Contents

Will Crypto Ever Rule the World?

What NYC Blockchain Week revealed on the state of crypto: then, now, and what's next.

To kick off New York City Blockchain Week last May, some of the most influential Blockchain funds in the space globally, with over $9 billion in assets under management (AUM), came together at the Blockchain Fund Summit in Manhattan, organized by Lightnode Media. Their purpose was to educate family offices and traditional investors on various investment strategies and opportunities. Not surprisingly there was a united belief among presenters in the value that has been created in the blockchain economy and an optimistic view of its huge expansion in the future.

In the short term, you could say they were correct as the price of Bitcoin bounced back. However, throughout the week, there were differing views and attitudes on the effects of the previous hype, the reality of the market today, and the future outlook.

Blockchain Fund Summit - NYC Blockchain Week - Light Node Media

About : The New York Blockchain Fund Summit will be focused on educating family offices and traditional investors on various investment strategies and opportunities…The Hype

Was the crypto craze good or bad for the industry?

In December 2017, the price of Bitcoin spiked to over $20,000, which was followed by a lot of hype which had both negative and positive effects that have significantly shaped the industry as we know it.

The most obvious example of the hype is the dozens of companies that simply added "bitcoin" and "blockchain" to their name and saw significant increases in stock price. There are also many examples that folks would soon like to forget, such as the number of exit scams and so-called "shitcoins".

This negatively affected the industry because it generated interest by speculative investors before blockchain technology was ready for use or widely adopted. In creating lots of noise, budding entrepreneurs were deterred according to Jalak Jobanputra, founder of FuturePerfect Ventures. In the public eye, the focus of the industry was dominated by folks looking for short term gains rather than patient capital for use cases beyond a store of value.

However, on the positive side, it brought widespread awareness across all age groups. A survey by Blockchain Capital finds nine in 10 Americans are aware of bitcoin. Additionally, blockchain technology and cryptocurrencies are taken seriously as viable mechanisms in the marketplace. Now that the hype is over and only true believers remain, the builders are hard at work developing the infrastructure for the nascent industry.

The Reality

What is really going on with investing and adoption?

The latter half of 2018 yielded a bear market that lasted a while, with the price of Bitcoin staying relatively consistent. This bear market hit institutional investors hard. According to a report by PwC, crypto hedge funds suffered a median -46% loss last year. However, 36% of funds surveyed use or can use leverage and 74% can take short positions. This explains why these funds performed better (or less bad) than Bitcoin itself (down -72%).

Arbitrage strategies are also effective, according to Joe Dipasquale, CEO of Bitbull Capital, a fund that was actually up 29% last year: "My own preference is to play off of crypto's unique volatility, so our own Opportunistic Fund engages in "market-neutral" strategies like arbitrage and market-making. These strategies profit off of volatility while being uncorrelated with the direction of crypto.

Now, bitcoin was the first and most well-known cryptocurrency, but it isn't the only player in the industry. In the first five months of 2019, over 250 token offerings have collected a total of 3.3 billion according to PwC's the 5th ICO / STO Report.

Yes, there is money to be made in buying and selling cryptocurrencies as well as investing in digital securities, but it begs the question: are people actually using cryptocurrencies to make transactions?

True story: during a dinner toward the end of NYC Blockchain Week, Bitcoin maximalists used Venmo to pay the person that covered the meal rather than transacting Bitcoin from their mobile wallets. If they believe Bitcoin is the dominant coin and will be ever-increasing in value, I can see why they would want to hold on to it rather then buy more. On top of that, all crypto sells, conversions, payments, donations, and earned income are reportable by US taxpayers. Paying a friend back for dinner isn't exactly worth increasing your taxes.

So if peer-to-peer payments haven't exactly caught on, what about paying for goods or services? Well, probably not-so-coincidentally the Flexa app was unveiled during NYC Blockchain Week, which allows consumers to spend crypto at fifteen major US retailers. This is great news as far as acceptance goes, but personally, I like the loyalty points I get from using my credit card for purchases.

The Future

Crypto is here to stay, but where will the best opportunities emerge?

It is extremely hard to predict the directional changes of crypto prices, but the blockchain economy is so much more than that. Fidelity conducted a crypto survey from over 400 institutions which revealed 47% of institutions believe digital assets have a place in their investment portfolios.

