Contents

- What are Centralized and Decentralized Exchanges?

- How do I fund my account?

- How do I buy on an Exchange?

- How should I store my Crypto?

- How do I set up My Wallet?

- Should I add additional Security?

- Are there other ways to get crypto into my wallet?

- How can I buy Crypto without exchanges or a wallet?

- What other further reading is recommended?

- "Bitcoin Billionaires" by Ben Mezrich

- "The Bitcoin Standard" by Saifedean Ammous

- "The Internet of Money" by Andreas Antonopoulos

How to buy cryptocurrency.

You can begin to acquire cryptocurrency in several different ways. Which is right for you?

Each of the ways to buy and sell crypto has advantages, disadvantages, and unique security considerations. Your most-common places to buy and sell crypto are:

- a cryptocurrency exchange

- a self-directed retirement account

- an app like PayPal or Square's Cash App.

It is convenient to allow a custodial company to manage your crypto holdings for you, but there's an important saying in the crypto world: "If you don't own your keys, you don't own your crypto." When buying crypto through retirement account companies or crypto app platforms, the custodial company will likely hold your crypto private key (or multiple private keys) for you, and you will not be able to store your crypto assets outside of their platform. Although there are legitimate, well-reputed investment companies and apps that many people trust with their crypto assets, many other crypto investors insist on holding their own private keys. Exchanges also hold your private keys for you, but after you buy crypto through most exchanges, you have the option to move your crypto off of the exchange, and keep it in a non-custodial wallet that you control yourself.

TL;DR (concentrated takeaways)

"Know Your Customer" (KYC) regulations for financial institutions limit the anonymity of crypto purchases.

Despite the initial overhead of KYC processes to establish an account, once it is completed, crypto exchanges offer a convenient "onramp" to load fiat currency in order to buy crypto.

Decentralized exchanges (DEXs) are less-regulated crypto "swap" marketplaces.

Due to various third-party risks, never leave large amounts of cryptocurrency on an exchange. "If you don't own your keys, you don't own your crypto."

Savvy investors learn how to safely store purchased crypto in their own digital wallet.

What are Centralized and Decentralized Exchanges?

A crypto exchange is a crypto trading platform that may support buying and selling directly with fiat currencies.

To buy from a centralized exchange like Coinbase, Kraken, Gemini, or Binance, you will be required to provide extensive personal information to verify who you are. As the cryptocurrency market matures, these regulations (called "KYC," or Know Your Customer) are becoming more rigorous. To verify identity, you will be required to submit various forms of identification like your driver's license, passport, a bill or statement proving your address, and sometimes a photo of your face. You will also need to provide an email address and cell phone number. After your KYC information has been accepted, you are permitted to set up your preferred payment method from a wide array of choices.

Decentralized Exchanges (DEXs) are not a good place to start buying cryptocurrencies, since they don't accept fiat money (Dollars, Euros, etc.). Some DEXs have third-party payment partners who offer to convert currency for a fee (from credit, debit cards), but you will likely not be able to set up a direct bank transfer. Since accepted payment methods are limited, it is common for people to transfer cryptocurrencies to the DEX instead of currencies, and then swap for different cryptocurrencies.

When establishing an account for crypto transactions, many experts recommend that you create a new, unique email account to use exclusively for crypto investing. Check out ProtonMail.com - an excellent, secure email provider. Some investors even buy a separate cell phone to use exclusively for crypto investing. You can then use this dedicated email and/or cell phone to verify your identity every time you want to trade or move your cryptocurrencies. Always use strong passwords, enable 2-factor authentication where available, and never share your passwords, seed phrases, or Private Keys with anyone! Anyone asking you to reveal these can use the information to steal your funds.

How do I fund my account?

When you buy from a Centralized Exchange, there will likely be a fee to transfer fiat money from your bank account to the exchange. Transaction fees can be lower on a Decentralized Exchange (DEX), reflecting lower costs of identification verification.

To fund your exchange account, you can send fiat money by ACH, wire transfer, or sometimes even by credit or debit card. ACH transfers usually have a low fee, but can take five to ten business days to reach the exchange. Wire transfer will be faster, but more expensive.

Andy Grove, the former CEO of Intel, wrote a book called "Only the Paranoid Survive." If you follow Andy's philosophy, you could open a separate bank account to use for sending funds to exchanges, to attain complete isolation of investment resources.

How do I buy on an Exchange?

