Bitcoin Billionaires and the Security of Money

A story of genius, betrayal, and redemption by Ben Mezrich

Crypto's Early Days

In the 2010s, The Winklevoss brothers -- Cameron and Tyler -- set about securing their recent purchases of Bitcoin. Realizing that a new security protocol was needed to thwart hackers, they created a systematic way to protect their crypto assets — one that involved safety deposit boxes, regional banks, sledgehammers, and concrete. In Ben Mezrich's book, Bitcoin Billionaires, he describes the meticulous detail that went into securing these assets, as well as stepping back and telling the story of how Bitcoin and cryptocurrency became a worldwide phenomenon.

In talking with crypto insiders, the first question is always, "When did you come across the Satoshi White Paper?" After that event, given the crypto industry's many twists and turns, it can be difficult to discern the key pivotal moments that have defined this movement. Ben puts this story into focus, connecting the dots between the people, the government and the technology. In doing so he shows that cryptocurrency is not just a fad, but a meaningful evolution of money, with most of its history yet to be written.

After Satoshi's white paper, this is the book that everyone needs to read, to understand where Bitcoin came from and where it is going.

Vault12, personal crypto security

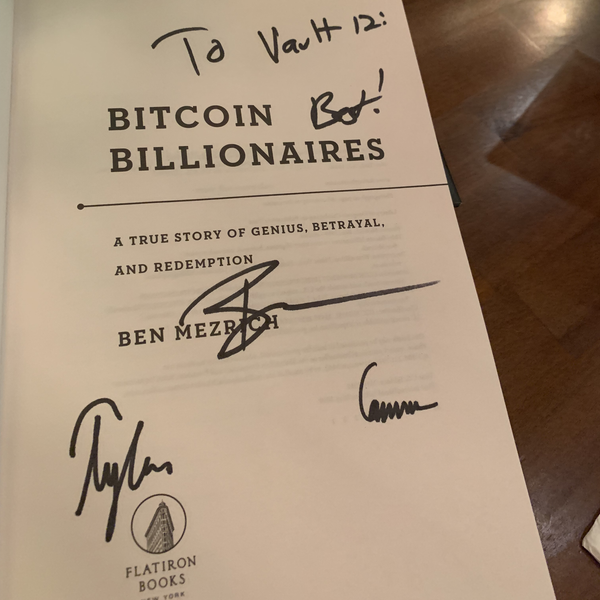

So why a review of Bitcoin Billionaires, you may ask? Whilst reading it to understand the people and the chain of events, I was surprised to find that many of the people involved in bringing Vault12, a personal crypto security platform, to fruition are part of this story: from early investors like Tyler and Cameron Winklevoss, to lead investors and advisors, Naval Ravikant and Matt Pauker, co-founder of 21.co.

When I read Chapter 11, however, Ben's account brought to life the very challenge that Vault12 was created to solve.

Security of Money

The great irony of digital money is that to secure it, you have to rely on paper stored in traditional banking institutions. Luckily companies like Gemini and Vault12 are leading the way to give people options to secure their assets.

If we look historically at every monetary system, we see that each approach had a very specific way for investors and consumers to protect money.

The world has gone from simple bartering, to exchanging shells for goods and services, to gold-backed currency, in 1792 the US Dollar became the official currency of the U.S. And in 1971 the switch was made to fiat money.

In the last 10 years we have seen digital money in the form of cryptocurrency added to the mix. Mechanisms to protect money have evolved from burying treasure, hiding cash in the mattress, to bank safety deposit accounts, FDIC, and regulatory bodies looking out for the interests of retail investors.

Looking forwards — think of all of the products services, jobs, opportunities, profits, regulations that have flourished across all sectors as the very nature of money has evolved over the generations — all because there were suitable ways for protecting money itself.

As Ben tells it, in the early days the story was very different for crypto:

"In the world of virtual currency, paranoia had no bounds — in the end, only the paranoid would survive. And the twins were hell-bent on surviving."

"Cameron and Tyler had set off across the country, creating what they believed was the most secure storage system in the history of Bitcoin. USB sticks and computer hard drives could be stolen or hacked. Private keys on paper in a vault could be photographed or taken. But shards spread out all over the country, in a dozen different safety-deposit boxes — that was different. Only the twins themselves knew where the shards were, or how the shards went back together. Only they could retrieve their private key and get to their bitcoin."

"A total of twelve safety-deposit boxes, held across three different banking institutions, and spread across four distinct regions in the United States, completed their security design. The twelve pieces of paper in these twelve safety-deposit boxes would make up the only four copies of the twins' private key in the world…"

"…Cameron and Tyler's homemade, off-line or "cold" storage system, built of paper and metal lock boxes, was ironically state-of-the-art; it rooted the security of the twin's bitcoin in the physical world, outside the reach of online hackers."

