the next 20 years from current generations to Gen X, Millenials and Gen Z. Renowned expert Matthew Sigil, head of digital assets research at Van Eck (a prominent issuer of Bitcoin ETFs) has estimated that of this amount, $6T in crypto assets will be passed on via inheritance.

This transfer will be successful only if care and attention are paid to crypto inheritance planning and management, and if the right approaches are in place to support the technical transfer of these funds. Crypto assets are technically different in a number of ways to traditional assets, so inheritance needs to be carefully choreographed between asset owners, Trust and Estate Lawyers, and intended crypto beneficiaries.

Despite the fact that important steps must be taken for the safe, secure, and private transfer of crypto assets, none of the participants in the crypto ecosystem have offered inheritance plans or services. The pioneer of crypto inheritance management since 2015 has been Vault12.

Vault12 has built and continues to innovate a comprehensive solution that is easy to use for non-technical participants, yet incorporates a highly secure architecture and technology that is designed to preserve your crypto wealth and ensure successful transfer to your heirs. Learn more at vault12.com.

The Bank of America Private Bank Study

This report by Bank of America Private Bank analyzes financial outlooks, investing habits, and estate planning practices of wealthy Americans. The study reveals a generational divide, with younger wealthy individuals exhibiting different investment preferences than older generations. Younger individuals tend to be more skeptical of traditional investment strategies, and favor alternatives like cryptocurrencies and private equity. The study highlights the challenges facing wealthy families as they navigate wealth transfer, including the emotional strain of inheritance and the increasing burden of serving as trustee or executor.

Takeaways

- Great Wealth Transfer: Approximately $84 trillion is projected to transfer from seniors and baby boomers to Gen X, millennials, and their heirs by 2045.

- Crypto Inheritance Surge: Matthew Sigel of VanEck Investments estimates that up to $6 trillion could enter the crypto market through inheritance in the next 20 years.

- Investment Shifts: Millennials and Gen Xers will inherit $84 trillion, with a growing proportion of cryptocurrencies.

- Young Investor Participation: To reach the $6 trillion estimate, young investors (ages 21-43) need to allocate 14% of their inherited wealth to crypto: about $300 billion annually.

- Broader Investment Preferences: Many young investors view traditional stocks and bonds as insufficient for superior returns, preferring high-growth assets like cryptocurrencies.