Most exchanges are easy to use from a mobile app or desktop browser. Once your money is in your exchange account, buying cryptocurrency is a simple matter of logging in, choosing the cryptocurrency you want to buy, and then clicking on BUY. The order will be processed nearly immediately at the current market price: a "Market" order. Some exchanges allow you to place more advanced orders called "limit" orders. Similar to other investments like stocks, limit orders allow you to buy or sell crypto at a specific price, for more price predictability. The exchange will accept your order and wait till the price hits your specified number (your limit). If it fails to hit that price, the limit order will not be executed.

Exchanges cannot help you with losses if your account gets compromised, or if you make an error. Check everything carefully before you commit to any trade!

Now that you've purchased some crypto, what do you do with it?

How should I store my Crypto?

Never leave large amounts of cryptocurrency on an exchange. Some well-established exchanges have been hacked, gone down due to high volume they couldn't handle, or have even been shut down by governments or regulators. You don't want your crypto to be frozen for months or years, or worse, lost forever. You should get a crypto wallet to store any large sums of currencies offline. Check out our article on crypto wallets here.

How do I set up My Wallet?

Software-based cryptocurrency wallets generally require that you download software to your computer, and hardware wallets require that you buy a small hardware device, as well as install software on your computer or smartphone. When you are ready to establish a crypto wallet, read more details about how to configure it, and how to safely back up your seed phrase.

Should I add additional Security?

As part of the exchange and wallet setup, you will be asked to set up an additional layer of security called Two-Factor Authentication (sometimes abbreviated as "2FA"). Two common apps for this that are more secure than SMS messages are Authy and Google Authenticator. Be sure to read our related article: "11 Things You Need for a Safer Crypto Environment."

Are there other ways to get crypto into my wallet?

If you have already set up your crypto wallet, and if you sell good or services, you could publish a public wallet address so that clients could pay you with cryptocurrencies.

You could also use a crypto ATM machine where you deposit fiat currency and have it deposit crypto funds to your wallet address. A commonly-used reference site to find cryptocurrency ATMs is coinatmradar.com.

How can I buy Crypto without exchanges or a wallet?

If you don't feel confident handling the tech involved with buying on an exchange and operating a crypto wallet, and you don't mind someone else maintaining custody of your cryptocurrencies, you may want to consider buying cryptocurrencies through an app. PayPal allows you to put money into their app and use it to buy major cryptocurrencies: Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and EOS. PayPal holds the coins and will show you your balance in their current value of your country's fiat currency. Your balance will go up and down with the market price of the coins you purchased. There will also be fees associated with that custody and those trades.

Square's Cash App is similar, but it only uses bitcoin. To buy anything with your Cash App debit card, you would use it like a regular debit card, but behind the scenes, transparently, you sell bitcoin.

With Paypal or Cash App, you also have the ability to click a couple of buttons to convert your cryptocurrencies back into fiat money.

Remember that these companies, as well as the centralized exchanges, know who you are, and these transactions will be taxable events. (The IRS will be informed, so plan on paying your taxes!)

If you are in the United States, you can open a Roth IRA account with (or move an established Roth IRA account to) a financial firm that provides a self-directed Roth IRA that allows you to buy cryptocurrencies with your IRA funds. Roth IRAs only contains after-tax dollars, and any capital gains can be taken out tax-free. (Talk to your accountant for more information about how IRAs work.)

What other further reading is recommended?

Now that you understand what's involved, be sure to click on the other links in this article for more Vault12 explainers. You may also be interested in the following books:

"Bitcoin Billionaires" by Ben Mezrich

From Ben Mezrich, the New York Times bestselling author of "The Accidental Billionaires" and "Bringing Down the House," comes "Bitcoin Billionaires" – the fascinating story of brothers Tyler and Cameron Winklevoss's big bet on cryptocurrency, and its dazzling pay-off.

Ben Mezrich's 2009 bestseller "The Accidental Billionaires" is the definitive account of Facebook's founding and the basis for the Academy Award–winning film "The Social Network." Two of the story's iconic characters are Harvard students Tyler and Cameron Winklevoss: identical twins, Olympic rowers, and foils to Mark Zuckerberg. "Bitcoin Billionaires" is the story of the brothers' redemption and revenge in the wake of their epic legal battle with Facebook.

