Contents

The Rapidly Increasing Value of Digital Assets Demands Better Security.

Digital Asset protection sorely needs an upgrade.

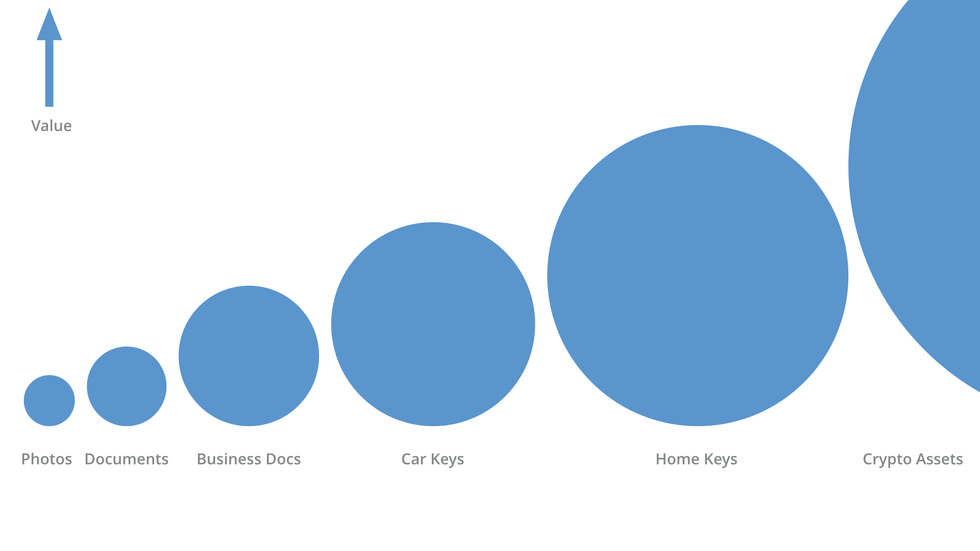

There was a time when the most important things people stored in the cloud were photographs and resumes. Now digital assets include bank account credentials, cryptocurrency, car keys, and house keys. The value of these assets has dramatically increased, so their protection needs to be dramatically upgraded too, commensurate with what is being protected.

In a general sense, a digital asset is a digitally stored, intangible object that is owned (by someone or something) and could have value.

However, one could argue that it is no longer quite right to describe a digital asset in this way, and that changes in the world over the past few decades warrant an updated definition. Ten years ago, a digital asset was something very different: what once represented images and documents now potentially represents entire financial systems, information oceans, and access to the control of anything and everything.

In other words, cryptocurrency and digitization have altered the notion of a digital asset — from what once represented simple information on a machine into something that represents real-world identities, big data, and financial objects.

The increasing value of digital assets.

As a thought experiment, consider the evolution of cloud sharing. Early iterations of cloud sharing were always intended for people to store items of relatively personal value: photos, documents, videos, animations, audio, or other multimedia content. It wasn't until mass cloud sharing was possible in the way late implementations like Dropbox established that the storage of digital assets on the cloud began erupting in popularity.

Security Cost and Risk

Protecting assets requires a trade off between the value of the asset, the cost of security, the overall reduction in risk, and of course convenience. People choose to put photos in cloud storage systems versus bank vaults. However, as the value of assets has increased, appropriate security has not kept pace.

Car keys on a phone are already in deployment for many cars. The cryptographic keys giving smartphones access to cars, homes and other precious assets are of immense value. Yet the mechanisms to secure them have not greatly changed.

Cryptocurrency and Blockchain

Since the invention of cryptocurrency, a broader vector of digital assets has taken the spotlight: the subclass of digital financial instruments that can be used as a store of value or a means of exchange. So far, these assets often have been stored in what can only be described as risky mediums, e.g., online accounts and USB devices. The private keys behind these assets are essentially left to individuals to protect in a scheme of their own choice.

"The Winklevosses came up with an elaborate system to store and secure their private keys. They cut up printouts of their private keys into pieces and then distributed them in envelopes to safe deposit boxes around the country, so if one envelope were stolen the thief would not have the entire key."

"How the Winklevoss Twins Found Vindication in a Bitcoin Fortune" by Nathaniel Popper, New York Times, December 19, 2017

Meanwhile, billions of dollars of blockchain-based cryptocurrency have been lost to hacks or other unfortunate occurrences.

Some crypto is simply lost.

20% of all Bitcoin is lost forever. That's many billions of dollars of value, and in fact, in 2018 alone, over $1.1B was stolen.

What is the next phase in digital asset protection?

The security of digital assets is a huge concern. In accordance with this abrupt spike in the valuation of digital assets, the security measures used to secure these assets need to be improved. Right now, there are just a few options for securing cryptocurrency and other digital assets, and all of them possess some single point of failure for the user.

Therefore, how custody of these emerging classes of digital assets is handled must be considered. Threats to the security of cryptocurrency storage need to be analyzed, and the correct frameworks for digital custody need to be designed accordingly. Digital custody needs to be vigorously explored, improved, and researched to robustly respond to this rapid demand for stronger security.

In future articles, we will look at digital custody and how individuals are using Vault12 to deal with the risks and challenges of protecting their cryptocurrency and other digital assets.

Thanks to Blake Commagere.

The Rapidly Increasing Value of Digital Assets Demands Better Security.

Digital Asset protection sorely needs an upgrade.

Vault12

Vault12 is the pioneer in crypto inheritance and backup. The company was founded in 2015 to provide a way to enable everyday crypto customers to add a legacy contact to their cry[to wallets. The Vault12 Guard solution is blockchain-independent, runs on any mobile device with biometric security, and is available in Apple and Google app stores.

Vault12 is NOT a financial institution, cryptocurrency exchange, or custodian. We do NOT hold, transfer, manage, or have access to any user funds, tokens, cryptocurrencies, or digital assets. Vault12 is exclusively a non-custodial information security and backup tool that helps users securely store their own wallet seed phrases and private keys for the purpose of inheritance. We provide no legal or financial services, asset management, transaction capabilities, or investment advice. Users maintain complete control of their assets at all times.

You will lose your Bitcoin and other crypto when you die...

...unless you set up Crypto Inheritance today.

It's simple — if you don't worry about crypto inheritance, nobody else will — not your software or hardware wallet vendors, not your exchanges, and not your wealth managers. So it's up to you to think about how to protect the generational wealth you have created, and reduce the risks around passing that crypto wealth on to your family and heirs. What are the challenges with crypto inheritance?

- Crypto Wallets are difficult to use and do not offer crypto inheritance management. In fact, most of them tell you to write down your seed phrase on a piece of paper, which is practically useless.

- Some people back up their wallet seed phrases or private keys on paper, local devices like hardware wallets or USBs, or in the cloud. All of these options have severe drawbacks that range from hacking to accidental loss to disrupted cloud services.

- Software wallets operate on specific blockchains, yet your crypto assets span multiple blockchains. For inheritance to work, you must be able to manage inheritance across every blockchain — now and forever.

Pioneering Crypto Inheritance: Secure Quantum-safe Storage and Backup

Vault12 is the pioneer in Crypto Inheritance, offering a simple yet powerful way to designate a legacy contact and pass on your crypto assets—like Bitcoin (BTC), Ethereum (ETH) and Solana (SOL) —to future generations. Built for everyday users yet robust enough for the most seasoned crypto enthusiasts, Vault12 Guard ensures your wallet seed phrases and private keys are preserved in a fully self-sovereign manner, across all Blockchains.

At the heart of Vault12 Guard is quantum-resistant cryptography and a decentralized, peer-to-peer network of trusted Guardians. Your critical information is never stored in the cloud, on Vault12 servers, or even on local devices—dramatically reducing the risk of a single point of failure. By fusing a powerful software layer with the Secure Element of iOS devices (Secure Enclave) and Google devices (Strongbox), Vault12 Guard locks down your private keys against present and future threats.

Our innovative approach harnesses social recovery, enabling you to appoint one or more trusted individuals or mobile devices as Guardians. These Guardians collectively safeguard your protected seed phrases in a decentralized digital Vault—so there’s no need for constant lawyer updates or bulky paperwork. Should the unexpected happen, your chosen legacy contact can seamlessly inherit your crypto assets without compromising your privacy or security.

Preserve your digital wealth for generations to come with Vault12 Guard—the simplest, most secure way to manage crypto inheritance and backup.

Take the first step and back up your crypto wallets.

Designed to be used alongside traditional hardware and software crypto wallets, Vault12 Guard helps cryptocurrency owners back up their wallet seed phrases and private keys (assets) without storing anything in the cloud, or in any single location. This increases protection and decreases the risk of loss.

The first step in crypto Inheritance Management is making sure you have an up-to-date backup.

The Vault12 Guard app enables secure decentralized backups, and provides inheritance for all your seed phrases and private keys across any blockchain, including Bitcoin, Ethereum, and others, and for any crypto wallet.

Note: For anyone unfamiliar with cryptocurrencies, Vault12 refers to wallet seed phrases and private keys as assets, crypto assets, and digital assets. The Vault12 Guard app includes a software wallet that works alongside your Digital Vault. The primary purpose of this is to guard your Bitcoin (BTC) and Ethereum (ETH) wallet seed phrases, private keys, and other essential data, now and for future generations.