How to create the best Guardian Strategy to protect your assets

Guardians can effectively protect your assets in a decentralised way - what is the best strategy?

Death and Taxes… Why Tax Time Is the Perfect Time to Fix Your Crypto Inheritance

In this world nothing can be certain except Death and Taxes

“In this world nothing can be said to be certain, except death and taxes.”

Benjamin Franklin wrote that in 1789. If he were alive today, he’d probably add a third certainty:

If you don’t plan your digital inheritance, a good chunk of your wealth will simply vanish.

Every year, tax season forces us into the same ritual: pull together documents, log into accounts, reconcile statements, and finally see—clearly—what we actually own.

That’s exactly why tax time is the single best moment to get your crypto and digital inheritance sorted out. You’re already doing the hard part: creating an inventory of your assets. All you need to do is extend that thinking one step further:

“If I got hit by the proverbial bus tomorrow… who could access this, and how?”

Let’s walk through how to turn your yearly tax chore into a quiet act of love for your future heirs.

The Hidden Superpower of Tax Season: Asset Inventory

Most people think of taxes as punishment, not a planning tool. But when you look at what you actually do each year, it’s powerful:

- You list employers and income sources

- You gather bank and brokerage statements

- You track gains, losses, and cost basis

- You note property, side gigs, investments, and loans

In other words: you build a living snapshot of your financial life.

That snapshot is exactly what your heirs and executor will need one day. The gap is that:

- It usually lives in your head, scattered in email, or dumped into a folder called “2025 Taxes.”

- It rarely includes your digital footprint or crypto assets in a structured way.

So tax time becomes this moment where you almost have everything needed for a great inheritance plan—but then you hit “submit,” breathe a sigh of relief, and bury the work for another year.

Most people think of taxes as punishment, not a planning tool. But when you look at what you actually do each year, it’s powerful:

- You list employers and income sources

- You gather bank and brokerage statements

- You track gains, losses, and cost basis

- You note property, side gigs, investments, and loans

In other words: you build a living snapshot of your financial life.

That snapshot is exactly what your heirs and executor will need one day. The gap is that:

- It usually lives in your head, scattered in email, or dumped into a folder called “2025 Taxes.”

- It rarely includes your digital footprint or crypto assets in a structured way.

So tax time becomes this moment where you almost have everything needed for a great inheritance plan—but then you hit “submit,” breathe a sigh of relief, and bury the work for another year.

The Missing Column: Your Digital and Crypto Assets

Traditional estate planning is still stuck in a world of:

- House

- Bank accounts

- Brokerage

- Retirement accounts

- Insurance

But your actual life now includes:

- Bitcoin, Ethereum, and other tokens

- NFTs and digital art

- Assets on DeFi platforms and L2s

- Staked assets and yield strategies

- Exchange accounts (even the “small” ones you forgot about)

- Password managers

- Encrypted notes and backups

- 2FA apps and hardware keys

- Cloud storage with important documents, photos, and IP

For your heirs, the hardest part is not taxes—it’s discovery and access:

- Discovery – “What did they have, and where is it?”

- Access – “How do we unlock it without their passwords and keys?”

Without answers to those two questions, a perfectly legal, well-structured estate still leaks value. With crypto, “leaks” usually means “gone forever.”

The Brutal Truth: Estate Law Can’t Recover a Lost Private Key

With traditional finance, losing a password is annoying but fixable:

- There’s a helpdesk.

- There’s KYC.

- There’s a paper trail.

With crypto, if your heirs don’t have:

- The seed phrase

- The private key

- The social recovery method

- Or the hardware wallet PIN + recovery

…then the assets are effectively burned.

Death certificates, probate orders, and court documents mean nothing to a blockchain. The network doesn’t know you died; it only knows valid signatures.

That’s why crypto inheritance must be designed in advance, at the same level of care you put into optimizing your tax bill.

Turning Tax Prep Into Inheritance Prep: A Simple 6-Step Ritual

You don’t need to become a lawyer or a security engineer. You just need to add a few extra steps to what you’re already doing each year.

1. Expand Your Asset Inventory to Include Digital

While you’re gathering statements and logging into platforms for tax reporting, create one master inventory that includes:

- All exchanges you use (even “test” accounts with small balances)

- All wallets (hardware, mobile, browser, paper)

- All major on-chain positions (staking, DeFi, L2s, NFTs)

- Any custodial platforms (CeFi yield platforms, centralized staking, etc.)

- Critical digital services:

- Password manager(s)

- Cloud storage that contains important docs

- Domain registrars, app store accounts, creator platforms (where there’s IP or revenue)

Treat this like a crypto & digital asset schedule to sit alongside your traditional tax and estate documents.

2. Label the “Where” and the “How”

For each item in your inventory, add two simple pieces of information:

- Where is it?

- Exchange name, wallet type, protocol, or chain

- How is it secured?

- Hardware wallet, seed phrase in a safe, multi-sig, social recovery, etc.

You’re not putting the actual secrets in this list—just the map, not the keys.

Think of it like this: if you weren’t around, could your executor at least know which hills to dig under?

3. Decide Who Should Ultimately Inherit What

Estate planning sounds technical, but at core it’s emotional:

- Who do you want to benefit from your Bitcoin, ETH, or NFTs?

- Are there assets that are more meaningful to specific people—e.g., digital art, ENS names, in-game assets, or creator royalties?

- Do you want a portion of your crypto to go to a foundation, DAO, or non-profit?

You can formalize distribution wishes in:

- Your will

- A letter of wishes

- A separate digital asset memo that your executor knows about

The key is that tax time already has you thinking in percentages and allocations—just extend that mindset one step into “what if I wasn’t here next year?”

4. Establish a Secure Way to Pass On Secrets (Without Sharing Them Now)

This is the biggest practical challenge:

How do you make sure your heirs can access your keys only when they’re truly supposed to?

Some approaches people use:

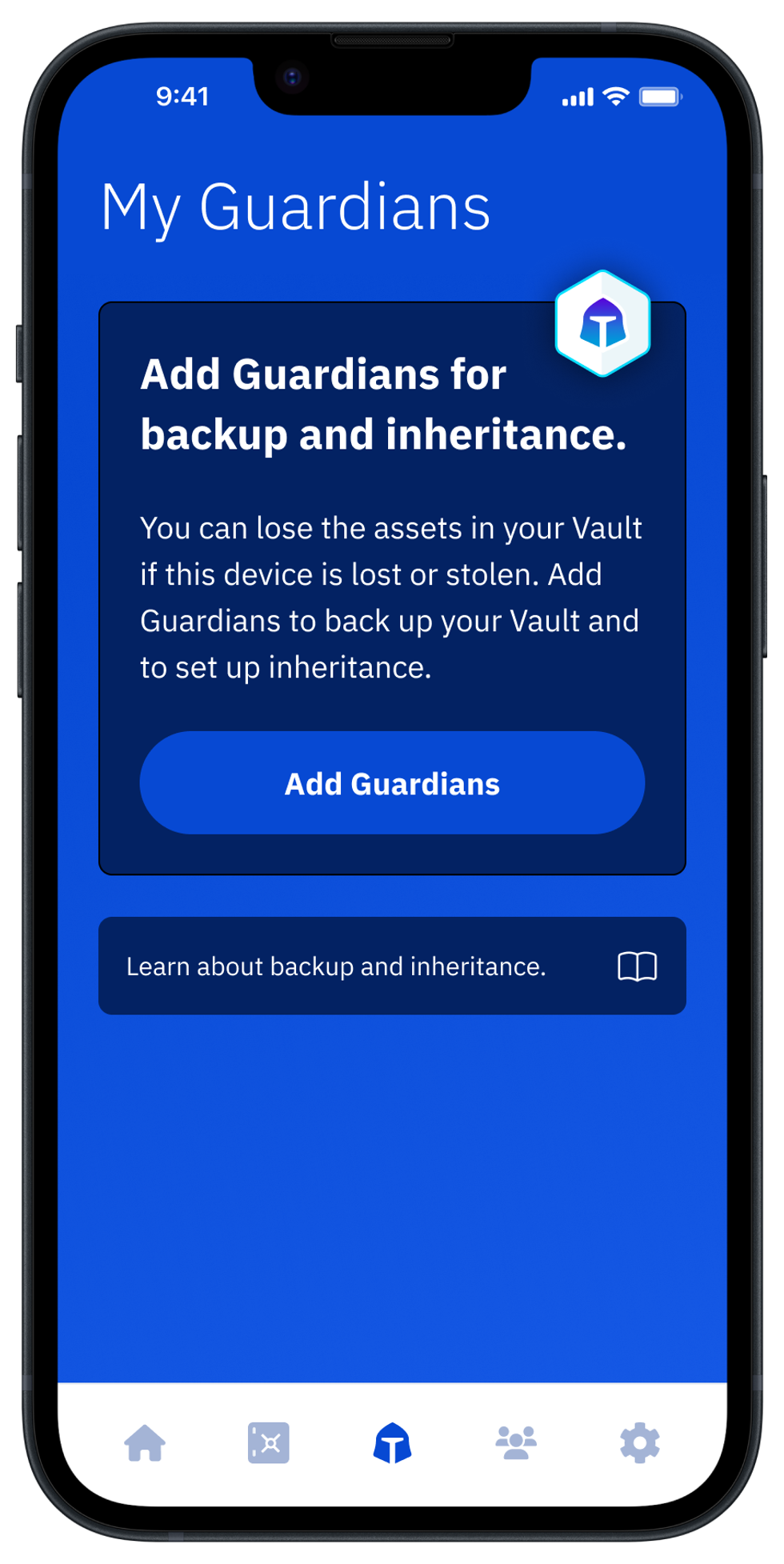

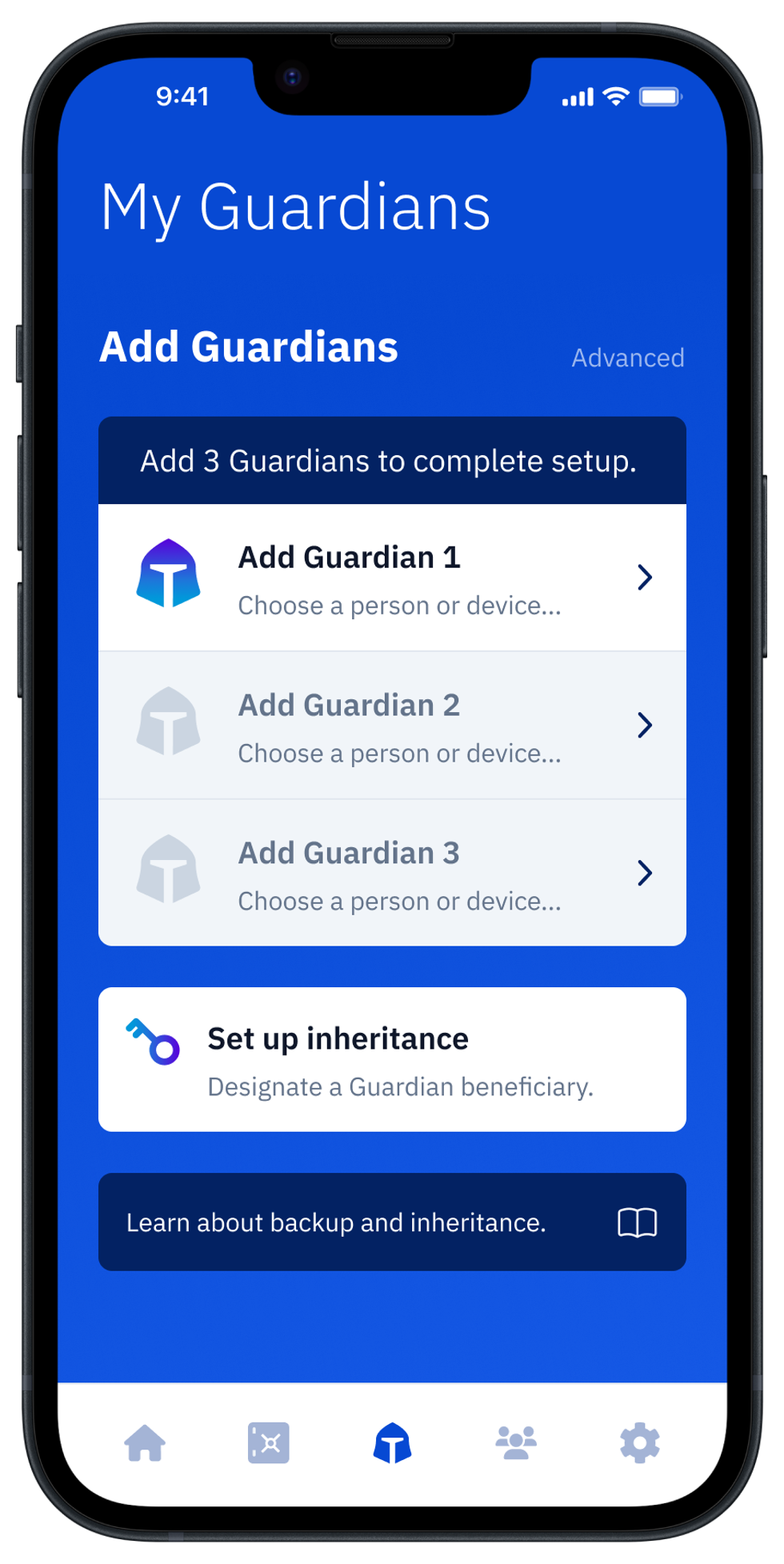

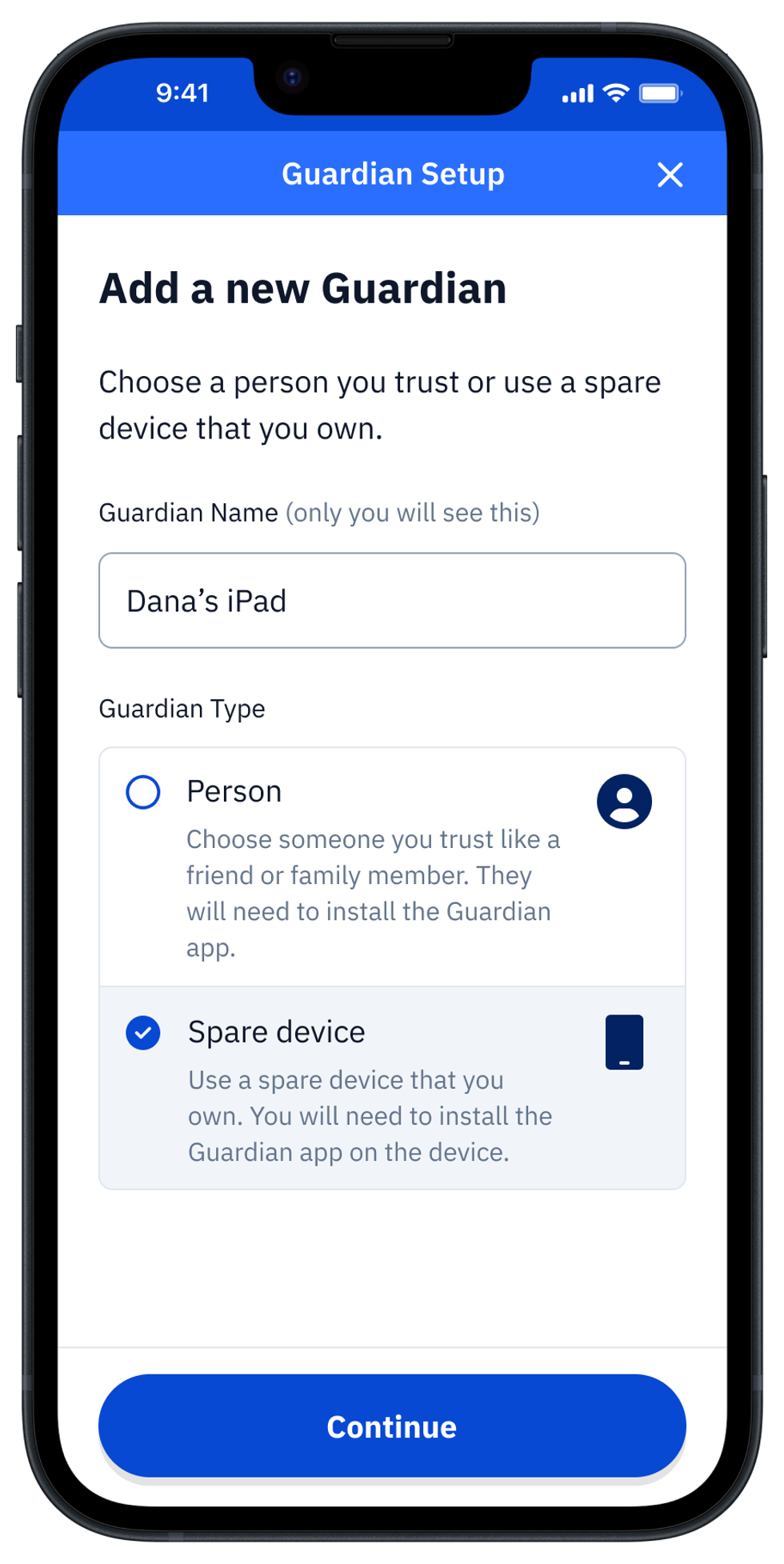

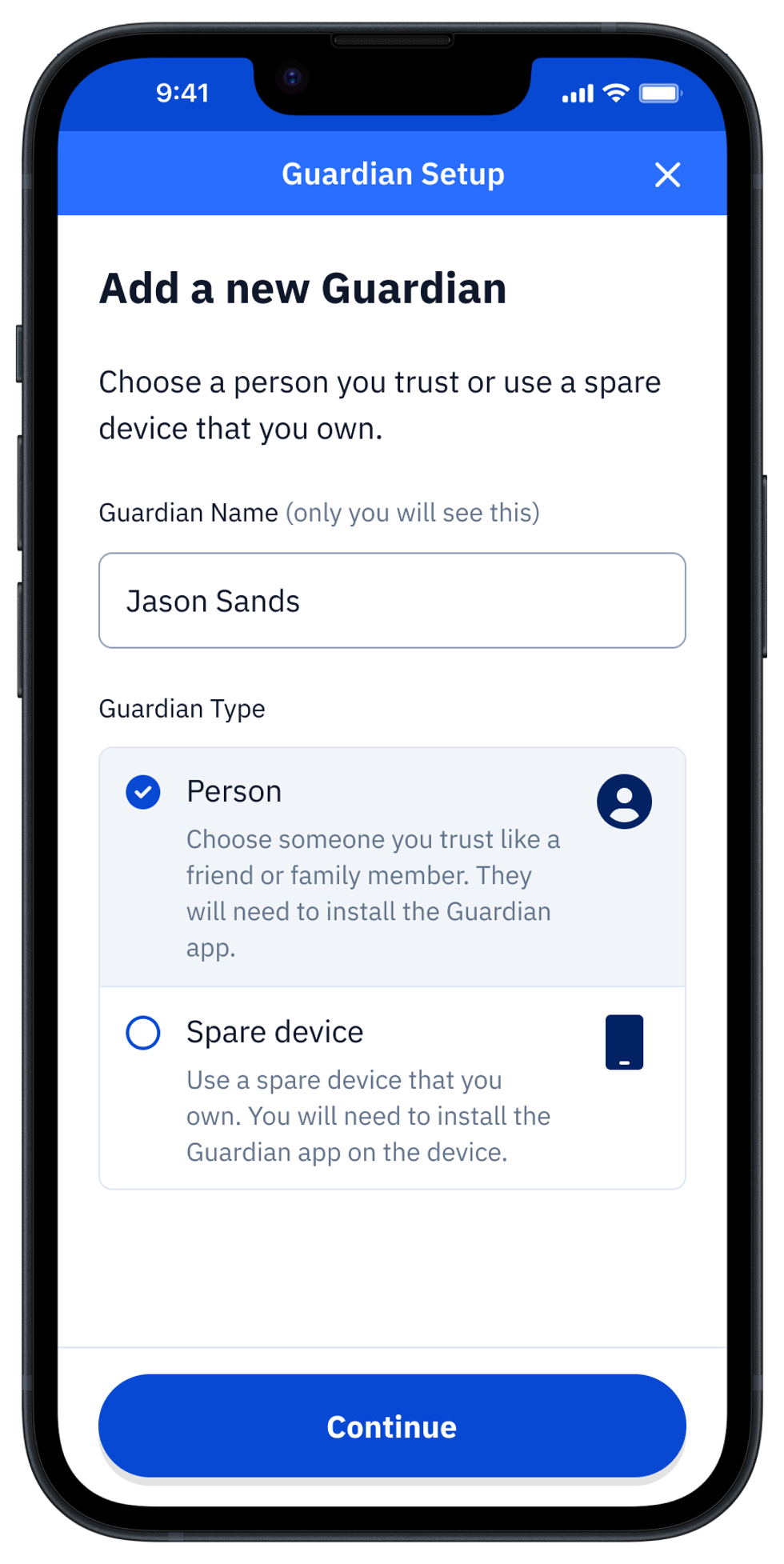

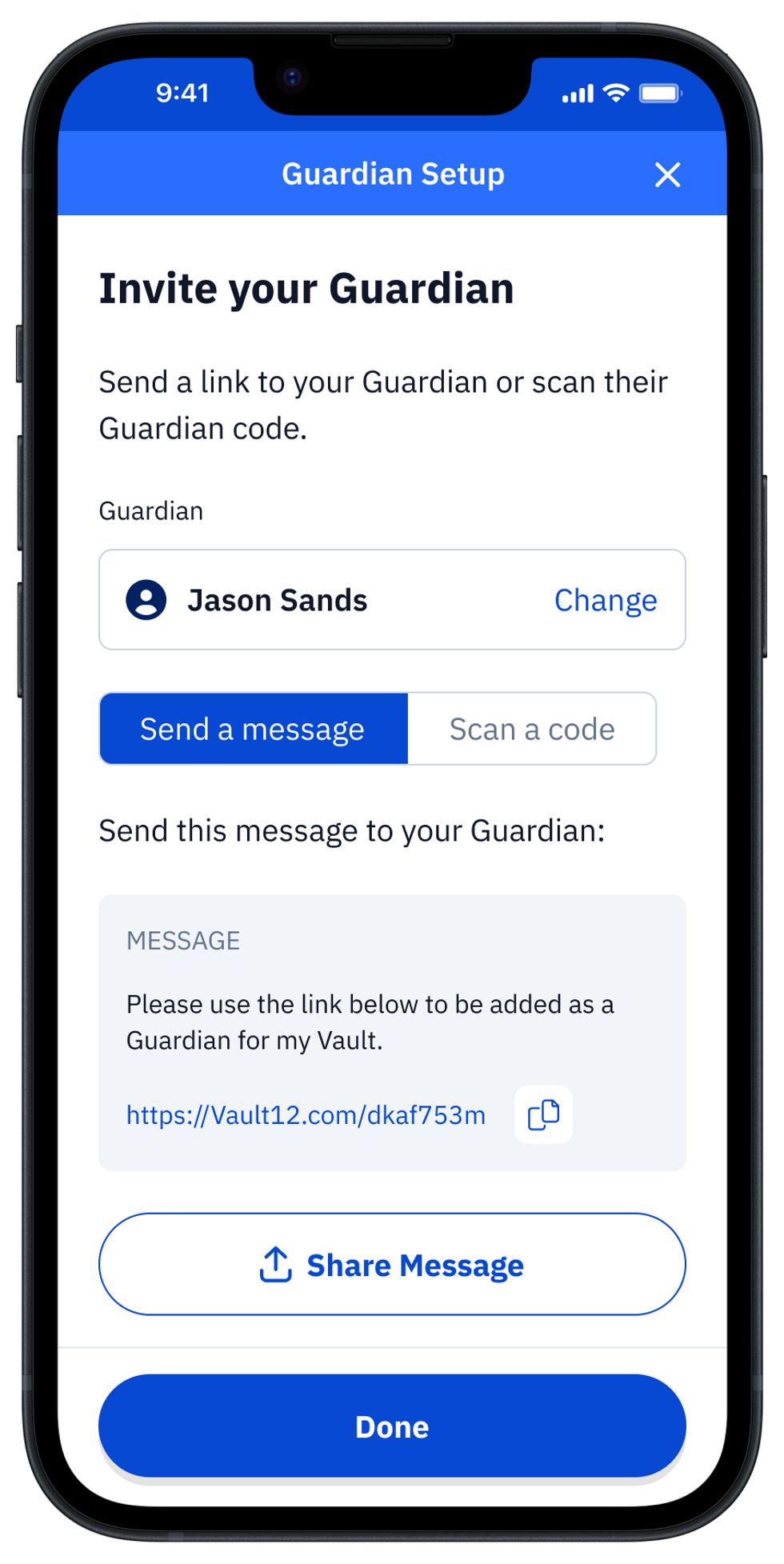

- Multi-sig wallets where one key is held by a trusted person or entity

- Shamir’s Secret Sharing or other threshold schemes, where parts of a secret are split among multiple “guardians”

- Dedicated crypto inheritance tools that combine encryption, sharding, and social recovery

- Estate-aware password manager plans, where a trusted contact can gain access after a verified event

What you don’t want to do is:

- Put seed phrases directly in a will (it becomes public in probate in many jurisdictions)

- Email your seed phrase to yourself or someone else

- Put everything in a single safe that no one even knows exists

The ideal pattern is:

Your inventory and intentions are discoverable,

your keys and instructions are recoverable but strongly protected,

and the whole system doesn’t depend on any one person’s memory.

5. Document “How to Use This” in Human Language

Your heirs might not be crypto-native. They might be terrified of doing something wrong.

So along with your technical plan, add a plain-English guide:

- “If I’m gone, here’s who to contact first.”

- “Here’s where to find the inventory of my accounts and wallets.”

- “These people/platforms have pieces that can help unlock access.”

- “Before moving anything, get a reputable crypto-savvy lawyer or advisor to help.”

- “Do not share seed phrases in email, text, or random websites promising recovery.”

You can think of this as the “Meet Joe Black” note to your future self and your family—the part the lawyers and accountants usually skip, but the humans desperately need.

6. Make It an Annual Habit: “Death and Taxes Day”

Finally, turn this into a ritual.

Once a year—when you do your taxes:

- Update your asset inventory (including new wallets, protocols, or accounts).

- Check that your inheritance mechanism (social recovery / Shamir / multi-sig / tool of choice) still works and still involves the right people.

- Revise your instructions and wishes if relationships or holdings have changed.

You don’t need to obsess over it all year. Just pair it with something you’re legally forced to do anyway.

If death and taxes are unavoidable, you might as well hijack tax day to make death a little less chaotic for the people you love.

Why This Matters More Each Year

Every year:

- More of your net worth migrates from the physical world to the digital one.

- More platforms, protocols, and wallets come into your life.

- More of your story—photos, messages, creations, IP—lives behind encrypted logins.

Failing to plan doesn’t just mean your family may pay more tax.

In the digital world, it means they may never even know what’s missing.

A thoughtful crypto and digital inheritance plan is:

- A financial decision (don’t burn assets by neglect)

- A security decision (don’t leak secrets prematurely)

- And above all, a love decision (don’t leave a puzzle no one can solve)

Tax season hands you the raw material for this plan every year. The next step is simply deciding:

“This is the year I stop pretending I’ll live forever—and I make sure my digital life is as well-organized for my heirs as it is for the tax office.”

If you’d like, I can now:

- Add a short intro blurb about Vault12 / your product as the “how” piece

- Turn this into a shorter LinkedIn version or an email newsletter

- Or create a 5-point checklist graphic you can use as a lead magnet: “Turn Tax Time Into Crypto Inheritance Time”

Where there's a Will, there's a way

How to protect your Digital Legacy

Many topics in life are difficult to discuss. Uncomfortable truths are often more easily brushed aside and ignored than discussed. The reality is that this doesn’t fix the issue. Although it can be difficult, it is essential to have open and honest conversations, especially with those closest to you. Being on the same page when it comes to these tough conversations often results in much better overall outcomes than ignoring them and hoping they go away.

One topic of particular difficulty for families to discuss is inheritance. The reasons for this are obvious. Nobody wants to think about losing their loved ones. It is one of the most painful experiences in this life. Not wanting to endure it more than one already has to in one lifetime is a completely understandable mindset.

The problem becomes that without a plan, families often find themselves in all sorts of predicaments that arise due to a lack of planning. Without having the conversation, children often don’t know what they even stand to inherit from their parents. When an inheritance comes as a surprise, it is even more difficult to know what to do with it.

Where there's a Will, there's a way

If you have never had a discussion with your core family about an inheritance plan, you probably aren’t super keen to start discussing their or your untimely demise over a casual dinner.

One major reason that people don’t set a plan is that inheritance doesn’t come up easily in conversation. It is simpler not to make others uncomfortable, as well as not to address the uncomfortable truth of one’s own mortality. Furthermore, unless someone has had the experience of having someone close to them pass away before, they likely don’t have the context for how the process of distributing assets to next of kin works and why it is so important to create a plan.

The law surrounding what happens to assets without a legally binding will from the deceased varies from one country to another, but the process of claiming assets without a will is messy at best, no matter where you go. The assets can end up getting tied up for months, sometimes years, and there are instances of people not inheriting their loved one’s wealth at all due to the lack of a will naming them the heir.

Willing assets to next-of-kin is already a painful enough process without having to combat outside parties, including the possibility of your own government, to obtain what you should have been rightfully entitled to from your loved one. As painful as it can be to think about losing a loved one, creating a legally binding will is a great first step to ensuring that there is some type of plan that can be carried out should the unthinkable happen.

Stick to the Plan

In addition to the grief that comes from losing a loved one, there are a great deal of practical expenses that come up when someone passes away. Ideally, these things are already covered through some plan in the will, allowing those closest to the departed to grieve instead of frantically coming up with thousands to cover end-of-life expenses while they’re in distress from losing their loved one to begin with.

Even with a will, there is no guarantee that the recipient of this windfall of assets is going to know what to do with them. The first step is to ensure that while expenses are covered, the family doesn’t transition their grief into a massive spending spree from receiving a windfall of assets. In many instances, inheritance is the largest individual wealth increase that a person will experience in their life, and it can be overwhelming to suddenly have significantly more money and borrowing power at your fingertips.

Fortunately, the ability to immediately access assets can vary greatly, depending on the liquidity of the asset class being inherited. It is not simple to turn around and sell a home, for example, but it can be fairly easy to unload stocks, bonds, and crypto, given the liquidity of the market. Avoiding the pitfall of liquidating everything is a step that many struggle with, and it isn’t easy to accomplish on your own, especially given the severity of emotions in this moment of life.

If this isn’t enough, there are also major tax concerns when it comes to inheritance, which vary based on geographical location. Again, unless they’ve had the great misfortune of going through the process previously, it is not very likely that the average person is an expert in tax law regarding willed assets and inheriting wealth. Without proper planning, wealth that should be going to the next of kin of the deceased can end up being paid in unnecessary taxes instead.

Inheritance management advisors can help with this issue. Not only do these experts have a lot of experience being a supportive presence for grieving families, but they also have the benefit of being well-versed in how to maximize the impact of an inheritance to help the family going forward.

Additional Considerations

An initial meeting with an expert in inheritance can make a world of difference in how solidified your plan is for when the worst happens to you or your loved ones. The professional advisor likely has years of experience in having discussions about wealth and estate planning, and can help to overcome the initial hesitancy regarding the difficult topic of death.

Your planning professional will also know local inheritance tax law and can help to create a structure that allows you or your loved one to give as much of the wealth that has been accumulated to whomever you desire, instead of having to pay an unnecessary amount to the government. Of course, it is best to follow the law and to pay the necessary taxes to avoid even further headaches when mourning a loved one, but few people would sign up for more of their wealth going to their government than to their own family, friends, or charitable causes.

In addition to tax planning, a proper plan will also help to create a route forward for the assets in question once they’ve been passed along. There is not necessarily a “right” answer to what should be done with the inheritance, but meeting short-term goals while ensuring longevity of the wealth to benefit the family without burning through it all is a balance that is easier struck by an unbiased third party than from within the familial unit.

Experts should be well-versed in the asset class or classes that are being passed on. There are so many different types of assets, especially today, that everyone can’t be an expert on every type of asset class or market. Ideally, the initial meeting with an estate planning professional can help identify what types of assets you or your loved one owns, what the plan is for those assets, and how comfortable the advisor is with planning around these types of assets. A good professional will assist in their own areas of expertise and have a network of experts in areas that they’re less familiar with to consult with or outsource management services to on behalf of clients.

With the emergence of blockchain technology, wealth has started being accumulated in digital assets over the course of the last decade and a half. While most asset custodians execute the beneficiary wishes of their customers on their behalf, digital assets can be self-custodied.

A plan for digital asset inheritance management should be conducted with a company like Vault12, who have experts in blockchain and crypto technology. This can be done in addition to planning for non-digital assets, which a traditional estate planner would likely have more experience with up to this point in their career.

If you or a loved one is involved in blockchain and digital assets, it can be too easy to misplace or lose access to wealth that exists on the blockchain without a proper plan. Instead of panicking during an already traumatizing event, consider reaching out to Vault12 for a consultation to discuss creating a wealth management plan.