Planning to start careers as venture capitalists, the brothers quickly discover that no one will take their money after their fight with Zuckerberg. While nursing their wounds in Ibiza, they accidentally run into an eccentric character who tells them about a brand-new idea: cryptocurrency. Immersing themselves in what is then an obscure and sometimes sinister world, they begin to realize that "crypto" is, in their own words, "either the next big thing or total bulls–t." There's nothing left to do but make a bet.

From the Silk Road to the halls of the Securities and Exchange Commission, "Bitcoin Billionaires" takes us on a wild and surprising ride while illuminating a tantalizing economic future. On November 26, 2017, the Winklevoss brothers became the first bitcoin billionaires. Here's the story of how they got there—as only Ben Mezrich could tell it.

"The Bitcoin Standard" by Saifedean Ammous

When a pseudonymous programmer introduced a new electronic cash system that's fully peer-to-peer, with no trusted third party, to a small online mailing list in 2008, very few paid attention. Ten years later, and against all odds, this upstart autonomous decentralized software offers an unstoppable and globally-accessible hard money alternative to modern central banks. "The Bitcoin Standard" analyzes the historical context to the rise of Bitcoin, the economic properties that have allowed it to grow quickly, and its likely economic, political, and social implications.

While Bitcoin is a new invention of the digital age, the problem it purports to solve is as old as human society itself: transferring value across time and space. Ammous takes the reader on an engaging journey through the history of technologies performing the functions of money, from primitive systems of trading limestones and seashells, to metals, coins, the gold standard, and modern government debt. Exploring what gave these technologies their monetary role, and how most lost it, provides the reader with a good idea of what makes for sound money, and sets the stage for an economic discussion of its consequences for individual and societal future-orientation, capital accumulation, trade, peace, culture, and art. Compellingly, Ammous shows that it is no coincidence that the loftiest achievements of humanity have come in societies enjoying the benefits of sound monetary regimes, nor is it coincidental that monetary collapse has usually accompanied civilizational collapse.

With this background in place, the book moves on to explain the operation of Bitcoin in a functional and intuitive way. Bitcoin is a decentralized, distributed piece of software that converts electricity and processing power into indisputably accurate records, thus allowing its users to utilize the Internet to perform the traditional functions of money without having to rely on, or trust, any authorities or infrastructure in the physical world. Bitcoin is thus best understood as the first successfully implemented form of digital cash and digital hard money. With an automated and perfectly predictable monetary policy, and the ability to perform final settlement of large sums across the world in a matter of minutes, Bitcoin's real competitive edge might just be as a store of value and network for final settlement of large payment: a digital form of gold with a built-in settlement infrastructure.

Ammous' firm grasp of the technological possibilities as well as the historical realities of monetary evolution provides for a fascinating exploration of the ramifications of voluntary free-market money. As it challenges the most sacred of government monopolies, Bitcoin shifts the pendulum of sovereignty away from governments in favor of individuals, offering us the tantalizing possibility of a world where money is fully extricated from politics and unrestrained by borders.

The final chapter of the book explores some of the most common questions surrounding Bitcoin: Is Bitcoin mining a waste of energy? Is Bitcoin for criminals? Who controls Bitcoin, and can they change it if they please? How can Bitcoin be killed? And what to make of all the thousands of Bitcoin knock-offs, and the many supposed applications of Bitcoin's 'blockchain technology'? "The Bitcoin Standard" is the essential resource for a clear understanding of the rise of the Internet's decentralized, apolitical, free-market alternative to national central banks.

"The Internet of Money" by Andreas Antonopoulos

While many books explain the "how" of bitcoin, "The Internet of Money" delves into the "why" of bitcoin. Acclaimed information-security expert and author of "Mastering Bitcoin," Andreas M. Antonopoulos examines and contextualizes the significance of bitcoin through a series of essays spanning the exhilarating maturation of this technology.

This three-volume book series can be delivered in print, audiobook, or ebook, and is available in several languages.

Next Up From Vault 12

Discover more

How to buy cryptocurrency.

You can begin to acquire cryptocurrency in several different ways. Which is right for you?

Inheritance: Get ready today.

