Contents

- Key Highlights about Digital Asset Inheritance

- Introducing Digital Inheritance

- What is needed for traditional and Digital Inheritance at a high level?

- What Digital Inheritance risks are related to beneficiaries?

- What Digital Inheritance risks are related to writing and maintaining instructions?

- What risks are related to storing your Digital Inheritance instructions?

- Why was the Digital Inheritance company Vault12 created?

- How does Vault12 Digital Inheritance clarify your intentions?

- How does Vault12 Digital Inheritance work?

- Vault12 maintains Digital Asset inventory and provides private access

- What are some personal stories of Digital Inheritance failures?

- Ready to ensure your inheritance of crypto assets?

Why should you care about Crypto and NFT Inheritance?

Cryptocurrency and NFT digital asset inheritance is a new area that is fraught with risks. Fortunately, Vault12 can reduce your risks by allowing you to protect, back up, recover, and simplify inheritance of your digital assets.

Digital assets such as cryptocurrency and NFTs are becoming more common, and if you're part of this exciting evolution, it is essential that you set up a plan to properly pass these assets on to the next generation. If you are investing in crypto, you should be thinking about what happens when you pass away. Digital assets carry unique challenges in how to protect your investments and how to ensure that your loved ones benefit from them some day. We'll help you navigate these complexities so that you can proceed with confidence and peace of mind.

Key Highlights about Digital Asset Inheritance

- Traditional estate planning fails to address new challenges of complexity and risk for digital asset inheritance.

- One big risk is the failure to correctly create or maintain an up-to-date inventory of digital assets, leading to their eventual loss.

- Another major risk is trusting a weak third party with credentials to access your digital assets. If you choose the wrong person or institution, they could lose the assets in a variety of ways, pass them on to an unauthorized third party, or even attempt to access them before they are entitled.

Introducing Digital Inheritance

Watch the video below for a brief introduction to Digital Inheritance.

What is needed for traditional and Digital Inheritance at a high level?

Whether you are planning inheritance of traditional assets or digital assets, there are a few general planning requirements that you need to consider. How these should be performed will vary depending on whether they are traditional or digital assets. Each comes with its own set of risks.

1. Identify your beneficiaries.

2. Create a legally binding will.

3. Write - and maintain - instructions detailing how to transition your various assets.

4. Contract for some form of storage to protect your inheritance plans.

Source: Cremation institute: https://cremationinstitute.com/cryptoasset-inheritance-planning/

What Digital Inheritance risks are related to beneficiaries?

With traditional inheritance, an executor ensures that each beneficiary receives the specific assets that you intend to go to them at the appropriate time. Similarly, with digital inheritance, a robust digital inheritance plan must ensure that no beneficiary can access their inherited assets earlier than they should.

RISK - If you directly give your intended beneficiary digital access to your assets today, they could access your assets before they should. Additionally, anyone else who sees the instructions could access them inappropriately.

RISK - If you give a lawyer or executor digital access to your assets today to hold for your beneficiary, there are various forms of third-party risk: the firm could fail to adequately safeguard them, leading to their loss or theft. Or they could go out of business or otherwise have the assets seized.Vault12 Guard involves your beneficiaries in your digital inheritance plan without the risk of them accessing assets early, and without the risk of a custodian losing assets before it falls into your beneficiaries' hands.

What Digital Inheritance risks are related to writing and maintaining instructions?

Your digital assets may be unique works of art, fungible cryptocurrencies, important documents, or a mix of all of these. And for each digital asset, depending on what it is, you may need to communicate specific instructions indicating where the asset is stored and all the pin codes, seed phrases, and passwords that are applicable to the asset.

RISK - You could incorrectly document your assets and access codes, or accidentally omit some.

The importance of keeping your instructions current cannot be overstated! Portfolios of digital assets can change frequently — you cannot rely on doing an inventory once, or for that matter continually, without assistance. With traditional approaches, you would need to amend your instructions each time you add a digital asset, together with all access details. Any errors or omissions could result in inaccessible assets, not to mention time wasted in documenting.

RISK - You forget to update the list of digital assets or the associated access information.

You also have to ensure that the detailed (and continually changing instructions) are not accessed by staff or other unauthorized people. In fact, it is imperative that these instructions are protected from theft.

RISK - Your instructions could be perfect, but fall into the wrong hands.