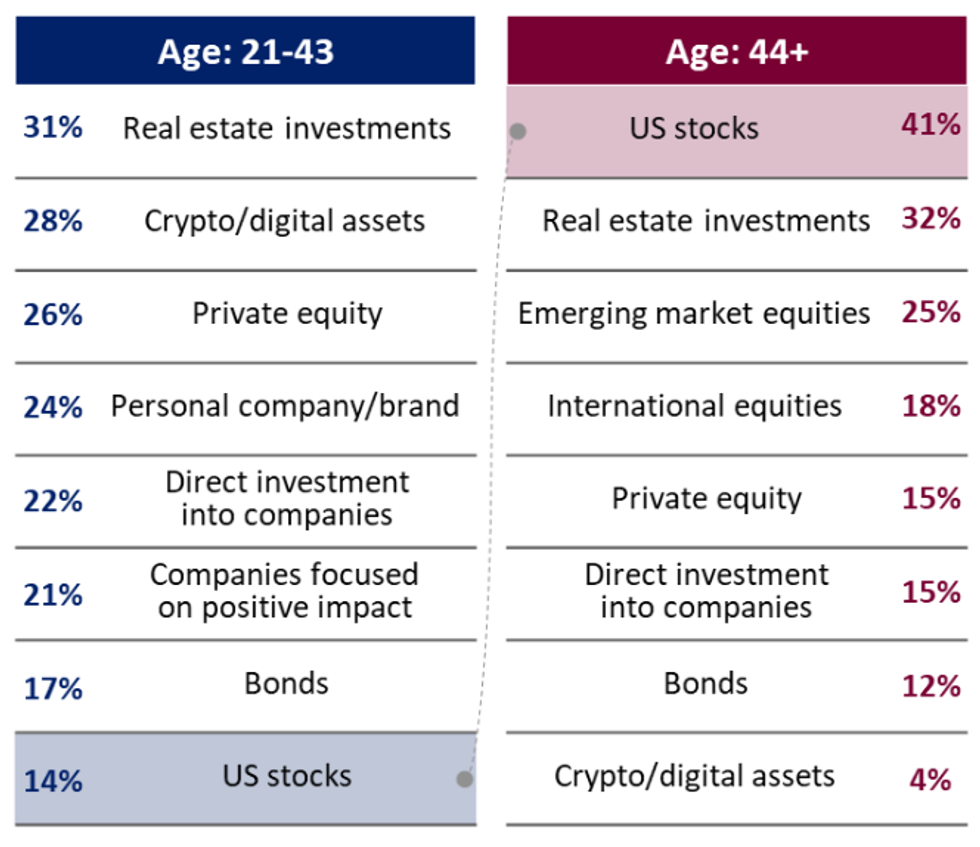

- Risk Appetite by Generation: Younger investors show a higher risk tolerance, with significant crypto allocations (14%-17%) compared to older investors, who remain conservative.

- Crypto Exposure: Younger investors hold the highest average exposure to crypto, highlighting a shift in how the next generation approaches digital assets.

Sources:

2024 Bank of America Private Bank Study of Wealthy Americans

VanEck: $6 Trillion Could Pour Into Bitcoin, XRP and Crypto via Inheritances Over 20 Years

Crypto and Digital Asset Allocations

Bank of America 2024 Private Bank Study on Wealthy Americans

Crypto, Inheritance, and Wealth Management in Younger Generations

The 2024 Bank of America Private Bank Study on Wealthy Americans focuses on several key trends related to inheritance, particularly how younger generations view the future of wealth, including crypto and estate planning.

1. Crypto and Digital Assets

Younger generations (ages 21-42) are more inclined to see digital assets like cryptocurrency as a key growth opportunity. Around 28% of younger respondents ranked crypto as a promising investment vehicle, significantly higher than older generations, where only 4% expressed the same confidence. This highlights the generational shift towards embracing newer financial instruments like blockchain and decentralized finance.

