Contents

- Vaults are a historic solution

- We all need vaults in today's digital world

- Safe deposit boxes for digital wallet private keys?

- Safe deposit boxes are no longer the best solution

- Safe deposit boxes are disappearing

- Safe deposit boxes are subject to theft

- Safe deposit boxes are subject to natural disasters

- Safe deposit boxes can be legally seized

- Safe deposit boxes aren’t insured

- Safe deposit boxes aren’t always accessible

- A Digital Vault is safer and more convenient

- A Vault12 Digital Vault is secure and always-accessible

- View the Vault12 Guard demo and download a trial today

The death of safe deposit boxes

Where will you store your digital wallet seed phrases now?

Vaults are a historic solution

For thousands of years, wealthy tribes and individuals have stored their treasures in temples, palaces, and fortresses. From ancient Mesopotamia to Egypt to the Knights Templar to today’s public banks, vaults have long been used to safeguard valuable possessions.

In the last couple of centuries, increased availability has led more "regular people" to turn to safe deposit boxes held at banks or private vaults to store heirlooms, cash, and important documents. In this way, vaults — once limited to society's elites — became a popular and practical mechanism for protecting one's most important assets.

We all need vaults in today's digital world

Just in the last couple of decades, people have had to consider what the safest place is to store not just small physical assets, but also digital assets and passwords such as electronic documents and crypto wallet seed phrase backups.

Digital asset owners know how important it is to keep a backup copy of one’s wallet seed phrase. Losing your wallet seed phrase results in losing access to your digital wallet — and thus, losing access to all of the digital assets you hold! The stakes are very high, and there are not many simple and robust solutions to choose from.

Safe deposit boxes for digital wallet private keys?

It has seemed natural for many people to turn to safe deposit boxes to store paper, electronic, or engraved-metal copies of their digital asset wallet seed phrases. In fact, the iconic and well-educated Winklevoss twins Cameron and Tyler used safe deposit boxes as part of their early strategy to distribute and protect pieces of their Bitcoin wallet keys.

"The Winklevosses came up with an elaborate system to store and secure their private keys. They cut up printouts of their private keys into pieces and then distributed them in envelopes to safe deposit boxes around the country, so if one envelope were stolen the thief would not have the entire key.""How the Winklevoss Twins Found Vindication in a Bitcoin Fortune" by Nathaniel Popper, New York Times, December 19, 2017

Safe deposit boxes are no longer the best solution

But given the state of the world today, is it a good idea to rely on a safe deposit box to store your digital wallet seed phrase backup? Unfortunately, the answer is a resounding “No.” Let’s consider why not.

