Contents

What is cryptocurrency?

How blockchain technology has allowed cryptocurrencies to solve real-world challenges for financial consumers of all types: small and large, speculative and non-speculative.

Cryptocurrency is the set of technologies used to store and exchange digital assets like virtual coins and tokens. Cryptocurrency's marketplace mechanics are decentralized (unlike emerging centralized digital currencies), and its security is provided by cryptography (encryption), which allows it to be both secure and anonymous.

Although Bitcoin is the best-known and most-capitalized cryptocurrency in the world, there are now thousands of cryptocurrencies listed in the popular price-tracking website Coinmarketcap.com. Cryptocurrencies other than Bitcoin are referred to as "altcoins."

TL;DR (concentrated takeaways)

Cryptocurrencies are digital money traded on decentralized networks called blockchains.

Bitcoin is the best-known cryptocurrency, but there are thousands of "altcoins."

Validation of crypto transactions is performed by crypto "miners," who are paid a fee in crypto for their efforts.

Large institutions are now investing sizeable sums as part of their investment portfolios.

Some creative investment vehicles allow investors to purchase products that reflect cryptocurrency's value without the consumer actually owning the cryptocurrency.

Cryptocurrency value is often volatile. Education and risk tolerance are key for crypto investors.

How do blockchains work?

You could think of a blockchain as a global, shared ledger (computer database) that publicly and transparently keeps track of digital property. Lots of digital coins are assigned to people, securely locked by their individual encryption keys. People can confirm a transfer or prove ownership of their coins by initiating a transfer with their unique private key). People interact with their digital coins or tokens through the use of digital wallet software.

Why would such a strange-sounding system of exchange come about? Cryptocurrencies were designed to exist outside of central authority or government control. They achieve this independence due to the way that blockchains can be decentralized to run on a group of independent computers, instead of operated by a single organization. In fact, because anyone can interact with or even have their computer run part of a public blockchain network, it is arguably the most significant disruptive technology since the birth of the internet.

A public blockchain network achieves decentralization by synchronizing the activity and computing power of many different computers to validate (confirm) each transaction and to demonstrate the integrity of the entire chain of transactions. It stores each transaction publicly and permanently as it is validated. Because there is no single person or entity in charge of such a distributed network, there is no one to regulate, control, or shut it down. Anyone can buy, sell, or send cryptocurrency to others directly, without the aid of any bank or other third party. But just because every transaction on a blockchain is visible for everyone to see doesn't mean you'll know who is sending or receiving digital money - the blockchain record shows the digital wallet addresses used in a given transaction, but not who controls those wallets.

When a new transaction is initiated, multiple "miners" (independent participants who run computer "nodes") perform a technical verification of that transaction and receive a cryptocurrency transaction fee for doing so. Each verification is also validated by other nodes, achieving "consensus," and then transactions are permanently added to the public blockchain. The chances for fraud are minimized by the fact that it would be very hard to get thousands of miners in multiple countries to conspire to perform false validations. Miners are financially incentivized to keep the blockchain honest and accurate.

How is the Crypto marketplace changing?

Bitcoin burst into the world with this transformative mechanism in 2009, publishing its code for all to see. Soon, variant cryptocurrencies like Litecoin and Bitcoin Cash appeared, with some variations in how they worked. Many other cryptocurrencies have since been created to fill a wide variety of use cases, such as lending, gaming, and voting. Early cryptocurrencies faced criticism because of the potential for their use in illegal activities, their volatility, and a lack of identifiable infrastructure. However, these negatives were outweighed by their positive qualities of portability (especially across borders), divisibility (you can buy less than one Bitcoin), transparency, and most of all, their popularity.

Although cryptocurrency is still young as an asset class, today it is receiving increasing acceptance by the financial community. Publicly-traded corporations have announced large purchases of crypto assets, deeming the crypto market a necessary diversification, and potentially a better store of value than cash. And a few countries like El Salvador have even made cryptocurrency a form of legal tender money.

Large banks, hedge funds, insurance companies, and financial institutions that have recently announced their participation in the cryptocurrency market include Fidelity, JP Morgan, Grayscale, Mass Mutual, PayPal, and Square. Michael Saylor, CEO of MicroStrategy, generated a lot of institutional interest recently after sharing his enthusiastic belief that Bitcoin is "an institutional-grade safe-haven asset."