2. Inheritance and Estate Planning

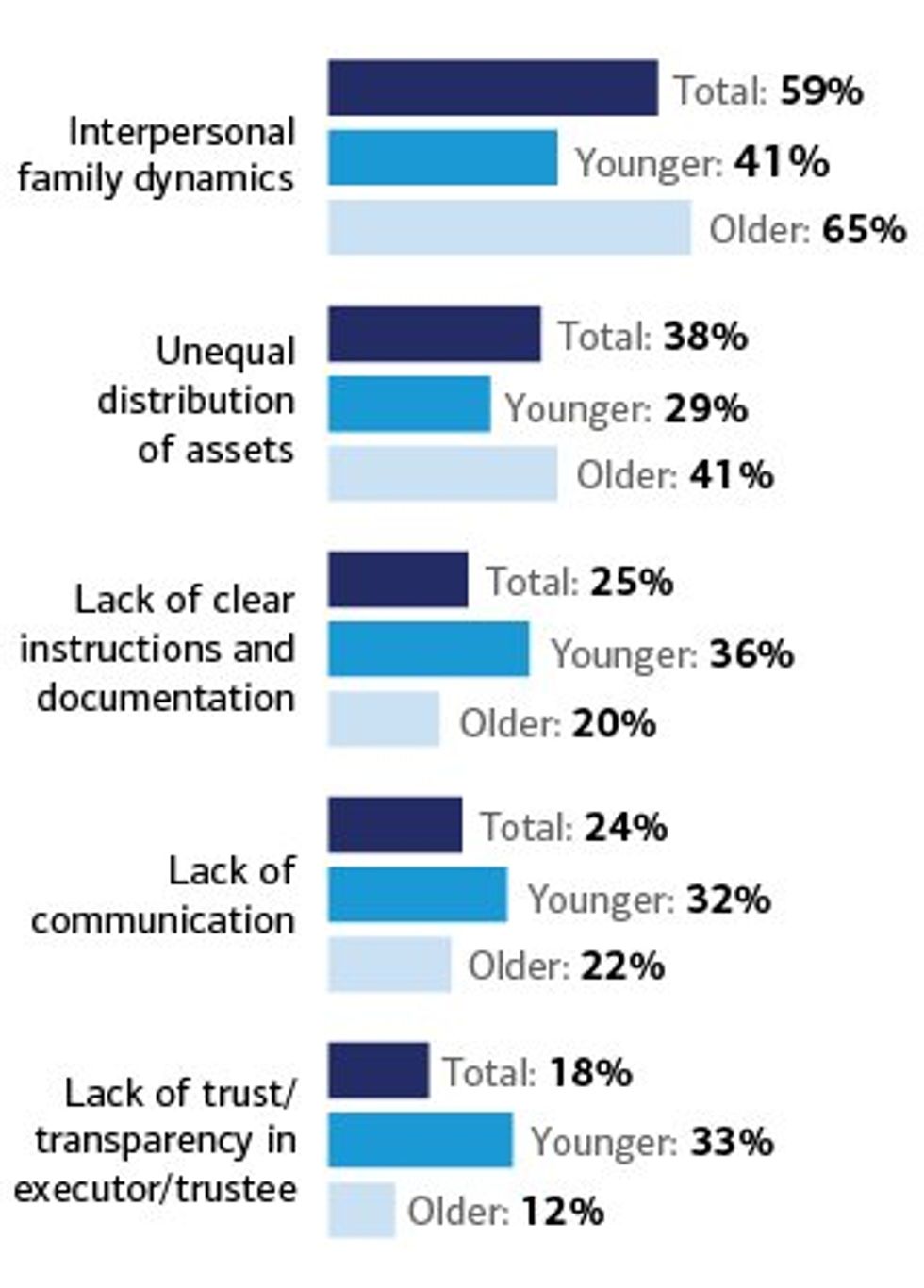

Interpersonal family dynamics can create tension during wealth transfers. For both younger and older wealthy individuals, unequal distribution of assets and a lack of clear instructions or communication were common sources of strain. Younger generations are more focused on including hard assets like jewelry and heirlooms — which are frequently overlooked in formal planning — in their estate plans.

3. Generational Differences in Wealth Management

Younger heirs are more likely to pursue alternative investment strategies, such as private equity and digital tools, reflecting their broader interest in controlling their wealth. These individuals also prioritize sustainability and impact investing as part of their inheritance planning, distinguishing their approach from older generations.

These insights demonstrate the ongoing generational divide in attitudes toward wealth management and the evolving role of digital assets in estate planning.

Inheritance and Estate Planning "Strain Points"

Factors driving strain on inheritance-related issues

Bank of America 2024 Private Bank Study

What you need to know about Crypto Inheritance Planning

Unlike traditional assets, crypto assets need to be managed differently from an inheritance standpoint. In fact, the only similarity between traditional and digital assets is that you must maintain an update inventory of them. The main challenges associated with crypto inheritance are:

- Inventory of crypto assets: You must carefully maintain an inventory of crypto assets. This means backing up seed phrases and/or private keys of all crypto wallets, across all blockchains, and all types of devices or places where those wallets exist, e.g., mobile phones, hardware wallets, cloud, and paper backups. Any assets that are not documented in your backup are liable to be lost.

- Privacy of all information: You must ensure absolute privacy of the backup information. Anyone with access to private keys or seed phrases will be able to compromise the funds. This includes ensuring that any documentation left with your lawyers is strongly protected.

- Critical Points of Failure: You must eliminate personal devices and cloud services as critical points of failure. The most significant risk in inheritance is reliance on individual devices, which can be stolen, lost, or damaged. The second risk is the dependency on one or more cloud servers. We have seen what happens when business relationships between cloud partners face legal challenges, or cloud services are disrupted by malware or bad software updates.

- Technical Beneficiary awareness: As the varieties of crypto assets expand over time, staying aware of them becomes important. You will need to designate someone technically fluent in this area. They may not be the ultimate beneficiary; however, you will need to trust them to distribute the assets per your wishes.

