The Renaissance of Securing Digital Assets and the Barbarian Hordes

In his keynote, Ahmad highlights Vault12's mission to bring innovation to the crypto market amidst a Renaissance of digital asset protection.

Digital currencies have gained recognition since the publishing of Satoshi Nakamoto's Bitcoin whitepaper in 2008, yet the industry continues to strive toward mainstream adoption. Institutional backing has recently begun to shift in favor of cryptocurrency, fulfilling a key ingredient for helping the industry reach its full potential. This is evidenced, in part, by the SEC approved Greyscale Bitcoin Investment Trust, which has $3.7 Billion in various cryptocurrency assets under management. In addition, Fidelity Investments reported that one 1/3 of institutional investors own digital assets. The tides are turning, yet the complexities of cryptocurrency tokens have stifled widespread adoption. Vault12 is advancing the industry forward with its personal digital asset security platform.

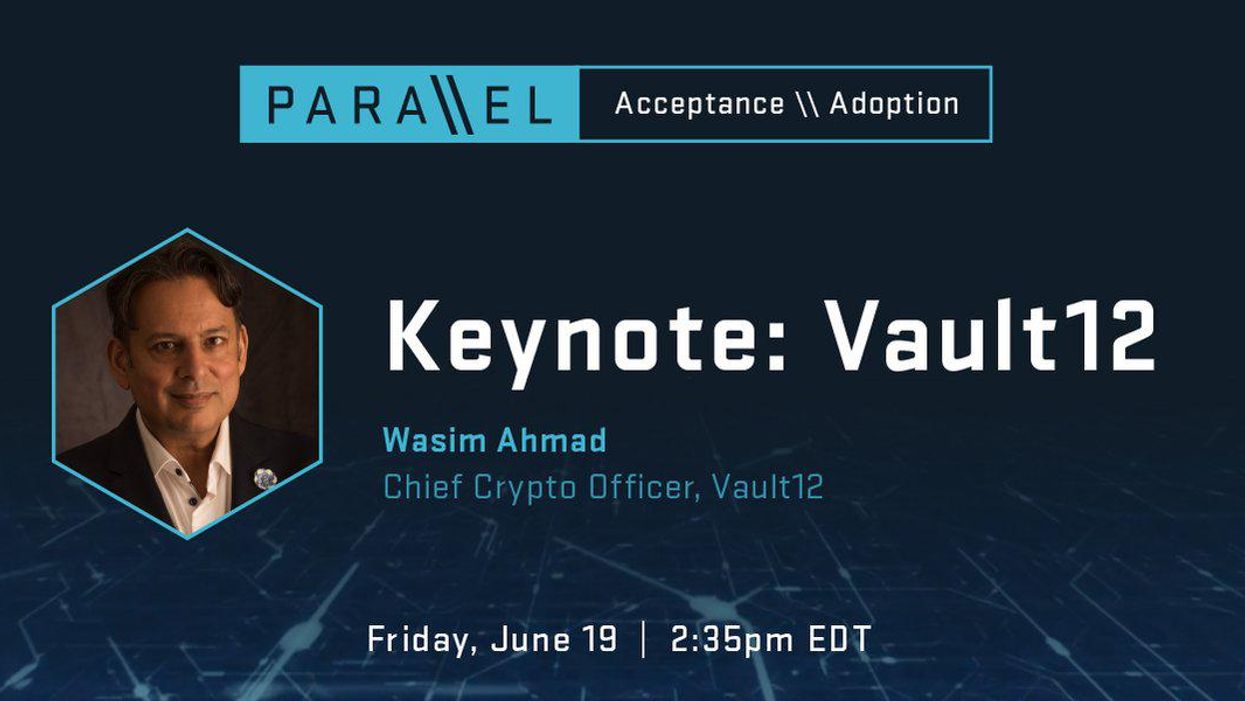

Vault12's Chief Crypto officer, Wasim Ahmad, explores acceptance and adoption in a recent keynote address at Parallel Summit — a virtual event series exploring fundamental transformations in the blockchain industry — The virtual conference discussion was centered around the future of crypto assets, regulatory developments, and hurdles to adoption — the full summit from June 19, 2020 is available at https://parallelsummit.io and includes a riveting panel with SEC and CFTC Commissioners Hester Peirce and Brian Quintenz that describes the future of digital assets.

