Not Your Keys, Not Your Coins #Proofofkeys

Not Your Keys, Not Your Crypto

The best way to store your crypto keys

Keeping your private keys safe, secure, and under your control is essential to ensure financial independence and autonomy. Financial autonomy is what attracted early crypto adopters, and it remains a highly-valued characteristic in the crypto community.

Proof of Solvency

In addition to offering you monetary sovereignty, controlling your own digital asset keys also serves as a way to hold third-party services accountable by testing them for their solvency.

Some exchanges have been accused of failing to carry sufficient reserves — a risk that is exacerbated during crypto market downturns. There's also the possibility that an exchange or wallet provider becomes insolvent, has its accounts frozen, or pulls a salacious exit scam. If a large enough volume of crypto is moved off of an exchange by a significant portion of asset holders, custodians are challenged to prove they can accommodate users' demands for ownership of their coins.

In recent years, the amount of Bitcoin held by centralized exchange reserves has fallen, according to analysis by CryptoQuant.

Due to understandable uncertainty about whether centralized exchanges actually hold sufficient reserves to protect the crypto that they hold in custody, many exchanges have begun to offer "Proof of Reserves" audits to reassure investors that their crypto is responsibly held for them. However, not all exchanges offer such transparency.

The ability to verify the activity by these entities is the accountability that is built into blockchain technology, one of the greatest aspects of the technology. It is extremely important to pay attention to this due diligence because a huge disparity between the crypto balances and transaction activity can indicate foul play; in fact, 95% of total volume reported is faked according to a report by BitWise Asset Management.

While regulators are getting stricter, there is still a real lack of protection for exchange users whose funds may be exposed to hacks. In the event that a less-than-desirable event like a hack or fraud happens to the service you keep your crypto on, you may have no way of getting it back. Custodians like Coinbase and Bakkt can simply refuse or limit withdrawals. Smaller exchanges have made no commitment to any safety standards.

The Outcome

Crypto holders are reminded to be careful of who truly controls crypto wallet keys. Those who are new investors should also be aware of the importance of moving coins away from the institution where they bought them. When you custody your own crypto, you own the keys, and so you can potentially become a single point of failure. If you delegate the keys to third parties, you can be increasing your risk of loss of access, or loss of funds.

Avoid becoming a single point of failure, and avoid trusting others to protect your crypto keys: make sure that your keys are backed up elsewhere — there are solutions that are far better than paper or custodial services and that offer you reliable, ongoing access to your assets.

About the Author:

Kyle Graden is a digital native who was born in what's considered the Millennial Generation. Kyle is a nomadic entrepreneur, growth consultant, and QryptoQueer, striving to make a more accountable, transparent, and equitable world. Kyle's experience in the blockchain and cryptocurrency industry spans from marketing a crypto hedge fund to being named to the Top 100 Fintech for UN SDG Influencers list to speaking at conferences and participating in hackathons.

Vault12

Vault12 is the pioneer in crypto inheritance and backup. The company was founded in 2015 to provide a way to enable everyday crypto customers to add a legacy contact to their cry[to wallets. The Vault12 Guard solution is blockchain-independent, runs on any mobile device with biometric security, and is available in Apple and Google app stores.

Vault12 is NOT a financial institution, cryptocurrency exchange, or custodian. We do NOT hold, transfer, manage, or have access to any user funds, tokens, cryptocurrencies, or digital assets. Vault12 is exclusively a non-custodial information security and backup tool that helps users securely store their own wallet seed phrases and private keys for the purpose of inheritance. We provide no legal or financial services, asset management, transaction capabilities, or investment advice. Users maintain complete control of their assets at all times.

You will lose your Bitcoin and other crypto when you die...

...unless you set up Crypto Inheritance today.

It's simple — if you don't worry about crypto inheritance, nobody else will — not your software or hardware wallet vendors, not your exchanges, and not your wealth managers. So it's up to you to think about how to protect the generational wealth you have created, and reduce the risks around passing that crypto wealth on to your family and heirs. What are the challenges with crypto inheritance?

- Crypto Wallets are difficult to use and do not offer crypto inheritance management. In fact, most of them tell you to write down your seed phrase on a piece of paper, which is practically useless.

- Some people back up their wallet seed phrases or private keys on paper, local devices like hardware wallets or USBs, or in the cloud. All of these options have severe drawbacks that range from hacking to accidental loss to disrupted cloud services.

- Software wallets operate on specific blockchains, yet your crypto assets span multiple blockchains. For inheritance to work, you must be able to manage inheritance across every blockchain — now and forever.

Pioneering Crypto Inheritance: Secure Quantum-safe Storage and Backup

Vault12 is the pioneer in Crypto Inheritance, offering a simple yet powerful way to designate a legacy contact and pass on your crypto assets—like Bitcoin (BTC), Ethereum (ETH) and Solana (SOL) —to future generations. Built for everyday users yet robust enough for the most seasoned crypto enthusiasts, Vault12 Guard ensures your wallet seed phrases and private keys are preserved in a fully self-sovereign manner, across all Blockchains.