Excerpts From: Ben Mezrich. "Bitcoin Billionaires." Apple Books. https://books.apple.com/us/book/bitcoin-billionaires/id1441117720

A digital future

" In the early day of crypto investing, literally the best way to secure your keys was take them offline. And that's what most of the OGs did. We took crypto keys, we put them into vaults, offline, physical Bitcoins, physical products, because the moment your key is online, someone can hack them."

— Vinny Lingham, entrepreneur and advisor.

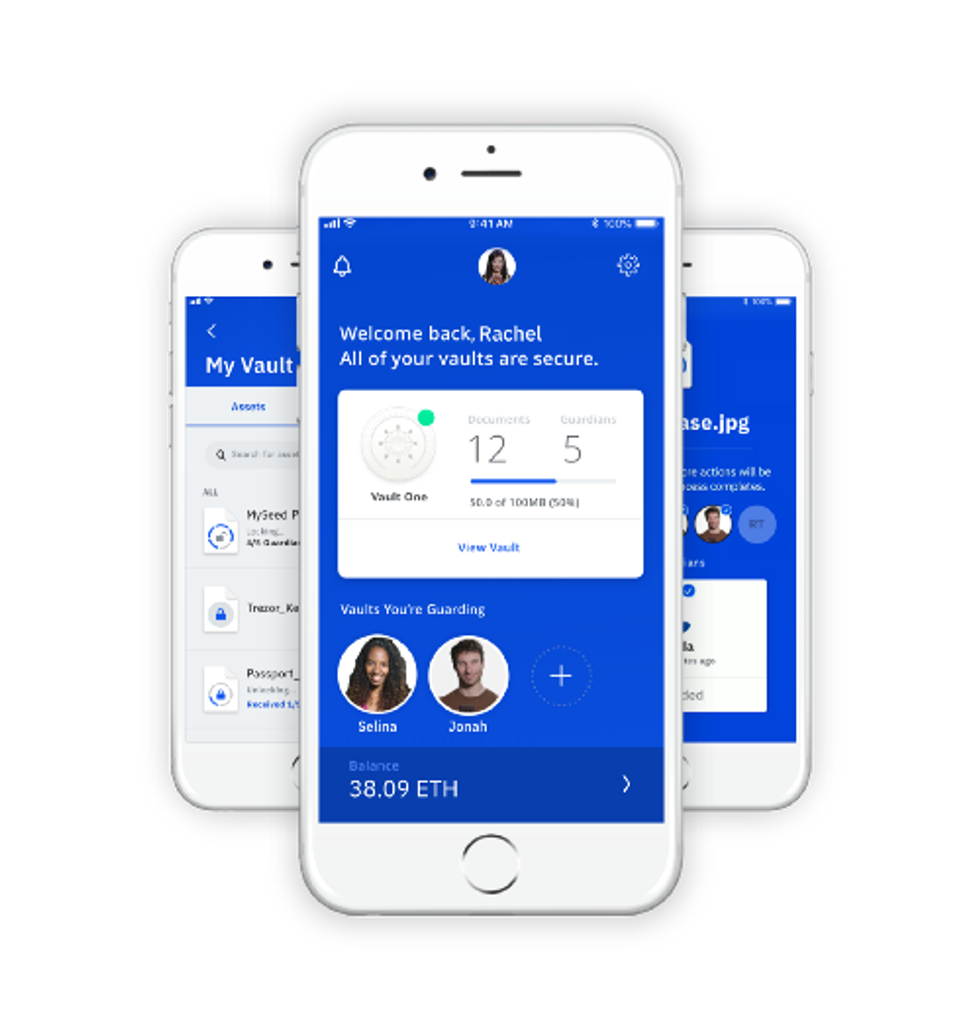

Technology has continued to evolve, resulting in new approaches that combine top-notch security with ease of use — the OGs might not need this, but your average retail crypto investor does. It's now possible with the mini-super computers we carry in our pockets to take an image in memory of your private key, encrypt it and distribute the shards directly to 12 trusted members of your friends and family, the original disappearing from your phone and nothing stored in any cloud, anywhere. This is the modern-day equivalent of what was done by the Winkelvoss twins in twelve safe deposit boxes with the first generation of bitcoin, and it is this type of security that powers the way forward — protecting your most precious digital assets in a simple and natural way so that you never have to worry about the security of money for any of your digital crypto assets.

Clearly, this is not a traditional review, but Ben, who is one of my favourite authors — now part of the Billions writing team, has weaved a dramatic tale that helps us understand the journey that Bitcoin has gone through, and throws open the vista of a bright future for crypto. Read the book today.