Safe deposit boxes are disappearing

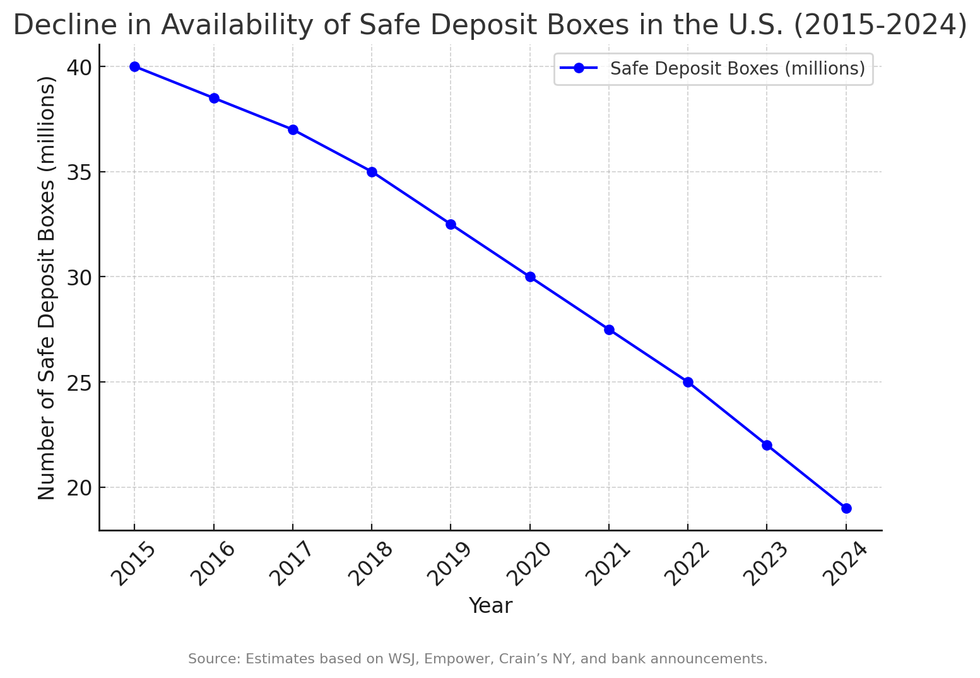

Many banks have phased out the availability of safe deposit boxes. In the United Kingdom, HSBC and Barclays have completely stopped offering safe deposit boxes. In the United States, JPMorgan Chase, Santander, and Capital One have stopped offering new safe deposit boxes, while Bank of America and Citibank have also reduced their availability. Among the reasons for this trend: declining demand, high maintenance costs, and regulatory challenges. The chart below reflects these startling changes.

Fewer and fewer safe deposit boxes are available

ChatGPT

Safe deposit boxes are subject to theft

In 2015, a Citibank safe deposit box in Sherman Oaks, California was mysteriously emptied of over half a million dollars worth of valuables — and surveillance cameras only covered the vault entrance, not individual boxes. In 2017, a Brooklyn Santander bank branch was broken into from an adjacent basement, and crooks made off with the contents of about 50 boxes. And from 2020 to 2023, safe deposit box customers at MUFG Bank in Tokyo had valuables stolen by a bank employee! (In this case, the customers were repaid by the bank.)

Safe deposit boxes are subject to natural disasters

Natural disasters do not spare safe deposit boxes. Hurricanes in the United States (Katrina in 2005 and Harvey in 2017) led to many lost and damaged safe deposit box valuables. Earthquakes have resulted in safe deposit box losses in Japan and New Zealand. Fires destroyed the contents of safe deposit boxes in Australia (2019/2020) and California (during several years including 2025), after the boxes essentially became high-temperature ovens. In cases of extreme physical disaster, sometimes the only possible safety is being in a different location.

Safe deposit boxes can be legally seized

If a safe deposit box custodian is presented with a legal claim to freeze or seize the contents of a safe deposit box (for example, if there is a suspicion of illegal activity), law enforcement will assume custody of the contents as permitted by the relevant jurisdiction. Sometimes, depending on a warrant’s scope, many boxes can be opened even without specific individual warrants.

Safe deposit boxes aren’t insured

Many people assume that safe deposit boxes are insured by default — but they’re not! In the United States, neither the FDIC nor the National Credit Union Administration insures them.Some private insurers will cover them with special policies, but you have to specifically seek them out and pay extra for them — and carefully analyze the fine print about valuation, exclusions, and policy limits.

Safe deposit boxes aren’t always accessible

Banks aren’t always open for business. Beyond expected “business hour” limitations, banks can be unexpectedly closed for various reasons, including pandemic responses. If a bank that holds safe deposit boxes finds itself in a legal dispute or financial failure, although the contents of the safe deposit boxes are not considered bank assets, access to the boxes may be temporarily blocked while administrative proceedings unfold.

Additionally, if a safe deposit box owner passes away, special access rules (varying by region) come into play, and a spouse or the executor of a will may not be permitted to access a safe deposit box — even if they have the key and PIN.

A Digital Vault is safer and more convenient

A better solution is to use a secure Digital Vault like Vault12 Guard. The Vault12 Digital Vault fulfills and exceeds all of the secure digital storage requirements that a physical vault offers … without the limitations or third-party risks. Vault12 Guard takes the form of a simple-to-use mobile app that can protect all of your digital assets in a highly-secure, decentralized manner, monitored by Guardians of your choice.

A Vault12 Digital Vault is secure and always-accessible

The Vault12 Digital Vault is more secure than a safe deposit box, safe from natural disasters due to its decentralized design, always accessible, and its Digital Inheritance feature is simple for your next of kin to use when the time comes.

View the Vault12 Guard demo and download a trial today

Check out an overview with demo to see how the Vault12 Digital Vault works. Learn more on the Vault12 website. When you’re ready, you can get started with your Digital Vault in just a few minutes.