Vault12 Guard simplifies how you create and store your asset access instructions, and reminds you to test and confirm that the access steps are correct.

What risks are related to storing your Digital Inheritance instructions?

In a traditional inheritance, you would likely pay for a safety deposit box in a bank or other physical custodial location.

RISK - Safety deposit boxes are not always safe or accessible (such as during pandemic bank closings), nor are they insured in the event of loss or theft.

The Vault12 Guard app is a safer place to keep your digital asset inheritance instructions than a safe deposit bank or any other physical location.

Why was the Digital Inheritance company Vault12 created?

Our CEO and co-founder spent time working on early crypto industry deals at Andreessen Horowitz (one of the first and most reputable venture capital firms in the blockchain space). He observed that there was no end-to-end solution for backing up and securing seed phrases and private keys, and also that in the event of death or incapacitation, there was no mechanism to directly pass on assets to a designated individual. That revelation brought the genesis of Vault12!

Beyond the personal tragedy of failing to pass along digital assets to one's loved ones, another unfortunate side effect of unplanned “death events” in the crypto economy is that they permanently and forever remove large amounts of coins from circulation. Such crypto losses reduce the total circulating supply for all current and future users. Left unchecked, this may develop into a far bigger issue for the crypto industry as a whole since just as the industry enters mainstream use, the supply of digital resources available to new entrants will shrink in unplanned ways.

How does Vault12 Digital Inheritance clarify your intentions?

Vault12 Digital Inheritance is the first solution to offer a simple, direct, and secure way that all types of investors can guarantee that their digital assets will be there for future generations.

- Traditional approaches to the inheritance of assets, when applied to digital assets, cause complexity and risk.

- Your portfolio of digital assets is continually changing — you cannot rely on doing an inventory once, or for that matter continually, without assistance.

- Vault12's simple Digital Vault solution with trusted Guardians accommodates all types of digital assets and reduces the uncertainty around assets not being available to the designated recipient. It also avoids having to approach and petition each service individually during probate to gain access.

How does Vault12 Digital Inheritance work?

- The Vault12 Digital Inheritance solution provides an app for protecting, backing up, and securing your digital assets. It enables you to designate a beneficiary who can inherit your entire portfolio of digital assets stored in your Vault when the time comes - no need to continually update an inventory or to issue updated instructions.

