Contents

Can Bitcoin Replace Government-Issued Money?

An Oxford-style debate at the SOHO Forum

On August 19, 2019 the SOHO Forum hosted a lively Oxford-style debate between George Selgin and Saifedean Ammous. Selgin is the Director of the Cato Institute's Center for Monetary and Financial Alternatives, where he is the editor-in-chief of the Center's blog, Alt-M, Professor Emeritus of economics at the Terry College of Business at the University of Georgia, and an associate editor of Econ Journal Watch. Ammous is an associate professor of economics at Adnan Kassar School of Business and a foreign member of the Center on Capitalism and Society at Columbia University. He is also the author of The Bitcoin Standard: Sound Money in a Digital Age published by Wiley Brothers in 2018.

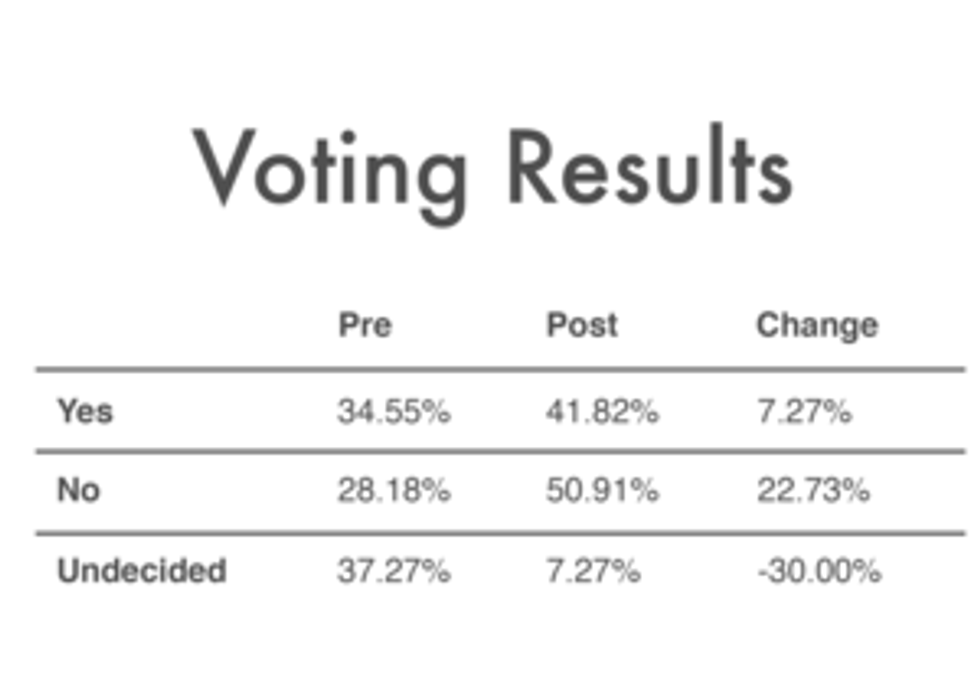

Oxford-style debates focus on a sharply worded resolution. They follow a formal structure that begins with audience members casting a pre-debate vote on the motion that is either for, against or undecided. Each panelist presents a seven-minute opening statement, after which the moderator takes questions from the audience with inter-panel challenges. Finally, each panelist delivers a two-minute closing argument, and the audience delivers their second (and final) vote for comparison against the first set of votes. The winner is determined by who has swayed more audience members between the two votes.

The resolution for this debate was "Bitcoin is Poorly Suited to the Purpose of Becoming Any Nation's Main Medium of Exchange". Selgin took the affirmative side of the resolution and Ammous took the negative. Prior to and after the debate, the audience was polled — see the results below.

Selgin’s Affirmative Argument

Selgin began his argument with the statement:

I want to start by pointing out that it is an uphill battle for any new upstart money to replace, to set aside, an incumbent money. . . That is because money is a network good. The usefulness of a good to anybody is a function of how many other people are using it. Money is a classic network good. The first question anyone asks about using a money is what I can buy with this stuff? Anyone who has ever travelled internationally and whipped out their dollars and suddenly discover that dollars are not too valuable in other parts of the world. This is certainly true for Bitcoin. The central proposition of my argument is that a necessary condition for an upstart money to replace an incumbent money is that it is significantly more attractive than the incumbent money.

Selgin goes on to talk about the relative attractiveness of five aspects of Bitcoin.

Trust. Selgin gives Bitcoin a grade of 'A' when it comes to trust. He noted that there will only be 21 million Bitcoins ever issued. Unlike fiat money where central governments can inflate the supply at will by printing more money, there will never be more than 21 million Bitcoin. Bitcoin is the definition of what he calls hard money.

Privacy. Selgin gives Bitcoin an 'A-' for privacy. Bitcoin wallets have pseudonymous versus anonymous identities. Individuals can do Bitcoin transactions without revealing their identity or being required to undergo a 'Know Your Customer' verification. Selgin points out, however, that with some detective work it is possible to trace Bitcoin transactions and potentially assign an identity to a Bitcoin wallet.

