Contents

The Utility of Blockchain for the Fine Art Industry

An original Picasso painting typically sells for millions of dollars. Can’t afford one? Learn how you can buy a masterpiece for a fraction of its price.

Summary

Fine art has been traded and speculated upon since the early medieval period — far longer than stocks or bonds — and is considered a legitimate, investable asset that falls within the broad category of “alternatives” in legacy financial services. The industry has quickly adopted blockchain technology to address issues of transparency and provenance. With the onset of non-fungible tokens (NFTs) and cryptoart, we are witnessing widespread adoption of decentralized tech throughout the traditional art world, while disruptive new art formats and communities are also emerging.

High Art Embraces Blockchain Fine Art

Although the first blockchain technology to reach the mainstream was Bitcoin, which launched in 2009, it wasn’t until the development of Ethereum that blockchain technology found further utility beyond that of a cryptocurrency. The breakthrough growth of decentralized applications (dApps) and digital assets that has taken place since is evident in many sectors — including the art world.

In fact, just three years after the launch of Ethereum, two of the world’s leading auction houses — Christie’s and Sotheby’s — leaped into blockchain headfirst. These venerable institutions — founded in 1766 and 1744, respectively — are frequented by the world’s wealthiest art investors, and are renowned for their blue-chip collections of fine art, antiques, and jewelry from every era in history and all parts of the globe. What makes their early adoption of blockchain remarkable is that Christie's and Sotheby’s have long borne a reputation for staid conservatism. Far from conservative, however, theirs was a prescient move and a solid endorsement for blockchain technology.

The First Fine Art Registered on Blockchain

Prior to implementation of blockchain technology, registering, reselling, and transferring ownership of artworks was an entirely paper-driven process. Every museum in the world, all of the auction houses, art galleries, and archives conducted provenance manually, and each used different procedures. This made for lengthy, expensive, and error-prone processes, which the auction houses were keen to move to the blockchain.

In 2018, Christie’s New York became the first auction house to register a sale on a blockchain platform with its $318-million sale of the Barney A. Ebsworth collection. One of the most coveted collections of 20th century American art in the world, the Ebsworth collection featured work by landmark American artists Edward Hopper and Georgia O’Keeffe, among others. The live auction took place in person, online, and over the phone — but all of its transactions were recorded entirely via blockchain technology.

Christie’s tech partner in the sale was Artory, a blockchain-powered fine art registry, which managed the registration process for each of the collection’s more than 85 artworks. Artory and Christie's used blockchain art-provenance technology to digitally establish the chain of custody and authenticity of works sold, while creating an immutable record of the transaction through verifiable cryptography.

The benefits of registering art on a blockchain are multifarious. Blockchain technology as offered by various platforms and iterations can be used to ensure privacy or anonymity between buyers, sellers, the public, and other industry actors. Blockchain art markets can also create transparency and fairness in the bidding and transfer phases, and in the ability to audit transactions publicly. Additionally, the immutable nature of blockchains — where publicly held data cannot be altered by any party — can be used to resolve disputes about ownership or damages.

The utility of blockchain technology extends through the art world far beyond the auction process, and includes:

- Significantly diminishing forgeries that have always plagued the industry

- Trading forms of digital art that previously were too hard to exchange

- Driving digital art sales through verifiable digital scarcity

- Democratizing access to fine art investment

Now, there are more than 50 blockchain-specific applications for the art world specifically, and auction houses around the globe are racing to incorporate blockchain into their processes. Further, a whole new sector of digital art has sprung up in the form of non-fungible tokens (NFTs). NFTs are unique, verifiable, and transferable digital tokens that can represent digital art, or otherwise represent an ownership portion in a piece of physical art.

The Tokenization of Art and NFT Marketplaces

The first piece of fine art ever to be tokenized with blockchain technology was an Andy Warhol painting titled “14 Small Electric Chairs,” valued at $5.6 million. In 2018, a crypto-art-friendly gallery in the U.K. and its tech partner, Maecenas, auctioned 31% of the Warhol painting, raising $1.7 million in the sale. The blockchain art auction was run entirely on Ethereum using smart contracttechnology. Buyers were able to purchase fractions of the Warhol painting with bitcoin (BTC), ether (ETH), or ART coins.