- Trust & Estate Attorney: You must consult with experienced lawyers who are well versed in inheritance of crypto assets. A great resource is "A Practical Guide to Estate Administration and Crypto Assets" by Richard Marshall from Hill Dickinson LLP.

Why Choose Vault12 Guard for Crypto Inheritance Management?

Vault12 is the pioneer of crypto inheritance management, and Vault12 Guard is the first solution to offer a simple, direct, and secure way for all types of investors to ensure that all of their crypto assets can be accessed by future generations.

Consider that:

- Traditional approaches to the inheritance of assets, when applied to digital assets, create complexity and risk.

- Your portfolio of digital assets is continually changing — you cannot rely on doing an inventory once, or for that matter continuously, without assistance.

- A simple and direct approach like Vault12 Guard reduces the uncertainty around assets not being available to the designated recipient. It also avoids having to approach and petition each service individually during probate to gain access.

- Inventory of crypto assets: The first step in inheritance is backing up all your crypto wallets. Vault12 makes this as easy as possible - despite the appalling lack of usability in current hardware and software wallets. There will always be new crypto assets on new blockchains, and Vault12 can manage any crypto asset on any device, on any blockchain, now and in the future.

- Privacy of all information: Your crypto assets are protected via a Secure Element (Secure Enclave in iOS, and Strongbox on Google Android phones), and the encryption used is Quantum-safe. With this security, no one knows what assets are part of your Vault.

- No Critical Points of Failure: No assets are stored locally, no assets are stored in any cloud, and no assets are stored at Vault12. There are no devices to lose, no paper backups, and no need to manually give encrypted assets to a subset of people. The Vault12 system is decentralized, making it a difficult target for hackers — and in fact for any type of failure.

- Confidence in a Technical Beneficiary: With Vault12 you get to designate a trusted technical beneficiary. Should you change your mind, you can swap them out at any time.

- Flexibility in Trust & Estate Attorney: While regulations and guidelines for inheritance planning can vary from state to state and country to country, Vault12 Guard is designed to be independent of whatever legal framework you choose to govern the inheritance of your assets. Vault12 Guard is simply a transfer mechanism that ensures all your crypto assets are passed from your control to a designated technical beneficiary.

Key Product Features of Vault12 Guard

The Vault12 platform provides your crypto assets with the highest security and strong backup resilience. Vault12 Guard Inheritance enables you to designate a beneficiary (an executor, trustee, or other chosen beneficiary) who can inherit the entire portfolio of digital assets that you choose to store in your Vault. There is no need to update an inventory continually or to issue updated instructions.

- Unified Digital Vault: Use Vault12 Guard Digital Vault to store digital assets, including cryptocurrency, financial login information, legal documents, medical records, and more.

- Guardian Network: The Vault is protected by your network of Guardians: friends, family, and/or business associates — people that you know and trust.

- Beneficiary Designation: Designate a beneficiary from your chosen Guardians. A declaration is then digitally signed, and can be emailed to other parties, such as lawyers.

- Trigger-Based Access: As a Vault Owner, you can configure a legally-defined trigger such as incapacitation or death. When the trigger occurs, the beneficiary indicates they are ready to access the digital assets. Assets are unlocked and transferred to the beneficiary only when a designated number of Guardians approve the request.

- Preemptive Veto Option: Should the beneficiary attempt to access the assets before they are intended to, the owner can veto the request before any of the Guardians receive an approval request.

.

$6 Trillion of Crypto Assets to Be Inherited by 2045

How will you manage your crypto inheritance?

Wasim Ahmad

Wasim Ahmad is a serial entrepreneur and an advisor in the fields of AI, blockchain, cryptocurrency, and encryption solutions. At Vault12, the pioneer of crypto inheritance, he led private and public fundraising efforts and focuses today on expanding the Vault12 ecosystem. In addition, he is a producer of the upcoming movie 'The Bitcoin Executor'.

His crypto experience began with AlphaPoint, where he worked with the founding team to launch the world's first crypto trading exchanges. Previously he was a founding member of Voltage Security, a spinout from Stanford University, that launched Identity-Based Encryption (IBE), a breakthrough in Public Key Cryptography, and pioneered the use of sophisticated data encryption to protect sensitive data across the world's payment systems.