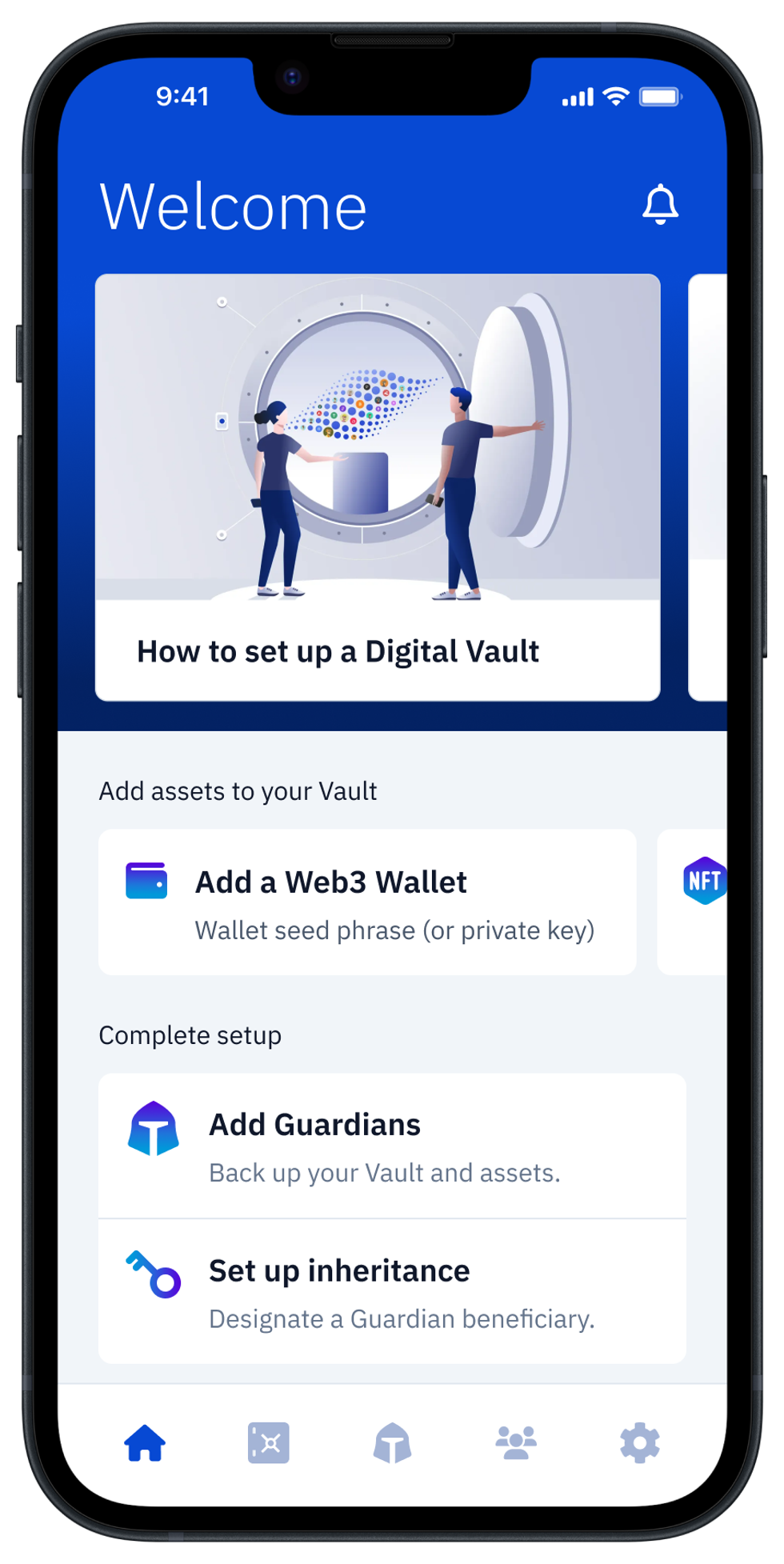

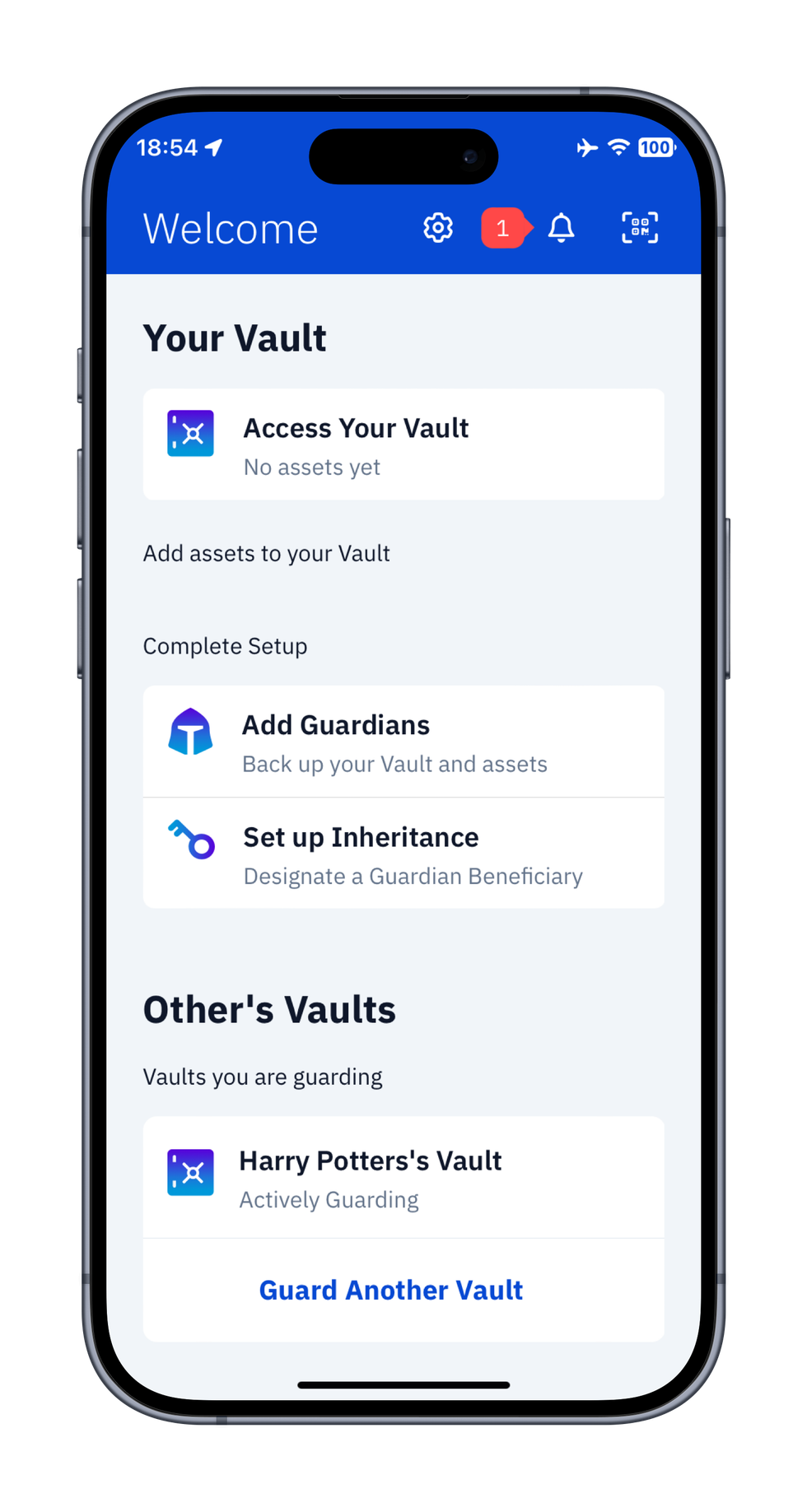

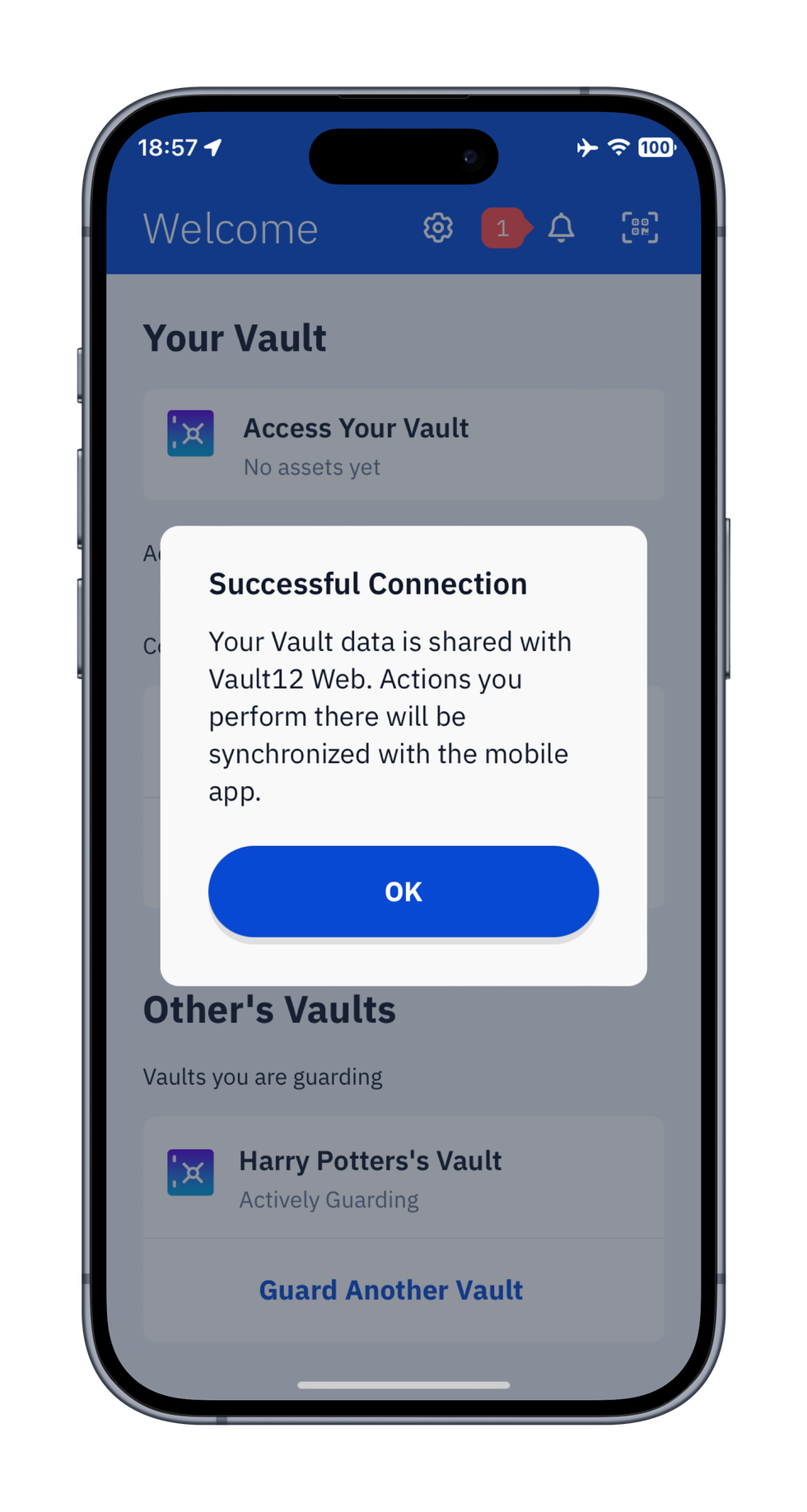

Digital Inheritance with Vault12

How it Works

Vault12 is NOT a financial institution, cryptocurrency exchange, or custodian. We do NOT hold, transfer, manage, or have access to any user funds, tokens, cryptocurrencies, or digital assets. Vault12 is exclusively a non-custodial information security and backup tool that helps users securely store their own wallet seed phrases and private keys for the purpose of inheritance. We provide no legal or financial services, asset management, transaction capabilities, or investment advice. Users maintain complete control of their assets at all times.

Boston Blockchain Week | Navigating Policy & Regulation in Blockchain

Presented at Boston Blockchain Week, Boston, MA, September 9th, 2025

🎙 Featured Panelists:

- Wasim Ahmad, Founding CMO & Business Development, Vault12

- Joe Ciccolo, Founder & President, BitAML

- Josh Deems, Head of Americas, Figment

- Kris Klaich, Senior Director of Operations & Policy, The Digital Chamber

- Markus Veith, National Industry Leader Digital Assets, Blockchain & web3, Grant Thornton (moderator)