The process of selling a fraction of a coveted work of art is made possible by tokenization. Via tokenization, data contained in a digital file is transformed on a blockchain into unique digital tokens by adding unique identifiers and indelible signatures. This process creates a NFT, which retains all essential data regarding provenance, ownership rights, and access to a specific work. Essentially, this process can fragment a painting’s ownership into thousands of pieces — or more. Buyers can purchase a tokenized percentage of a painting in the same way they would purchase a percentage of a business by buying its stock.

Since the Warhol sale in 2018, NFT art sales and NFT marketplaces have exploded in popularity. Many notable artists globally across the arts, music, and entertainment sectors are creating NFTs and utilizing blockchain technology for a wide and emerging variety of purposes.

Fine art as investment has typically been reserved for an elite few for hundreds, perhaps thousands of years. Blockchains and NFTs are rapidly changing this paradigm to democratize access to one of the most exclusive industries in the world. To learn more about digital art, cryptoart, and blockchain, our deep dive into the subject is a great place to start.

Cryptopedia does not guarantee the reliability of the Site content and shall not be held liable for any errors, omissions, or inaccuracies. The opinions and views expressed in any Cryptopedia article are solely those of the author(s) and do not reflect the opinions of Gemini or its management. The information provided on the Site is for informational purposes only, and it does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. A qualified professional should be consulted prior to making financial decisions. Please visit our Cryptopedia Site Policy to learn more.

The Utility of Blockchain for the Fine Art Industry

An original Picasso painting typically sells for millions of dollars. Can’t afford one? Learn how you can buy a masterpiece for a fraction of its price.

Gemini Cryptopedia

Gemini is a next generation cryptocurrency exchange and custodian that allows customers to buy, sell, and store digital assets.

You will lose your Bitcoin and other crypto when you die...

...unless you set up Crypto Inheritance today.

It's simple — if you don't worry about crypto inheritance, nobody else will — not your software or hardware wallet vendors, not your exchanges, and not your wealth managers. So it's up to you to think about how to protect the generational wealth you have created, and reduce the risks around passing that crypto wealth on to your family and heirs. What are the challenges with crypto inheritance?

- Crypto Wallets are difficult to use and do not offer crypto inheritance management. In fact, most of them tell you to write down your seed phrase on a piece of paper, which is practically useless.

- Some people back up their wallet seed phrases or private keys on paper, local devices like hardware wallets or USBs, or in the cloud. All of these options have severe drawbacks that range from hacking to accidental loss to disrupted cloud services.

- Software wallets operate on specific blockchains, yet your crypto assets span multiple blockchains. For inheritance to work, you must be able to manage inheritance across every blockchain — now and forever.

DISCLAIMER: Vault12 is NOT a financial institution, cryptocurrency exchange, wallet provider, or custodian. We do NOT hold, transfer, manage, or have access to any user funds, tokens, cryptocurrencies, or digital assets. Vault12 is exclusively a non-custodial information security and backup tool that helps users securely store their own wallet seed phrases and private keys. We provide no financial services, asset management, transaction capabilities, or investment advice. Users maintain complete control of their assets at all times.

Pioneering Crypto Inheritance: Secure Quantum-safe Storage and Backup

Vault12 is the pioneer in Crypto Inheritance, offering a simple yet powerful way to designate a legacy contact and pass on your crypto assets—like Bitcoin (BTC), Ethereum (ETH) and Solana (SOL) —to future generations. Built for everyday users yet robust enough for the most seasoned crypto enthusiasts, Vault12 Guard ensures your wallet seed phrases and private keys are preserved in a fully self-sovereign manner, across all Blockchains.

At the heart of Vault12 Guard is quantum-resistant cryptography and a decentralized, peer-to-peer network of trusted Guardians. Your critical information is never stored in the cloud, on Vault12 servers, or even on local devices—dramatically reducing the risk of a single point of failure. By fusing a powerful software layer with the Secure Element of iOS devices (Secure Enclave) and Google devices (Strongbox), Vault12 Guard locks down your private keys against present and future threats.

Our innovative approach harnesses social recovery, enabling you to appoint one or more trusted individuals or mobile devices as Guardians. These Guardians collectively safeguard your protected seed phrases in a decentralized digital Vault—so there’s no need for constant lawyer updates or bulky paperwork. Should the unexpected happen, your chosen legacy contact can seamlessly inherit your crypto assets without compromising your privacy or security.

Preserve your digital wealth for generations to come with Vault12 Guard—the simplest, most secure way to manage crypto inheritance and backup.