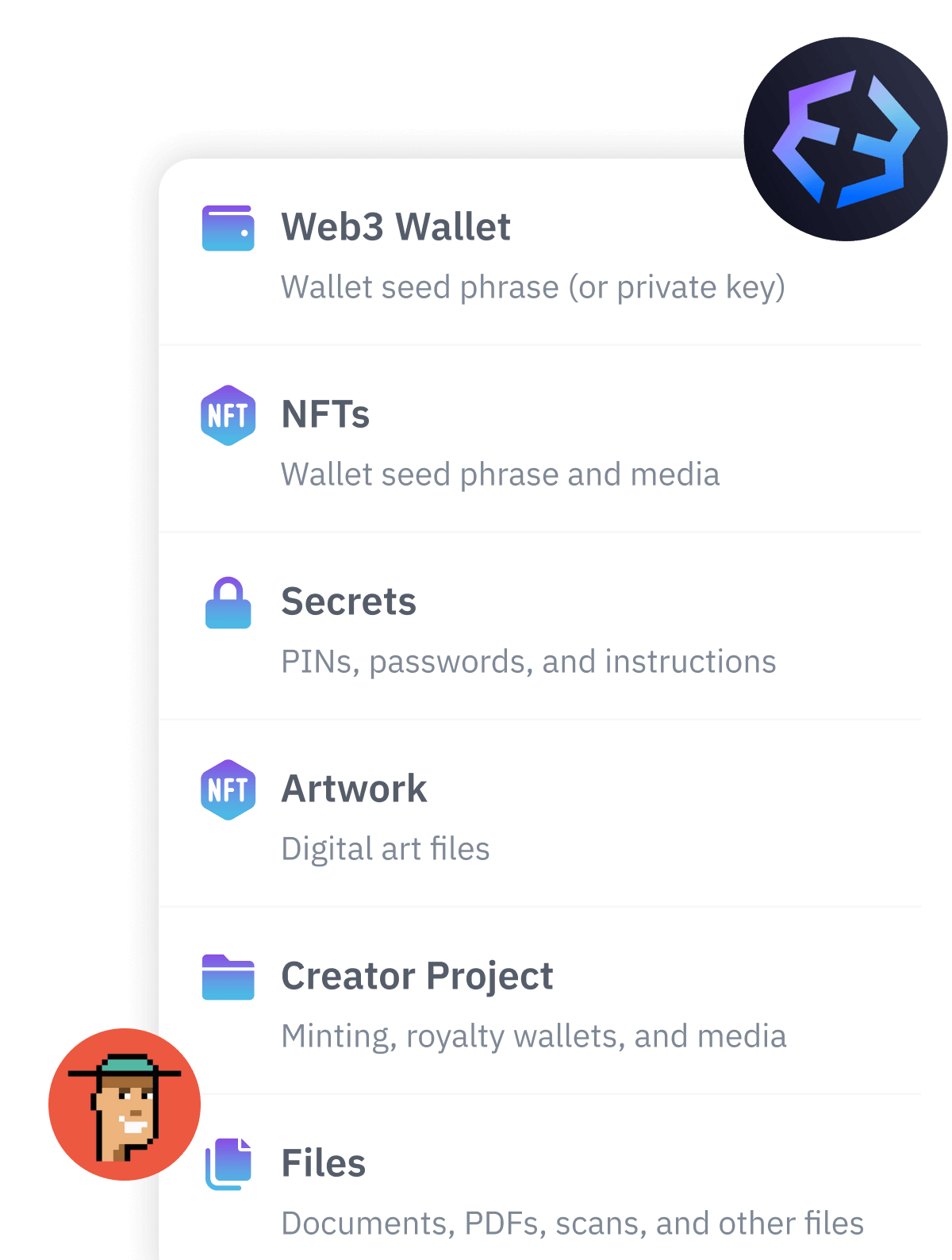

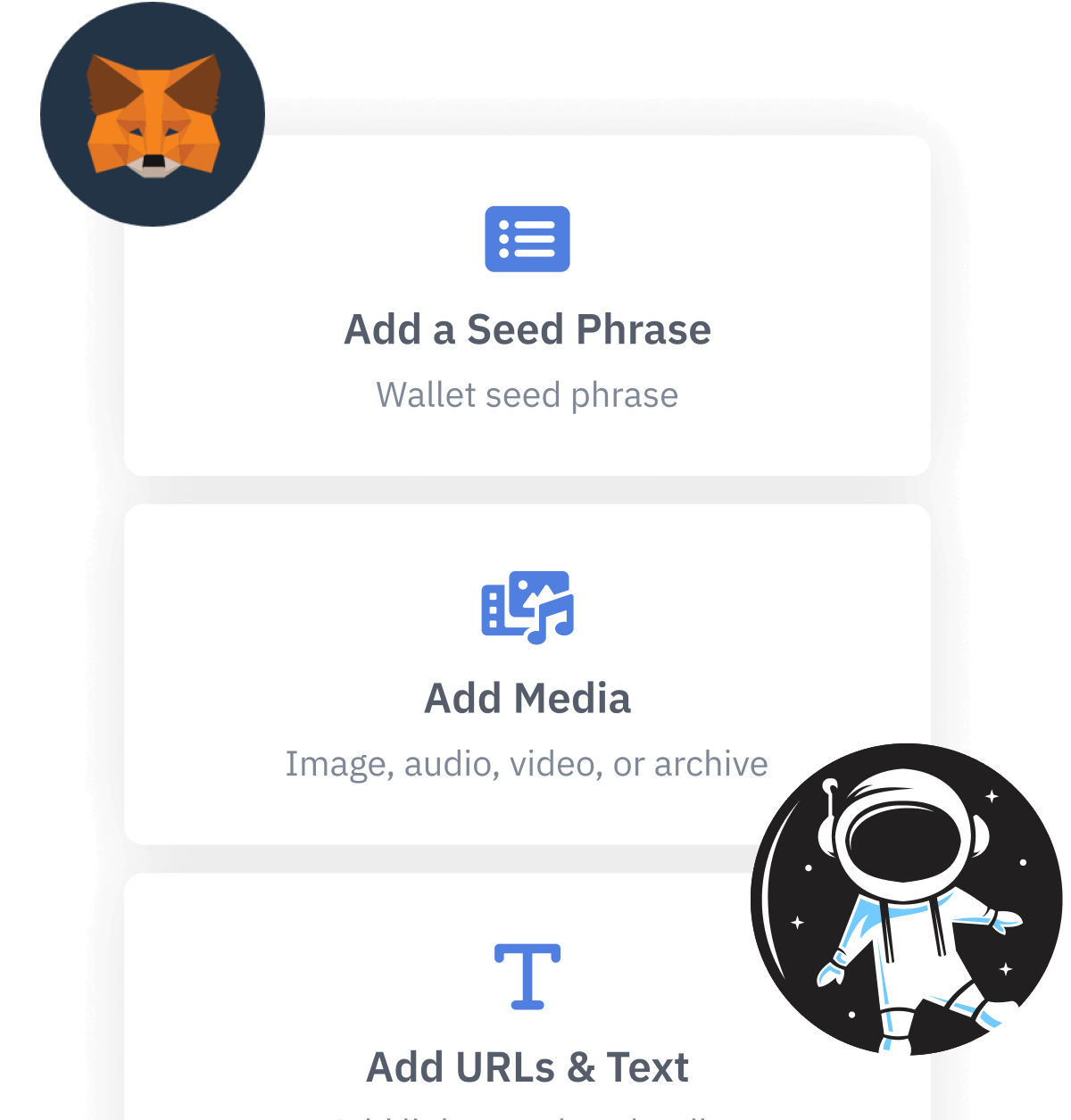

- Digital assets, including cryptocurrency, financial login information, legal documents, medical records, and more can be added to a Vault12 Digital Vault.

- The Vault is protected by a network of Guardians — these are friends, family, and business associates - people that you know and trust.

- A beneficiary is designated by the Vault owner from amongst the Guardians, and a declaration is digitally signed and transmitted to the beneficiary and lawyers as needed.

- Upon the passing of the Vault owner, when the beneficiary is ready to access the digital assets, a designated number of Guardians approve the request, and the assets are restored with access granted to the beneficiary.

- Should the beneficiary attempt to access the assets prior to the owner’s passing, the owner can veto the request.

Vault12 maintains Digital Asset inventory and provides private access

Vault12 Digital Inheritance was designed to reduce the risks associated with managing digital assets and preparing them for future transfer:

- Comprehensive Digital Asset Inventory: Designed to accept all forms of digital assets. When used to secure and backup an investor’s full range of assets, it provides an up-to-date inheritance inventory.

- Direct access for the designated individual: Offers a simple and direct way for the designated individual to gain access to digital assets without having to petition multiple services or financial institutions.

- Privacy: Ensures that, unlike with multi-sig solutions, information about the digital assets is kept private - even from lawyers.

What are some personal stories of Digital Inheritance failures?

There is a steady drumbeat of these stories happening with worrisome regularity:

- In December 2018, Gerald Cotten, the founder of Canadian Bitcoin trading exchange QuadrigaCX, died (under somewhat mysterious circumstances) resulting in the loss of $250M and the exchange going bankrupt. Gerald was only 30 years old and had not created an inheritance plan, nor were instructions of how to access the centralized assets ever found. https://www.cbc.ca/news/canada/nova-scotia/quadriga-widow-jennifer-roberston-gerald-cotten-1.6318955

- In April 2018, Matthew Mellon, heir to Mellon family banking fortune and former chairman of the NY Republican Party finance committee, and cryptocurrency proponent died. Prior to his death, he held an estimated $1B in Ripple (XRP) - all of this remains inaccessible as he left no instructions, even though he protected the cryptocurrency via cold storage in multiple locations around the US in different people’s names.

https://fortune.com/2018/04/17/matthew-mellon-crypto-billionaire/

- In 2017, an unidentified young crypto investor in Colorado died with a small fortune in cryptocurrency held in a Coinbase account. The family, however, had no access to the account, and had to petition Coinbase directly. Eventually, the assets were released after a lengthy process. If the account holder had not been a U.S. Citizen, this would have been a much more complicated process.

Ready to ensure your inheritance of crypto assets?

Please visit the Vault12 website to learn more, and join us in the new era of Digital Inheritance. In just a few minutes, you can download the Vault12 Guard app and protect all of your digital resources.

Why should you care about Crypto and NFT Inheritance?

Cryptocurrency and NFT digital asset inheritance is a new area that is fraught with risks. Fortunately, Vault12 can reduce your risks by allowing you to protect, back up, recover, and simplify inheritance of your digital assets.