In his keynote, Ahmad highlights Vault12's mission to bring innovation to the crypto market amidst a Renaissance of digital asset protection.

In today's uncertain times, digital assets promise to revolutionize the financial industry and its systems, but the journey to mass adoption will be a marathon, not a sprint. Regulation and security are key components in the process, which faces significant hurdles. As those invested in traditional markets begin to transition to digital assets, the institutional custody that has always existed in traditional markets must be apparent, according to Ahmad, yet personal custody will be just as important when it comes to cryptocurrency.

Traditionally, security measures for cryptocurrency have been convoluted and difficult to keep track of, with few options available. For example, of the 18 most popular crypto wallets, there are only two options for saving a wallet's seed phrase — a list of random words (usually 12) used to recover crypto assets. Some only offer one option: to write it down. As a result, access to one's digital currency carries inherent risk of being affected by hacking, natural disaster, or other barriers. The risk of hacking has been made evident with popular scandals like Mt. Gox, where $460 Million was stolen from the world's largest Bitcoin exchange.

Aside from hacking, there is also a risk of losing access to one's seed phrase, without which the digital currency itself is rendered inaccessible. The most seasoned crypto veterans go to great lengths to prevent the heart-fluttering moment of having misplaced or inadvertently lost a seed phrase, yet conventional methods all have their pitfalls. Imagine writing a seed phrase on a sheet of paper, which is thrown out by an unknowing family member or losing access to stored files containing your seed phrase. This means that unless you have a great (read: 100% accurate) memory, your digital assets could be inaccessible. Forever.

The Covid-19 pandemic uncovered another potential barrier to access when banks, along with other business were ordered to close. Imagine having stored portions of your seed phrase in various physical locations such as a bank safe deposit box. Post-Covid-19 investors will prefer decentralized solutions over highly centralized institutions when it comes to accessing digital assets. Enter, Vault 12.

According to Ahmad, the next generation of investors will need to understand these risks and must have a tried and true policy at their fingertips to avoid barriers to access. Vault12's digital asset protection platform seeks to help solve current security shortcomings. The mobile app is leading a paradigm shift toward heightened security and more reliable accessibility of one's digital access. This is carried out via a digital vault, which is protected by the vault owner's trusted social network, known as "guardians". End-to-end encryption offers an added layer of protection as neither party has the full seed phrase, nor can they see their portion. Guardians can also be replaced if a contact has been lost or severed. Lost your phone? Not to worry as your Vault can be recovered from your new mobile device.

After 5 years of development, the Vault12 app is finally available for download in the app store. Download it now or request a live walk-through here.

The Renaissance of Securing Digital Assets and the Barbarian Hordes

In his keynote, Ahmad highlights Vault12's mission to bring innovation to the crypto market amidst a Renaissance of digital asset protection.

Wasim Ahmad

Wasim Ahmad is a serial entrepreneur and an advisor in the fields of AI, blockchain, cryptocurrency, and encryption solutions. At Vault12, the pioneer of crypto inheritance, he led private and public fundraising efforts and focuses today on expanding the Vault12 ecosystem. In addition, he is a producer of the upcoming movie 'The Bitcoin Executor'.

His crypto experience began with AlphaPoint, where he worked with the founding team to launch the world's first crypto trading exchanges. Previously he was a founding member of Voltage Security, a spinout from Stanford University, that launched Identity-Based Encryption (IBE), a breakthrough in Public Key Cryptography, and pioneered the use of sophisticated data encryption to protect sensitive data across the world's payment systems.

He has also been very involved with regulatory initiatives in both the US and the UK, providing feedback to the SEC and FCA respectively pushing for expanded momentum for innovation and startups within the regulatory frameworks of both countries.

Wasim served on the board of non-profit, StartOut, and is a Seedcamp and WeWork Labs global mentor.