Take the first step and back up your crypto wallets.

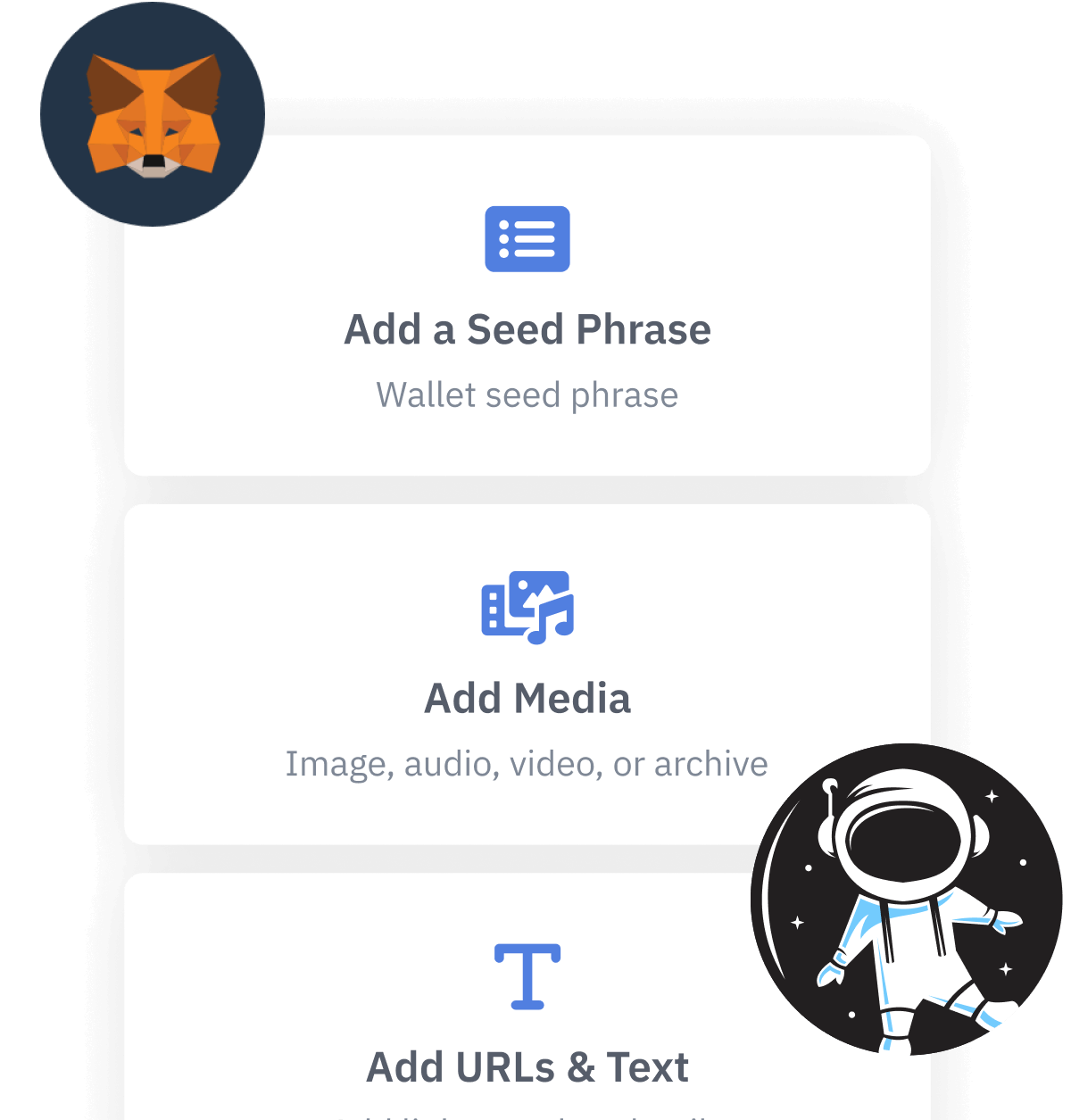

Designed to be used alongside traditional hardware and software crypto wallets, Vault12 Guard helps cryptocurrency owners back up their wallet seed phrases and private keys (assets) without storing anything in the cloud, or in any single location. This increases protection and decreases the risk of loss.

The first step in crypto Inheritance Management is making sure you have an up-to-date backup.