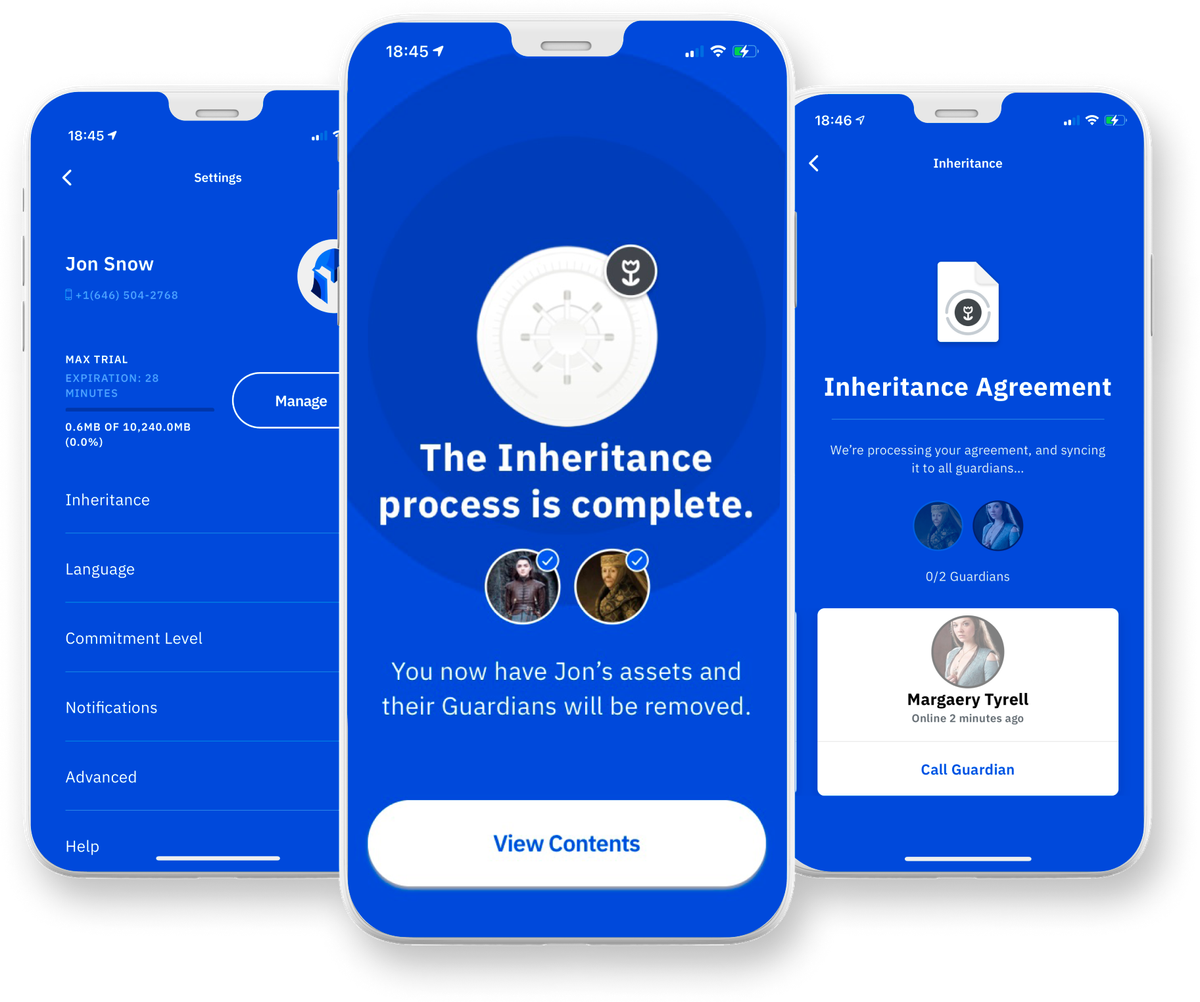

Vault12 Digital Inheritance is the first solution to offer a simple, direct, and secure way to ensure cryptocurrency, NFTs, and other Web3 digital assets can be inherited by future generations.

Digital Inheritance enables investors to designate an individual or a mobile device as a guardian that will inherit their entire portfolio of digital assets (seed phrases, private keys, digital art and other secrets) inside a secure digital Vault once the time comes, eliminating undue risk and the need to continually update an inventory or issue updated instructions which result in privacy leakage.

Decentralized Secure Backup.