Next Selgin moved on to a number of features of Bitcoin that are very unattractive:

Hacking. Selgin gives Bitcoin a grade of 'C- or D' when it comes to hacking. He noted that approximately 1/3rd of Bitcoin exchanges had been hacked, while only about 1% of traditional banks had been hacked. Approximately $2 billion of Bitcoin has been stolen and that is a significant percentage of the roughly $200 billion in Bitcoin in circulation today.

Valuable Utility. Selgin gives Bitcoin a grade of 'F'. When using money as a medium of exchange, individuals do not want to have a lot of risks that the value of their money is going to change. If they want risk they want it to be a conscious choice. They don't want the money they keep on hand to change dramatically while they decide what they want to spend it on. Selgin noted that gold is a volatile store of value, its price changes every day. George noted that the price of Bitcoin is seven times more volatile than that of gold. This makes it very unattractive.

Transaction Fees/Processing Fees. Selgin graded the costs to process Bitcoin transactions and the sped of processing the transactions a 'D or F'. He mentioned the Bitcoin transaction fee crisis of December 2017 as an example of how high transaction fees simply cannot compete with the low cost of traditional credit cards or payment services like PayPal or Venmo. George also reminded the audience that multiple confirmations are required to confirm a Bitcoin transaction. It can take up to an hour to get six confirmations — such a delay just won't work if you want to buy a roll of toilet paper at 7/11. While there are other technologies like Bitcoin Cash and the Lightning Network that offer faster confirmation, their low level of adoption will not match the current speed of payment networks like Visa.

Selgin ended his affirmative argument talking about 'basket-case' currencies like the Venezuelan Bolivar or the Zimbabwe Dollar. Selgin admits that Bitcoin meets the requirements to replace those currencies, but he points out that there are many established currencies like the U.S. Dollar or the Euro that are more attractive for those citizens to use as a medium of exchange.

Ammous’ Negative Argument

Ammous began his argument with the following:

The key thing to keep in mind is that Bitcoin already working, it has been functioning and operating for ten years and it is already one of top 20 valued currencies in the world. Bitcoin is the only working alternative to central banks.

The rest of Saif's argument focused on a few key points:

Evolution. Bitcoin is still evolving. Since its launch in 2008, it has grown to almost $200 billion in value making it one of the top 20 currencies in the world. It is unrealistic to think that Bitcoin was born ready to serve every possible need and able to totally displace existing fiat currencies. It takes time in the decentralized world of Bitcoin to evolve the governance and control mechanisms that central banks can enforce today.

Bitcoin Is Hard Money. Ammous points out that the core value equation of Bitcoin is that it is hard money and hard money always beats out soft money because soft money is so easy to overproduce.

Volatility. Saef comments that Bitcoin is volatile, but that is primarily due to the amount of liquidity in the Bitcoin market. While Bitcoin has grown in 10 years to be worth $200 billion, which only represents 0.2% to 0.3% of the global money supply. Large transactions, like the billion-dollar transaction from early September, will inevitably introduce price volatility. Ammous points out that if the total value of Bitcoin continues to grow, the impact of a single large transaction on price volatility will decrease.

Transaction Costs. Bitcoin transaction costs are not like the costs of credit card, PayPal, or Venmo transactions. Those transactions are essentially ledger entries in the books of Visa, PayPal, or Venmo, the actual bank settlements take significantly longer. There is no such thing as an instantaneous Bitcoin transaction. For any on-chain transaction Saef notes you should wait for at least two and preferably six confirmations which take about an hour. It is not a problem that Bitcoin cannot do instantaneous confirmations because the problem of commercial payments has already been solved by things like the Visa network, PayPal, and Venmo. There are already Bitcoin backed credit cards, like the Ternio Block Card and Bitpay Bitcoin debit card.

Escape Government Capture. A key aspect of Bitcoin is that it escapes government control and it would be difficult for a central government to capture or confiscate the when President Franklin D. Roosevelt under executive order 6102 in 1933 that forbade the hoarding of gold coin, gold bullion, and gold certificates within the continental United States.

Results

The winner of an Oxford-style debate is determined by a vote taken at the end of the debate. The winner is determined by whichever side sways more people to their side. In this debate, Ammous was declared the winner:

It is important to remember that Oxford-style debates focus on the narrow interpretation of the resolution. In this debate, the resolution was "Bitcoin is Poorly Suited to the Purpose of Becoming Any Nation's Main Medium of Exchange" — not that Bitcoin will become any nation's main medium of exchange. Selgin's arguments were more focused on Bitcoin not being likely to become a nation's medium of exchange, while Ammous was focused on suitability

Viewpoint from Wasim Ahmad, Chief Crypto Officer of Vault12 who attended the debate and chatted with George Selgin and Saifedean Ammous.

When we look at money and the systems around it, the world has gone from simple bartering to exchanging shells for goods and services, to Gold-backed currency, in 1792 the US Dollar became the official currency of the US. And in 1971 the switch was made to fiat money, in the last 10 years we have seen digital money, cryptocurrency added to the mix.

Throughout these changes, there have been security safeguards to protect the money; everything from burying treasure, hiding cash in the mattress, to bank safety deposit accounts, other forms of protection such as the FDIC, and regulatory bodies looking out for the interests of retail investors.