The author, Ben Mezrich and the Winklevoss twins at 92nd Street Y in the Summer of 2019

Bitcoin Billionaires and the Security of Money

A story of genius, betrayal, and redemption by Ben Mezrich

Wasim Ahmad

Wasim Ahmad is a serial entrepreneur and an advisor in the fields of AI, blockchain, cryptocurrency, and encryption solutions. At Vault12, the pioneer of crypto inheritance, he led private and public fundraising efforts and focuses today on expanding the Vault12 ecosystem. In addition, he is a producer of the upcoming movie 'The Bitcoin Executor'.

His crypto experience began with AlphaPoint, where he worked with the founding team to launch the world's first crypto trading exchanges. Previously he was a founding member of Voltage Security, a spinout from Stanford University, that launched Identity-Based Encryption (IBE), a breakthrough in Public Key Cryptography, and pioneered the use of sophisticated data encryption to protect sensitive data across the world's payment systems.

He has also been very involved with regulatory initiatives in both the US and the UK, providing feedback to the SEC and FCA respectively pushing for expanded momentum for innovation and startups within the regulatory frameworks of both countries.

Wasim served on the board of non-profit, StartOut, and is a Seedcamp and WeWork Labs global mentor.

Wasim graduated with a Bachelor of Science in Physics and French from the University of Sussex.

Vault12 is NOT a financial institution, cryptocurrency exchange, or custodian. We do NOT hold, transfer, manage, or have access to any user funds, tokens, cryptocurrencies, or digital assets. Vault12 is exclusively a non-custodial information security and backup tool that helps users securely store their own wallet seed phrases and private keys for the purpose of inheritance. We provide no legal or financial services, asset management, transaction capabilities, or investment advice. Users maintain complete control of their assets at all times.

You will lose your Bitcoin and other crypto when you die...

...unless you set up Crypto Inheritance today.

It's simple — if you don't worry about crypto inheritance, nobody else will — not your software or hardware wallet vendors, not your exchanges, and not your wealth managers. So it's up to you to think about how to protect the generational wealth you have created, and reduce the risks around passing that crypto wealth on to your family and heirs. What are the challenges with crypto inheritance?

- Crypto Wallets are difficult to use and do not offer crypto inheritance management. In fact, most of them tell you to write down your seed phrase on a piece of paper, which is practically useless.

- Some people back up their wallet seed phrases or private keys on paper, local devices like hardware wallets or USBs, or in the cloud. All of these options have severe drawbacks that range from hacking to accidental loss to disrupted cloud services.

- Software wallets operate on specific blockchains, yet your crypto assets span multiple blockchains. For inheritance to work, you must be able to manage inheritance across every blockchain — now and forever.

Pioneering Crypto Inheritance: Secure Quantum-safe Storage and Backup

Vault12 is the pioneer in Crypto Inheritance, offering a simple yet powerful way to designate a legacy contact and pass on your crypto assets—like Bitcoin (BTC), Ethereum (ETH) and Solana (SOL) —to future generations. Built for everyday users yet robust enough for the most seasoned crypto enthusiasts, Vault12 Guard ensures your wallet seed phrases and private keys are preserved in a fully self-sovereign manner, across all Blockchains.

At the heart of Vault12 Guard is quantum-resistant cryptography and a decentralized, peer-to-peer network of trusted Guardians. Your critical information is never stored in the cloud, on Vault12 servers, or even on local devices—dramatically reducing the risk of a single point of failure. By fusing a powerful software layer with the Secure Element of iOS devices (Secure Enclave) and Google devices (Strongbox), Vault12 Guard locks down your private keys against present and future threats.

Our innovative approach harnesses social recovery, enabling you to appoint one or more trusted individuals or mobile devices as Guardians. These Guardians collectively safeguard your protected seed phrases in a decentralized digital Vault—so there’s no need for constant lawyer updates or bulky paperwork. Should the unexpected happen, your chosen legacy contact can seamlessly inherit your crypto assets without compromising your privacy or security.

Preserve your digital wealth for generations to come with Vault12 Guard—the simplest, most secure way to manage crypto inheritance and backup.

Take the first step and back up your crypto wallets.

Designed to be used alongside traditional hardware and software crypto wallets, Vault12 Guard helps cryptocurrency owners back up their wallet seed phrases and private keys (assets) without storing anything in the cloud, or in any single location. This increases protection and decreases the risk of loss.

The first step in crypto Inheritance Management is making sure you have an up-to-date backup.

The Vault12 Guard app enables secure decentralized backups, and provides inheritance for all your seed phrases and private keys across any blockchain, including Bitcoin, Ethereum, and others, and for any crypto wallet.

Note: For anyone unfamiliar with cryptocurrencies, Vault12 refers to wallet seed phrases and private keys as assets, crypto assets, and digital assets. The Vault12 Guard app includes a software wallet that works alongside your Digital Vault. The primary purpose of this is to guard your Bitcoin (BTC) and Ethereum (ETH) wallet seed phrases, private keys, and other essential data, now and for future generations.