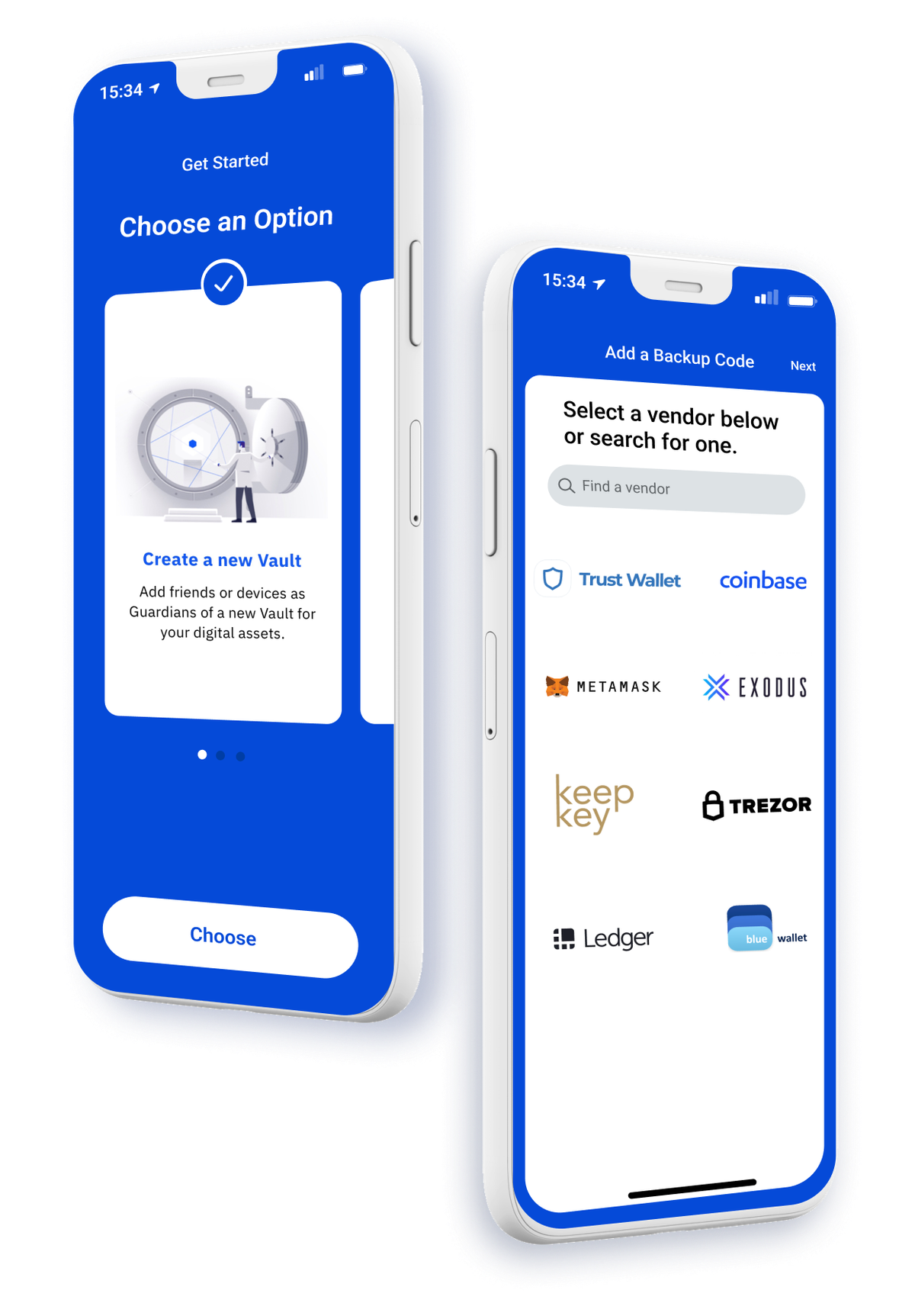

Designed to be used alongside traditional hardware, software, and online wallets, Vault12 helps cryptocurrency owners, professional crypto traders, and high-net-worth investors safeguard their digital assets without storing anything in the cloud or in fact, any one single location. This increases protection and decreases the risks of loss.

The Vault12 Guard app enables decentralized secure backups, and provides legacy inheritance for all your web3 digital assets, including NFTs, wallet seed phrases, secrets like keys, PIN codes, DAO project keys, and digital art.

Collectors, ensure your Art is protected for the future.

Whether your digital art is suitable for a phone, or represents much higher resolution multimedia, make sure that you have backed up a copy in case the resource link is disrupted in the future. Digital art can easily be added to the Vault either via the mobile app or via the desktop utility. Once you have stored your artwork in your Vault, it will also benefit from inheritance once you activate that in your app.