Looking to all of the products services, jobs, opportunities, profits, regulations that have flourished across all sectors as the very nature of money has evolved over the generations — all because there were suitable ways for protecting money itself.

With cryptocurrency and the blockchain creating efficiencies, and transparencies for financial institutions, for consumers and for investors, there needs to be an evolution in security for cryptocurrency also — in the last few years over $3B has been lost or stolen.

That's what Vault12 is focused on — protecting your most precious digital assets in a new, simple and natural way, so that you never have to worry about the security of money or of any of your digital crypto assets.

For more information on #protectingthefutureofmoney and personal crypto security, visit vault12.com.

Can Bitcoin Replace Government-Issued Money? A Debate

"Bitcoin is poorly suited to the purpose of becoming any nation's main medium of exchange."That was the topic of a public debate hosted by the Soho Forum in ...WRITTEN BY

John Mecke

FollowJohn has over 20 years of experience in leading product management and corporate development organizations for enterprise firms.

Can Bitcoin Replace Government-Issued Money?

An Oxford-style debate at the SOHO Forum

Vault12

Vault12 is the pioneer in crypto inheritance and backup. The company was founded in 2015 to provide a way to enable everyday crypto customers to add a legacy contact to their cry[to wallets. The Vault12 Guard solution is blockchain-independent, runs on any mobile device with biometric security, and is available in Apple and Google app stores.

You will lose your Bitcoin and other crypto when you die...

...unless you set up Crypto Inheritance today.

It's simple — if you don't worry about crypto inheritance, nobody else will — not your software or hardware wallet vendors, not your exchanges, and not your wealth managers. So it's up to you to think about how to protect the generational wealth you have created, and reduce the risks around passing that crypto wealth on to your family and heirs. What are the challenges with crypto inheritance?

- Crypto Wallets are difficult to use and do not offer crypto inheritance management. In fact, most of them tell you to write down your seed phrase on a piece of paper, which is practically useless.

- Some people back up their wallet seed phrases or private keys on paper, local devices like hardware wallets or USBs, or in the cloud. All of these options have severe drawbacks that range from hacking to accidental loss to disrupted cloud services.

- Software wallets operate on specific blockchains, yet your crypto assets span multiple blockchains. For inheritance to work, you must be able to manage inheritance across every blockchain — now and forever.

DISCLAIMER: Vault12 is NOT a financial institution, cryptocurrency exchange, wallet provider, or custodian. We do NOT hold, transfer, manage, or have access to any user funds, tokens, cryptocurrencies, or digital assets. Vault12 is exclusively a non-custodial information security and backup tool that helps users securely store their own wallet seed phrases and private keys. We provide no financial services, asset management, transaction capabilities, or investment advice. Users maintain complete control of their assets at all times.

Pioneering Crypto Inheritance: Secure Quantum-safe Storage and Backup

Vault12 is the pioneer in Crypto Inheritance, offering a simple yet powerful way to designate a legacy contact and pass on your crypto assets—like Bitcoin (BTC), Ethereum (ETH) and Solana (SOL) —to future generations. Built for everyday users yet robust enough for the most seasoned crypto enthusiasts, Vault12 Guard ensures your wallet seed phrases and private keys are preserved in a fully self-sovereign manner, across all Blockchains.

At the heart of Vault12 Guard is quantum-resistant cryptography and a decentralized, peer-to-peer network of trusted Guardians. Your critical information is never stored in the cloud, on Vault12 servers, or even on local devices—dramatically reducing the risk of a single point of failure. By fusing a powerful software layer with the Secure Element of iOS devices (Secure Enclave) and Google devices (Strongbox), Vault12 Guard locks down your private keys against present and future threats.

Our innovative approach harnesses social recovery, enabling you to appoint one or more trusted individuals or mobile devices as Guardians. These Guardians collectively safeguard your protected seed phrases in a decentralized digital Vault—so there’s no need for constant lawyer updates or bulky paperwork. Should the unexpected happen, your chosen legacy contact can seamlessly inherit your crypto assets without compromising your privacy or security.

Preserve your digital wealth for generations to come with Vault12 Guard—the simplest, most secure way to manage crypto inheritance and backup.

Take the first step and back up your crypto wallets.

Designed to be used alongside traditional hardware and software crypto wallets, Vault12 Guard helps cryptocurrency owners back up their wallet seed phrases and private keys (assets) without storing anything in the cloud, or in any single location. This increases protection and decreases the risk of loss.

The first step in crypto Inheritance Management is making sure you have an up-to-date backup.

The Vault12 Guard app enables secure decentralized backups, and provides inheritance for all your seed phrases and private keys across any blockchain, including Bitcoin, Ethereum, and others, and for any crypto wallet.

Note: For anyone unfamiliar with cryptocurrencies, Vault12 refers to wallet seed phrases and private keys as assets, crypto assets, and digital assets. The Vault12 Guard app includes a software wallet that works alongside your Digital Vault. The primary purpose of this is to guard your Bitcoin (BTC) and Ethereum (ETH) wallet seed phrases, private keys, and other essential data, now and for future generations.