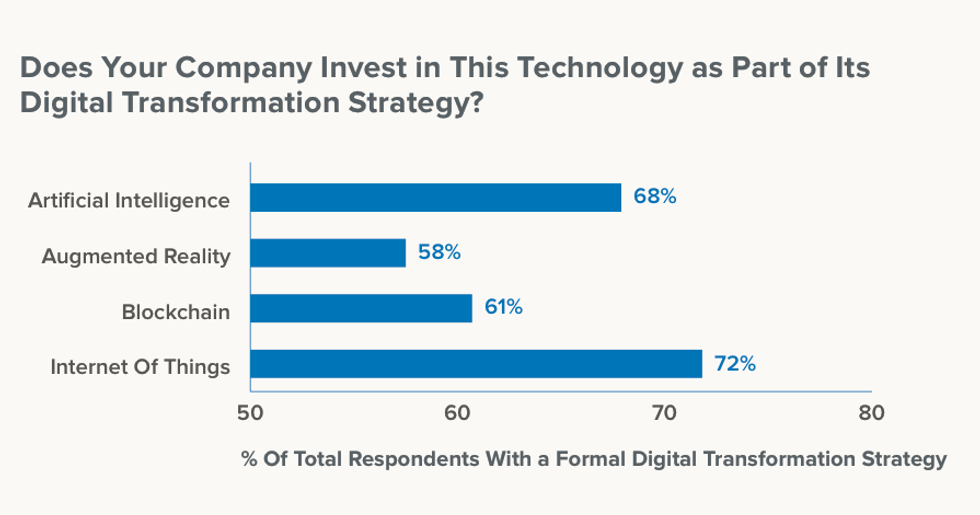

Furthermore, corporate investment in blockchain signals acquisition potential down the road and the legal teams in large companies thinking about issues could be allies in the regulatory battle. A report from Oktareveals that 61% of the world's largest businesses are investing in blockchain as part of their digital transformation strategies.

Okta's The Digital Enterprise Report: How the World's Largest Companies are Evolving with Technology

Some examples of corporate investment in blockchain platforms, companies, and assets, to name a few, include:

- IBM Blockchain, enabling organizations to bring together allies across departments and disciplines, industries and organizations, and countries and cultures.

- PayPal investing in Cambridge Blockchain, a startup that helps financial institutions and other companies manage sensitive data using shared ledgers.

- Facebook announces Libra cryptocurrency, which will let you buy things or send money to people with nearly zero fees

Although these established organizations are beginning to understand and harness this emerging technology, the biggest outcomes will likely come from new markets and independent players.

Crypto Security

The discussions during NYC Blockchain Week invariably turned to security, chiefly because, Binance, the worlds largest cryptocurrency exchange announced — very transparently — that it had been attacked and lost over $40M. Seemingly hackers were able to compromise several high-net-worth accounts, whose crypto was kept in Binance's hot wallets. What was not widely reported at the time, but confirmed by other exchange operators, was that hackers attempted penetrations of multiple exchanges at the same time.

The impact here in on the value and confidence in the crypto economy — 21% of all Bitcoin is inaccessible — that's $20 billion. In the last two years, almost $3B has been stolen and in fact, the first 3 months of 2019, over $356M has been stolen from cryptocurrency exchanges according to a recent report from blockchain intelligence company Ciphertrace.

There needs to be a better approach to reducing the risks associated with owning and handling cryptocurrency: personal crypto security — that is the problem Vault12 is solving. To download the app (beta) visit vault12.com/getapp

WRITTEN BY

Kyle Graden

Citizen of the World looking to expand our understanding of gender beyond the binary.

Will Crypto Ever Rule the World?

What NYC Blockchain Week revealed on the state of crypto: then, now, and what's next.

Wasim Ahmad

Wasim Ahmad is a serial entrepreneur and an advisor in the fields of AI, blockchain, cryptocurrency, and encryption solutions. At Vault12, the pioneer of crypto inheritance, he led private and public fundraising efforts and focuses today on expanding the Vault12 ecosystem. In addition, he is a producer of the upcoming movie 'The Bitcoin Executor'.