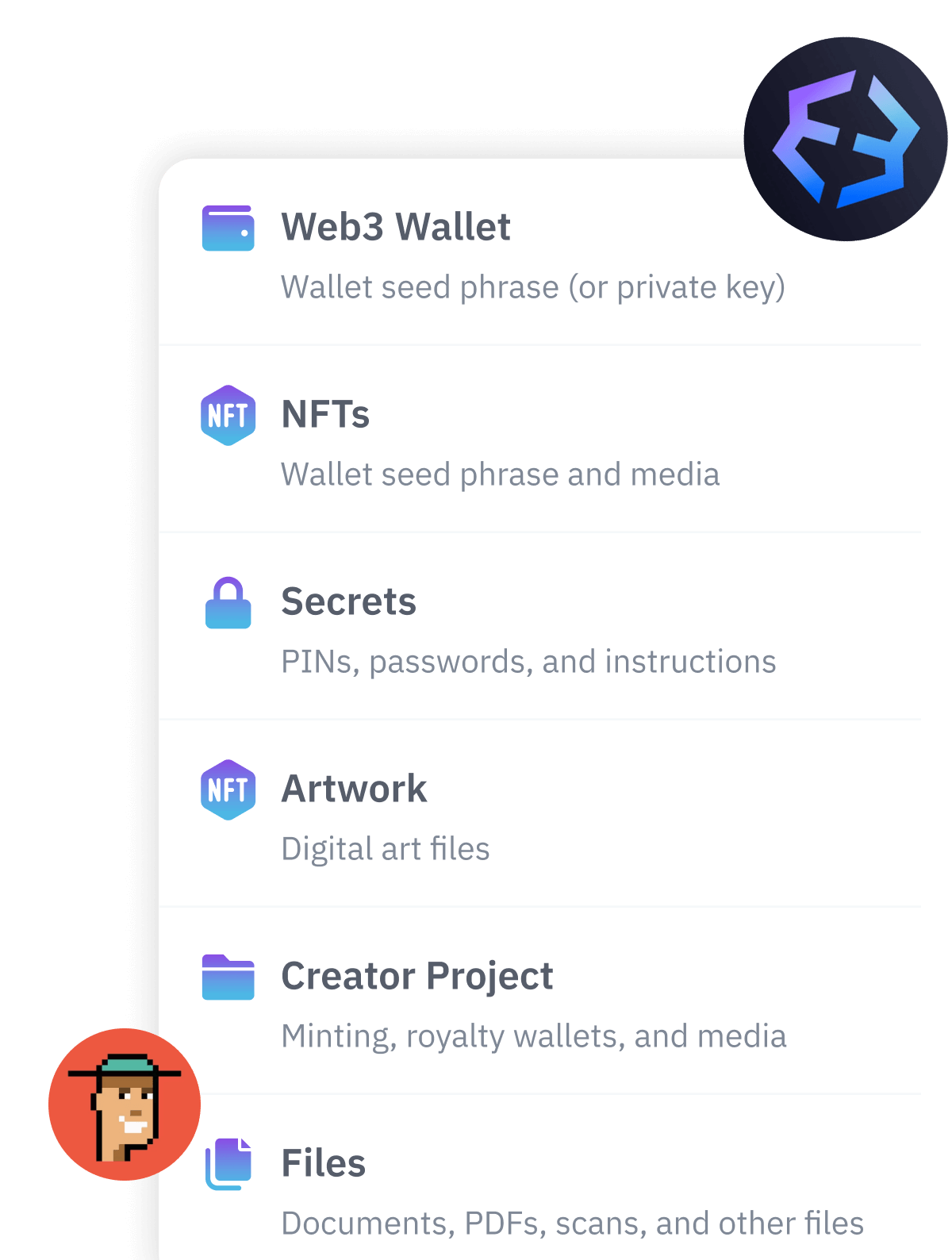

The Vault12 Guard app enables secure decentralized backups, and provides inheritance for all your seed phrases and private keys across any blockchain, including Bitcoin, Ethereum, and others, and for any crypto wallet.

Note: For anyone unfamiliar with cryptocurrencies, Vault12 refers to wallet seed phrases and private keys as assets, crypto assets, and digital assets. The Vault12 Guard app includes a software wallet that works alongside your Digital Vault. The primary purpose of this is to guard your Bitcoin (BTC) and Ethereum (ETH) wallet seed phrases, private keys, and other essential data, now and for future generations.