At the heart of Vault12 Guard is quantum-resistant cryptography and a decentralized, peer-to-peer network of trusted Guardians. Your critical information is never stored in the cloud, on Vault12 servers, or even on local devices—dramatically reducing the risk of a single point of failure. By fusing a powerful software layer with the Secure Element of iOS devices (Secure Enclave) and Google devices (Strongbox), Vault12 Guard locks down your private keys against present and future threats.

Our innovative approach harnesses social recovery, enabling you to appoint one or more trusted individuals or mobile devices as Guardians. These Guardians collectively safeguard your protected seed phrases in a decentralized digital Vault—so there’s no need for constant lawyer updates or bulky paperwork. Should the unexpected happen, your chosen legacy contact can seamlessly inherit your crypto assets without compromising your privacy or security.

Preserve your digital wealth for generations to come with Vault12 Guard—the simplest, most secure way to manage crypto inheritance and backup.

Take the first step and back up your crypto wallets.

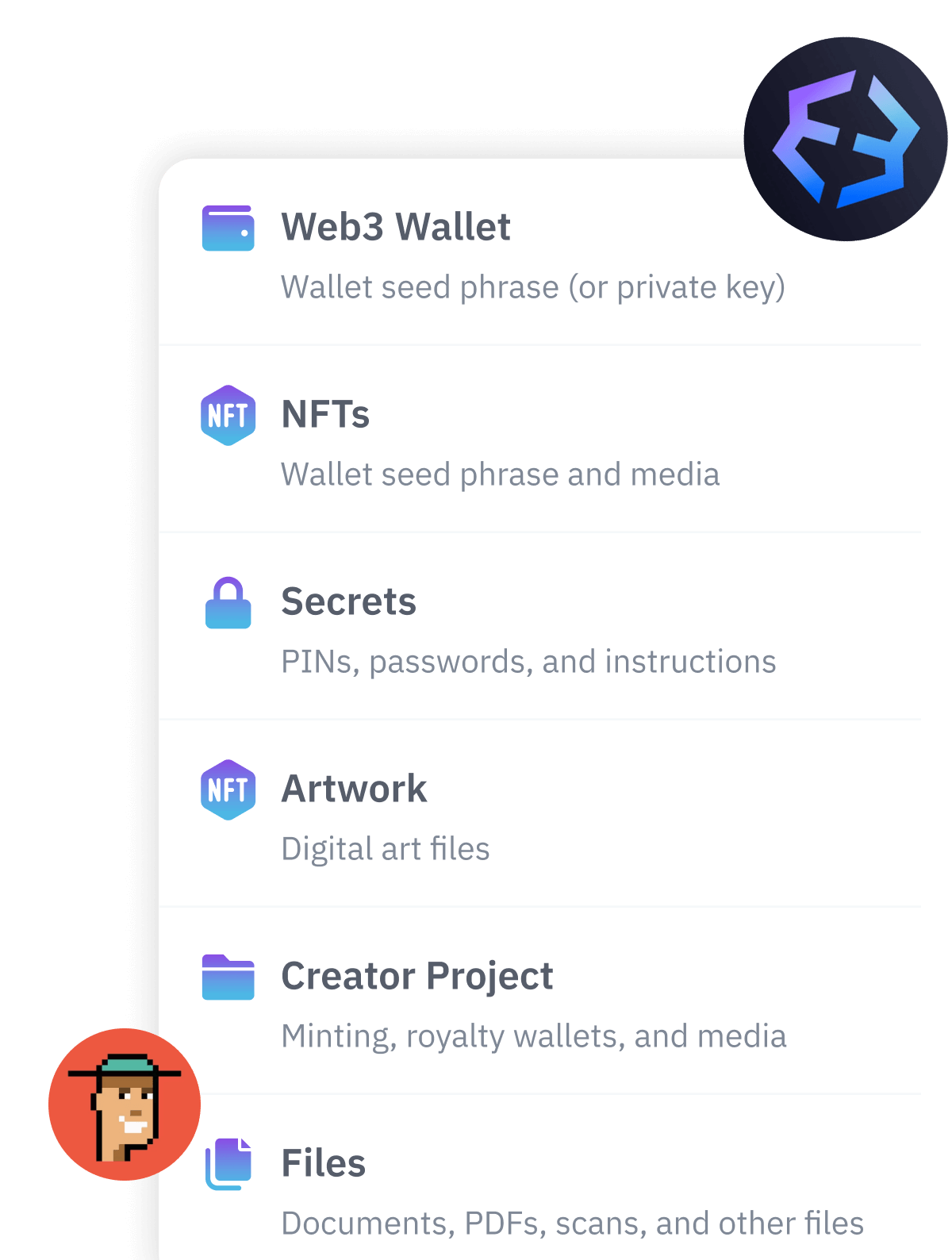

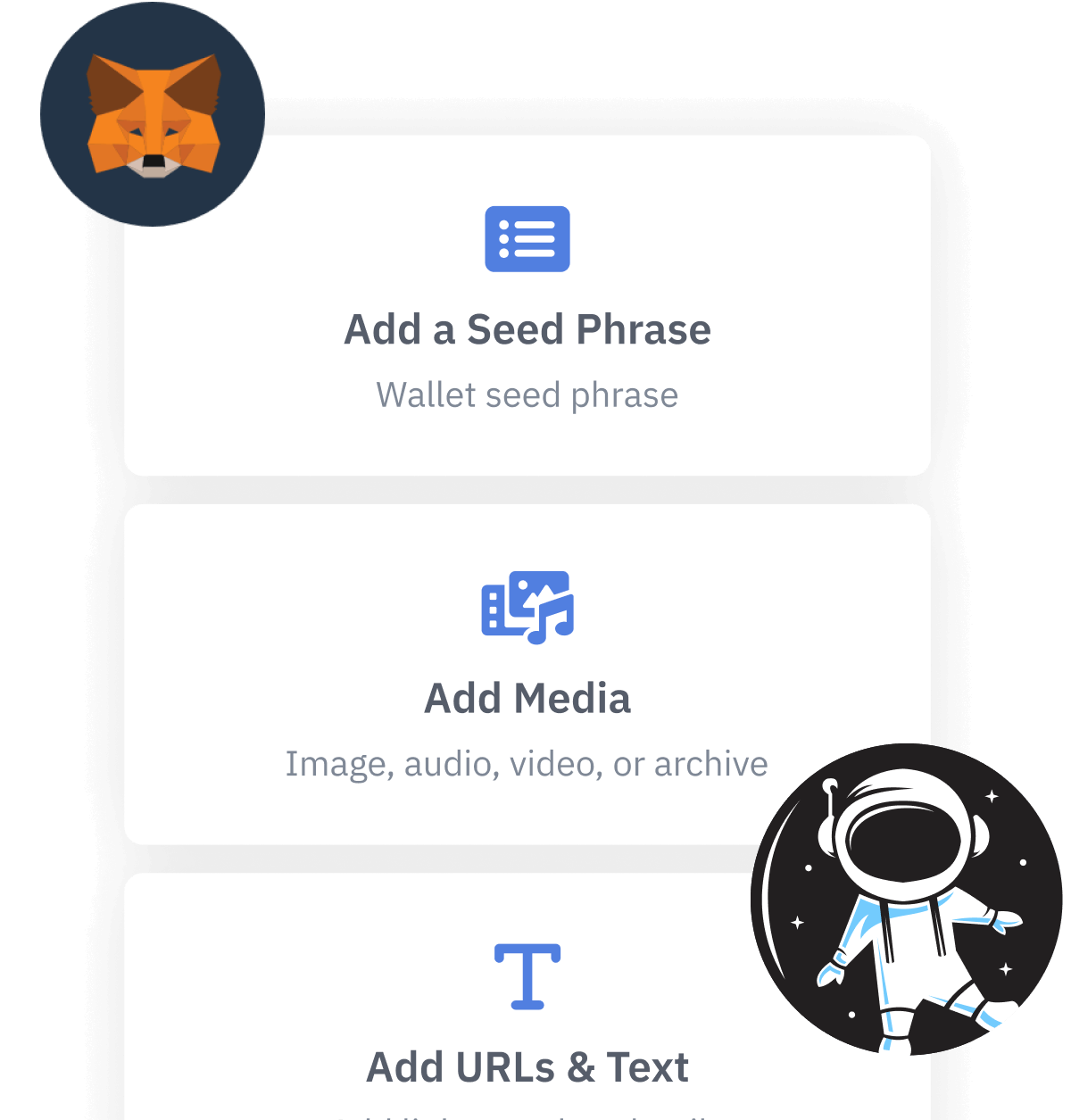

Designed to be used alongside traditional hardware and software crypto wallets, Vault12 Guard helps cryptocurrency owners back up their wallet seed phrases and private keys (assets) without storing anything in the cloud, or in any single location. This increases protection and decreases the risk of loss.

The first step in crypto Inheritance Management is making sure you have an up-to-date backup.

The Vault12 Guard app enables secure decentralized backups, and provides inheritance for all your seed phrases and private keys across any blockchain, including Bitcoin, Ethereum, and others, and for any crypto wallet.

Note: For anyone unfamiliar with cryptocurrencies, Vault12 refers to wallet seed phrases and private keys as assets, crypto assets, and digital assets. The Vault12 Guard app includes a software wallet that works alongside your Digital Vault. The primary purpose of this is to guard your Bitcoin (BTC) and Ethereum (ETH) wallet seed phrases, private keys, and other essential data, now and for future generations.