Contents

- What are the most common use cases for stablecoins?

- Stablecoins and investment risk

- How did stablecoins evolve?

- Modern stablecoins

- Stablecoin successes

- What financial institutions issue or transact in stablecoins?

- How is the United States handling stablecoins?

- How can you protect the stablecoins in your digital wallet?

- Vault12 Guard can protect all of the digital assets that you hold

Stablecoins' momentum builds in bridging traditional and digital assets

Include stablecoins in your digital recovery and inheritance plans

There is a lot of buzz about stablecoins. So what are they, should you have some, and how should you protect them if you do have some?

First, let's review what they are: stablecoins are blockchain-based tokens that are designed to act as stable forms of value. Their prices are synchronized to predictable external assets, such as stable currencies. But unlike currency, which can be slow to deploy or move (whether physically or via a bank electronic transaction), stablecoins instantly can be transferred or exchanged for a huge array of digital assets.

Given their stable value, stablecoins have a unique place in the crypto world: unlike more-volatile cryptocurrencies, they act as low-risk intermediaries between digital assets and other traditional forms of value.

And even though their role is intermediary, they could be held for short periods of time, or long ones. Let’s consider why so many people and institutions buy stablecoins — and sometimes hold them for long periods of time.

What are the most common use cases for stablecoins?

There are many ways that people and institutions use stablecoins:

As a mechanism for exchange between other forms of value: Some people buy stablecoins for just a short period of time to support making another transactions: for example, it may be necessary to buy stablecoins when moving fiat currency to or from a centralized exchange, or converting between two different types of cryptocurrencies if there is no direct exchange possible between them. A huge market that uses stablecoins as a medium of exchange is International remittences.

As a store of wealth: Stablecoins offer a more stable form of wealth preservation than holding cash in a country with high inflation or an otherwise-volatile currency (e.g., Argentina and Turkey).

As liquidity: Stablecoins provide ready-to-deploy financial liquidity that can be used to quickly participate in DeFi opportunities or trade for other cryptocurrencies when time is of the essence (without needing to slog through slow fiat on-ramps).

As loan collateral to avoid a taxable crypto sale: By borrowing stablecoins against their crypto assets on DeFi, holders can utilize their capital or spend some proceeds without selling crypto assets — thereby avoiding the tax consequences of a sale.

As an investment that bears yields: Stablecoins can be used to earn yield (this typically requires allowing an exchange or DeFi platform to “lock” them).

As a low-risk hedge relative to other investments: Stablecoins can be used to reduce risk as part of a balanced digital portfolio.

Stablecoins and investment risk

If you are considering investing in stablecoins, remember that:

- If you let a centralized exchange hold the keys to your coins, you are subject to third-party risks related to trusting the company, their security, and their financial health. (Remember, "Not your keys, not your coins.") Understand how to manage your keys.

- If you hold your own keys and invest via DeFi, you are subject to the risks of associated smart contracts having bugs, vulnerabilities, or otherwise behaving in unexpected ways.

Nothing is risk-free in life, especially in investing. Choose the levels and forms of risks that you are comfortable with as appropriate for your situation.

How did stablecoins evolve?

When cryptocurrencies like Bitcoin, Ethereum, and altcoins first joined the financial scene, their extreme volatility made them high-risk, speculative investments. Most coins have rollercoaster price periods! Stablecoins were introduced as a way to buffer that volatility.

But a few kinks had to be worked out first: some early attempts to build stablecoins failed because their price was not as stable as the issuers had planned. Specifically, algorithmic stablecoins, which were meant to hold a stable value based on mathematical algorithms, smart contracts, and modeled market behaviors, did not always perform as expected.

For example, the algorithmic stablecoin TerraUSD spectacularly failed in May 2022 due to faulty assumptions in the design of the algorithm about market behavior in response to unexpected events. As a result of several failed algorithmic stablecoins, these days, algorithmic stablecoins have lost much of their initial popularity.

Modern stablecoins

Most stablecoins today are backed by real-world assets (collateral), such as currency, government treasury bonds, cryptocurrencies (sufficiently over-collateralized to buffer against volatility), or baskets of commodities. Confidence is improved when tangible assets back up digital coins, not just trust in the behavior of a "pegging" algorithm.