Youtube: https://youtu.be/CKx_nghg1qU

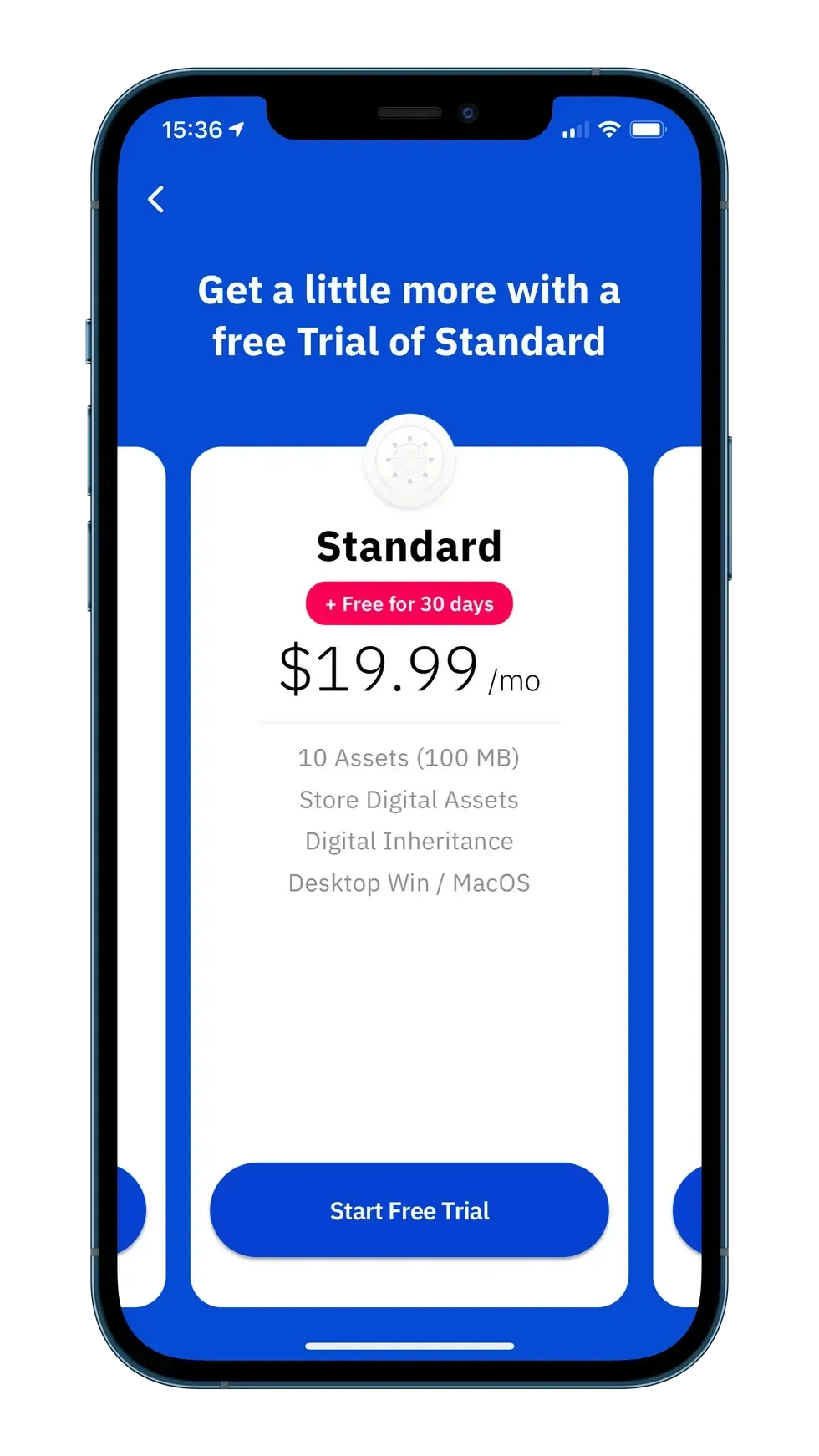

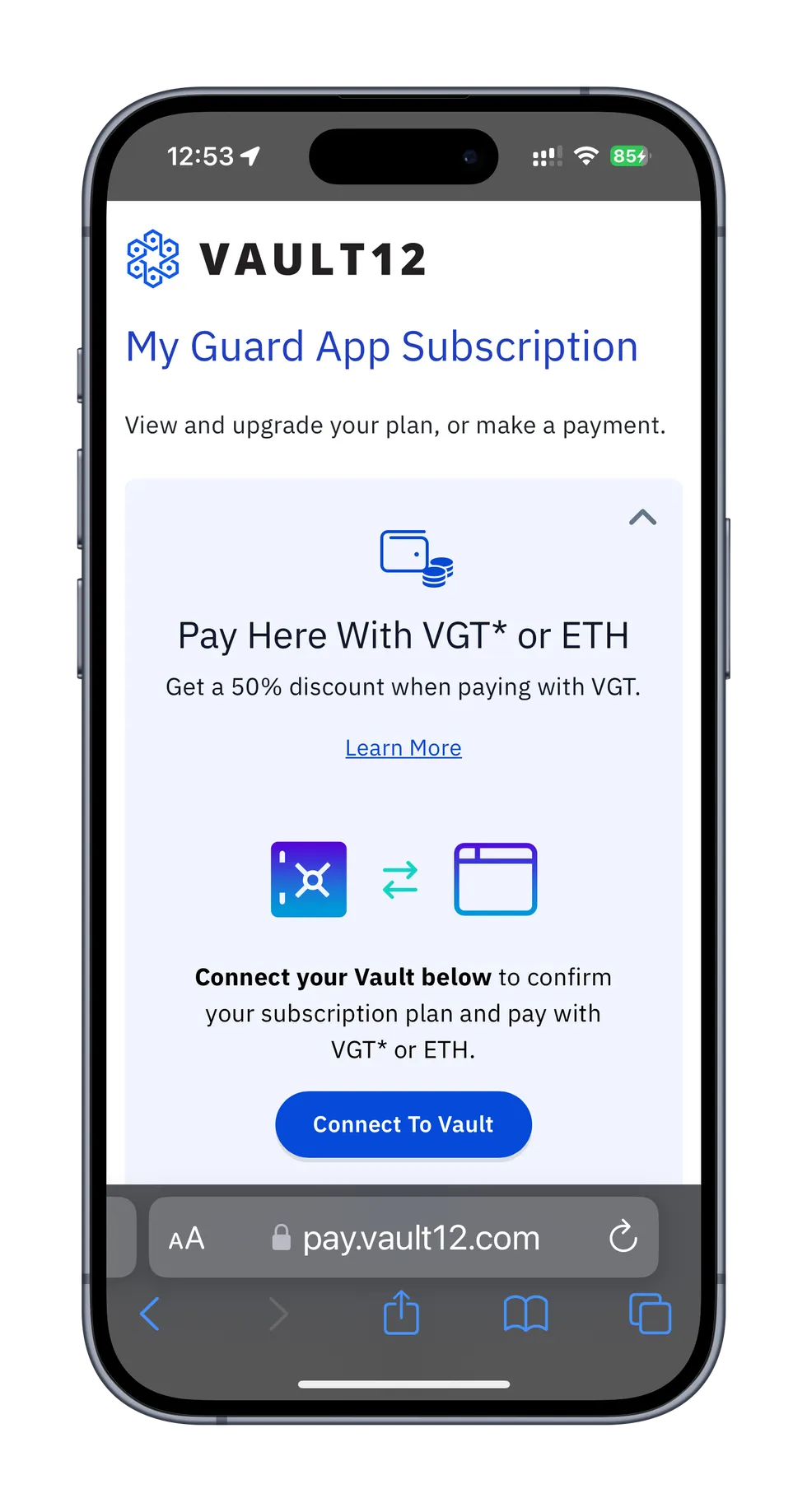

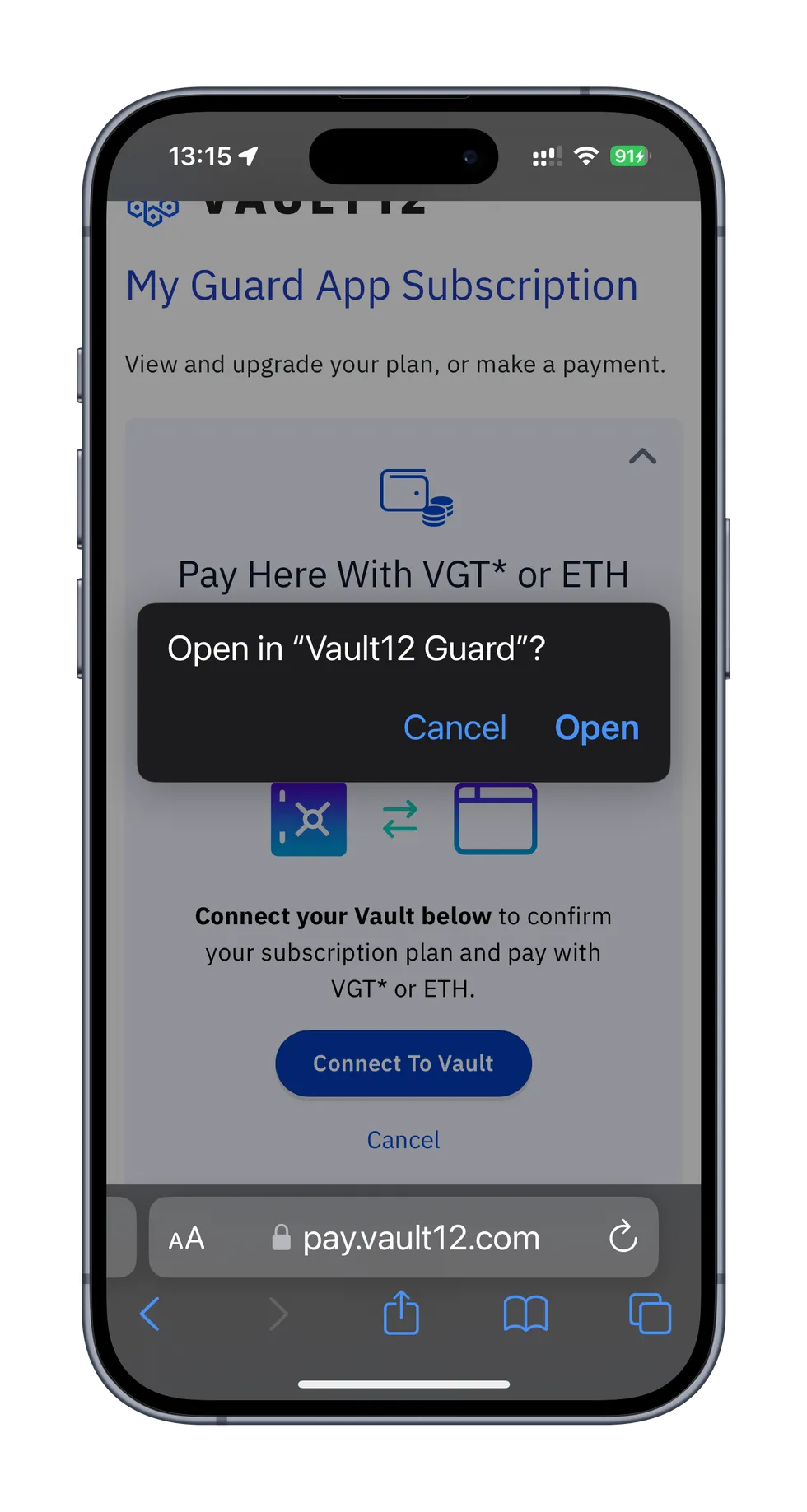

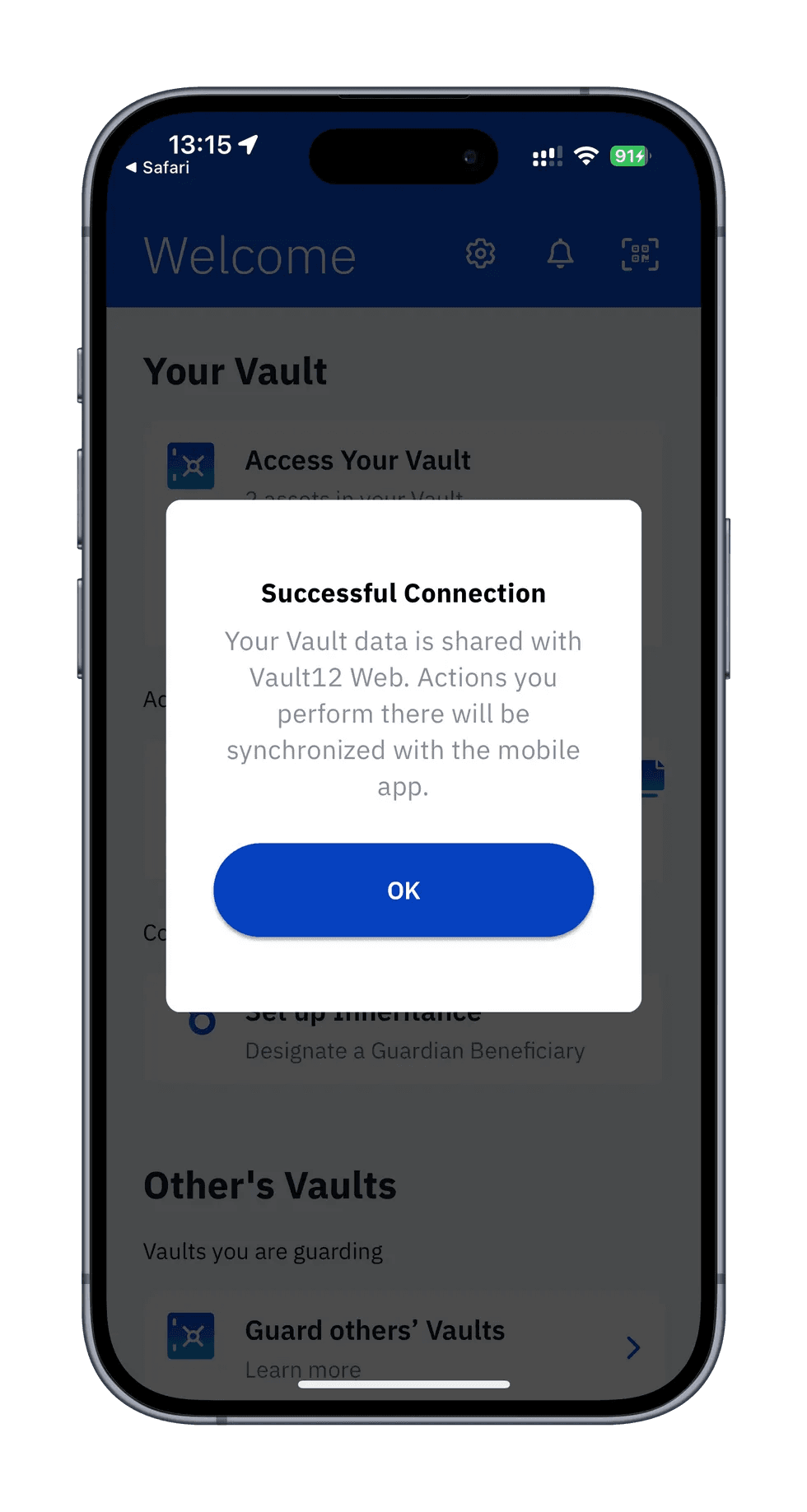

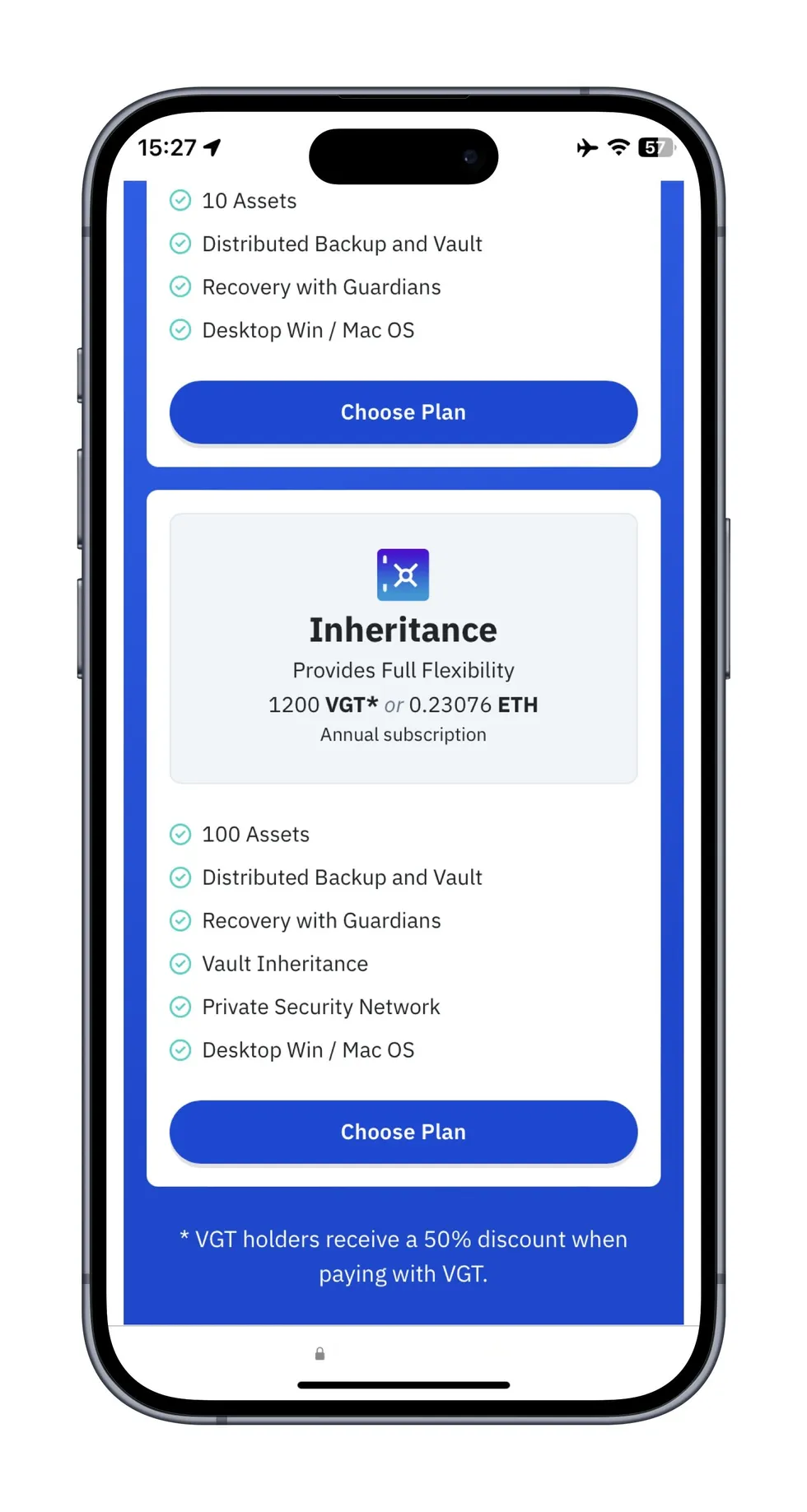

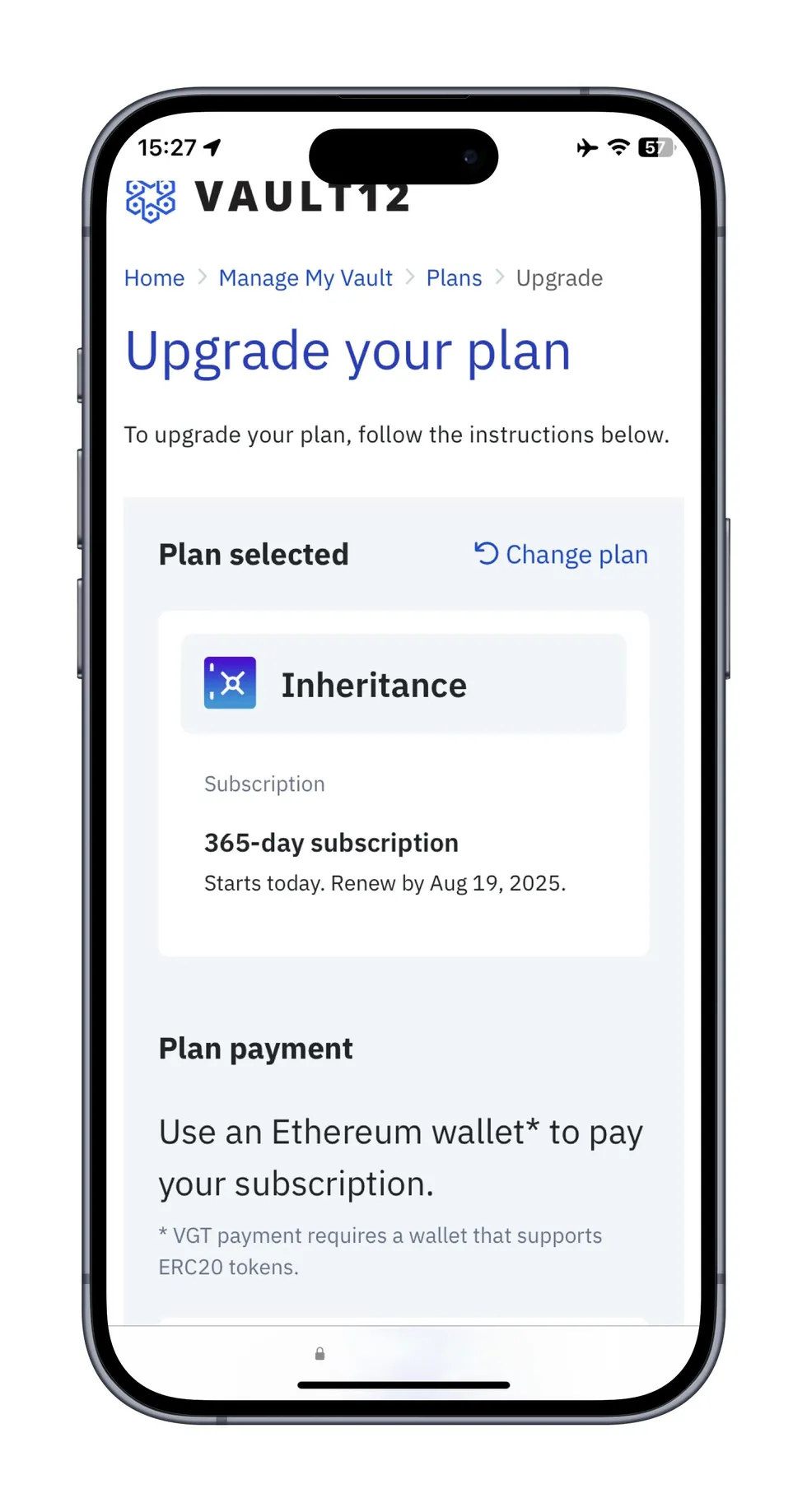

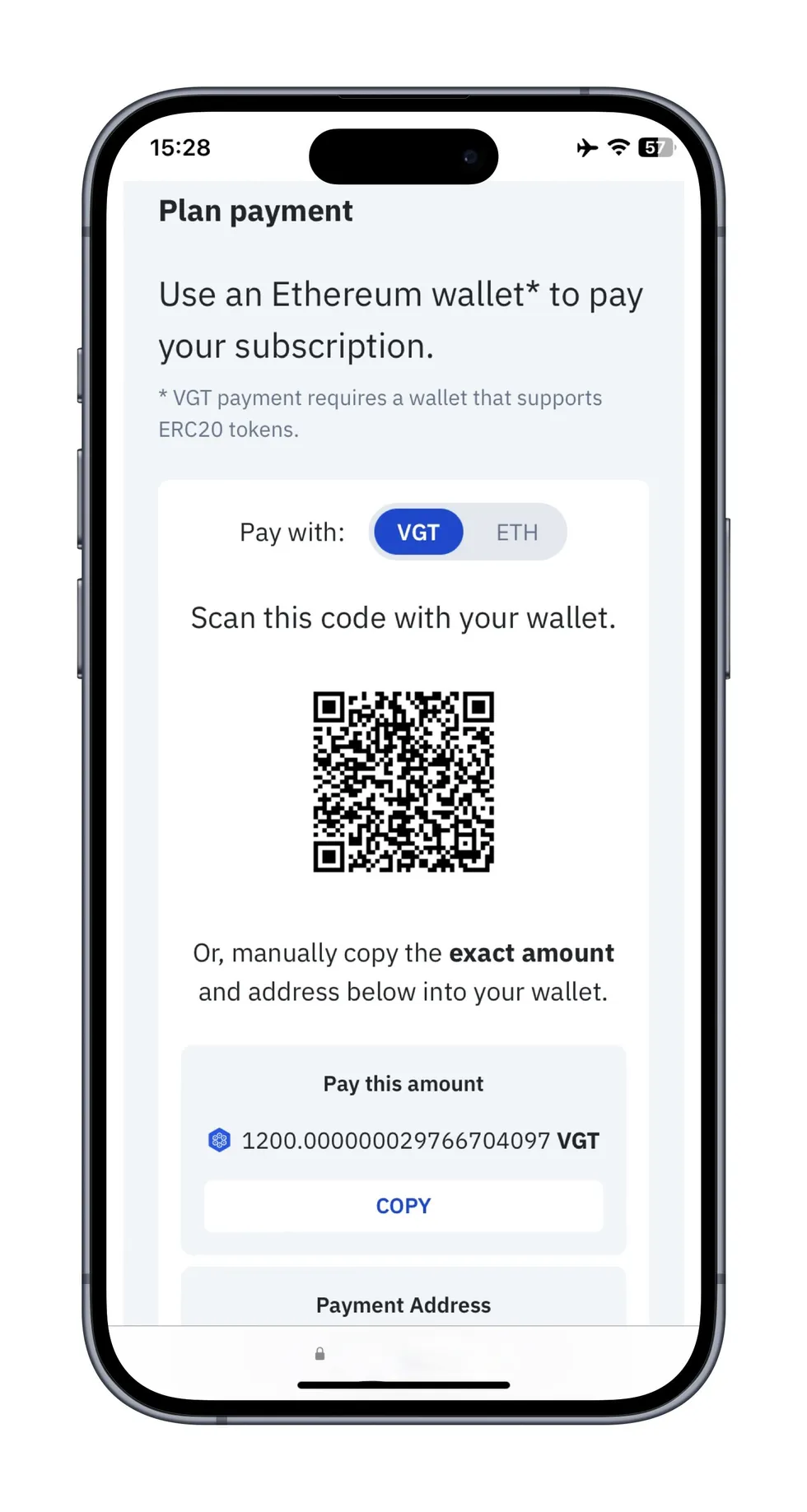

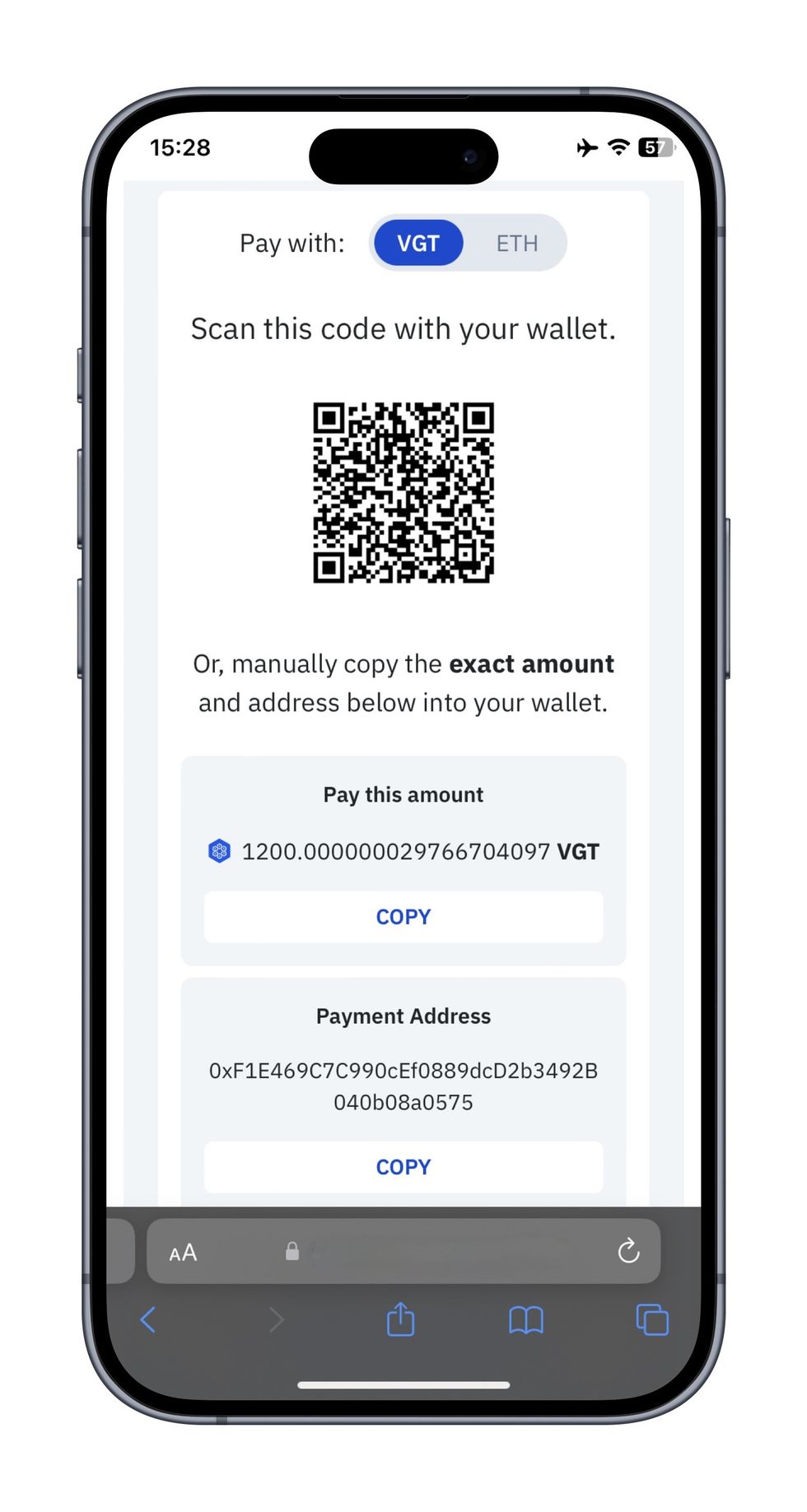

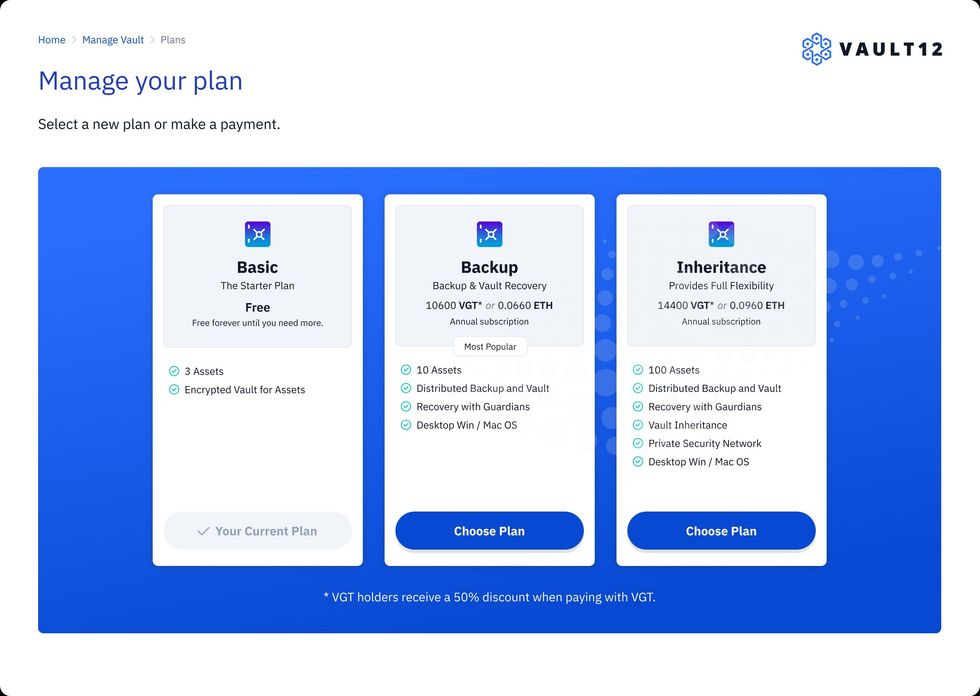

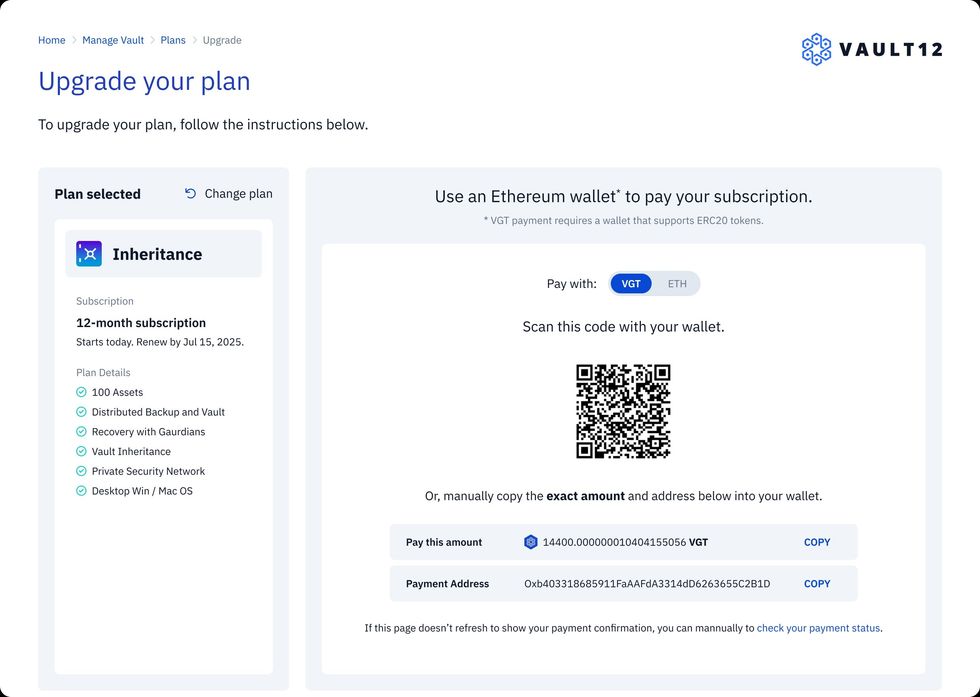

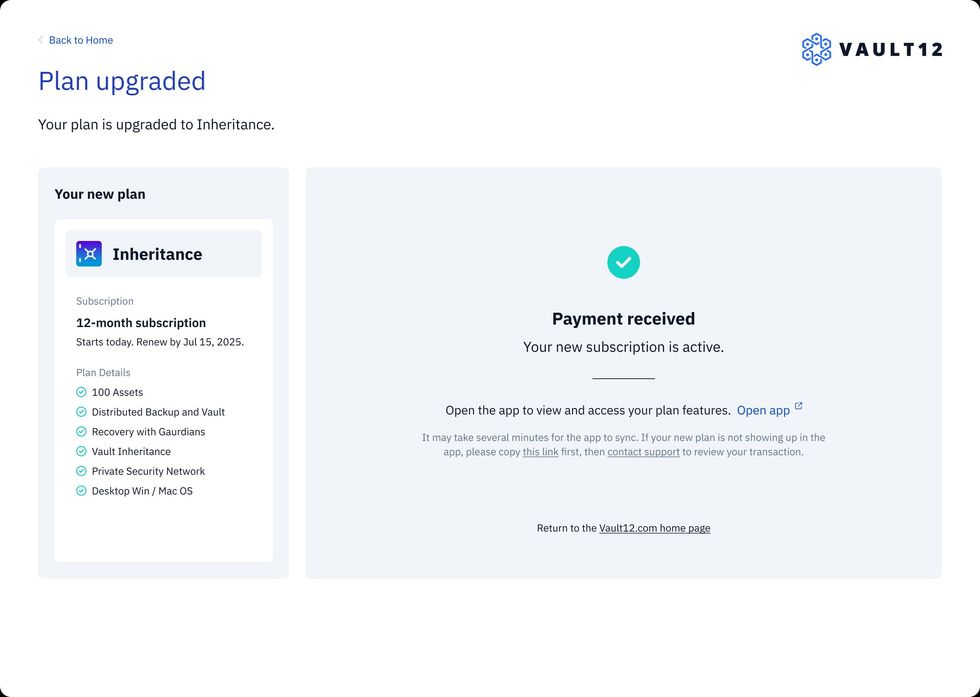

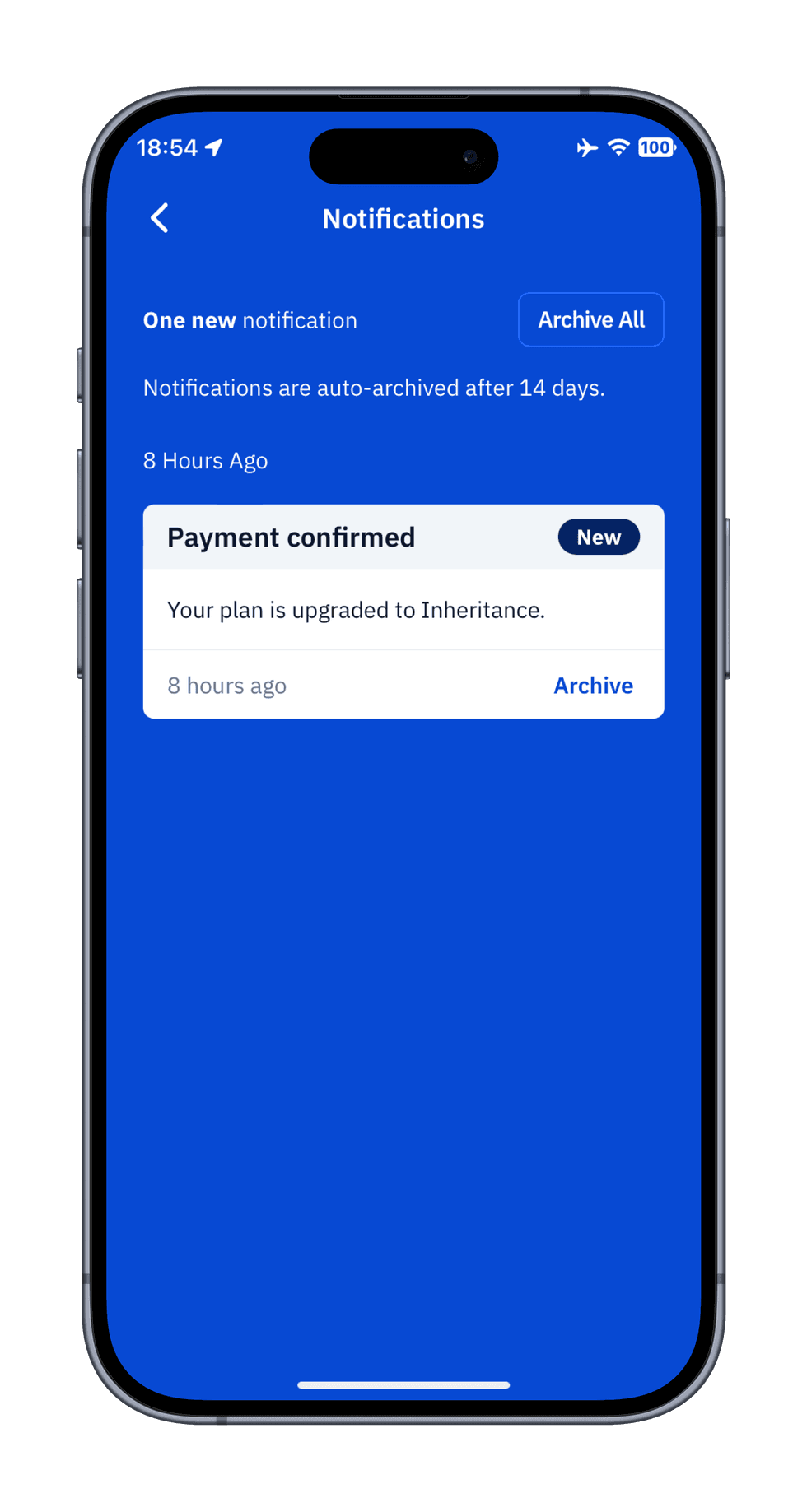

*** Special Offer for Podcast listeners ***

Promo codes for Vault12 Guard

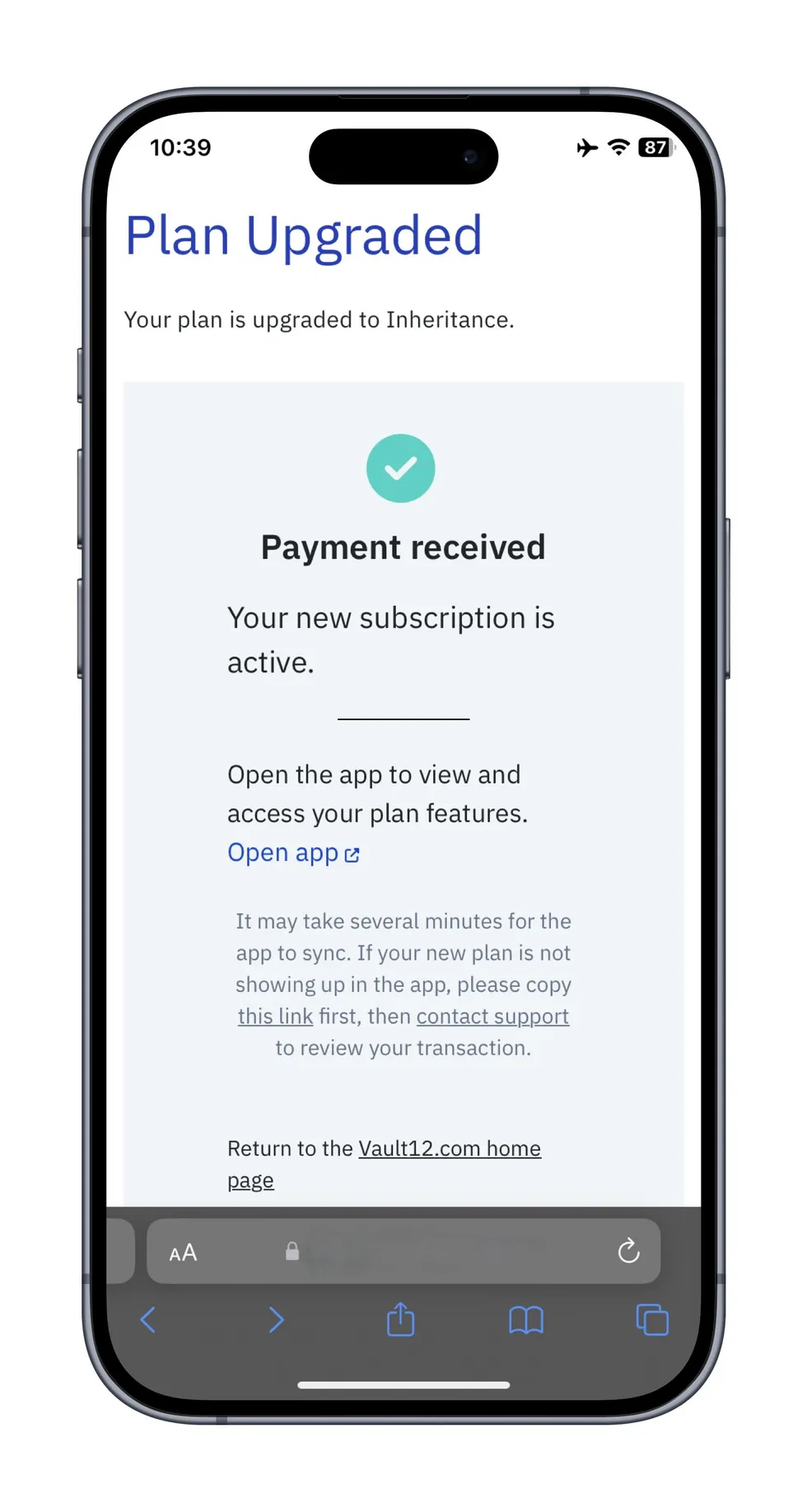

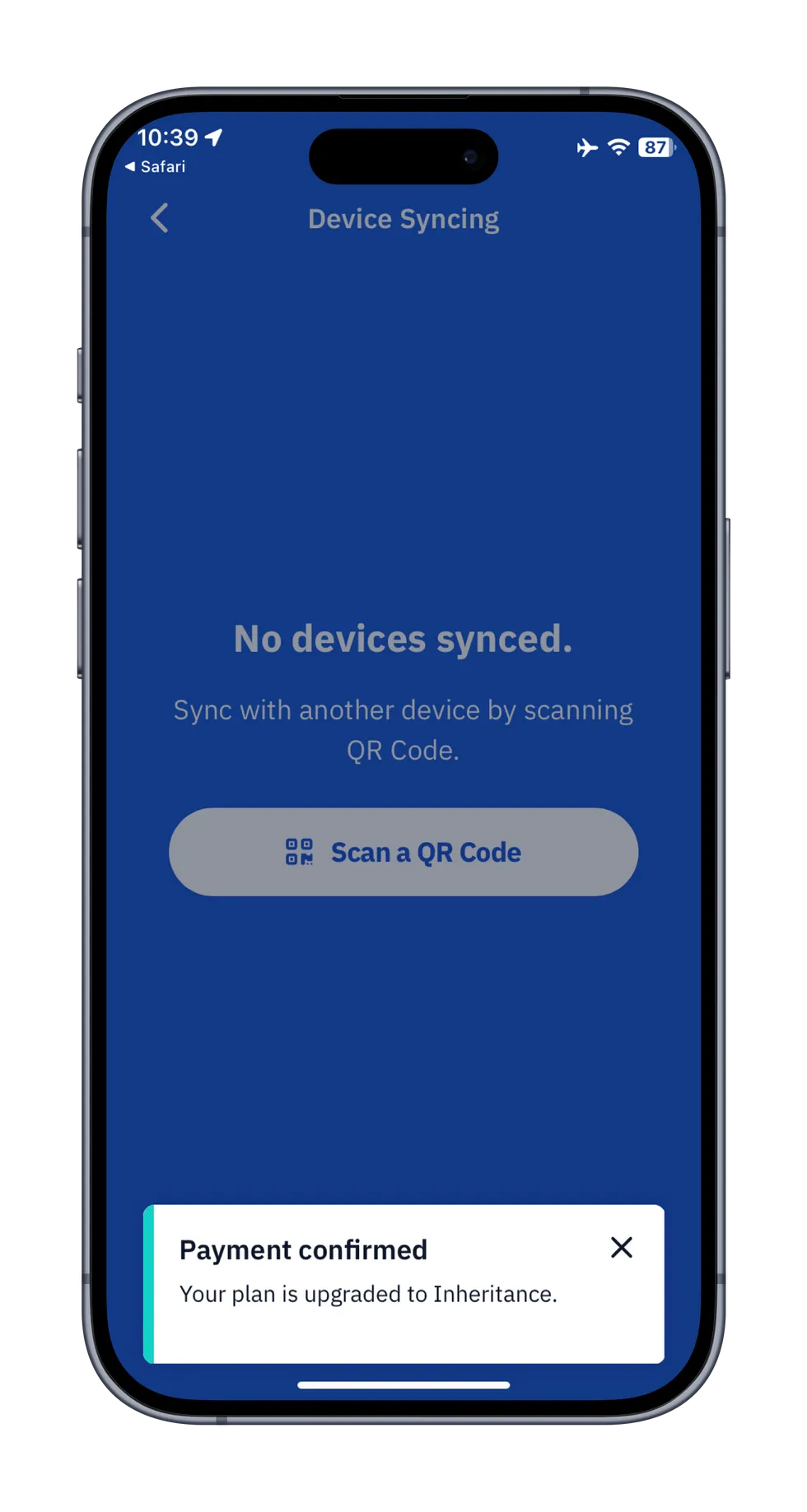

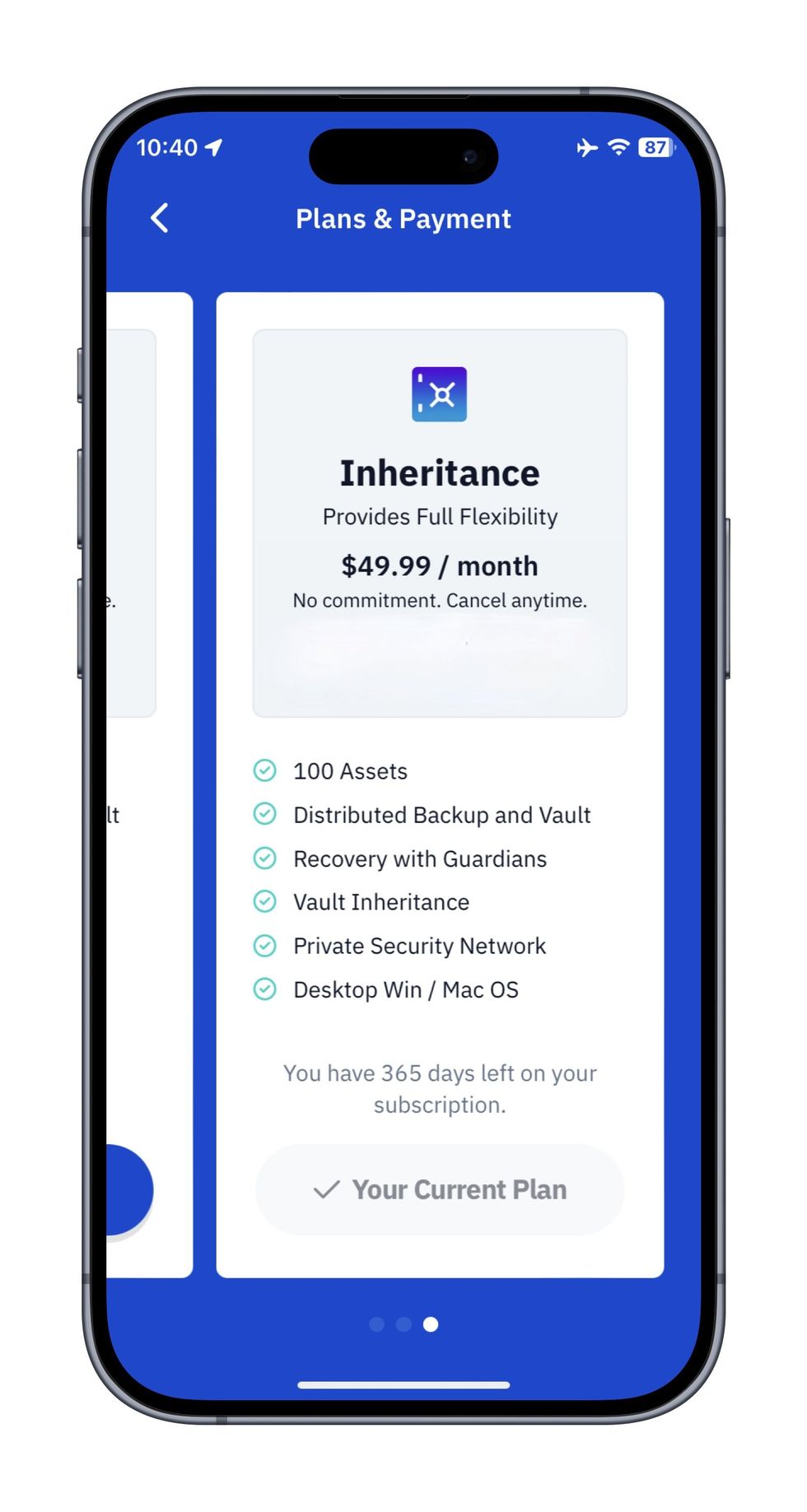

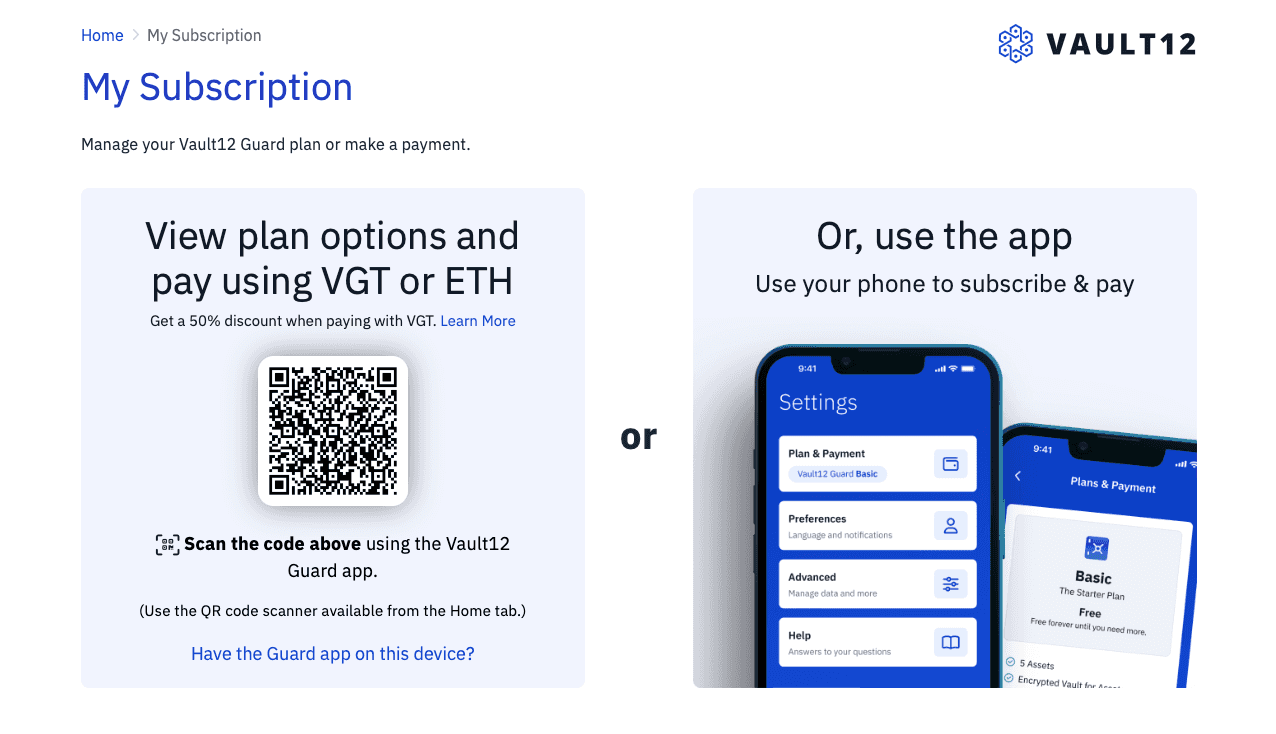

The iOS codes are good for 1 year subscription at no cost, then will revert to standard price for Inheritance plan. iOS codes can be redeemed in the Apple App Store.

The Android codes are good for 90 days subscription at no cost, then will revert to standard price for Inheritance plan. Android codes are redeemed when selecting and paying for the Inheritance plan in the app.

Instructions for how to redeem here.

Code: CMNYC25

iOS: https://apps.apple.com/redeem?ctx=offercodes&id=1451596986&code=CMNYC25

Android: Enter code CMNYC25 when you select the Inheritance plan

Wasim Ahmad, Founding CMO & Business Development, Vault12

Joe Ciccolo, Founder & President, BitAML

Josh Deems, Head of Americas, Figment

Kris Klaich, Senior Director of Operations & Policy, The Digital Chamber

Markus Veith, National Industry Leader Digital Assets, Blockchain & web3, Grant Thornton (moderator)

Boston Blockchain Week

Transcript

Markus Veith:

All right. Good afternoon, everyone. Thanks for joining us. We are going to talk about regulatory and legislative developments in a crypto space. And we're just going to do a quick round of introductions. As Ian already said, I'm Markus Veith. I'm a Partner. I'm the National Leader for Crypto Blockchain for the accounting firm Grant Thornton, and a pleasure to be here. I'll be your moderator.

Joe Ciccolo:

Hi, everybody. Joe Ciccolo, founder and President of BitAML. We provide regulatory compliance consulting services to the crypto space. I'm also the Executive Director of the California Blockchain Advocacy Coalition 501(c)(6) Trade Association, representing the interests of the crypto and broader Web3 community before the California legislature, California Governor's Office, and various state regulatory agencies.

Josh Deems:

Great, nice to meet everyone. My name is Josh Deems. I am Head of Americas for Figment. Figment is a staking services company headquartered in Canada, but we do a lot of work here in the US. I'm based in Boston, so it's nice to have an event like this in our backyard, which is fantastic. I've spent a lot of time working in the space, both in the Boston area with Fidelity and State Street prior and kind of full circle now bringing staking services to larger institutions, having the regulatory clarity that they've got over the last year. I'm really excited to talk to you all more about that today.

Wasim Ahmad:

Hi, everyone. My name is Wasim Ahmad. I am Co-Founder of a company called Vault12, and we handle crypto inheritance. A few years ago we issued tokens, and since then we've been encumbered by the lack of regulations here in the US and the lack of regulations in the UK and the ridiculous regulations that now exist in Europe. And so, I spent a lot of time commenting on bills, briefing politicians, briefing staffers, working with the Digital Chamber, working with other lobby groups, so lots to say on this subject.

Kristopher Klaich:

Hello, everybody, my name is Kristopher Klaich. I am a Senior Director of Operations and Policy at the Digital Chamber. We are the largest and first trade association for the industry. We represent around 160 companies to advocate and educate on their behalf largely to the federal government, but increasingly at the state level and internationally. And I lead our National Security Policy.

Markus Veith:

All right. So without further ado, let's get started. We have prepared a couple of questions and we have about 30 minutes. We don't have room for Q&A, so if you have any questions, please approach us after the sessions. We'll all be hanging around.

So let's get started. So we recently have seen the first piece of crypto legislation signed into law, the GENIUS Act. As stablecoins continue to grow and gain prominence and more adoption, I just wanted to start with that topic. So Josh, I'd like to start with you. Can you talk about some of the details with the GENIUS Act and what it means for the industry?

Josh Deems:

Yeah. So even just to zoom out one step further and talk about how the GENIUS Act fits within the overall framework that this current administration is pushing, at least from an agenda and policy perspective on crypto assets, there was kind of three main things or four main things that they're trying to accomplish. The first is come up with a regulatory framework for stablecoins. This exists in some way, shape, or form in Europe, exists in some way, shape, or form in Hong Kong. And this is really, shaping this was something that was critical to the second term of this Trump presidency. So that is kind of goal number one, is come up with a national framework for being able to issue and list a stablecoin. The second was really allow stablecoins to be issued by private entities and keep them out of this sort of surveillance style of what we call central bank digital currency. So those were kind of like the two stablecoin-related goals of this current congress and the current executive branch.

And then, on top of that is come up with a market structure bill, which is really at the heart of it determining what the SEC has the oversight over versus what the CFTC does, what constitutes a security versus a commodity, and all the downstream implications from there. And I guess the last is really just coming up with a way for the US to hold a strategic crypto reserve.

GENIUS Act is the first law that we have in the United States around cryptocurrencies, period. And it allows non-bank issuers as well as bank issuers to issue their own form of money, to issue a dollarized version on a blockchain. And it sort of prescribes how they want to see this done. There are reserve requirements, so how much can be held in short-term Treasuries, how much can be held in cash behind the actual issuance of the token. But really, this opens the door for companies like Circle to be able to list USDC and other firms to be able to interact with USDC as a payment mechanism under the law of the United States. So that's a major step forward in terms of a policy achievement under this administration.

For us at Figment, we're a producer of blocks, we're helping generate rewards for keeping the blockchain running. And so, the reason we like to see GENIUS, the reason stablecoins matter is people are using blockchains more. There's more demand for blockspace, meaning there are fees that are being paid to the chains in order to send stablecoin transactions. So ultimately, this benefits the overall crypto economic system, but in a way that is being done not through regulatory arbitrage, but also through having sound policy. So we were really excited to see the GENIUS Act get signed into law this July.

Markus Veith:

If I can just add one more thing on the requirements. As the accountant on the panel, the GENIUS Act also comes with reporting requirements, right? So as many of you know, most the stablecoin issuers outside of New York state, DFS has come up with a set of rules and requirements for stablecoin attestation. There's now a monthly stablecoin attestation requirement as well as the annual audit requirement that also comes with the Act.

Next up, just to stay with the stablecoins, I keep reading more and more about that banks and particularly regional banks are feeling the heat from stablecoin issuers, and they're feeling unfairly treated about some of the requirements they're subjected to versus non-bank regulated or non-state bank regulated stablecoin issuers. Josh, can you just also elaborate on that a little bit?

Josh Deems:

Yeah, so I think some of the state banks are under pressure or they're feeling competitive pressure because a company like Circle can condition with stablecoin not have the same reserve requirements as a regular bank and they're basically be able to bifurcate or sort of sort of bypass this dual banking system, this state-by-state banking framework that we've set up if you create a bank at a state level. So there'll probably be some changes to GENIUS. I think there's healthy debate and I think there's also bipartisan support to kind of work on some carve-outs that still also protect the state-level banks, but this was something that they'll fix over time, but not something that people have any real major opposition to.

Wasim Ahmad, Founding CMO & Business Development, Vault12

Josh Deems, Head of Americas, Figment

Kris Klaich, Senior Director of Operations & Policy, The Digital Chamber

Boston Blockchain Week

Markus Veith:

Great, thank you. So Josh already mentioned a little bit about the market structure bill, so just want to talk a little bit about the market structure bill, which is the next landmark legislation. Can you talk a little bit about the upcoming regulation, what you see in your space?

Wasim Ahmad:

Sure. So the market structure bill is the over-encompassing bill that will govern how the market works, who's going to regulate it, and how the market participants will interact with all of the rules that the regulators come up with. And so, there's a couple of pieces to this.

Firstly, what is the role of the SEC versus the CFTC? So that is being redefined and both of these regulators are getting focused on very, very specific areas.

So an example of that, the prior administration's SEC was very focused on enforcement with lawsuits and those kinds of things. Now they're very, very focused on not only innovation, I think all these bills support innovation, but they're focused on fraud. So they have a very specific mandate to root out and find fraud, which is great.

The CFTC is going to have jurisdiction over another range of commodities and will have to work hand in hand with the SEC. So there's sort of stipulations around how the SEC communicates with the CFTC to make sure that nothing falls through the cracks.

Other parts of the market structure bill involve how companies who issue tokens, which may in the past have been considered securities, how they can transition to a different model where the token is being used inside the network, so in a very decentralized way. So these are some of the kinds of things that are coming along.

The status of it is that the House has passed a version of the CLARITY Act, and then there's a version from the Senate. But there's quite a lot of work that needs to happen over the next couple of months, and so it's heading to get signed by the end of the year. So that's kind of the timeline of the market structure bill, the actual law getting signed.