Wasim Ahmad

Wasim is a serial entrepreneur and an advisor in the fields of AI, blockchain, cryptocurrency, and encryption solutions. At Vault12, the pioneer of crypto inheritance, he led the private and public fundraising efforts and focuses today on expanding the Vault12 ecosystem. His crypto experience began with AlphaPoint, where he worked with the founding team to launch the world's first crypto trading exchanges. Previously he was a founding member of Voltage Security, a spinout from Stanford University, that launched Identity-Based Encryption (IBE), a breakthrough in Public Key Cryptography, and pioneered the use of sophisticated data encryption to protect sensitive data across the world's payment systems. Wasim serves on the board of non-profit, StartOut, and is a Seedcamp and WeWork Labs global mentor.

Wasim graduated with a Bachelor of Science in Physics and French from the University of Sussex.

Vault12

Vault12 is the pioneer in crypto inheritance and backup. The company was founded in 2015 to provide a way to enable everyday crypto customers to add a legacy contact to their cry[to wallets. The Vault12 Guard solution is blockchain-independent, runs on any mobile device with biometric security, and is available in Apple and Google app stores.

You will lose your Bitcoin and other crypto when you die...

...unless you set up Crypto Inheritance Management today.

It's simple — if you don't worry about crypto inheritance, nobody else will — not your software or hardware wallet vendors, not your exchanges, and not your wealth managers. So it's up to you to think about how to protect the generational wealth you have created, and reduce the risks around passing that crypto wealth on to your family and heirs. What are the challenges with crypto inheritance?

- Crypto Wallets are difficult to use and do not offer crypto inheritance management. In fact, most of them tell you to write down your seed phrase on a piece of paper, which is practically useless.

- Some people back up their wallet seed phrases or private keys on paper, local devices like hardware wallets or USBs, or in the cloud. All of these options have severe drawbacks that range from hacking to accidental loss to disrupted cloud services.

- Software wallets operate on specific blockchains, yet your crypto assets span multiple blockchains. For inheritance to work, you must be able to manage inheritance across every blockchain — now and forever.

Crypto Inheritance Management: Secure, Self-Custody Crypto Inheritance and Backup

Vault12 is the pioneer in Crypto Inheritance Management, offering a simple yet powerful way to designate a legacy contact and pass on your crypto assets—like Bitcoin (BTC), Ethereum (ETH) and Solana (SOL) —to future generations. Built for everyday users yet robust enough for the most seasoned crypto enthusiasts, Vault12 Guard ensures your wallet seed phrases and private keys are preserved in a fully self-sovereign manner, across all Blockchains.

At the heart of Vault12 Guard is quantum-resistant cryptography and a decentralized, peer-to-peer network of trusted Guardians. Your critical information is never stored in the cloud, on Vault12 servers, or even on local devices—dramatically reducing the risk of a single point of failure. By fusing a powerful software layer with the Secure Element of iOS devices (Secure Enclave) and Google devices (Strongbox), Vault12 Guard locks down your private keys against present and future threats.

Our innovative approach harnesses social recovery, enabling you to appoint one or more trusted individuals or mobile devices as Guardians. These Guardians collectively safeguard your protected seed phrases in a decentralized digital Vault—so there’s no need for constant lawyer updates or bulky paperwork. Should the unexpected happen, your chosen legacy contact can seamlessly inherit your crypto assets without compromising your privacy or security.

Preserve your digital wealth for generations to come with Vault12 Guard—the simplest, most secure way to manage crypto inheritance and backup.

Take the first step and back up your crypto wallets.

Designed to be used alongside traditional hardware and software crypto wallets, Vault12 Guard helps cryptocurrency owners back up their wallet seed phrases and private keys (assets) without storing anything in the cloud, or in any single location. This increases protection and decreases the risk of loss.

The first step in crypto Inheritance Management is making sure you have an up-to-date backup.

The Vault12 Guard app enables secure decentralized backups, and provides inheritance for all your seed phrases and private keys across any blockchain, including Bitcoin, Ethereum, and others, and for any crypto wallet.

Note: For anyone unfamiliar with cryptocurrencies, Vault12 refers to wallet seed phrases and private keys as assets, crypto assets, and digital assets. The Vault12 Guard app includes a software wallet that works alongside your Digital Vault. The primary purpose of this is to guard your Bitcoin (BTC) and Ethereum (ETH) wallet seed phrases, private keys, and other essential data, now and for future generations.