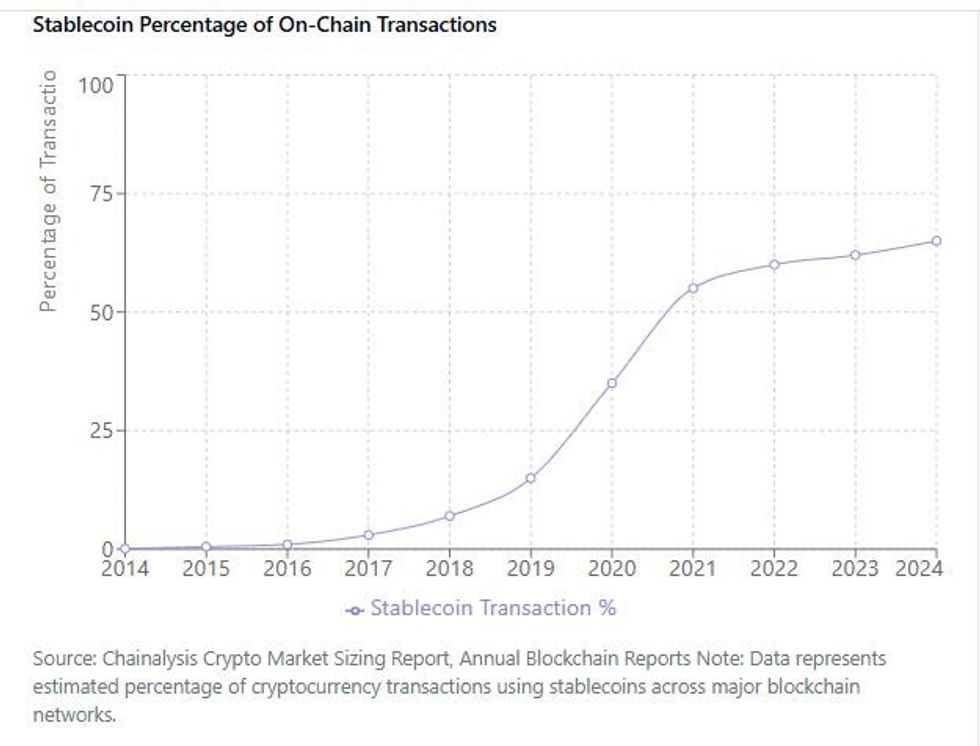

Transparency, maturity, and regulatory acceptance all lead to increased use of stablecoins. Today's largest stablecoins have made leaps and bounds towards achieving each of those ends. Reflecting this evolution, stablecoins have been making up an increasing share of on-chain transactions — more than half of all crypto transactions — as the following chart demonstrates.

Chainalysis via Claude.ai

Stablecoin successes

Several collateralized U.S. Dollar stablecoins from private corporate issuers have matured and gained popular acceptance. Among them, descending by market capitalization:

- USDT ("Tether"), from Tether

- USDC ("USDC Coin"), from Circle (until 2023, issued by the Centre Consortium, founded by both Circle and Coinbase)

- PYUSD ("PayPalUSD"), from Paxos Trust Company

- RLUSD ("Ripple USD"), from Ripple

According to the "State of Stablecoins in 2025" report by Dune and Artemis, Tether shows stablecoin leadership in volume and market penetration with a $146 billion market cap, while USDC Coin, with a $56-60 billion market cap, excels in institutional adoption and DeFi usage, driven by its regulatory compliance and on-chain activity.

If you'd like a deep dive into the differences between USDT and USDC, we recommend Coin Bureau's insightful comparison.

What financial institutions issue or transact in stablecoins?

Crypto exchanges and stablecoin issuers necessarily hold large quantities of stablecoins, but did you know that many other major financial institutions are moving into the use of stablecoins as well? Institutions like Visa, Bank of America, and Revolut are using or piloting projects to issue and accept selected stablecoins as part of their service packages and partnerships. Even Fidelity Investments is testing their own stablecoin.

How is the United States handling stablecoins?

The United States is undergoing a sea change in its stablecoin appetite, having issued new guidance in March 2025 permitting banks to engage in both crypto custody and certain stablecoin activities. And the Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025 (“GENIUS Act”), which describes a broader range of stablecoin guidance, is quickly approaching finalization as law. Further, the U.S. Treasury Secretary Scott Bessent has even announced plans to leverage stablecoins backed by U.S. Treasury bills to bolster the dollar's position as the world's dominant reserve currency.

Regulatory clarity for stablecoins is happening fast, which reduces risks for all users.

How can you protect the stablecoins in your digital wallet?

If you hold stablecoins in a digital wallet, you should include them in a secure wallet backup and an inheritance plan just as you would for your other digital assets. Don’t put off thinking about the possibility of wallet access disruptions, or about your digital inheritance.

- Back up your wallet seed phrase so that you can restore your wallet if you ever lose access to it. A decentralized Digital Vault is the most effective place to safeguard your digital assets.

- Think about who your digital asset beneficiary or beneficiaries should be, and plan your digital inheritance.

- You could also choose to keep your Centralized Exchange passwords in your Vault12 Digital Vault, as well as any other related passwords. A Digital Vault is more secure than a standard password manager.