Because of the speed of change in the world of digital assets, investors should find and follow at least one or two favorite "crypto news" journals to stay informed of the latest news. Some popular web sites that track cryptocurrency prices also offer a selection of crypto news from a wide range of sources.

How Is Cryptocurrency Used?

A primary use case for cryptocurrency is to make secure, online payments. Using cryptocurrency can lower transaction costs and streamline payment processing. However, for technical reasons, including a dependency on the consumer having a "smart device," and the fact that transactions are not always immediately confirmed, widespread adoption of paying for goods with cryptos has faced some challenges. If you want to go into a store and buy something with your crypto, there are few places set up to do that - but it is becoming more common.

In some African countries where a large portion of the population is unbanked, people are using cryptocurrencies to bring commerce to areas that previously had no way to send or receive funds. In China, you can be hard-pressed to find anyone who will accept cash. Even street vendors selling vegetables will only take digital payments using your phone!

Using cryptocurrency for cross-border payments can be life-changing for many people. If you've ever tried to send money from one bank to another bank, or to a person or business in another country, you know how slow the traditional currency transaction system is. It can take days or even weeks to send funds, and can cost a substantial sum - migrant workers can be charged up 20% of their hard-earned paychecks to send money to family members in another country through a traditional service. In contrast, cryptocurrency can be transferred from one person to another within seconds or minutes for almost nothing.

Another use case for cryptocurrency includes acting as a vehicle for short-term or long-term investments. Altcoins are particularly popular with traders looking for short-term trades fueled by high volatility. As a crypto asset that can serve as a long-term store of wealth, Bitcoin has even been called "digital gold."

Where Do I Keep Cryptocurrency?

Once you have purchased some cryptocurrency, you can either keep it in your own crypto wallet (a digital wallet made with computer software), or allow a third-party custodian to hold on to it for you. Most cryptocurrency experts recommend that you hold and manage your own coins in a crypto wallet. There is a saying among cryptocurrency experts: "If you don't own your keys, you don't own your crypto."

Traditional and nontraditional financial institutions are creating ways to invest in crypto without having to maintain your own crypto wallet or control your own cryptographic keys. Some crypto exchanges manage your wallet for you, and some others manage a large pool of cryptocurrency where they may mingle "your" cryptocurrency with the rest of their customers' crypto inside a fund. These third-party fund managers require you to trust them with your investment. Although cryptocurrency was created to make "trust" unnecessary, and instead allow you to be your own bank, trusted custodians are an option for people who do not feel comfortable with the technology required to hold their own cryptocurrency.

Is Cryptocurrency a Safe Investment?

We cannot give you investment advice - only advice about security.

Every investment carries risk, and some experts believe that cryptocurrency is one of the riskier choices. But crypto also has unique risk characteristics that can bolster a diversification strategy, and some experts believe that cryptocurrency represents the future of money. Qualified financial services advisors can help you to identify a balanced approach to traditional and digital investments.

Volatility (big swings in price/value) can make cryptocurrencies unnerving for newcomers. But history has shown that fiat currency too can be subject to extreme volatility.

As with everything, stay away from any offer that looks too good to be true. We all know there are hackers and scammers on the internet, and of course, they show up in the crypto space. It's unfortunate, but not exclusive to crypto. There have been many Ponzi schemes in the stock market. After all, some rich, brilliant people fell for Bernie Madoff's scheme. So why should crypto be any different?

It's essential to do your own research and to never invest more than you can afford to lose. That said, the risk-to-reward ratio of many cryptos is unlike that of any other investment.

Before you get into the market, there are steps that you can take to keep your investment safer. Get informed about the threats out there, and protect yourself with that information.

How Do I Secure Cryptocurrency?

The best way to secure your cryptocurrency is to keep it in a crypto wallet for which you control the keys. There are a few different types of crypto wallet that may be best suited for your investment and exchange needs. You should spend some time learning about them before deciding which type is right for you. A good next step would be to read "What is a Crypto Wallet?"

Where Can I Buy Cryptocurrency?

Cryptocurrencies have become increasingly easy to exchange and store safely. There are a few ways to buy cryptocurrencies directly: you can buy them on an exchange, inside a self-directed IRA, or with one of many cash apps.