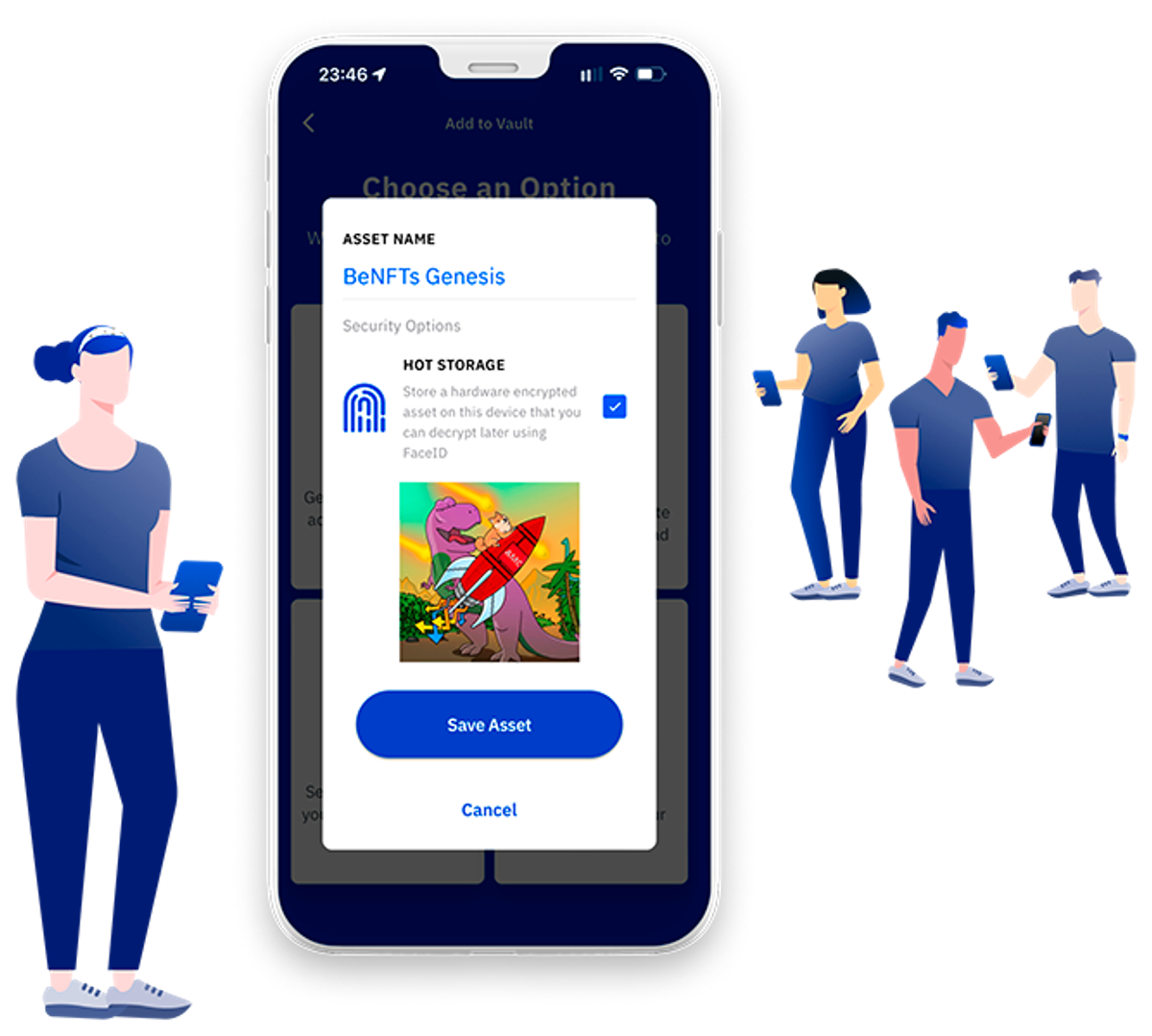

Creators, do you have creative security?

As a creator, you can use Vault12 to safeguard not just your NFT and crypto wallets but also your original digital artwork. Project creators will always have to deal with multiple wallets - inventory, treasury, as well as future royalty wallets.

Vault12 safeguards your project assets, increasing protection and decreasing the risks of loss whilst ensuring that everything is ready to be passed onto future generations when the need arises. This is creative security.

Learn

Step-by-step guides for setting up your digital Vault and adding assets, inheriting and restoring Vaults. Vault12 Guard helps you inherit and back up all assets stored in your Vault, including Bitcoin, Ethereum, crypto, private keys, seed phrases, digital wallets, and essential home & family data.