The death of safe deposit boxes

Where will you store your digital wallet seed phrases now?

Vault12

Vault12 is the pioneer in crypto inheritance and backup. The company was founded in 2015 to provide a way to enable everyday crypto customers to add a legacy contact to their cry[to wallets. The Vault12 Guard solution is blockchain-independent, runs on any mobile device with biometric security, and is available in Apple and Google app stores.

Vault12 is NOT a financial institution, cryptocurrency exchange, or custodian. We do NOT hold, transfer, manage, or have access to any user funds, tokens, cryptocurrencies, or digital assets. Vault12 is exclusively a non-custodial information security and backup tool that helps users securely store their own wallet seed phrases and private keys for the purpose of inheritance. We provide no legal or financial services, asset management, transaction capabilities, or investment advice. Users maintain complete control of their assets at all times.

You will lose your Bitcoin and other crypto when you die...

...unless you set up Crypto Inheritance today.

It's simple — if you don't worry about crypto inheritance, nobody else will — not your software or hardware wallet vendors, not your exchanges, and not your wealth managers. So it's up to you to think about how to protect the generational wealth you have created, and reduce the risks around passing that crypto wealth on to your family and heirs. What are the challenges with crypto inheritance?

- Crypto Wallets are difficult to use and do not offer crypto inheritance management. In fact, most of them tell you to write down your seed phrase on a piece of paper, which is practically useless.

- Some people back up their wallet seed phrases or private keys on paper, local devices like hardware wallets or USBs, or in the cloud. All of these options have severe drawbacks that range from hacking to accidental loss to disrupted cloud services.

- Software wallets operate on specific blockchains, yet your crypto assets span multiple blockchains. For inheritance to work, you must be able to manage inheritance across every blockchain — now and forever.

Pioneering Crypto Inheritance: Secure Quantum-safe Storage and Backup

Vault12 is the pioneer in Crypto Inheritance, offering a simple yet powerful way to designate a legacy contact and pass on your crypto assets—like Bitcoin (BTC), Ethereum (ETH) and Solana (SOL) —to future generations. Built for everyday users yet robust enough for the most seasoned crypto enthusiasts, Vault12 Guard ensures your wallet seed phrases and private keys are preserved in a fully self-sovereign manner, across all Blockchains.

At the heart of Vault12 Guard is quantum-resistant cryptography and a decentralized, peer-to-peer network of trusted Guardians. Your critical information is never stored in the cloud, on Vault12 servers, or even on local devices—dramatically reducing the risk of a single point of failure. By fusing a powerful software layer with the Secure Element of iOS devices (Secure Enclave) and Google devices (Strongbox), Vault12 Guard locks down your private keys against present and future threats.

Our innovative approach harnesses social recovery, enabling you to appoint one or more trusted individuals or mobile devices as Guardians. These Guardians collectively safeguard your protected seed phrases in a decentralized digital Vault—so there’s no need for constant lawyer updates or bulky paperwork. Should the unexpected happen, your chosen legacy contact can seamlessly inherit your crypto assets without compromising your privacy or security.

Preserve your digital wealth for generations to come with Vault12 Guard—the simplest, most secure way to manage crypto inheritance and backup.

Take the first step and back up your crypto wallets.

Designed to be used alongside traditional hardware and software crypto wallets, Vault12 Guard helps cryptocurrency owners back up their wallet seed phrases and private keys (assets) without storing anything in the cloud, or in any single location. This increases protection and decreases the risk of loss.

The first step in crypto Inheritance Management is making sure you have an up-to-date backup.

The Vault12 Guard app enables secure decentralized backups, and provides inheritance for all your seed phrases and private keys across any blockchain, including Bitcoin, Ethereum, and others, and for any crypto wallet.

Note: For anyone unfamiliar with cryptocurrencies, Vault12 refers to wallet seed phrases and private keys as assets, crypto assets, and digital assets. The Vault12 Guard app includes a software wallet that works alongside your Digital Vault. The primary purpose of this is to guard your Bitcoin (BTC) and Ethereum (ETH) wallet seed phrases, private keys, and other essential data, now and for future generations.