"Failing to plan is planning to fail."— Benjamin Franklin

Vault12 Guard can protect all of the digital assets that you hold

The Vault12 Guard Digital Vault can protect the stablecoins and all other digital assets in your wallets. See how easy it can be for you to protect your digital wealth in a decentralized way using your personal choice of Vault Guardians. Simply and conveniently protect all of your digital assets today in your own Digital Vault. When you’re ready, take it a step further to secure the future of your digital wealth with Vault12 Digital Inheritance.

Stablecoins' momentum builds in bridging traditional and digital assets

Include stablecoins in your digital recovery and inheritance plans

Vault12

Vault12 is the pioneer in crypto inheritance and backup. The company was founded in 2015 to provide a way to enable everyday crypto customers to add a legacy contact to their cry[to wallets. The Vault12 Guard solution is blockchain-independent, runs on any mobile device with biometric security, and is available in Apple and Google app stores.

You will lose your Bitcoin and other crypto when you die...

...unless you set up Crypto Inheritance today.

It's simple — if you don't worry about crypto inheritance, nobody else will — not your software or hardware wallet vendors, not your exchanges, and not your wealth managers. So it's up to you to think about how to protect the generational wealth you have created, and reduce the risks around passing that crypto wealth on to your family and heirs. What are the challenges with crypto inheritance?

- Crypto Wallets are difficult to use and do not offer crypto inheritance management. In fact, most of them tell you to write down your seed phrase on a piece of paper, which is practically useless.

- Some people back up their wallet seed phrases or private keys on paper, local devices like hardware wallets or USBs, or in the cloud. All of these options have severe drawbacks that range from hacking to accidental loss to disrupted cloud services.

- Software wallets operate on specific blockchains, yet your crypto assets span multiple blockchains. For inheritance to work, you must be able to manage inheritance across every blockchain — now and forever.

DISCLAIMER: Vault12 is NOT a financial institution, cryptocurrency exchange, wallet provider, or custodian. We do NOT hold, transfer, manage, or have access to any user funds, tokens, cryptocurrencies, or digital assets. Vault12 is exclusively a non-custodial information security and backup tool that helps users securely store their own wallet seed phrases and private keys. We provide no financial services, asset management, transaction capabilities, or investment advice. Users maintain complete control of their assets at all times.

Pioneering Crypto Inheritance: Secure Quantum-safe Storage and Backup

Vault12 is the pioneer in Crypto Inheritance, offering a simple yet powerful way to designate a legacy contact and pass on your crypto assets—like Bitcoin (BTC), Ethereum (ETH) and Solana (SOL) —to future generations. Built for everyday users yet robust enough for the most seasoned crypto enthusiasts, Vault12 Guard ensures your wallet seed phrases and private keys are preserved in a fully self-sovereign manner, across all Blockchains.

At the heart of Vault12 Guard is quantum-resistant cryptography and a decentralized, peer-to-peer network of trusted Guardians. Your critical information is never stored in the cloud, on Vault12 servers, or even on local devices—dramatically reducing the risk of a single point of failure. By fusing a powerful software layer with the Secure Element of iOS devices (Secure Enclave) and Google devices (Strongbox), Vault12 Guard locks down your private keys against present and future threats.

Our innovative approach harnesses social recovery, enabling you to appoint one or more trusted individuals or mobile devices as Guardians. These Guardians collectively safeguard your protected seed phrases in a decentralized digital Vault—so there’s no need for constant lawyer updates or bulky paperwork. Should the unexpected happen, your chosen legacy contact can seamlessly inherit your crypto assets without compromising your privacy or security.

Preserve your digital wealth for generations to come with Vault12 Guard—the simplest, most secure way to manage crypto inheritance and backup.

Take the first step and back up your crypto wallets.

Designed to be used alongside traditional hardware and software crypto wallets, Vault12 Guard helps cryptocurrency owners back up their wallet seed phrases and private keys (assets) without storing anything in the cloud, or in any single location. This increases protection and decreases the risk of loss.

The first step in crypto Inheritance Management is making sure you have an up-to-date backup.

The Vault12 Guard app enables secure decentralized backups, and provides inheritance for all your seed phrases and private keys across any blockchain, including Bitcoin, Ethereum, and others, and for any crypto wallet.

Note: For anyone unfamiliar with cryptocurrencies, Vault12 refers to wallet seed phrases and private keys as assets, crypto assets, and digital assets. The Vault12 Guard app includes a software wallet that works alongside your Digital Vault. The primary purpose of this is to guard your Bitcoin (BTC) and Ethereum (ETH) wallet seed phrases, private keys, and other essential data, now and for future generations.