He has also been very involved with regulatory initiatives in both the US and the UK, providing feedback to the SEC and FCA respectively pushing for expanded momentum for innovation and startups within the regulatory frameworks of both countries.

Wasim served on the board of non-profit, StartOut, and is a Seedcamp and WeWork Labs global mentor.

Wasim graduated with a Bachelor of Science in Physics and French from the University of Sussex.

You will lose your Bitcoin and other crypto when you die...

...unless you set up Crypto Inheritance today.

It's simple — if you don't worry about crypto inheritance, nobody else will — not your software or hardware wallet vendors, not your exchanges, and not your wealth managers. So it's up to you to think about how to protect the generational wealth you have created, and reduce the risks around passing that crypto wealth on to your family and heirs. What are the challenges with crypto inheritance?

- Crypto Wallets are difficult to use and do not offer crypto inheritance management. In fact, most of them tell you to write down your seed phrase on a piece of paper, which is practically useless.

- Some people back up their wallet seed phrases or private keys on paper, local devices like hardware wallets or USBs, or in the cloud. All of these options have severe drawbacks that range from hacking to accidental loss to disrupted cloud services.

- Software wallets operate on specific blockchains, yet your crypto assets span multiple blockchains. For inheritance to work, you must be able to manage inheritance across every blockchain — now and forever.

DISCLAIMER: Vault12 is NOT a financial institution, cryptocurrency exchange, wallet provider, or custodian. We do NOT hold, transfer, manage, or have access to any user funds, tokens, cryptocurrencies, or digital assets. Vault12 is exclusively a non-custodial information security and backup tool that helps users securely store their own wallet seed phrases and private keys. We provide no financial services, asset management, transaction capabilities, or investment advice. Users maintain complete control of their assets at all times.

Pioneering Crypto Inheritance: Secure Quantum-safe Storage and Backup

Vault12 is the pioneer in Crypto Inheritance, offering a simple yet powerful way to designate a legacy contact and pass on your crypto assets—like Bitcoin (BTC), Ethereum (ETH) and Solana (SOL) —to future generations. Built for everyday users yet robust enough for the most seasoned crypto enthusiasts, Vault12 Guard ensures your wallet seed phrases and private keys are preserved in a fully self-sovereign manner, across all Blockchains.

At the heart of Vault12 Guard is quantum-resistant cryptography and a decentralized, peer-to-peer network of trusted Guardians. Your critical information is never stored in the cloud, on Vault12 servers, or even on local devices—dramatically reducing the risk of a single point of failure. By fusing a powerful software layer with the Secure Element of iOS devices (Secure Enclave) and Google devices (Strongbox), Vault12 Guard locks down your private keys against present and future threats.

Our innovative approach harnesses social recovery, enabling you to appoint one or more trusted individuals or mobile devices as Guardians. These Guardians collectively safeguard your protected seed phrases in a decentralized digital Vault—so there’s no need for constant lawyer updates or bulky paperwork. Should the unexpected happen, your chosen legacy contact can seamlessly inherit your crypto assets without compromising your privacy or security.

Preserve your digital wealth for generations to come with Vault12 Guard—the simplest, most secure way to manage crypto inheritance and backup.

Take the first step and back up your crypto wallets.

Designed to be used alongside traditional hardware and software crypto wallets, Vault12 Guard helps cryptocurrency owners back up their wallet seed phrases and private keys (assets) without storing anything in the cloud, or in any single location. This increases protection and decreases the risk of loss.

The first step in crypto Inheritance Management is making sure you have an up-to-date backup.

The Vault12 Guard app enables secure decentralized backups, and provides inheritance for all your seed phrases and private keys across any blockchain, including Bitcoin, Ethereum, and others, and for any crypto wallet.

Note: For anyone unfamiliar with cryptocurrencies, Vault12 refers to wallet seed phrases and private keys as assets, crypto assets, and digital assets. The Vault12 Guard app includes a software wallet that works alongside your Digital Vault. The primary purpose of this is to guard your Bitcoin (BTC) and Ethereum (ETH) wallet seed phrases, private keys, and other essential data, now and for future generations.