His crypto experience began with AlphaPoint, where he worked with the founding team to launch the world's first crypto trading exchanges. Previously he was a founding member of Voltage Security, a spinout from Stanford University, that launched Identity-Based Encryption (IBE), a breakthrough in Public Key Cryptography, and pioneered the use of sophisticated data encryption to protect sensitive data across the world's payment systems.

He has also been very involved with regulatory initiatives in both the US and the UK, providing feedback to the SEC and FCA respectively pushing for expanded momentum for innovation and startups within the regulatory frameworks of both countries.

Wasim served on the board of non-profit, StartOut, and is a Seedcamp and WeWork Labs global mentor.

Wasim graduated with a Bachelor of Science in Physics and French from the University of Sussex.

Vault12

Vault12 is the pioneer in crypto inheritance and backup. The company was founded in 2015 to provide a way to enable everyday crypto customers to add a legacy contact to their cry[to wallets. The Vault12 Guard solution is blockchain-independent, runs on any mobile device with biometric security, and is available in Apple and Google app stores.

Vault12 is NOT a financial institution, cryptocurrency exchange, or custodian. We do NOT hold, transfer, manage, or have access to any user funds, tokens, cryptocurrencies, or digital assets. Vault12 is exclusively a non-custodial information security and backup tool that helps users securely store their own wallet seed phrases and private keys for the purpose of inheritance. We provide no legal or financial services, asset management, transaction capabilities, or investment advice. Users maintain complete control of their assets at all times.

You will lose your Bitcoin and other crypto when you die...

...unless you set up Crypto Inheritance today.

It's simple — if you don't worry about crypto inheritance, nobody else will — not your software or hardware wallet vendors, not your exchanges, and not your wealth managers. So it's up to you to think about how to protect the generational wealth you have created, and reduce the risks around passing that crypto wealth on to your family and heirs. What are the challenges with crypto inheritance?

- Crypto Wallets are difficult to use and do not offer crypto inheritance management. In fact, most of them tell you to write down your seed phrase on a piece of paper, which is practically useless.

- Some people back up their wallet seed phrases or private keys on paper, local devices like hardware wallets or USBs, or in the cloud. All of these options have severe drawbacks that range from hacking to accidental loss to disrupted cloud services.

- Software wallets operate on specific blockchains, yet your crypto assets span multiple blockchains. For inheritance to work, you must be able to manage inheritance across every blockchain — now and forever.

Pioneering Crypto Inheritance: Secure Quantum-safe Storage and Backup

Vault12 is the pioneer in Crypto Inheritance, offering a simple yet powerful way to designate a legacy contact and pass on your crypto assets—like Bitcoin (BTC), Ethereum (ETH) and Solana (SOL) —to future generations. Built for everyday users yet robust enough for the most seasoned crypto enthusiasts, Vault12 Guard ensures your wallet seed phrases and private keys are preserved in a fully self-sovereign manner, across all Blockchains.

At the heart of Vault12 Guard is quantum-resistant cryptography and a decentralized, peer-to-peer network of trusted Guardians. Your critical information is never stored in the cloud, on Vault12 servers, or even on local devices—dramatically reducing the risk of a single point of failure. By fusing a powerful software layer with the Secure Element of iOS devices (Secure Enclave) and Google devices (Strongbox), Vault12 Guard locks down your private keys against present and future threats.

Our innovative approach harnesses social recovery, enabling you to appoint one or more trusted individuals or mobile devices as Guardians. These Guardians collectively safeguard your protected seed phrases in a decentralized digital Vault—so there’s no need for constant lawyer updates or bulky paperwork. Should the unexpected happen, your chosen legacy contact can seamlessly inherit your crypto assets without compromising your privacy or security.

Preserve your digital wealth for generations to come with Vault12 Guard—the simplest, most secure way to manage crypto inheritance and backup.

Take the first step and back up your crypto wallets.