Crypto exchanges are commonly used to buy and sell crypto. Some exchanges offer advanced features that behave like a full-fledged trading platform.

The set of crypto marketplaces that you can use is affected by your citizenship, since each country has its own crypto regulatory structure. International exchanges often limit who can use their services, or may offer different versions of their application to users in different countries so that they can tailor specific capabilities and choices (for example, special cryptocurrency regulations apply for United States citizens).

Lastly, be aware that if you buy crypto as part of an IRA plan, or with a cash app like PayPal or Cash App, you may not be able to take that crypto from the exchange to store it for yourself.

Learn even more in "How to Buy Cryptocurrency."

What is cryptocurrency?

How blockchain technology has allowed cryptocurrencies to solve real-world challenges for financial consumers of all types: small and large, speculative and non-speculative.

Vault12

Vault12 is the pioneer in crypto inheritance and backup. The company was founded in 2015 to provide a way to enable everyday crypto customers to add a legacy contact to their cry[to wallets. The Vault12 Guard solution is blockchain-independent, runs on any mobile device with biometric security, and is available in Apple and Google app stores.

Vault12 is NOT a financial institution, cryptocurrency exchange, or custodian. We do NOT hold, transfer, manage, or have access to any user funds, tokens, cryptocurrencies, or digital assets. Vault12 is exclusively a non-custodial information security and backup tool that helps users securely store their own wallet seed phrases and private keys for the purpose of inheritance. We provide no legal or financial services, asset management, transaction capabilities, or investment advice. Users maintain complete control of their assets at all times.

You will lose your Bitcoin and other crypto when you die...

...unless you set up Crypto Inheritance today.

It's simple — if you don't worry about crypto inheritance, nobody else will — not your software or hardware wallet vendors, not your exchanges, and not your wealth managers. So it's up to you to think about how to protect the generational wealth you have created, and reduce the risks around passing that crypto wealth on to your family and heirs. What are the challenges with crypto inheritance?

- Crypto Wallets are difficult to use and do not offer crypto inheritance management. In fact, most of them tell you to write down your seed phrase on a piece of paper, which is practically useless.

- Some people back up their wallet seed phrases or private keys on paper, local devices like hardware wallets or USBs, or in the cloud. All of these options have severe drawbacks that range from hacking to accidental loss to disrupted cloud services.

- Software wallets operate on specific blockchains, yet your crypto assets span multiple blockchains. For inheritance to work, you must be able to manage inheritance across every blockchain — now and forever.

Pioneering Crypto Inheritance: Secure Quantum-safe Storage and Backup

Vault12 is the pioneer in Crypto Inheritance, offering a simple yet powerful way to designate a legacy contact and pass on your crypto assets—like Bitcoin (BTC), Ethereum (ETH) and Solana (SOL) —to future generations. Built for everyday users yet robust enough for the most seasoned crypto enthusiasts, Vault12 Guard ensures your wallet seed phrases and private keys are preserved in a fully self-sovereign manner, across all Blockchains.

At the heart of Vault12 Guard is quantum-resistant cryptography and a decentralized, peer-to-peer network of trusted Guardians. Your critical information is never stored in the cloud, on Vault12 servers, or even on local devices—dramatically reducing the risk of a single point of failure. By fusing a powerful software layer with the Secure Element of iOS devices (Secure Enclave) and Google devices (Strongbox), Vault12 Guard locks down your private keys against present and future threats.

Our innovative approach harnesses social recovery, enabling you to appoint one or more trusted individuals or mobile devices as Guardians. These Guardians collectively safeguard your protected seed phrases in a decentralized digital Vault—so there’s no need for constant lawyer updates or bulky paperwork. Should the unexpected happen, your chosen legacy contact can seamlessly inherit your crypto assets without compromising your privacy or security.

Preserve your digital wealth for generations to come with Vault12 Guard—the simplest, most secure way to manage crypto inheritance and backup.

Take the first step and back up your crypto wallets.