Wasim graduated with a Bachelor of Science in Physics and French from the University of Sussex.

Vault12

Vault12 is the pioneer in crypto inheritance and backup. The company was founded in 2015 to provide a way to enable everyday crypto customers to add a legacy contact to their cry[to wallets. The Vault12 Guard solution is blockchain-independent, runs on any mobile device with biometric security, and is available in Apple and Google app stores.

Vault12 is NOT a financial institution, cryptocurrency exchange, or custodian. We do NOT hold, transfer, manage, or have access to any user funds, tokens, cryptocurrencies, or digital assets. Vault12 is exclusively a non-custodial information security and backup tool that helps users securely store their own wallet seed phrases and private keys for the purpose of inheritance. We provide no legal or financial services, asset management, transaction capabilities, or investment advice. Users maintain complete control of their assets at all times.

You will lose your Bitcoin and other crypto when you die...

...unless you set up Crypto Inheritance today.

It's simple — if you don't worry about crypto inheritance, nobody else will — not your software or hardware wallet vendors, not your exchanges, and not your wealth managers. So it's up to you to think about how to protect the generational wealth you have created, and reduce the risks around passing that crypto wealth on to your family and heirs. What are the challenges with crypto inheritance?

- Crypto Wallets are difficult to use and do not offer crypto inheritance management. In fact, most of them tell you to write down your seed phrase on a piece of paper, which is practically useless.

- Some people back up their wallet seed phrases or private keys on paper, local devices like hardware wallets or USBs, or in the cloud. All of these options have severe drawbacks that range from hacking to accidental loss to disrupted cloud services.

- Software wallets operate on specific blockchains, yet your crypto assets span multiple blockchains. For inheritance to work, you must be able to manage inheritance across every blockchain — now and forever.

Pioneering Crypto Inheritance: Secure Quantum-safe Storage and Backup

Vault12 is the pioneer in Crypto Inheritance, offering a simple yet powerful way to designate a legacy contact and pass on your crypto assets—like Bitcoin (BTC), Ethereum (ETH) and Solana (SOL) —to future generations. Built for everyday users yet robust enough for the most seasoned crypto enthusiasts, Vault12 Guard ensures your wallet seed phrases and private keys are preserved in a fully self-sovereign manner, across all Blockchains.

At the heart of Vault12 Guard is quantum-resistant cryptography and a decentralized, peer-to-peer network of trusted Guardians. Your critical information is never stored in the cloud, on Vault12 servers, or even on local devices—dramatically reducing the risk of a single point of failure. By fusing a powerful software layer with the Secure Element of iOS devices (Secure Enclave) and Google devices (Strongbox), Vault12 Guard locks down your private keys against present and future threats.

Our innovative approach harnesses social recovery, enabling you to appoint one or more trusted individuals or mobile devices as Guardians. These Guardians collectively safeguard your protected seed phrases in a decentralized digital Vault—so there’s no need for constant lawyer updates or bulky paperwork. Should the unexpected happen, your chosen legacy contact can seamlessly inherit your crypto assets without compromising your privacy or security.

Preserve your digital wealth for generations to come with Vault12 Guard—the simplest, most secure way to manage crypto inheritance and backup.

Take the first step and back up your crypto wallets.

Designed to be used alongside traditional hardware and software crypto wallets, Vault12 Guard helps cryptocurrency owners back up their wallet seed phrases and private keys (assets) without storing anything in the cloud, or in any single location. This increases protection and decreases the risk of loss.

The first step in crypto Inheritance Management is making sure you have an up-to-date backup.

The Vault12 Guard app enables secure decentralized backups, and provides inheritance for all your seed phrases and private keys across any blockchain, including Bitcoin, Ethereum, and others, and for any crypto wallet.

Note: For anyone unfamiliar with cryptocurrencies, Vault12 refers to wallet seed phrases and private keys as assets, crypto assets, and digital assets. The Vault12 Guard app includes a software wallet that works alongside your Digital Vault. The primary purpose of this is to guard your Bitcoin (BTC) and Ethereum (ETH) wallet seed phrases, private keys, and other essential data, now and for future generations.