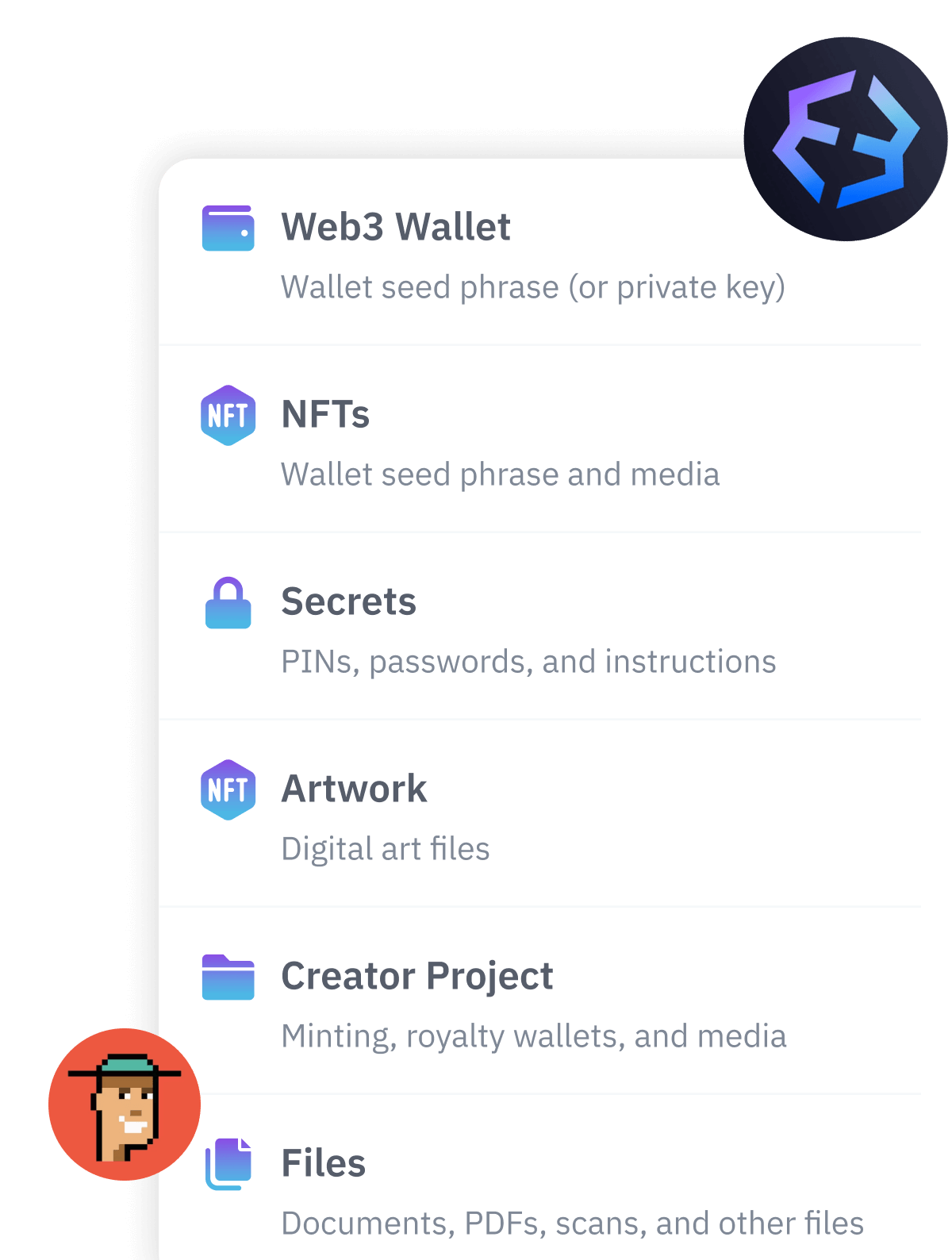

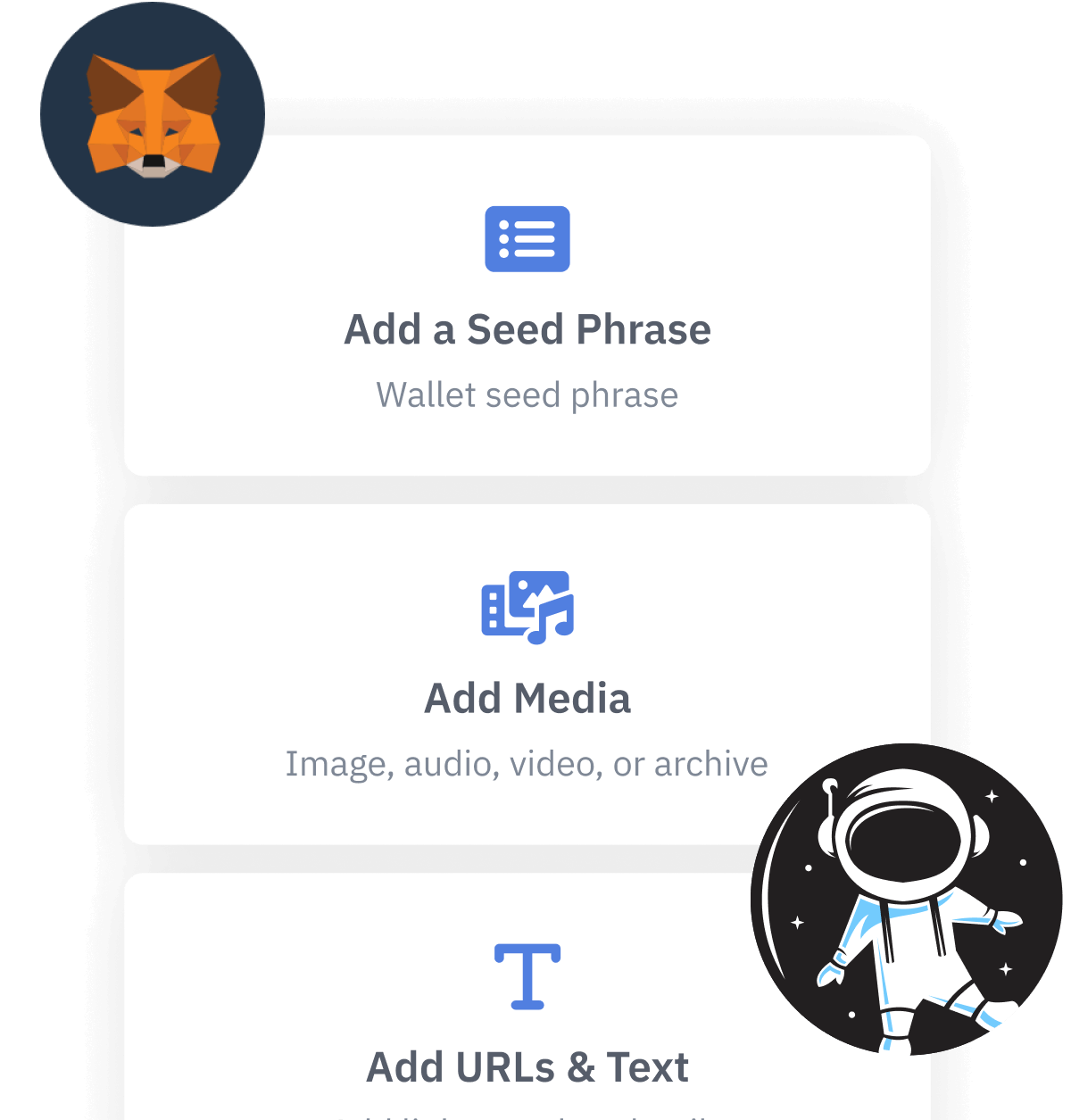

Designed to be used alongside traditional hardware and software crypto wallets, Vault12 Guard helps cryptocurrency owners back up their wallet seed phrases and private keys (assets) without storing anything in the cloud, or in any single location. This increases protection and decreases the risk of loss.

The first step in crypto Inheritance Management is making sure you have an up-to-date backup.

The Vault12 Guard app enables secure decentralized backups, and provides inheritance for all your seed phrases and private keys across any blockchain, including Bitcoin, Ethereum, and others, and for any crypto wallet.

Note: For anyone unfamiliar with cryptocurrencies, Vault12 refers to wallet seed phrases and private keys as assets, crypto assets, and digital assets. The Vault12 Guard app includes a software wallet that works alongside your Digital Vault. The primary purpose of this is to guard your Bitcoin (BTC) and Ethereum (ETH) wallet seed phrases, private keys, and other essential data, now and for future generations.