But if I may, there are some other layers that certainly this administration has been, from a strategic perspective, putting into all of the legislation. So there's overarching bills. A lot of what's in the GENIUS Act is referred to in the market structure bill. There's also guidelines like Safe Harbor that are being pursued, which is something that's coming from the SEC. So the idea is that all of these bills, all of these laws and then the rules underneath, are layered so that if one of them is rescinded by a future administration, there's still protection for the overall market. And I think this is a very good thing. It means that things will take a little longer to get done. Originally, CLARITY Act was supposed to be signed by August 1st and then it was September 30th, but I think third time lucky, I think we're on track for post-Thanksgiving.

The other thing to note just in this area of regulations, the laws are the laws, but the rules are what the regulators will give to the market, and the rules also have to be formulated. And obviously, everyone is beavering away. The SEC is super busy doing that right now. I know because I've been talking to them.

Some of those rules may have some kind of 90-day consultation period, some of them which are a lower level, maybe it's better to call it guidance, can just be issued, communicated to the market and they go into effect straight away. So after the law is signed, there's going to be a period of time before all of the rules are in place and we actually have a way to participate in the market and be very, very clear about how things work. So we're not done December 30th, but it's coming. And it hasn't been coming for many years and now there's tremendous momentum here. And the best thing about the market structure bill is it's going to usher in an era of consumer crypto, which is the biggest I think, opportunity especially here in Massachusetts with all the financial services companies here.

Kristopher Klaich:

I can add a little bit of color because we're in the weeds on these issues, helping to develop the policy and the laws. We're working directly with Congress and the senators and their staff and the congressmen and their staff to help flesh out the details of what will go into these bills based on our members' interests and input. And then, as you mentioned, after a bill is passed, we are working with the regulators to help flesh out what those rules are, responding to the request for comment from Treasury, from FinCEN, from SEC and CFDC, for example, to help define how those laws are actually implemented in practice. And so, that's a long, much more convoluted process than the average crypto or blockchain adherent would maybe realize, but it's a long ugly process sometimes and that's what we do to help advocate on behalf of our members to make sure that the industry can thrive in the US.

Markus Veith:

Thank you.

Wasim Ahmad, Founding CMO & Business Development, Vault12

Joe Ciccolo, Founder & President, BitAML

Josh Deems, Head of Americas, Figment

Kris Klaich, Senior Director of Operations & Policy, The Digital Chamber

Markus Veith, National Industry Leader Digital Assets, Blockchain & web3, Grant Thornton (moderator)

Boston Blockchain Week

Joe Ciccolo:

Yes. I just wanted to add, similarly, in California we're going through, I mentioned rulemaking working with our regulators. So in California we passed DFAL, Digital Financial Assets Law. It's comprehensive regulatory framework for crypto, including oversight of stablecoin issuers. And that was signed back in 2023 pre-GENIUS, so we're grappling with what that might look like. There's language already in GENIUS that would put in preemption for state level. And so, there's a feeling in California that we worked so hard to build this infrastructure and staffing, and now we're sort of going, "Are we going to oversee? What's that going to look like? Is there going to be licensing? Maybe, but maybe some of the aspects of the rulemaking won't go through." So right now, going through the rulemaking process for DFAL, which goes live July 1st of next year. So that's regulating crypto exchanges, trading platforms, but also the stablecoin issuers. That Chapter 6 of Assembly Bill 39, which would oversee stablecoin issuers, is kind of in flux at the moment. And so, through the rulemaking process, there's been several notice of public engagement and not one has dealt with stablecoin topics.

So we're sort of deer in the headlights in California, and I think that brings up a broader issue of what that might look like at the state levels when we have preemption. And as I understand it, in CLARITY or at least one of the more recent versions I saw, there was preemption in that as well. So what does that mean for all the state regulators that are counting on their ability to continue to oversee various aspects of the crypto marketplace?

Markus Veith:

Yeah. It's interesting, right? I've been involved with crypto for 10 years now, 10, 11 years. And at the beginning it was like the Wild West, right? Most of the entrepreneurs consider themselves and may still consider themselves to be running a technology firm. My background is banking and banking risk, credit risk management, but I always said, "Look, this looks to me like a broker dealer like a bank." And I was always expecting 10 years down the road, crypto companies will have some kind of a banking or broker dealer license.

And then, 2022 happened, came around and everybody was crying foul and looking for being rescued, being bailed out and, "Where's the federal regulator?" Right? You can't have it both ways. I'm a proponent of regulation, but it needs to be sensible. It needs to protect the users, specifically individuals, consumers, but it also needs to give the flexibility for companies to grow and explore and expand. So it's glad to see after 10 years of back and forth, maybe, maybe not that we finally see some traction.

And I think we're going to talk a little bit more, it has to be bipartisan. Right? It cannot be a partisan issue. Crypto is not a national, it's not a political thing. It's international. It's a technology that we all want to benefit and harvest and see the best use of it.

So next up, I want to talk a little bit about the SEC's recent take on staking. So the SEC has declared certain staking services as not a security offering. And Josh, I know Figment is dealing with it on the forefront. Can you tell the audience a little bit more what is staking and how does it impact the thought process at SEC? How does it impact the industry?

Josh Deems:

Yeah. So basically, staking is a consensus mechanism that non-Bitcoin effectively protocols operate on top of which requires participants to lock their tokens without transferring the custody of them into a validator. That validator then is responsible for securing the blockchain for basically voting and attesting to transactions happening on the blockchain. And in return for providing that service for locking up your tokens, you earn a reward. And that reward is usually in two components. One is new inflation, so the new issuance of tokens on the blockchain, and the second is in the form of transaction fees, so fees that users are paying to each other to transact on chain.

We did not have clarity in the United States on whether or not staking, using or holding Ethereum or Solana or any of these tokens that have staking embedded within their operating, within their consensus mechanism, whether or not that constituted the creation of a security, right? You're earning rewards by validating a blockchain network. Us and our competitors and pretty much everybody had gotten legal opinion that stated staking does not, it's a technology service, but there was nothing really at the highest level of government.

And so, on May 29th, we actually received notice from the SEC, or not notice, but we received non-binding guidance that basically stated staking does not constitute the offering of a security when it's offered in the way that we do and most of our competitors offer it, which was huge news for us. It just gave us a sigh of relief, because it gave legitimacy to what we were doing and the rules looked exactly as we had thought that they would be designed. Again, it's non-binding guidance so if there were to be a new SEC that were to come in under a new administration, that could potentially go away. But that was a really good step in the right direction.

The second thing is about a month and a half later, the SEC followed up with guidance around liquid staking token. So we talked about what staking is, a liquid staking token is a representation of a stake position, but it's liquid, it's tokenized. So my stake Ethereum can become tokenized. I can deposit my Ethereum in a protocol called Lido and receive ST ETH or staked ETH back. But I can trade that, I can transact that, which I can't do when my Ethereum is locked. The SEC came out and said, "LST, those liquid staked tokens, also don't constitute the creation of a security in July guidance.

So I think, very similar to you, Wasim, I've been in lockstep with a crypto task force over the last couple of months. I think again, it's just a signal. If anything it's symbolic, that this SEC is willing to engage, willing to have the conversation, willing to be educated. We've done teach-ins. They've said, "Hey, just come in and tell us how these things work." We'll bring people from our engineering team or our compliance team or whoever to come in and just engage. And I think that sort of engagement is leading to good decisions, even though it's not law, at least rules that operators like us can abide by, so yeah.

We think the next thing that will happen from here on out is the whole reason we want the SEC to kind of be in favor of staking as a technology service, not constitute the offering of a security, is so that the ETFs, the impending Solano ETFs and the existing Ethereum ETFs in the United States, which have almost $20 billion of assets in them, can stake those assets; because today they can't because there wasn't this type of clarity around whether or not the act of staking created a security or not.

Markus Veith:

Thank you. Just one more point, you mentioned you got a legal letter, right? I think before the shift in the stance by the SEC, I think law firms were less and less willing to issue a legal letter, right? Because as an accountant, I deal with it. I would be the one that says, "Hey, do you have a legal letter, a legal opinion that says it's not a securities offering?" And law firms, like accounting firms, have been holding back saying, "Look, this is becoming too risky. It's becoming too hot a topic." So it's good to see that we're finally making progress here.

So next up, we already talked a little bit about the state level, so I'd like to hear a little bit more how the federal initiatives impact the state level. And if you can also talk a little bit what we mentioned about the bipartisan and blue versus red states a little bit, if you can.

Joe Ciccolo:

Yeah, and I think I talked about preemption before, and I think that's a concern for the states having their sort of orbit of regulatory oversight and what does that look like in response. And I think that there's a lot of wait and see on that.

As far as bipartisanship, I've met with some of the other chapters or other groups at different states, both red and blue and I guess purple, we can throw that in the mix. And we agree, we want to make this bipartisan or nonpartisan at all. And so, I've met with some of the other blue state leadership and how can we elevate the voices of folks that are out there that have been enthusiastic about crypto and it just so happens they're Democrats. How do we make sure that we don't lose them in the process? And at the same time as an extension of that, how do we bring on board more Democrats and more folks on the liberal side of the aisle that do support crypto, and what does that look like so it doesn't become about one particular elected official or one particular political party.

And different ways of achieving that, right? In California, we talk about the balance between protecting consumers and being pro-innovation. Right? We have Silicon Valley and we sort of fancy ourselves being ahead of the curve on protecting consumers; both noble pursuits that I don't think are mutually exclusive, so using that. And then, maybe if we talk to some folks from Texas, we might get a different opinion about the swashbuckling entrepreneur and how can we mine more crypto and things like that. So it's about appealing to the constituency and finding what resonates in terms of messaging.

Real quick, since it was mentioned before, we were talking about staking; so following that, a lot of the states rescinded their cease and desist against staking rewards. California was not one of those states. There's still an active cease and desist that targeted Coinbase, although it's widely viewed as a blanket across the board. So Commissioner Mohseni said he'll reconsider that in a recent conversation with me, so hopefully he'll follow up and take a look at that. But it just sort of shows that it's not sort of one-to-one, right? The federal government does something and the states go, "Oh, that sounds good to me." There's still going to be a back and forth and a little bit of a tug of war going on.

Markus Veith:

Great, thank you. So kind of like to round it up, I want to get back to the federal level. Chris, can you talk a little bit more or take a look at the crystal ball and see what you think we'll see in the near future as other federal regulation or initiatives that will give us regulatory clarity?

Kristopher Klaich:

Sure. Yeah. So right now the administration's three main priorities are developing the rules and regulations that will flow out of the GENIUS Act that was passed at the end of July; developing the market structure legislation that we've talked about, that has to go through a process which I can break down a little bit more; and then, also the Strategic Bitcoin Reserve Act. Those are the three main priorities that the administration has and is leaning in to hard.

The process for having the market structure bill passed, as I mentioned before, it's much more complex than just throwing some words on a paper and having a vote in sometime over the next few months. Right now we have new language that has come out of the Senate Banking Committee that we and others have helped to shape by providing input into what we think ought to be in the bill. That will be marked up, which is really sort of a public opportunity where the Senate Banking Committee comes together to edit and debate the bill inside the committee.

The Senate Agriculture Committee is doing the same thing. They're probably a month or so behind, give or take. So we are waiting for language, draft language to come from the Senate Agriculture Committee for their portions of the bill. The industry will comment on it, provide some feedback, and there will be a markup on that bill in the Senate Agriculture Committee sometime probably in end of October, potentially November, ideally with a vote before Congress goes out of session for the end of the year.

That's probably the best case scenario. And like I said, the administration is leaning very hard on Congress to get something done, but you just never know. I say this in a loving way. I cut my teeth in D.C. working in the Senate, but Congress is sort of like a cat with a laser pointer. And again, I don't mean that to demean them, but they end up being focused on whatever is in the front page of the news. So if there is an attack, there's a war, something like that, attention can shift very quickly and momentum can stall very quickly. And so, the time to act is to push now and to try to get something completed as soon as possible.

Wasim Ahmad, Founding CMO & Business Development, Vault12

Joe Ciccolo, Founder & President, BitAML

Josh Deems, Head of Americas, Figment

Kris Klaich, Senior Director of Operations & Policy, The Digital Chamber

Markus Veith, National Industry Leader Digital Assets, Blockchain & web3, Grant Thornton (moderator)

Boston Blockchain Week

Markus Veith:

Great, thank you. And just I guess the last question real quick, just a sentence or two, I just want to ask the panelists what they think we will see in the next five years near-term, mid-term from a regulatory development. Chris, do you want to start?

Kristopher Klaich:

I think if we do have the market structure bill passed over the next several months, real world assets and asset tokenization has, many companies are already jumping in even without full clarity because they see the writing on the wall and the opportunity is just massive, massive from a financial perspective and efficiencies perspective. So I think that focus will shift there. And the focus is never far from the national security issues as well. That is an underlying and continual concern that won't go away regardless of what is passed and when it's passed.

Markus Veith:

Wasim.

Wasim Ahmad:

Sure. I think market structure bill getting signed means a huge wave of momentum for consumer crypto financial services. Every bank will offer exposure to crypto, and then exposure to other services like insurance, inheritance, et cetera. And hopefully we'll see the end of our reliance on software wallets and not ridiculous hardware wallets and we'll just deal with all of that on devices like this, which is strong enough to hold my passport so it should be strong enough to hold my crypto.

Josh Deems:

Yeah, I'm with you, Wasim. I really believe in this idea of a super app where you can have access to your banking, your crypto, your commodities, your stocks. You can pay anybody anywhere at any time without any sort of intervention or anyone in between. I think that's like if we land a market structure bill and we do it right, I think we'll have this sort of concept in the US. The last thing I'll say is I want to own Bitcoin and I want to own Solana and Ethereum and be able to stake those two in my retirement account. That's a lofty goal.

Joe Ciccolo:

Fantastic. What do I see in crystal ball? I think the turf war is going to ramp up the states and the federal government, not just with GENIUS, but presuming that CLARITY moves forward in some form or fashion I think the issue of preemption is going to remain. And I think you're going to see the states sort of push back, a lot of that obviously driven by politics, and so we will see that how that shakes out. The state regulators aren't going away. There's not going to be a spirit of Halloween banner across the state regulatory agency offices. It's just going to be a matter of who's going to oversee what and how they complement or don't complement each other.

Markus Veith:

All right. Thank you very much.

DC Blockchain Summit | The Mindset of Retail Investors

Presented at DC Blockchain Summit 2025 in Washington D.C.

🎙 Featured Panelists:U.S. Rep. Shri Thanedar, Andrew McCormick, eToro, Tarek Mansour, Kalshi

Moderated by: Wasim Ahmad: Wasim Ahmad, Vault12

Livestream: livestream

Youtube: https://www.youtube.com/@TheDigitalChamber/videos

*** Special Offer for Podcast listeners ***

Promo codes for Vault12 Guard

The iOS codes are good for 1 year subscription at no cost, then will revert to standard price for Inheritance plan. iOS codes can be redeemed in the Apple App Store.

The Android codes are good for 90 days subscription at no cost, then will revert to standard price for Inheritance plan. Android codes are redeemed when selecting and paying for the Inheritance plan in the app.

Instructions for how to redeem here.

Code: CMNYC25

iOS: https://apps.apple.com/redeem?ctx=offercodes&id=1451596986&code=CMNYC25

Android: Enter code CMNYC25 when you select the Inheritance plan

Transcript

Wasim Ahmad:

Hey, everyone. My name is Wasim Ahmad. I'm one of the co-founders of Vault12, which helps retail investors do cryptocurrency inheritance, something that everyone needs to think about because no one's going to do it for you. And then, joining me on the panel today is Tarek Mansour from Kalshi, Andrew McCormick from eToro and Congressman Shri Thanedar from Michigan.

Wonderful. Great. Okay, so we're going to jump into it straight away. So my first question is for Andrew and Tarek really to define for us the conversation around retail investors. So who have they been and how is that evolving? Do you want to take it away?

Andrew McCormick:

Yeah. I'd love to jump in. Thanks, everyone, for being here. So I think we've seen some incredible and really cool trends in the last couple years. Historically, the stereotypes is investing is for older, rich people, and that's it. In the last couple of years, we're seeing all those barriers fall down. In the US in traditional markets, we've seen 50% of Americans typically own stocks. That's now more like 60%, 65%. A percentage of Americans holding crypto assets in the last two to three years has doubled. And I think what's especially cool is there's more people investing, but also at a younger age. And at eToro, we are retail trading platform serving millions of customers around the world and a majority of our users are millennials and younger, which we classify as young investors, which brings joy to my heart, because I'm barely a millennial. So technically I am still at age 42, a young investor.

And so what we see more people are investing, at younger ages and it's having a very interesting impact because younger folks have a longer time horizon so they can take more risk. Stereotypically, that's like the YOLO trades people talk about in the news, meme stocks, meme coins, but it goes beyond that. We've seen ETF assets more than double in the last five years. And I think it's cool because if you're a young investor and you're starting at 20 instead of 45, you can take more risk, you have a longer time horizon. I think that's really, really healthy and really exciting and will seem relevant to your world. An amazing trend we're going to see in 20 years is where just 80 plus trillion dollars are going to pass from older generations to millennials and younger by 2050.

Wasim Ahmad:

And 7 trillion of that is going to be in crypto assets.

Andrew McCormick:

That's a great commercial for you. And what's amazing, most of those assets today are probably in advisory accounts where people go into an office, they meet with a financial advisor once or twice a year. And younger investors, I don't think that's our jam. That's not what people are going to do in the future. And so mobile trading apps where people are doing these trades on their phone, I think are going to be a recipient for a lot of these types of assets. And maybe that's crypto, maybe that's meme stocks, maybe that's really cool binary futures platforms where today, older folks aren't really down with it, but in the future, it's going to be the norm. So more people investing and younger, and I think that's a powerful force.

Wasim Ahmad:

So Tarek, you started your company at the age of 22. So your retail customer's older or younger?

Tarek Mansour:

We have the full spectrum. So it's definitely concentrated. It's a curve that just goes down as the age goes up. But maybe just a little bit of context on how we started the company. So what we do at Kalshi, we're a prediction market in the US, the leading one. If you didn't hear the name of the company, you probably heard that we were forecasting Trump winning the election leading up to the election. What we do is we list derivatives, we're regulated by the CFTC, and these derivatives are yes or no question about anything that could happen in the future. Who is going to win an election? Will it rain tomorrow? What is the Fed going to do at the next meeting, and is a hurricane going to hit a certain city? So I actually started the company after spending some time at Goldman and Citadel, and the key insight that we saw when I was there, the clients were not retail clients, they were institutional clients actually. They were asking very simple questions about the future. It's like, "Hey, we want to hedge against Brexit or get exposure to Brexit." That was actually 80% of the flow we used to get at the desk at Goldman.