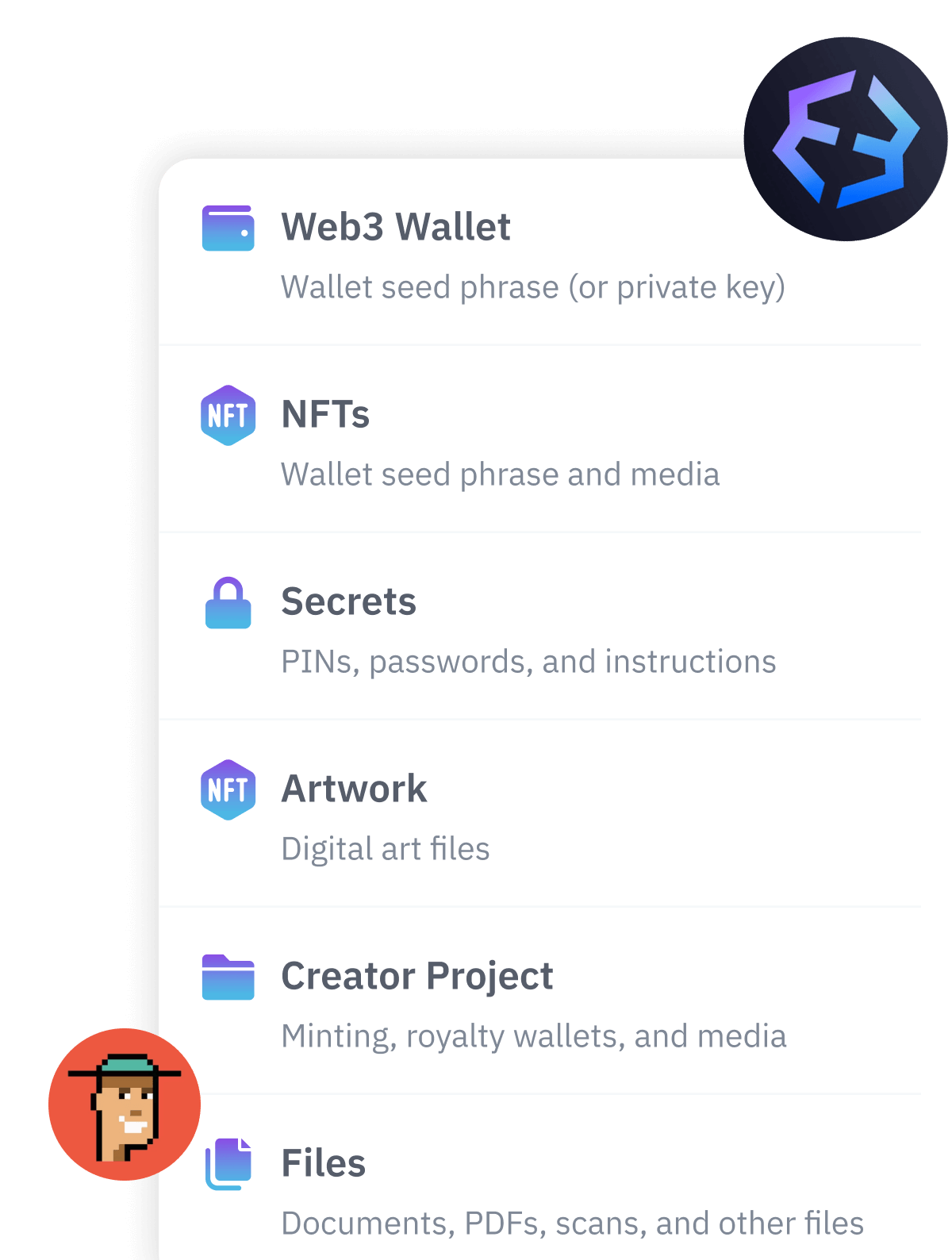

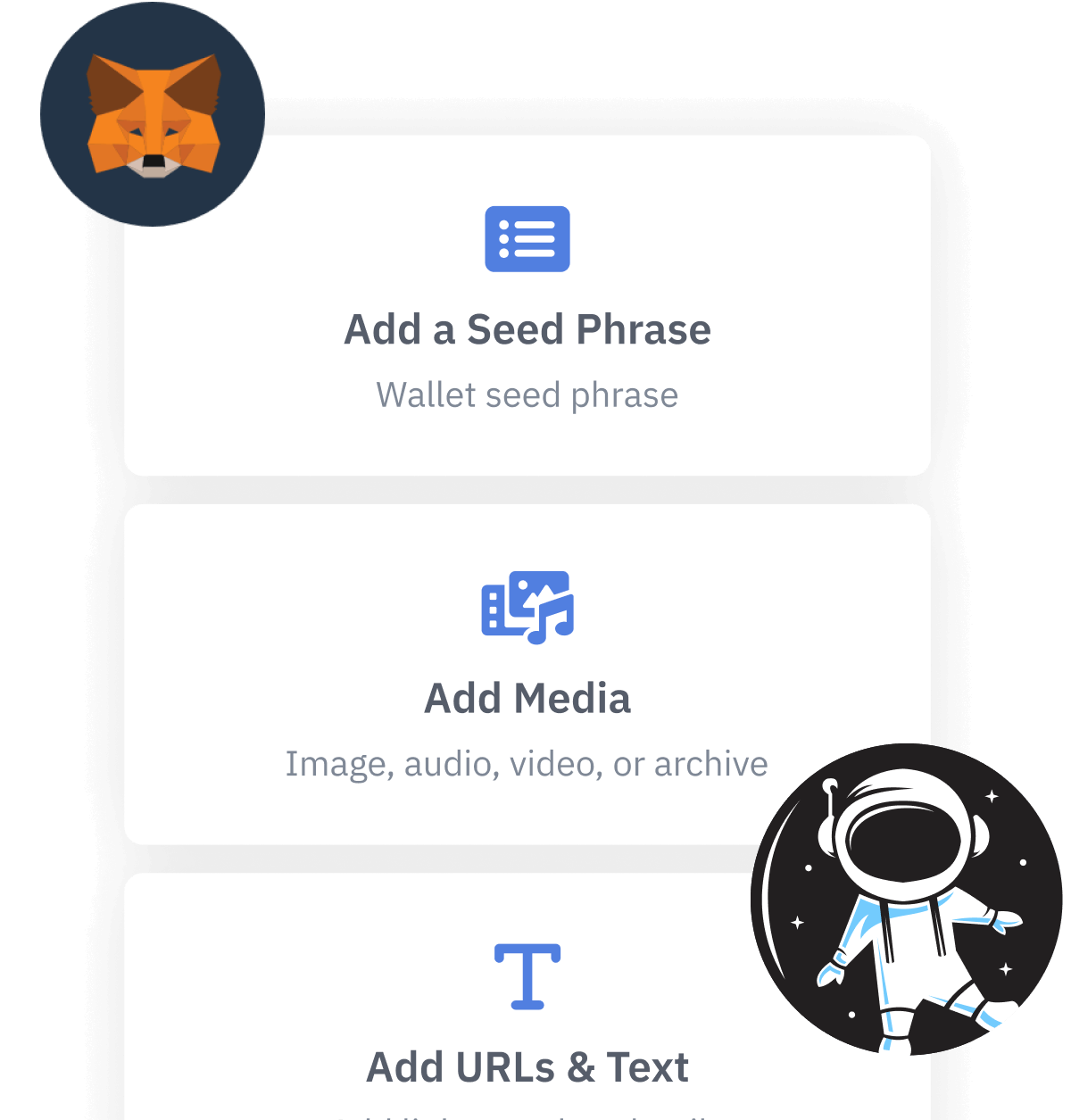

Designed to be used alongside traditional hardware and software crypto wallets, Vault12 Guard helps cryptocurrency owners back up their wallet seed phrases and private keys (assets) without storing anything in the cloud, or in any single location. This increases protection and decreases the risk of loss.

The first step in crypto Inheritance Management is making sure you have an up-to-date backup.

The Vault12 Guard app enables secure decentralized backups, and provides inheritance for all your seed phrases and private keys across any blockchain, including Bitcoin, Ethereum, and others, and for any crypto wallet.

Note: For anyone unfamiliar with cryptocurrencies, Vault12 refers to wallet seed phrases and private keys as assets, crypto assets, and digital assets. The Vault12 Guard app includes a software wallet that works alongside your Digital Vault. The primary purpose of this is to guard your Bitcoin (BTC) and Ethereum (ETH) wallet seed phrases, private keys, and other essential data, now and for future generations.