Contents

What is Self-Custody?

Who should be responsible for holding your cryptocurrency and digital assets?

In previous articles, we introduced the notion of a "digital asset." We explained our thesis for why self-custody — your secure handling of digital assets — is an essential topic of discussion, given that the valuation of digital assets has increased dramatically over the past few decades. We have also explained how the digital asset subclass of cryptocurrency has significant security risks that magnify the importance of digital asset custody. This article explores an under-discussed topic: How should cryptocurrency and digital assets be held?

Taking control of your assets

As we all know, cryptocurrency offers peer-to-peer transactions — instead of a bank holding on to your money and keeping your funds intact, you, yourself, can be fully responsible. On the one hand, this gives people the ability to own their own money and appeals to the libertarian crowd. On the other hand, some argue - and perhaps rightfully so - that people are not capable of taking control of their finances. Either way, maintaining a 48-character private key (which gives access to a cryptocurrency wallet) is difficult.

This article from 2018 highlighted many of the challenges with specific solutions ... and alas, today, these challenges remain.

What is Custody?

Custody is a service offered by professionals for the holding and maintenance of valuable assets. Traditionally this has been common among high net worth individuals and institutions. Custody services aren't common among everyday consumers because generally banks act as custodians to their assets: people can store the few valuables they have in a bank account or safety deposit box. While this culture of custody worked in the traditional finance realm, the new era of peer-to-peer finance — where consumers own their assets and are thus liable for them — begs a new way of conceiving custody.

What is Self-Custody?

Self-custody is the new wave in the institutional and High-Net-Worth-Individual (HNW) realm of peer-to-peer finance. This is because managing private keys of accounts upwards of a million dollars usually will not be left to single individuals to maintain on a hard or stick drive.

Demand for self-custody of cryptocurrency assets has risen rapidly in the past few years as speculating on, holding, and transferring crypto assets has become more popular. These options range from robust, institutional-grade compliant custody solutions like Coinbase Custody to more flexible and controlled custody options like personal cryptocurrency wallets. With owners holding onto assets for the long term, and security threats remaining ever-present, digital custody is an essential topic of discussion for the future of the digital asset class.

What are Custodians?

One of the only widely-compliant custody solutions on the market right now is Coinbase Custody. Coinbase Custody is a service that provides insurance, hierarchical control, segregated cold storage, SLAs on fund transfers, and 24/7 customer service. Coinbase works in collaboration with an SEC-registered broker-dealer and a FINRA-compliant brokerage firm to be fully compliant as a custody service provider.

While custody with the likes of Coinbase may be the best solution for high net worth individuals, this service is unavailable for typical retail investors. Moreover, institutions have grown to be skeptical of Coinbase Custody because the idea of custody of an asset typically entails disintermediating the asset from the market.

Many hedge funds await big investment houses like Goldman Sachs and ICE to expand and mature their custody desk services, so that custody of their assets is handled outside of the hands of cryptocurrency businesses. Institutions have also awaited the approval of cryptocurrency exchange-traded products (ETPs) which could turn out to be a powerful liquidity and custody solution to the market. Meanwhile, many filings have been denied by the SEC, and it is unclear which the SEC will approve and when.

How do Exchanges handle custody?

Exchanges take custody of assets that speculators own. It's apparent that traders are comfortable holding their funds on exchanges — as some of the largest exchanges hold a total of over 4% of Bitcoin's circulating supply. However, exchanges have not proven themselves to be bulletproof custodians in the past. Mt. Gox's hack in 2014, Bitfinex's hack in 2016, and Coincheck's hack in 2018 showed us that exchanges are not exactly what one would call risk-free.

Holding assets on exchanges is common among retail investors. Institutions with a lot of capital typically open up corporate accounts on multiple exchanges for more liquid trading. Exchanges like Poloniex, Kraken, OKex, and Huobi have opened doors to institutions where they provide more customized service and custody options.

How do Wallets handle Custody?

Wallets are means of storing public and private key pairs that identify and give access to cryptocurrency on the blockchain. Wallets include both hot wallets and cold storage wallets.

Hot wallets are connected to the internet. Where this wallet is stored presents a potential point of failure — if a malicious actor gets hold of the wallet, they could steal a users funds.

Cold wallets are offline and isolated, such as a hardware wallet. Hardware wallets are more secure but more complicated for the average user. Executing a transaction on a hardware wallet requires that one confirms the transaction using a button on a dedicated physical device. To protect individuals from losing funds if they lose their device, each hardware wallet uses a seed phrase. This is a set of words that can be used to regain access to a wallet without having to have that device. While hardware wallets are relatively secure and safe, the seed phrase is a central point of failure to the security of one's funds.

We've established a few things so far. Hot wallets present a single point of failure wherever the private access key is stored. Cold storage presents a single point of failure wherever the private key or seed phrase to restore the account is stored. Exchanges store funds in their wallets which could be compromised at any time. Professional digital custody solutions are not yet where institutions quite need them to be, and are unavailable to average investors.

How does Vault12 handle Custody?

So how do we establish a universal and secure means of digital custody that does not include a central point of failure? The way that we at Vault12 do so is by decentralizing storage of access points themselves — private keys and seed phrases — breaking them up into shares that are useless on their own, but then are combined to reconstruct these keys. This isn't a solution that would replace paper or hardware wallets per se, but rather would be an extra layer of security on top.

In other words, we spread these central points of failure out, to make the storage of access keys to cryptocurrency safer, more secure, and more practical. Instead of storing your private keys on a server, or on a fragile memory disk — your keys are split up and stored on a mesh of devices around the world — completely resistant to targeted attacks and unfortunate occurrences.

Investment Panel: Naval Ravikant, Meltem Demirors, Garry Tan | Blockstack Summit 2017

This video includes insights about the future of holding digital assets as shared by leading industry investors during these still-formative years.

Self-custody of crypto assets remains an opportunity for innovation. We're looking to find the fine line between decentralization, security, and usability of cryptocurrency wallets and other containers of digital assets — and bring that solution to you in the Vault12 platform.

What is Self-Custody?

Who should be responsible for holding your cryptocurrency and digital assets?

Wasim Ahmad

Wasim Ahmad is a serial entrepreneur and an advisor in the fields of AI, blockchain, cryptocurrency, and encryption solutions. At Vault12, the pioneer of crypto inheritance, he led private and public fundraising efforts and focuses today on expanding the Vault12 ecosystem. In addition, he is a producer of the upcoming movie 'The Bitcoin Executor'.

His crypto experience began with AlphaPoint, where he worked with the founding team to launch the world's first crypto trading exchanges. Previously he was a founding member of Voltage Security, a spinout from Stanford University, that launched Identity-Based Encryption (IBE), a breakthrough in Public Key Cryptography, and pioneered the use of sophisticated data encryption to protect sensitive data across the world's payment systems.

He has also been very involved with regulatory initiatives in both the US and the UK, providing feedback to the SEC and FCA respectively pushing for expanded momentum for innovation and startups within the regulatory frameworks of both countries.

Wasim served on the board of non-profit, StartOut, and is a Seedcamp and WeWork Labs global mentor.

Wasim graduated with a Bachelor of Science in Physics and French from the University of Sussex.

Vault12

Vault12 is the pioneer in crypto inheritance and backup. The company was founded in 2015 to provide a way to enable everyday crypto customers to add a legacy contact to their cry[to wallets. The Vault12 Guard solution is blockchain-independent, runs on any mobile device with biometric security, and is available in Apple and Google app stores.

Vault12 is NOT a financial institution, cryptocurrency exchange, or custodian. We do NOT hold, transfer, manage, or have access to any user funds, tokens, cryptocurrencies, or digital assets. Vault12 is exclusively a non-custodial information security and backup tool that helps users securely store their own wallet seed phrases and private keys for the purpose of inheritance. We provide no legal or financial services, asset management, transaction capabilities, or investment advice. Users maintain complete control of their assets at all times.

You will lose your Bitcoin and other crypto when you die...

...unless you set up Crypto Inheritance today.

It's simple — if you don't worry about crypto inheritance, nobody else will — not your software or hardware wallet vendors, not your exchanges, and not your wealth managers. So it's up to you to think about how to protect the generational wealth you have created, and reduce the risks around passing that crypto wealth on to your family and heirs. What are the challenges with crypto inheritance?

- Crypto Wallets are difficult to use and do not offer crypto inheritance management. In fact, most of them tell you to write down your seed phrase on a piece of paper, which is practically useless.

- Some people back up their wallet seed phrases or private keys on paper, local devices like hardware wallets or USBs, or in the cloud. All of these options have severe drawbacks that range from hacking to accidental loss to disrupted cloud services.

- Software wallets operate on specific blockchains, yet your crypto assets span multiple blockchains. For inheritance to work, you must be able to manage inheritance across every blockchain — now and forever.

Pioneering Crypto Inheritance: Secure Quantum-safe Storage and Backup

Vault12 is the pioneer in Crypto Inheritance, offering a simple yet powerful way to designate a legacy contact and pass on your crypto assets—like Bitcoin (BTC), Ethereum (ETH) and Solana (SOL) —to future generations. Built for everyday users yet robust enough for the most seasoned crypto enthusiasts, Vault12 Guard ensures your wallet seed phrases and private keys are preserved in a fully self-sovereign manner, across all Blockchains.

At the heart of Vault12 Guard is quantum-resistant cryptography and a decentralized, peer-to-peer network of trusted Guardians. Your critical information is never stored in the cloud, on Vault12 servers, or even on local devices—dramatically reducing the risk of a single point of failure. By fusing a powerful software layer with the Secure Element of iOS devices (Secure Enclave) and Google devices (Strongbox), Vault12 Guard locks down your private keys against present and future threats.

Our innovative approach harnesses social recovery, enabling you to appoint one or more trusted individuals or mobile devices as Guardians. These Guardians collectively safeguard your protected seed phrases in a decentralized digital Vault—so there’s no need for constant lawyer updates or bulky paperwork. Should the unexpected happen, your chosen legacy contact can seamlessly inherit your crypto assets without compromising your privacy or security.

Preserve your digital wealth for generations to come with Vault12 Guard—the simplest, most secure way to manage crypto inheritance and backup.

Take the first step and back up your crypto wallets.

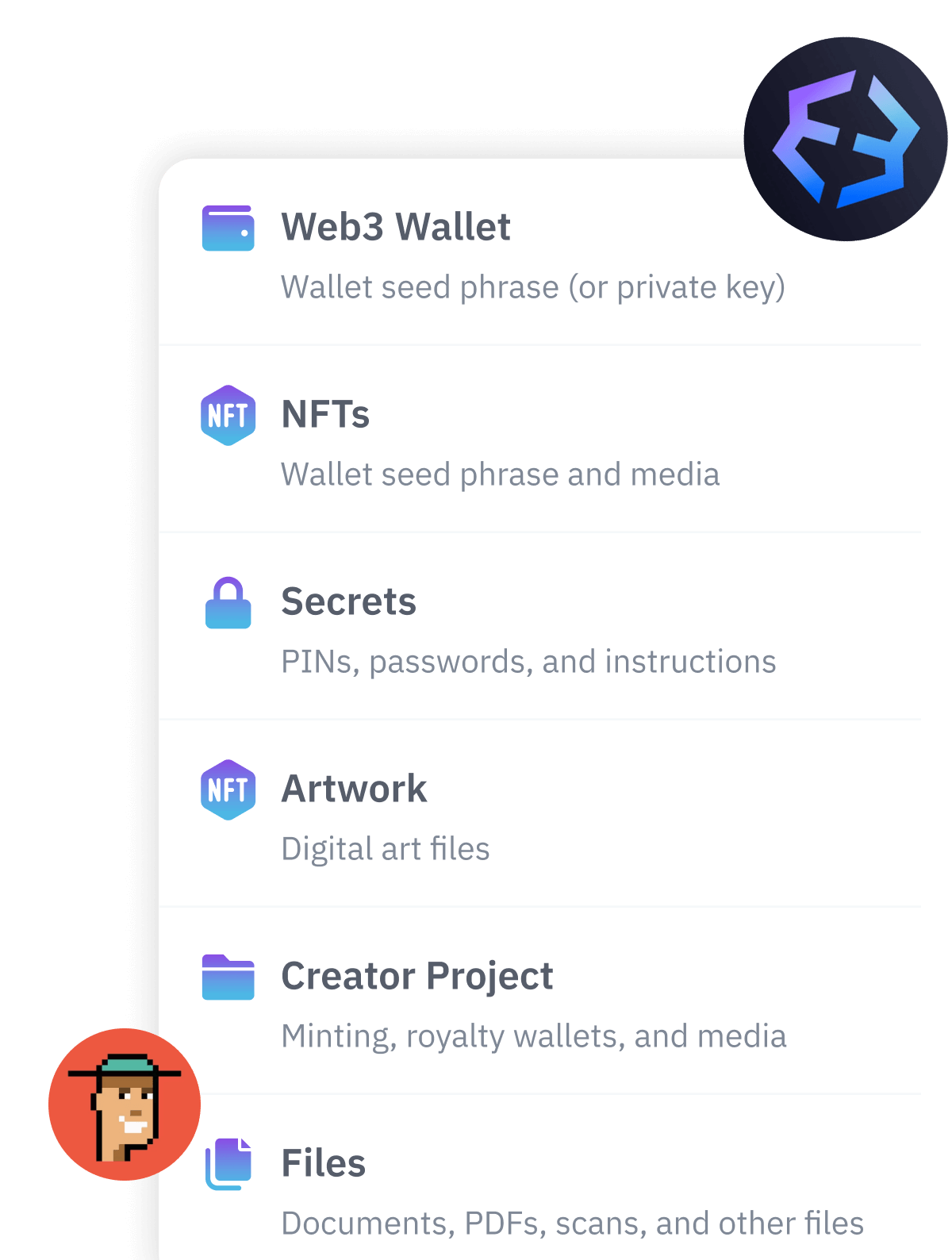

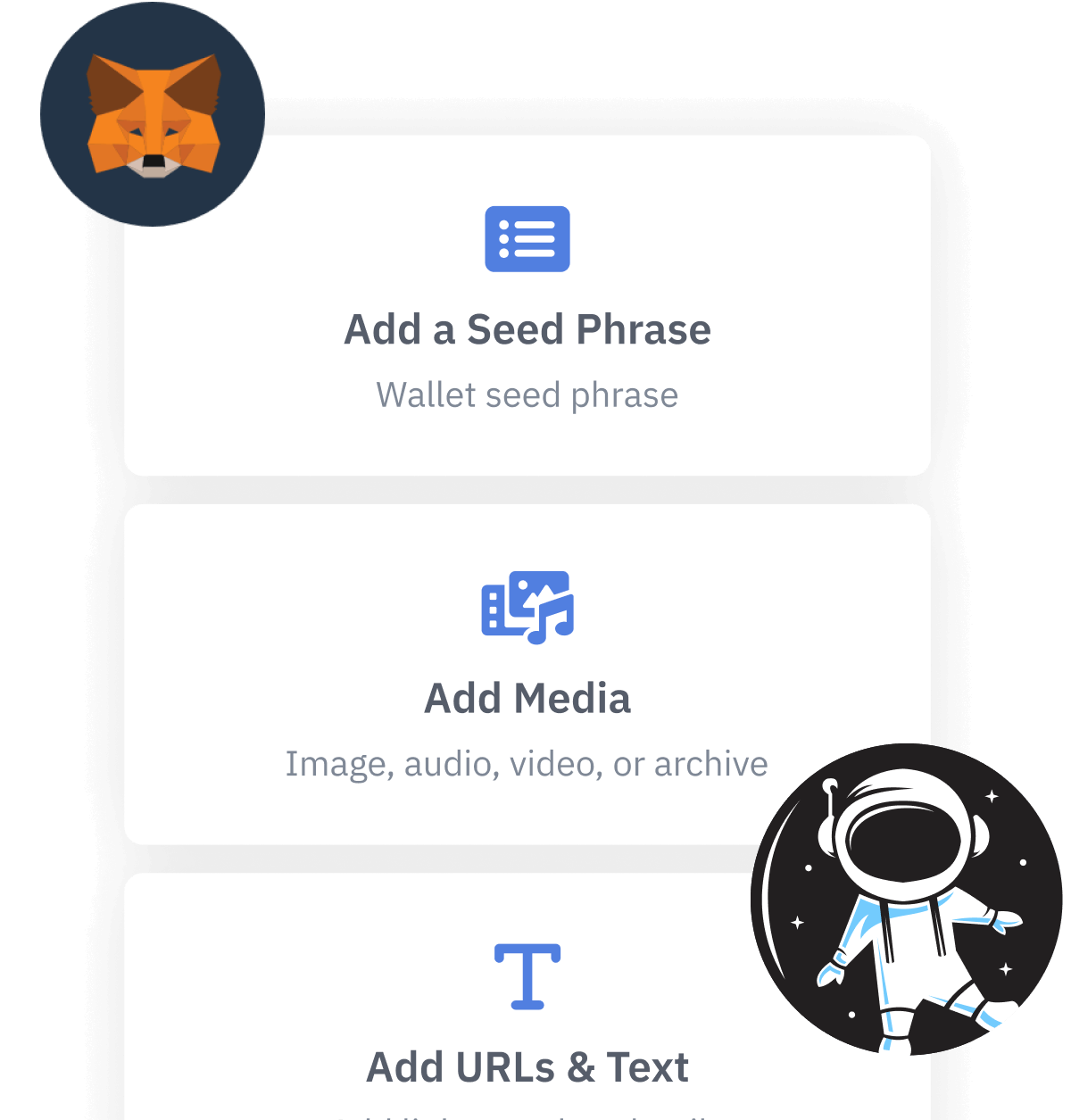

Designed to be used alongside traditional hardware and software crypto wallets, Vault12 Guard helps cryptocurrency owners back up their wallet seed phrases and private keys (assets) without storing anything in the cloud, or in any single location. This increases protection and decreases the risk of loss.

The first step in crypto Inheritance Management is making sure you have an up-to-date backup.

The Vault12 Guard app enables secure decentralized backups, and provides inheritance for all your seed phrases and private keys across any blockchain, including Bitcoin, Ethereum, and others, and for any crypto wallet.

Note: For anyone unfamiliar with cryptocurrencies, Vault12 refers to wallet seed phrases and private keys as assets, crypto assets, and digital assets. The Vault12 Guard app includes a software wallet that works alongside your Digital Vault. The primary purpose of this is to guard your Bitcoin (BTC) and Ethereum (ETH) wallet seed phrases, private keys, and other essential data, now and for future generations.