And what we would do is we would use traditional assets to give them that exposure they were looking for. But there were a few problems. One, it was a proxy. So a lot of people actually put on an S&P short ahead of the 2016 Trump election because they thought that was a Trump hedge. Trump did indeed win. So they were right, but they lost money because the S&P went up. And then number two is kind of opaque, it was OTC, the banks would decide the price, and there wasn't sort of a dynamic transparent marketplace for these things. That's where we came from to build this marketplace.

So going back to the question about retail, what we see with Kalshi, so we spent years getting regulated, we've grown a lot now, we have millions of customers. And these customers are actually generally speaking, people that have traditionally not been in financial markets. Our average customer, if you ask them, "Do you trade in options and derivatives?" Their usual answer is actually, "No because I don't gamble." And the reason they answer that way is because what we've built is we've built a tool, a financial instrument that a much vaster and wider range of people relate to. A lot of people may relate to things around culture and what's going on there or the weather. Most people relate with the weather, because they can see if it's rainy or sunny or politics, which a lot of people... I mean, I don't need to tell you about how much people relate with politics and a variety of other things, but they didn't really have a mechanism to actually express opinions on these types of topics that they relate to or have views on or hedge risk with respect to these things. And it's so interesting because if you're a person that's worried about Brexit, how it's going to impact your business, you actually understand that very, very well and intricately. You may not understand a lot of the traditional assets.

So we see kind of this rising class of people that are entering financial markets, but really through prediction markets, through Kalshi, and it's this sort of idea of... I like the analogy at the time Uber was like the pitch to a lot of drivers was like you have extra time, how about you monetize it? And this rising class of people that... And it's really beautiful. You read the news a lot. You know a lot about the economy, you have a lot of views, you go to trivia night and argue with your friends on Twitter. You have a lot of knowledge, how about you monetize it? And that's really what we're seeing at least on our end. And I find that very, very exciting because the playing field now is pretty level. Citadel is not actually the dominant force in our types of markets. It's retail.

Wasim Ahmad:

Great. Great. So Congressman, I want to turn to you. You represent a district in Michigan. You were the only democratic co-sponsor of a bill that focused on removing the IRS from being able to kind of mess around with CeFi and DeFi corporations. What is your vision for how crypto can help retail investors?

Shri Thanedar:

Well, look, thank you for having me on the panel, Wasim.

Wasim Ahmad:

Of course.

Shri Thanedar:

My name is Shri Thanedar. I represent Michigan's 13th Congressional District, and I was proud to vote for the FIT21 and as well as Resolution 25. Again making it easier, in my district now, my district is one of the fifth poorest district in the country, and I'm starting to see Bitcoin ATMs popping up especially in the low income areas, something that is charging 20% premium on purchasing Bitcoin. So from that, how do we go to a position where crypto is in every wallet and people, not just the wealthy and accessible, but people at the low income area, how would they start using this as their daily currency? How would my small mama-papa businesses would use this to do business across the world? And then, how does Congress come in and make it easier? How do we make sure that the innovators and entrepreneurs aren't going to UAE and aren't going to Singapore and everywhere else, that we have meaningful guidelines that the innovators and the entrepreneurs feel comfortable setting up their shop in the US because they could go take their laptop and go anywhere they want to go. And how do we keep them here in the US? How do we make this, just make sure that crypto is in every wallet?

Wasim Ahmad:

Great. So I'm going to delve into those questions a little later.

Andrew McCormick, eToro

Wasim Ahmad:

So before we get there though, I would like the panelists to talk about what are the biggest challenges facing retail investors today.

Andrew McCormick:

So there's certainly challenges. I'm a lawyer by trade, so I'll give a disclosure at the beginning because lawyers love disclosures, that there's no better time in American history to be an investor than today. So typically, you would need to know a financial advisor. Just to place a trade, you need $20 to pay a commission. You'd have to buy a full share. And if you want to do that for G&E or something, you might need $300 to place a single trade. Today, you can get started with $10. Whether that's a stock, ETF, crypto. And so there's no better time to be an investor than today. It's never been easier. At the same time, there's never been so many educational resources out there, so many platforms that are making cool, innovative, engaging products that help people build better lives for them and their families.

Some challenges though with that is there's persistent news out there, right? So years ago, if there's a huge drop in the stock market, you read about it the next day in the newspaper, you go to work. Now you're getting alerts on your phone, your friends are talking about it, you see it on TV, social media, emails, so it's easy to freak out and get scared. And there's probably nothing worse as an investor to do is to panic, to make an emotional sell, emotional trade. And I think that's hard in today's market because there's just information everywhere, which is really great and empowering and breaks down barriers but can cause an emotional drain on you, whether it's finance or politics or your sports team is not performing how you want, you see it all the time. So I think that information overload is a challenge, so I think it's important as an investor to stay committed and don't freak out and just plan for the future one step at a time.

Wasim Ahmad:

So eToro is like the Robinhood of Europe, and then you have a footprint now in the US that's growing. Really what is it that you're delivering that addresses the challenges of retail investors? Is it a smoother on ramp into a variety of different financial products? Is that kind of your mission?

Andrew McCormick:

So one is diversity of products, right? We're not just crypto, we're not just stocks. We have crypto, stocks, ETFs. In the future, we'll probably have futures and investment accounts and advisory accounts. So the diversity of offering is number one. Number two, we're very passionate about education. So we have a whole content called the eToro Academy with hundreds, maybe thousands of articles, videos in what we call snackable content. It's like not some long thesis that no one's ever going to read, like a two-minute video on key topics. What's an ETF? What's day trading? Things like that, where people can digest it in the way we digest news and information today.

And then, just trying to make it super easy to get started. No commission on stock trading. You can make investments for as little as $10. So my family, we're passionate about Chipotle. So one thing that like all our kids eat, and historically you might need $500 to buy a share of Chipotle. Now if you're passionate about Chipotle and you're like, you know what? I don't want to be just a customer there, I want to be an owner, $10. And you can start building that platform, and that innovative $10 entry point is not something that most firms offer.

Tarek Mansour, Kalshi

Wasim Ahmad:

That's great. So Tarek, you have upwards of 2 million downloads, billions of dollars in the market, and then you have partnered with Robinhood and Webull. Is that right?

Tarek Mansour:

Yeah. With more in the pipeline.

Wasim Ahmad:

Right, right. So what are you seeing as either challenges or just things that retail investors are overcoming in the rush to jump on top of prediction markets?

Tarek Mansour:

Yeah. I mean, I think, yeah, we now have, I would say one of the largest ecosystems in terms of retail presence in the US. I'll talk a little bit about the challenges because I do think it's an interesting question. I think of them as sort of two buckets. One of them is regulation and the second one is let's call it like short attention spans, which I think is a real problem in retail today. The thing with regulation, and I'm talking a bit more strictly about CFTC world, which is the world that we live in. I mean, historically retail has generally been a bit left off the conversation. They're kind of always lagging, generally they're underestimated. And I think the world has woken up now to like, yeah, actually retail can propel a stock to multi-trillion dollar market caps these days. That's something that was totally not possible 10 years ago. It is today. And I think there is a lot of work to do on creating...

One example is in our world in CFTC, there's actually no real consensus definition of what a retail investor is. When you're asking about retail, I'm thinking like, I actually don't really know what that is. Or a general definition, it's a dude trading, but like what is retail, and how do you think about that? Because there's sophisticated retail, there's extremely informed flow, there's less informed flow, and how do you differentiate between these? And I think so that's one challenge. I think there's a lot of work to do and I think it's been very encouraging over... In recent history, we're seeing a lot more willingness and discussion around retail in our world, in the CFTC world.

The second thing is, I think the world is short. Like we talk a lot about retail, sort of short attention span with people, but you're not seeing kind of changes that fit that. But the reality is like people can't really read anymore. The average 25-year-old cannot read a blog post. They just can't. They have to get something in 10 seconds, and if it's less than 10 seconds, they're gone. As we think about that, it's like you need to restructure the marketplace. You need to restructure education. You need to restructure the entire journey that a retail customer goes through when they experience any financial service with that core principle in mind. Like you cannot actually go force people to go read long blog posts or long terms and conditions and then tell them like, "Hey, it was there. You should have known." You have to kind of integrate that into your UX, and that's a lot of the work we do at Kalshi.

Wasim Ahmad:

Great. So Congressman, you touched on this. So how do you see crypto helping the average ordinary investor? You talked about it, you touched on it in your opening remarks, and I know Senator Cory Booker has talked about this, but it's not a general conversation that's out in the media or anywhere. So having seen poverty and all of those kinds of things, where do you see crypto helping the average person, the everyday person?

Shri Thanedar:

Well, look, the small businesses. Doing business across the world is so difficult through the current banking system, the long delays that are happening, the rejections of wires and transfer of money, the cost. As opposed to through crypto, transactions can happen in a matter of seconds. And to having that access, low cost or no cost access to be able to transact quickly, efficiently, without having to go through the bureaucracy of a bank or without having to go through the fee structure. I do a lot of business myself with India, and when it's sending small amounts of dollars to Indian vendor become so difficult because invariably, they get caught into the banking structure, and I get almost half of my wires get rejected when I go through the bank.

Whereas having that access to do business, it would mean a lot to have that access for a small business. It would mean a lot to have that access for person of low income transacting. And the blockchain just takes this further with all kinds of opportunities outside of crypto. That all need to be explored. And we in the United States, need to be the leader of the world in this. And this is where most of the innovation must happen. Unfortunately, currently, the crypto transaction, 90% of them are outside of the US, so that has to change. And that's what something I want to look at it from the Congress's perspective, how can we change regulations? How can we change things to make it easier for people to do business?

Wasim Ahmad:

Okay. So unlike a lot of Congresspeople, you are actually a businessperson, a scientist, and an entrepreneur prior to taking your place in Congress. So how are you working with your colleagues? Earlier today, there was a session with Representatives Sarah McBride, Don Davis and Sam Liccardo, talking about how they were working with Congress. So I'd love to hear from you, what are you doing to further your vision?

Shri Thanedar:

Well, currently, as we look at the voting on the first FIT21, only about 45 Democrats voted for it. The last resolution were about 72 Democrats. So a very small group of Democrats do support this at this time. I am a part of a Congressional Progressive Caucus, and there is a lot of suspicion in the Progressive Caucus about and crypto is looked at as a tool of the rich and the powerful. However, the Progressive Caucus and members of Progressive Caucus who care about access to financial markets, access to transactions, financial empowerment for people at low means, this is really the tool that [inaudible 00:19:03]. So it's going to take a long time to turn people around, but education is the key, education of members of Congress. They need to really understand about the powerful technology this is, and how this is going to help average everyday Americans.

Andrew McCormick, eToro

Wasim Ahmad:

Great. Now, let's hear from the other side. So both of you have platforms, target investors, everyday investors. How are you going to work with policymakers? What do you need the policymakers to do? How do you get better outcomes for your customers as far as working with people in Congress, people in the Senate, etc.?

Andrew McCormick:

I'd say clarity is helpful. It's interesting, in the United States and with our platform, we offer stocks and ETFs and options, but also crypto assets. And what that means, we have over a hundred different regulatory jurisdictions. 50 states all have different says on the security side, stocks, ETFs, as well as the SEC and FINRA. And on the crypto side, 50 different states have opinions on that and all different standards and rules. And when you're trying to run and build a lean, innovative FinTech, a startup that's trying to help empower customers, it's really, really hard when you have over a hundred different regulatory regimes you have to navigate. And we have operations in over 75 different countries, so we always have this very interesting AB test of like how things operate in other countries. And when we talk with our AML and compliance colleagues in the UK, for example, this all sounds crazy to them. They have one regulator, stocks, crypto-

Wasim Ahmad:

I've been working with them. It's insane what they're not doing.

Andrew McCormick:

Yeah. It's just much more efficient. And of course, there's Dubai and Singapore where they're breaking new ground and everything is very clear and certain and welcoming. I mean, this is the best place of capital markets in human history. And the money's here, the talent's here, the brilliance is here. We just need that regulatory clarity. It doesn't need to be perfect legislation, perfect regulations, but just something that's progressing and it's just clear, I think would be helpful.

Wasim Ahmad:

We're going to hear from Commissioner Peirce on the main stage, so hopefully we'll start to see some of that clarity. Tarek, what do you have to add?

Tarek Mansour:

I think we might be out of time.

Wasim Ahmad:

No, no. We have two minutes.

Tarek Mansour:

Okay. I'll do two minutes then. I'll do it fast. And it's pretty simple. I actually think my perspective is slightly different. So I think we're talking about the CFTC, the Commodity Futures Trading Commission. Obviously, CFTC is becoming more and more famous and popular these days. That's pretty cool to be CFTC-regulated because of crypto, which is awesome. I actually think the CFTC has structurally been a very... I mean, the difficulty is always kind of how do you balance sort of innovation and bringing things on shore and having the US capital markets or derivatives markets thrive, and then making sure that you don't let things explode, basically and be diligent and [inaudible 00:22:01]. Actually, my perspective after working with CFTC for I think close to five or six years now, I think that regulator has actually done a pretty good job at kind of towing that balance. And in some ways like, maybe it's one of those rarest things, like we don't have much to complain.

I mean, we have our disagreements with the CFTC. This guy from a company that has sued that regulator two years ago. And sometimes we disagree on certain issues. On that specific issue, we ended up winning. But on most issues, I think it's been a regulator that's been sort of very pro-listening to new entrants and innovation. And maybe the TLDR here is just kind of this sort of bi-directional dialogue. That's I think, pretty critical. It's for companies to actually educate regulators and vice versa for companies to listen to regulators. And so yeah, I think that's probably my perspective on this.

Wasim Ahmad:

Great. Thank you very much. I think we are now out of time. Thank you, panelists. Thank you so much for sharing your insights today.

DC Blockchain Summit

Genzio Podcast | Vault12 Crypto Inheritance and Wealth Management | Toronto

"It's one of those things everyone needs to think about; but often doesn’t." -@wasima, @_vault12__, joins @DogecoinZack to talk about digital asset inheritance, the inspiration behind Vault12, and what real adoption looks like when it comes to securing wealth for the next generation.

0:23 – What Is Vault12?

1:44 – The Story Behind the Name

2:05 – What Types of Crypto Are Being Passed Down?

3:50 – What Adoption Really Looks Like

5:48 – Wild Inheritance Stories (Yes, a dog ate the seed phrase)

6:39 – Will Crypto Language Ever Simplify?

7:39 – Thoughts on Stablecoin Wealth Storage

9:17 – What Brought Vault12 to @Futurist_conf

Listen to the entire podcast

*** Special Offer for Podcast listeners ***

Promo codes for Vault12 Guard

The iOS codes are good for 1 year subscription at no cost, then will revert to standard price for Inheritance plan. iOS codes can be redeemed in the Apple App Store.

The Android codes are good for 90 days subscription at no cost, then will revert to standard price for Inheritance plan. Android codes are redeemed when selecting and paying for the Inheritance plan in the app.

Instructions for how to redeem here.

Code: GENZIO25

iOS: https://apps.apple.com/redeem?ctx=offercodes&id=1451596986&code=GENZIO25

Android: Enter code GENZIO25 when you select the Inheritance plan

Transcript

Zack:

Hey, what's up? Zack here with Genzio. Excited speaking with Wassim from Vault12 co-founder. For our audience who doesn't know, tell us about Vault12.

Wasim:

Thanks for having me, Zach. Vault12, we do crypto inheritance. It's one of those things that everyone needs to think about, but they don't.

Zack:

I agree completely. Actually, I got my mom to buy crypto when Bitcoin is like 7,000 bucks. She has quite a bit of crypto. She's very young, I think she'll live a long time. But I can imagine a scenario where if you didn't have the right thing set up, it could get problematic.

Wasim:

There's lots of cases of people doing all kinds of very, very secure things like putting their seat phrases inside mountains and different places. The Winklevoss' split up their private keys and put them in safety deposit boxes, 30 minutes from a set of six regional airports around the country. They flew off and did that. You can't find safety deposit boxes anymore. They're going out of business. If you don't have a way for your family or your heirs to access that, if you're incapacitated or you passed away, then it's gone.

Zack:

I completely agree, and I think it's really important to be thinking about these things proactively because we're Genzio, there's a lot of young people in crypto, but they're going to grow up. We all get older. It's part of life. And having plans like that in place I think are incredibly important. Where does the name come from?

Wasim:

Vault12?

Zack:

Yeah.

Wasim:

It's from a video game called Fallout.

Zack:

Of course, a great game.

Wasim:

Absolutely.

Zack:

Very cool. And what would you say is the biggest crypto that people are passing down? Is it Bitcoin, mostly ETH? And do you guys support all different crypto or how does that work?

Wasim:

We're completely independent of any blockchain. I can't tell you the answer to that because we don't know what assets are getting saved or stored. You can store a seed phrase, you can store a private key, but you can also make a video of a riddle of the 12 words that go into your wallet. We don't know. And I'm sure it's Bitcoin, but I don't actually know.

Zack:

That's a great answer.

Wasim:

I don't know who the owners are and I don't know what assets are going in.

Zack:

Privacy is important.

Wasim:

It's a completely decentralized, distributed, peer-to-peer solution.

Zack:

Why do you think that now is the time that this is getting adoption?

Wasim:

I think the risks around cryptocurrency are being lowered slowly but surely with all the lawsuits going away, the banks can now do custody. There's stuff going through Congress and the Senate hasn't quite passed yet, but it's going to happen. Once that market structure bill is in place in August, a lot of the risks will go away. It'll be very clear what happens in the US and then the rest of the world is going to follow that model. And for banks, for retail institutions, because we're a retail company, they will start exposing their customers to crypto. And then after a while, they're going to want to talk about insurance and inheritance and life insurance and all these other things that go hand in hand when you're trying to sort out and manage your finances because your finances will include digital assets.

Zack:

I think this is really interesting too because globally different countries do inheritance differently. I know you said I understand privacy is a huge part of this. Where would you see from what you can observe in the world this is getting the most adoption?

Wasim: