Which is a better wallet: Ledger Nano X or Exodus?

Consider both your short-term needs and the long-term protection of your assets

When choosing crypto wallets, many users base their decisions on day-to-day asset management needs and perceived wallet or device security. However, savvy crypto users first consider a wallet's ability to handle long-term security scenarios.

Long-term security includes expected essentials like backup and recovery tools, and often-overlooked features related to secure and fault-proof third-party recovery. Wait, what's third-party recovery? You can think of third-party recovery as your ability to allow crypto assets to be inherited by successors. All crypto investors should have a comprehensive security strategy for the full life cycle of their crypto assets.

Let's begin by helping you understand the pros and cons of the Ledger Nano X hardware wallet and the Exodus software wallet for day-to-day activities, as well as considering their ability to safeguard the long-term security of your assets.

Overview

The Ledger Nano X and Exodus wallets both provide a wide variety of features and support a broad spectrum of cryptocurrencies, making them suitable for diverse crypto portfolios.

At a high level, several differences are clear:

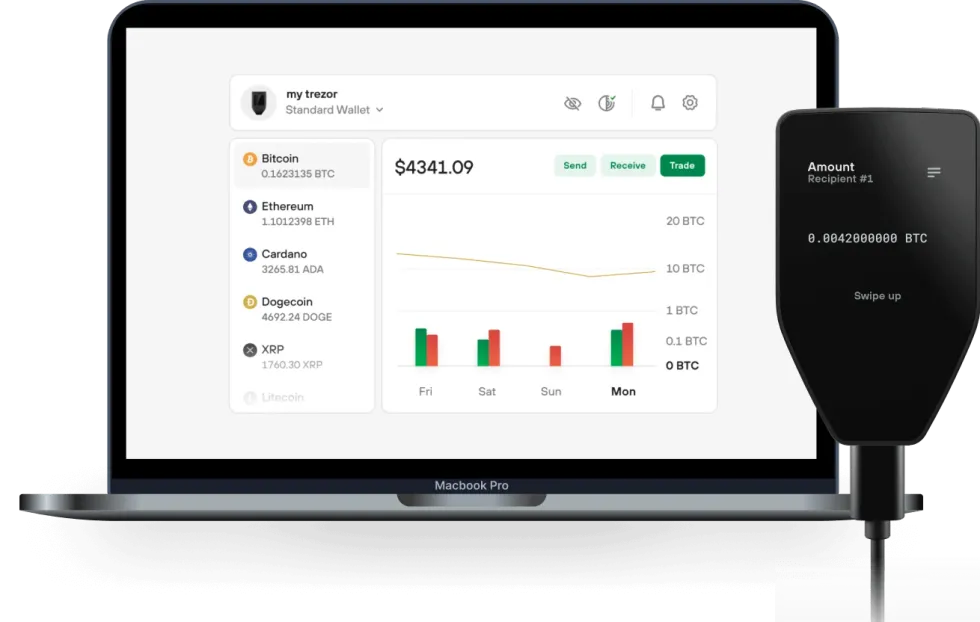

Ledger Nano X

- Form: A hardware wallet, with mobile-centric usability via Bluetooth.

- General Usability: User-friendly (with necessary trade-offs due to its more-robust security features).

- Design: Compact and durable. The de facto standard for securing transactions on desktops.

- Price Point: It's not free, like software wallets are.

Exodus

- Form: A software wallet, available in both mobile and desktop versions.

- General Usability: Easy to use, and has particularly well-reviewed customer support.

- Design: Built-in exchange features and a moderate number of integrations.

- Price Point: The wallet software is free; the company makes money on exchange services provided through the wallet.

The decision between the two will likely hinge on individual preferences for target security requirements, preferred platforms (mobile or desktop), and should take into account the planned frequency of use.

Approach to comparison

Now, let's have a closer look.

When choosing the best hardware wallet for cryptocurrency security, you may wonder not only which is better, the Ledger Nano X or the Exodus, but also:

- What happens if your wallet is lost or stolen? (How well can these wallets recover from user errors?)

- How do these wallets handle more advanced scenarios like inheritance of crypto assets?

- How easy to use are these wallets?

- How do their security features compare?

This article compares important characteristics for these two popular wallets. We’ll break down the strengths and weaknesses of each, focusing on security, ease of use, and backup and recovery methods. By the end of this comparison, you’ll clearly understand which wallet is right for you, as well as how to recover your crypto assets in case of accidents.

What happens if your wallet is lost or stolen?

Wise wallet owners recognize the critical importance of crypto recovery before they find themselves in an unexpected bind! That's why it's important to understand the fundamental topic of crypto asset longevity, including features such as backup, recovery, and inheritance for crypto assets. These considerations are central to long-term planning.

Technical security is essential, but in the world of crypto, the degree to which backup and recovery solutions are foolproof for users is at least equally important. Here are the backup and recovery options for these two wallets:

Ledger Nano X | Exodus | |

Backup & Recovery methods | Recommends Recovery Seed Phrase be written on paper, or engraved onto metallic plates. | Recommends Recovery Seed Phrase be written on paper, or using iCloud or Google Account saving it along with your everyday passwords. |

Optional paid subscription | Ledger Recover, a centralized 3rd-party cloud service, highly criticized by the crypto community. Clouds are not safe — especially when operated by multiple 3rd parties. | No. |

How do these wallets handle Crypto Inheritance?

Crypto Inheritance Features

Currently, most crypto wallets, including the Ledger Nano X and Exodus, lack any features for establishing and managing crypto inheritance. This gap presents a challenge for users who want to be sure that their crypto assets can be transferred to their heirs.

Ledger Nano X | Exodus | |

Backup |

- Written only | - Written only |

Inheritance | No | No |

Decentralized backup with Vault12 | Yes | Yes |

Inheritance Management with Vault12 | Yes | Yes |

Backup and recovery differentiators

Ledger Nano X Recover service Disadvantages:

- The optional Ledger Recover backup service is a paid service provided by three corporations that each hold parts of the user’s seed phrase in a cloud. This introduces risks, as the seed phrase could potentially be accessed via subpoena; or business partners could terminate agreements or become involved in lawsuits that result in locked data or resources (like, for example, Gemini and Genesis). These scenarios contain multiple potential points of failure.

- Very important detail: The terms of the optional Ledger Recover service do not mention support for inheritance, meaning any unfortunate accident related to the user could make crypto assets unrecoverable for his or her successors. Ledger itself suggests using 3rd-party crypto inheritance services for those purposes.

Ledger Nano X Recover service Advantages:

- People have different preferences. If a user is comfortable trusting a bank with their assets, they might also feel confident using Ledger Recover for securing their seed phrase backup (even though Ledger is not providing the entire cloud backup solution).

Exodus backup Disadvantages:

- Exodus has a cloud backup feature that comes with similar security assumptions and risks as all other passwords stored in your cloud provider. It is not recommended to rely on cloud backups for significant crypto balances.

Exodus backup Advantages:

- Exodus does offer a one-click solution for backup for insignificant balances of crypto.

How easy are these crypto wallets to use?

Let's compare the key aspects of both wallets side by side, and then summarize what really stands out for user convenience:

Ledger Nano X | Exodus | |

Display |

1” Monochrome OLED, | Full smartphone screen |

Input interface | 2 click buttons | Full smartphone screen |

Cable | USB-C | n/a |

Wireless | Bluetooth | As smartphone |

Platforms | macOS, Windows, Linux, Android, iOS, Browser Extension (3rd party) |

iOS, Android, Browser Extension |

3rd party wallets and dapps support | MetaMask, Exodus + 28 more | Ledger, Trezor |

Password manager & 2FA | FIDO2 2FA & Passkeys, Password Manager | n/a |

Product size & weight | 72 x 19 x 12 mm / 34g | - |

Convenience features | Battery (Up to 5 hours in use) | Exchange support |

Number of supported coins | 5,500+ | 200+ |

Price | $149 | $0 |

Crypto wallet user experience (UX) differences

Ledger Nano X with Smartphone UX

Ledger Nano X Disadvantages:

- The display is literally the size of a coin: very uncomfortable to use.

- Requires two-handed operation, making it difficult to use with a phone simultaneously — contrary to some misleading ads.

- The buttons are stiff, making operations cumbersome.

Ledger Nano X Advantages:

- Offers Bluetooth connectivity — works with or without a cable, at least with smartphones.

- Wide support for third-party wallets and dapps, allowing the Ledger Nano X to sign transactions directly in MetaMask, Uniswap, and other platforms without relying on Ledger Live software. This is a huge advantage for DeFi users.

Exodus UX Disadvantages:

- As a product that prioritizes ease of use, Exodus does not offer a full suite of advanced features such as fiat currency on/off ramps or advanced Web3 / DeFi integrations.

- The desktop version of Exodus offers more features than the mobile version (e.g., portfolio management tools, Trezor hardware integration, and a broader set of supported cryptocurrencies).

Exodus UX Advantages:

- Exodus is generally more user-friendly than the Ledger Nano X (and other hardware wallets).

How do these wallets' security features compare?

Now, we dive deeper into the core specification of every hardware wallet: security features.

| Ledger Nano X | Exodus | |

| PIN-code | 4 - 8 digits | up to 6 digits |

| BIP39 Passphrase | Yes | No |

| Open-source | Partial | Partial |

| Secure Element | Yes | No |

| Multisignature | Yes | No |

Crypto wallet security feature differentiators

Ledger Nano X security Disadvantages:

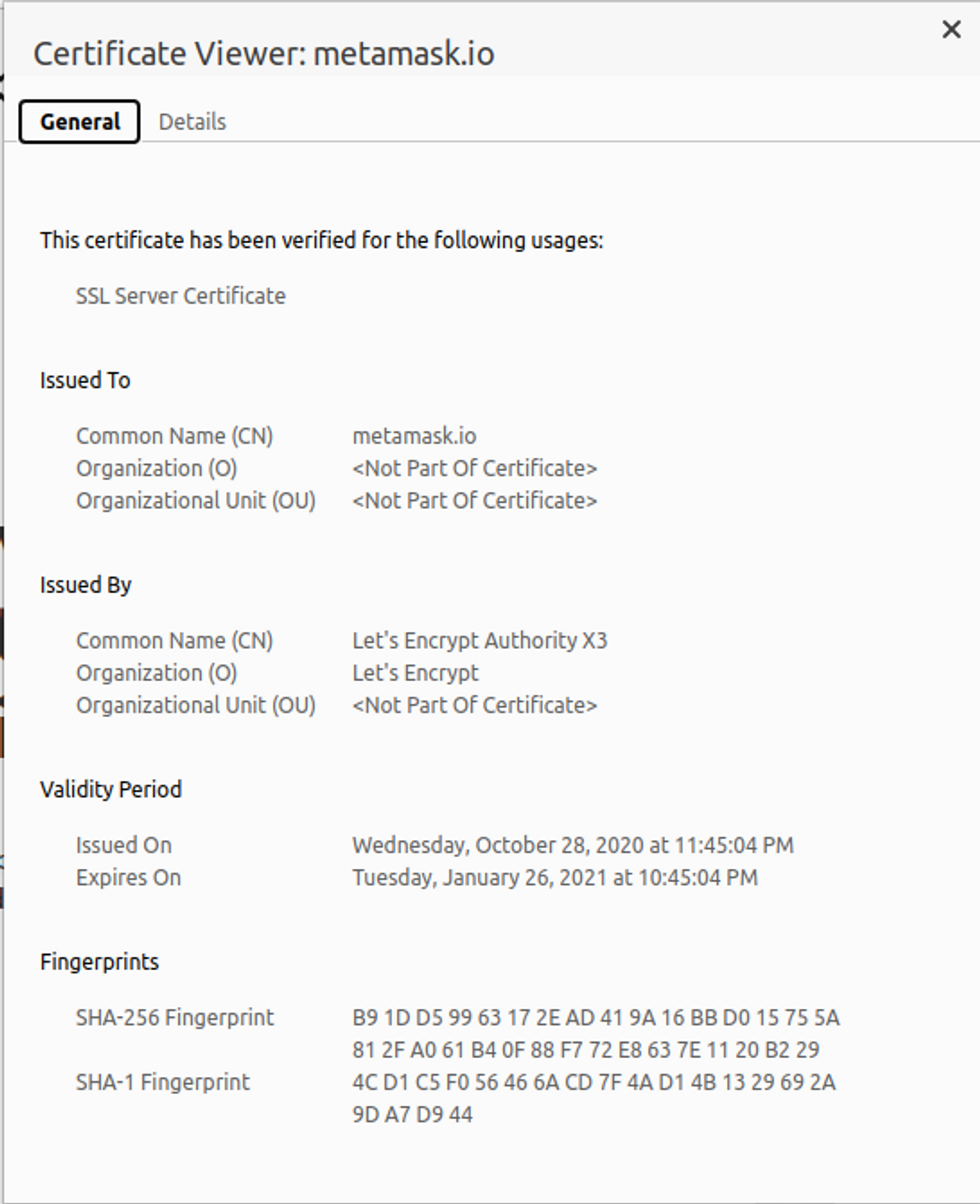

- Some critical components are closed-source. This raises concerns, especially after the controversial introduction of the Ledger Recover backup service, which challenged the previous assumption that the Secure Element could never transmit the recovery seed phrase outside the hardware wallet.

Ledger Nano X security Advantages:

- Includes a Secure Element, giving Ledger devices a strong reputation for withstanding physical attacks. This is important for users who prefer not to complicate their security with BIP39 passphrases, prioritizing ease of use.

Exodus security Disadvantages:

- Portions of the Exodus wallet are closed-source, preventing full transparency of its code security.

- Exodus, like all software wallets, operates in an inherently less-secure operating environment than a hardware wallet.

- As a software wallet, Exodus lacks a Secure Element.

- Exodus lacks support for some common security extensions such as 2-factor authentication, creation of multisignature transactions, and entry of a wallet "extra word" passphrase.

Exodus security Advantages:

- Some of Exodus's security disadvantages could be mitigated by using Exodus together (integrated) with Ledger Nano X (they are compatible with each other).

Summary of Ledger Nano X and Exodus Comparison

The Ledger Nano X and Exodus both provide a respectable set of features, and support a broad spectrum of cryptocurrencies, making them suitable for diverse crypto portfolios.

The Ledger Nano X is a mobile-friendly, security-oriented solution, and offers a balance of security and convenience features. It provides a small display and uncomfortable input, but with the advantages of a Secure Element and wireless connectivity options like Bluetooth.

On the other hand, Exodus is free and simple, but provides fewer security capabilities. It's great for beginning users and suitable for relatively small amounts of crypto.

The decision between the two will likely hinge on individual preferences for the target use case and balance, and should take into account the planned frequency of use.

Given their convenient integration, the best of all worlds could be to use both wallets, holding larger amounts of crypto in your Ledger Nano X wallet while keeping a small, ready-to-transact "petty cash" stash in your Exodus wallet.

Whichever you choose, remember to add crypto inheritance to your choice of wallet to ensure the long-term safety of your digital assets.

Vault12 Guard: a decentralized solution for Crypto Inheritance

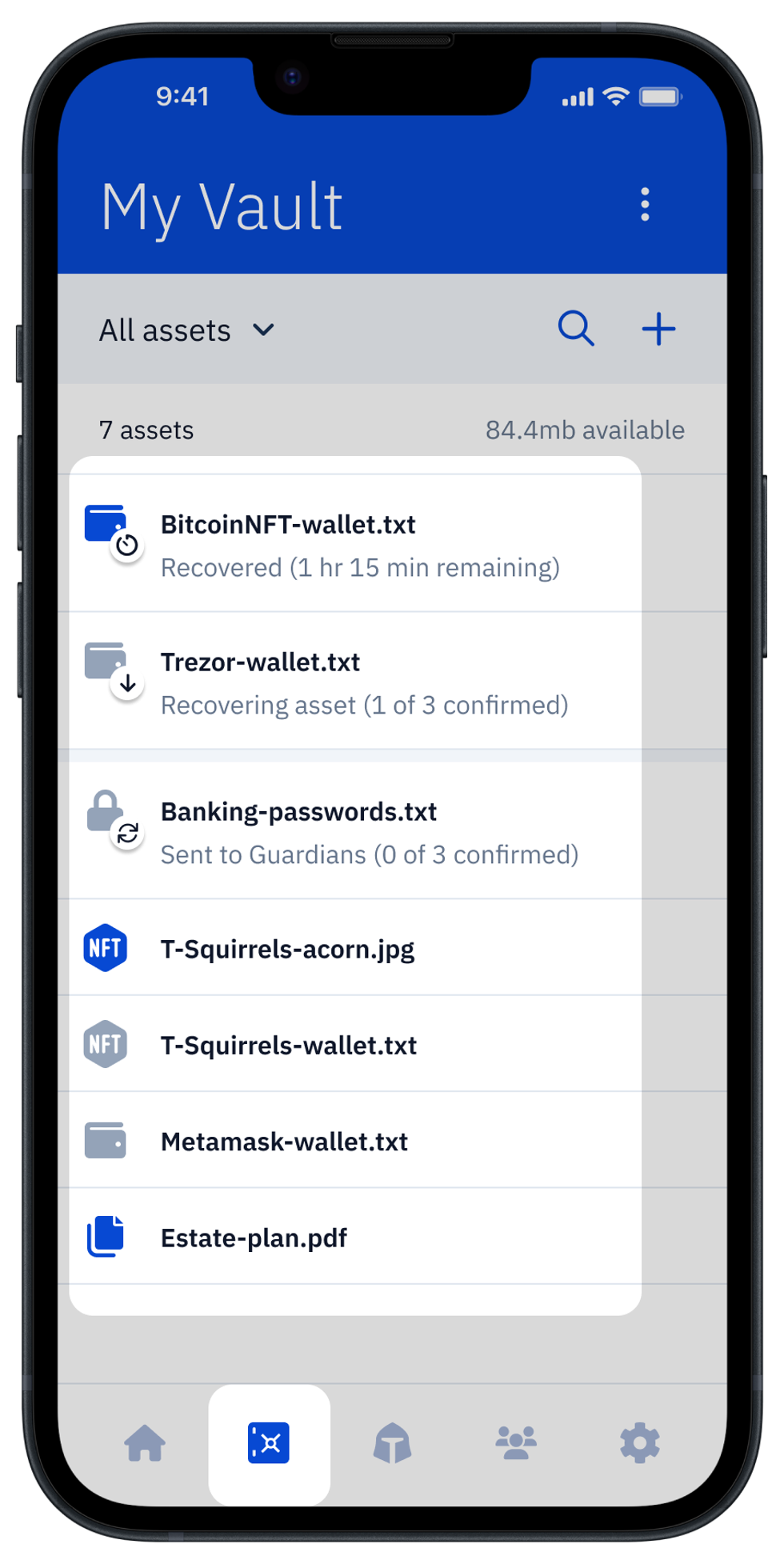

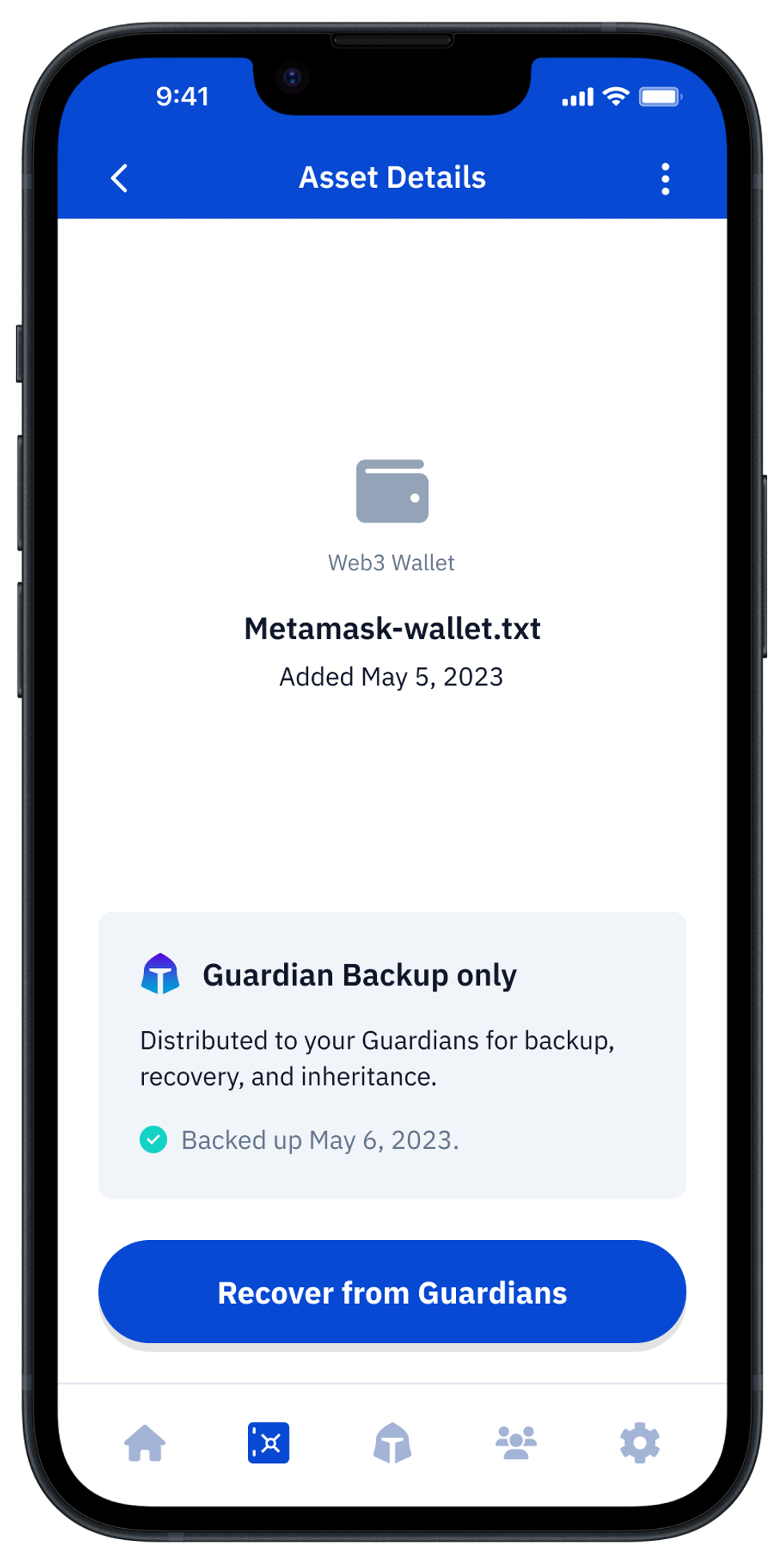

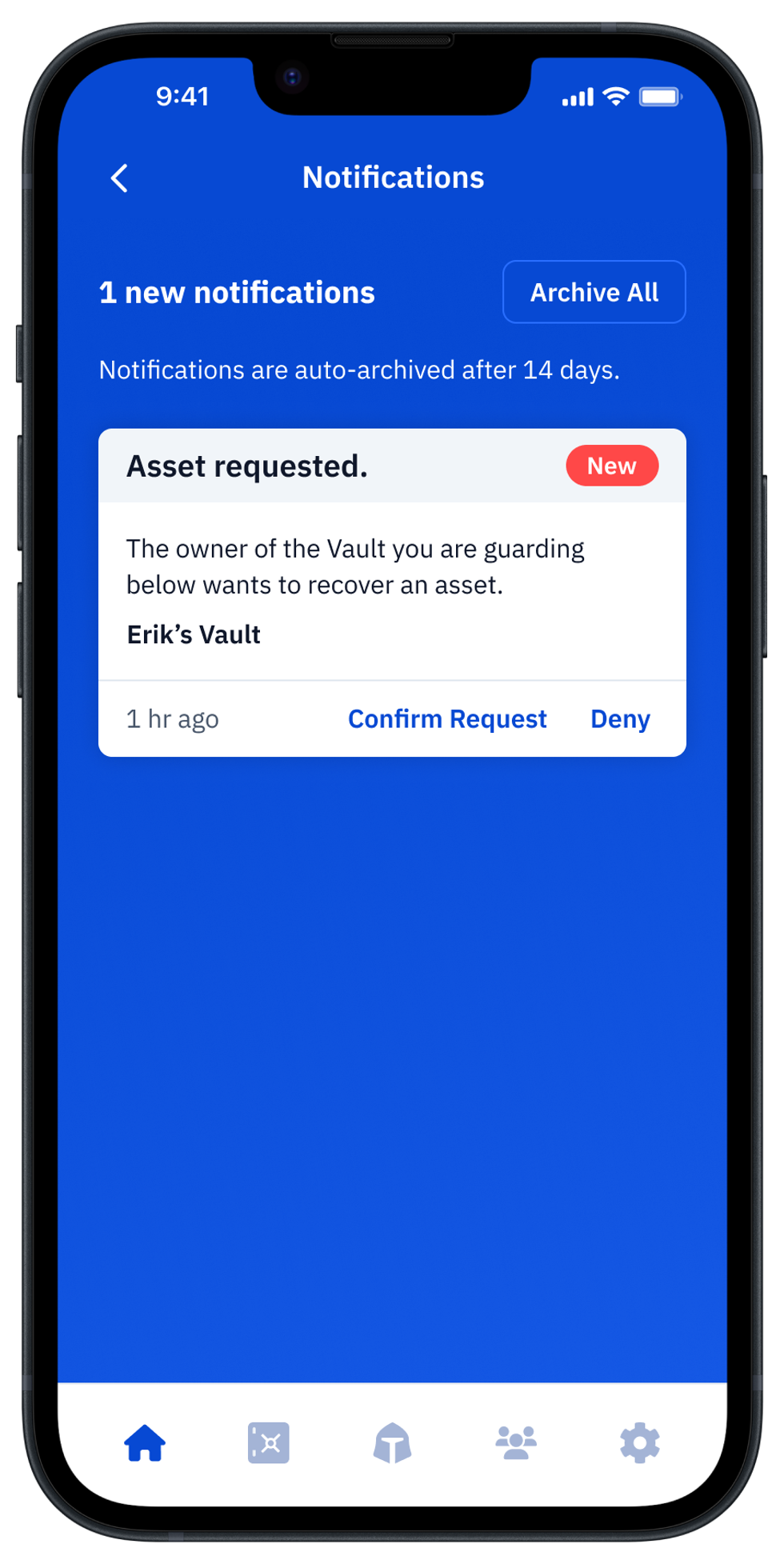

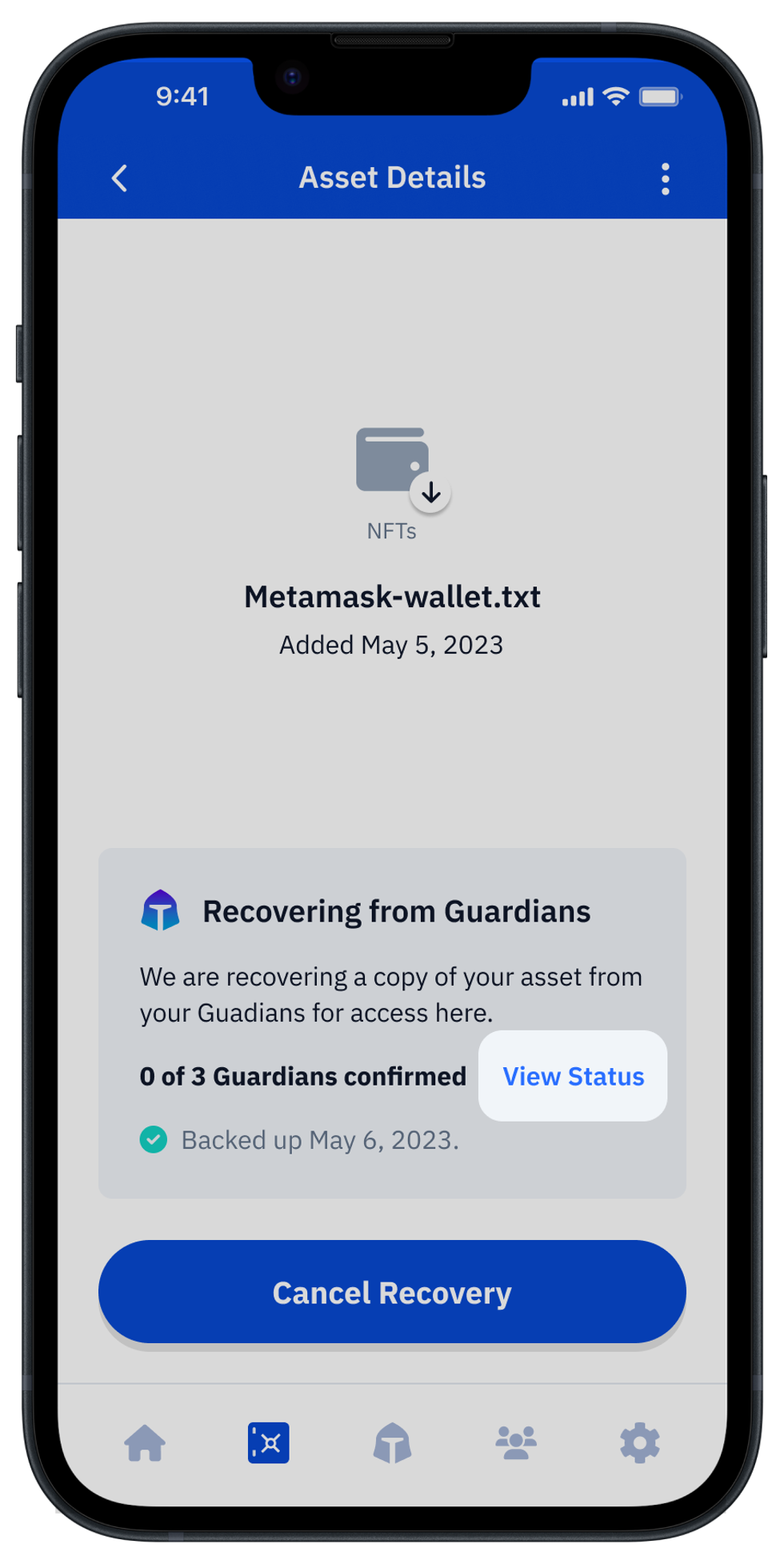

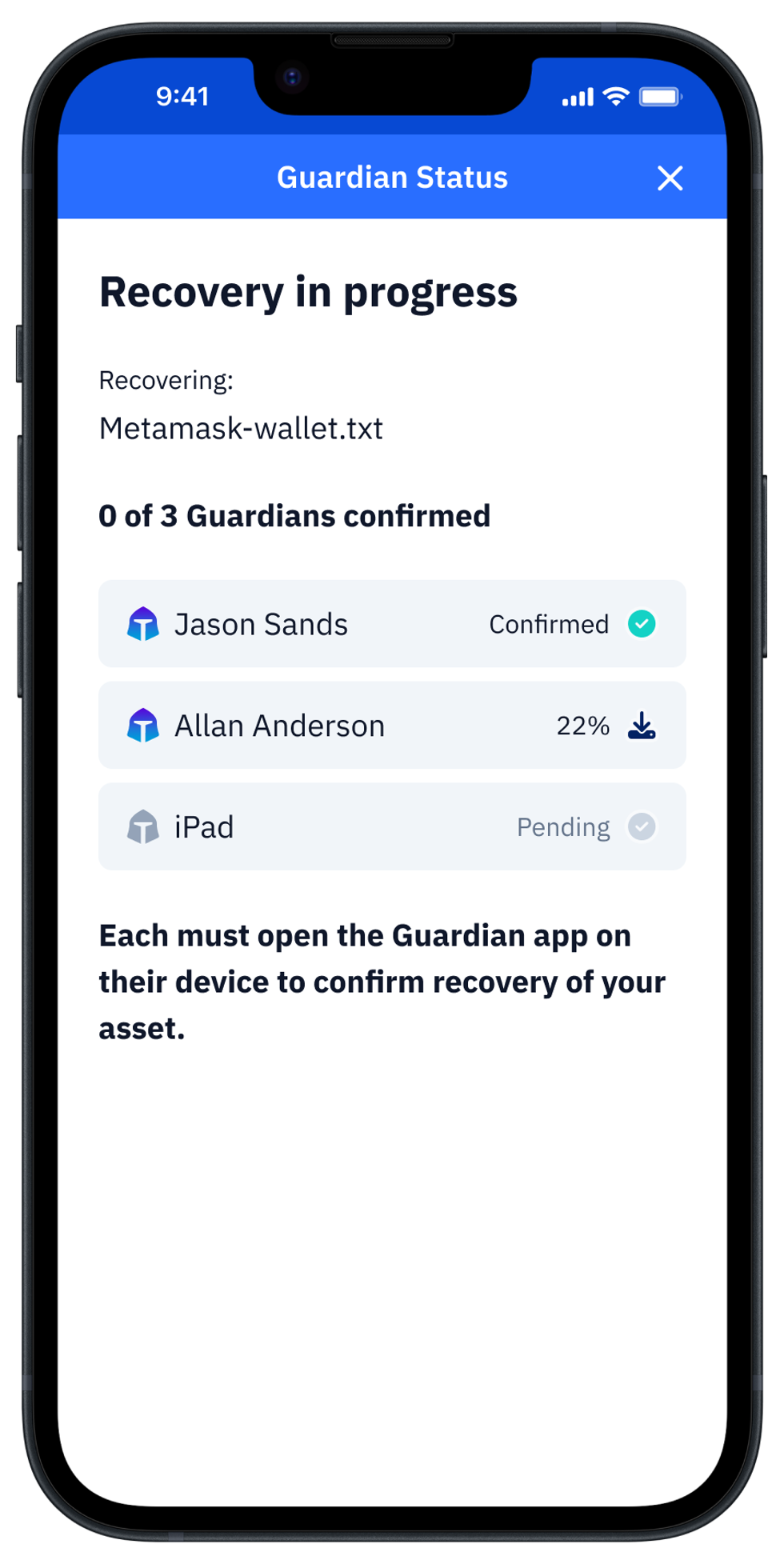

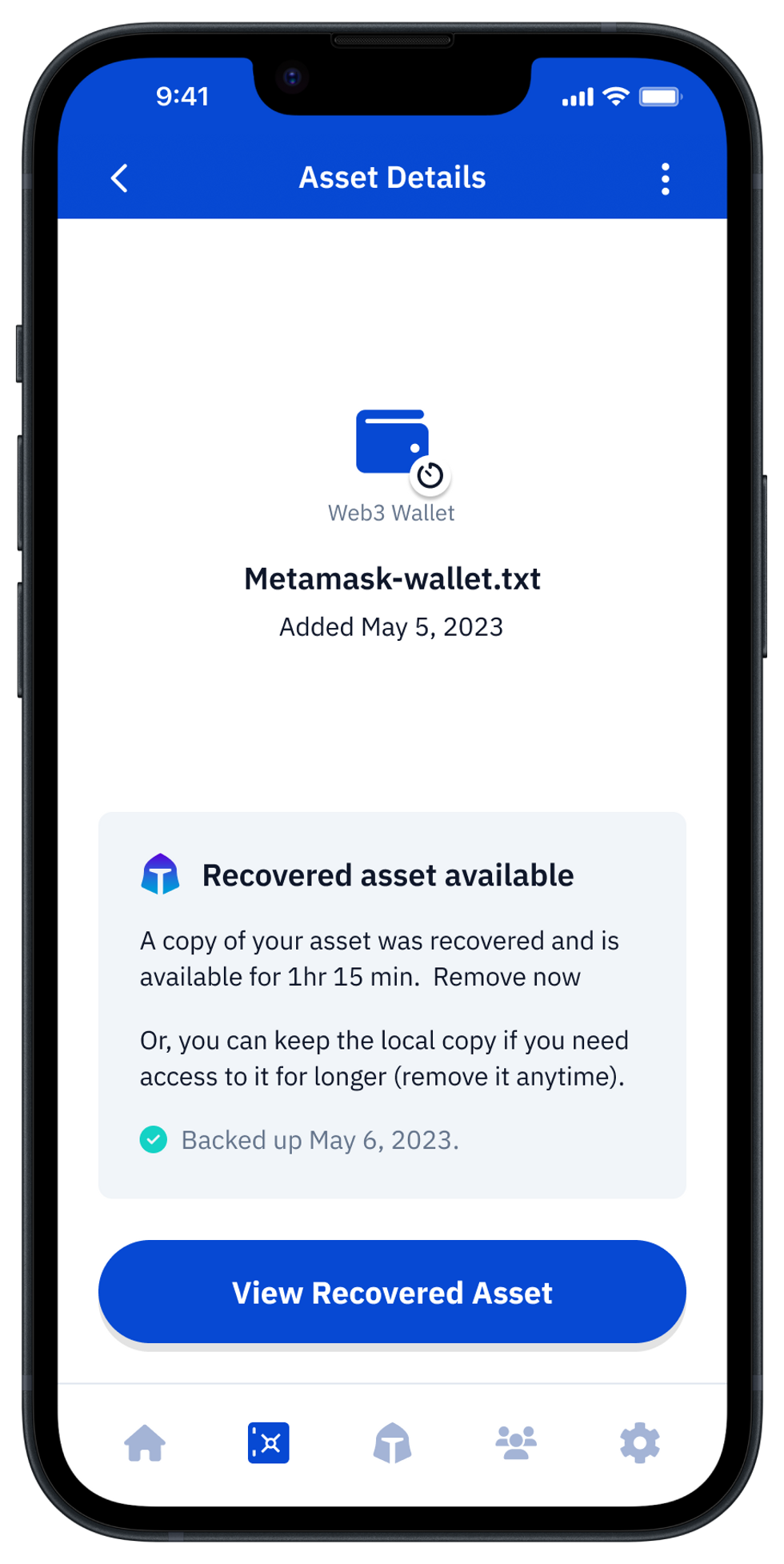

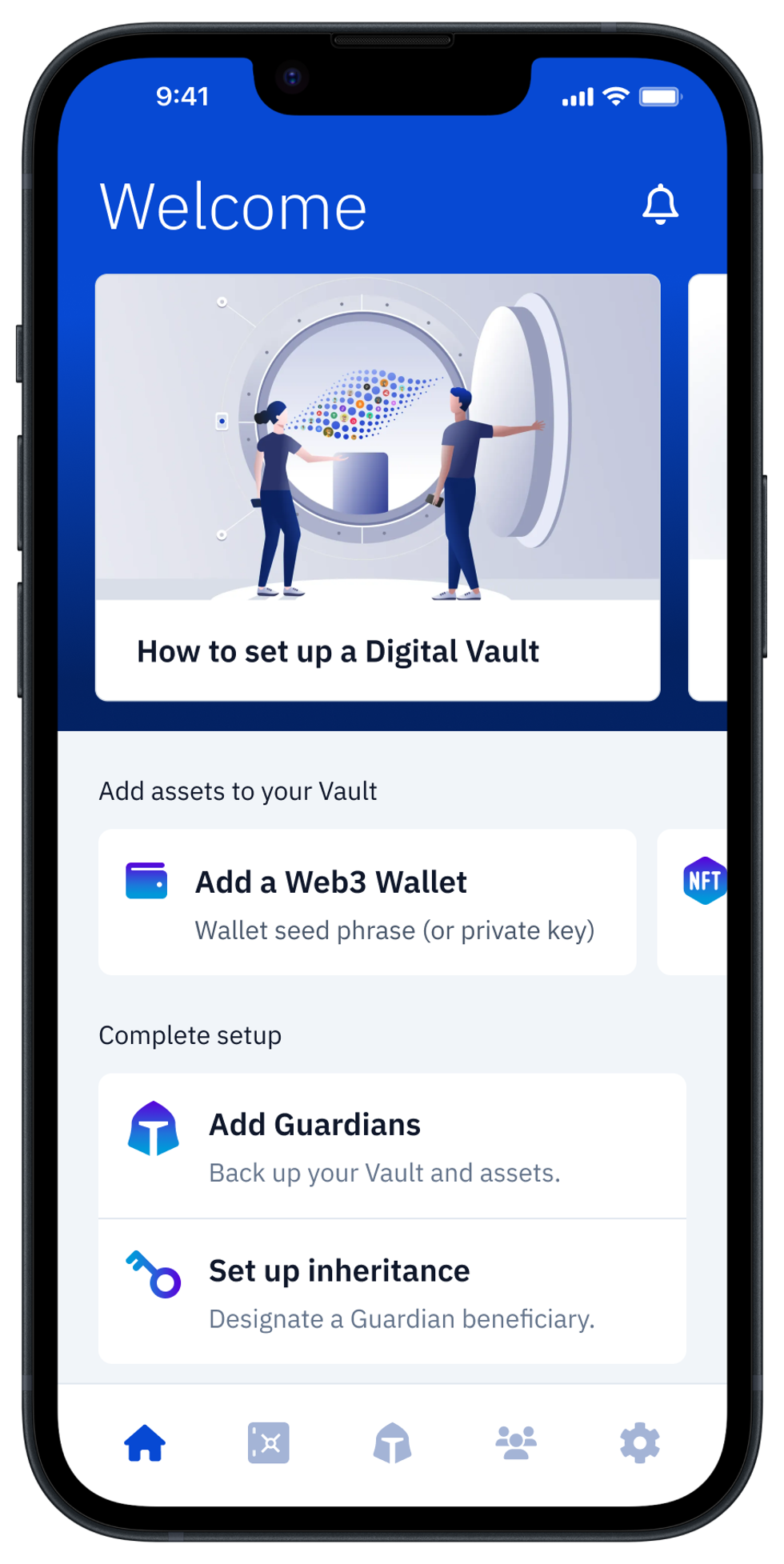

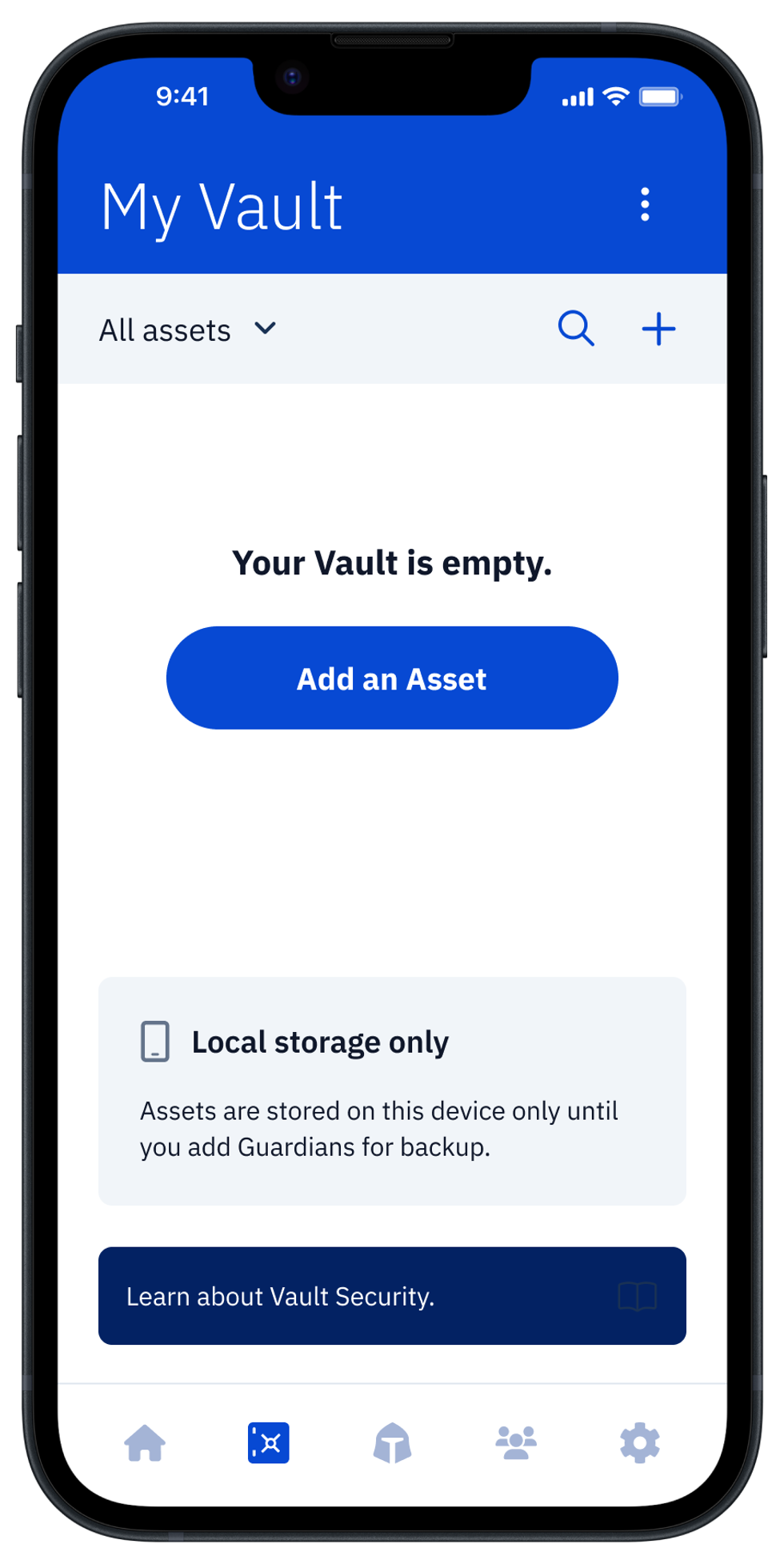

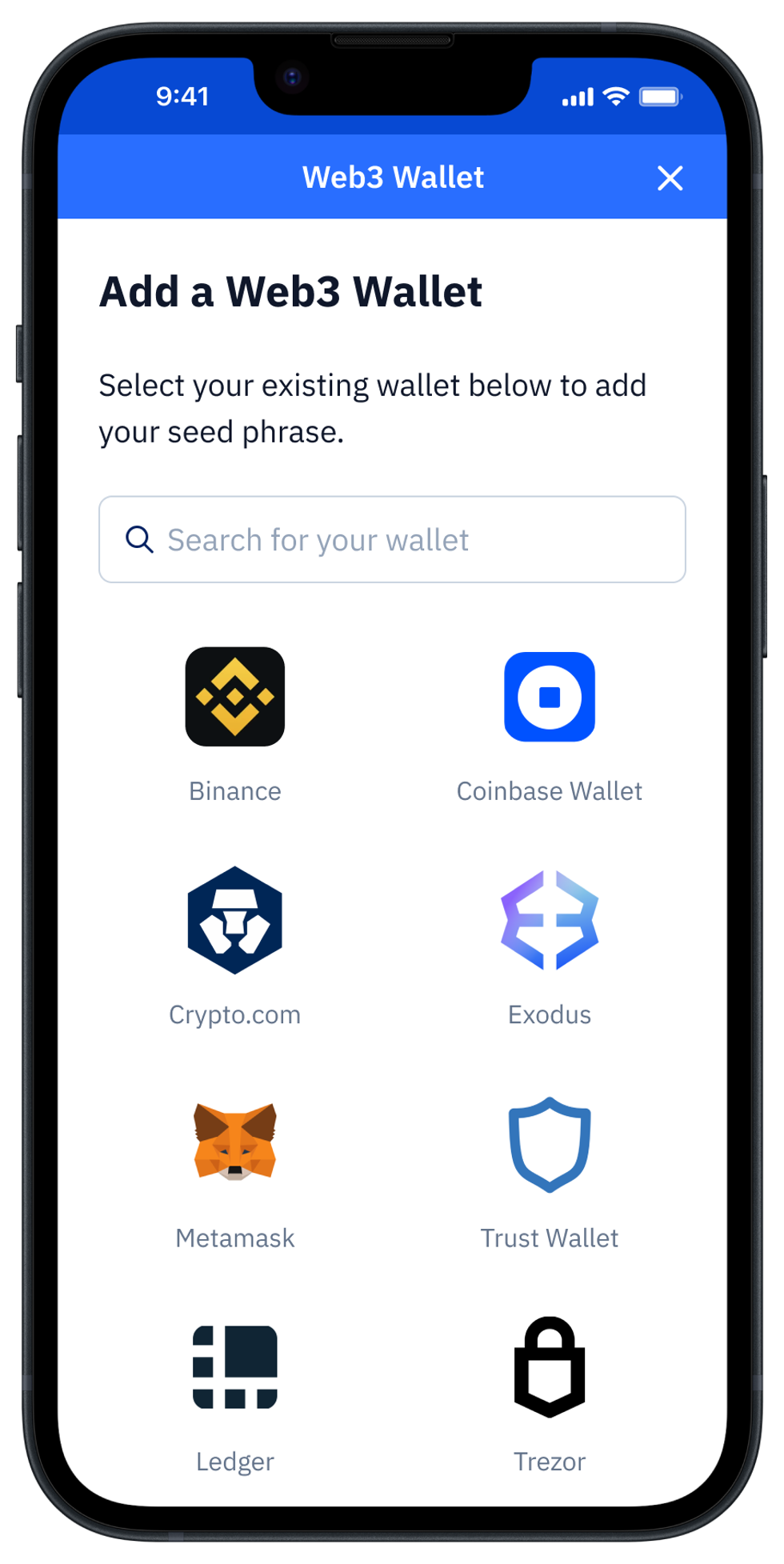

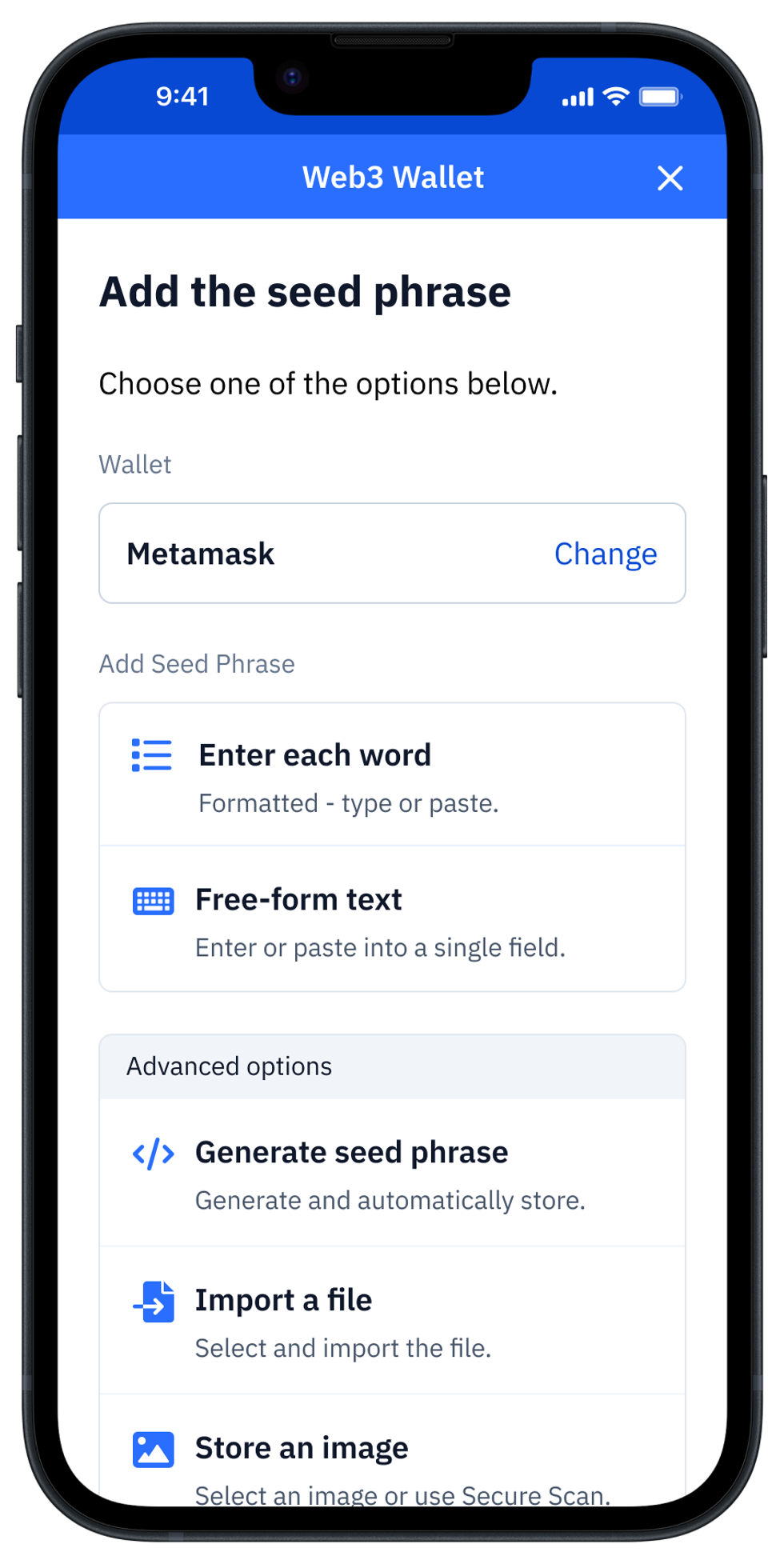

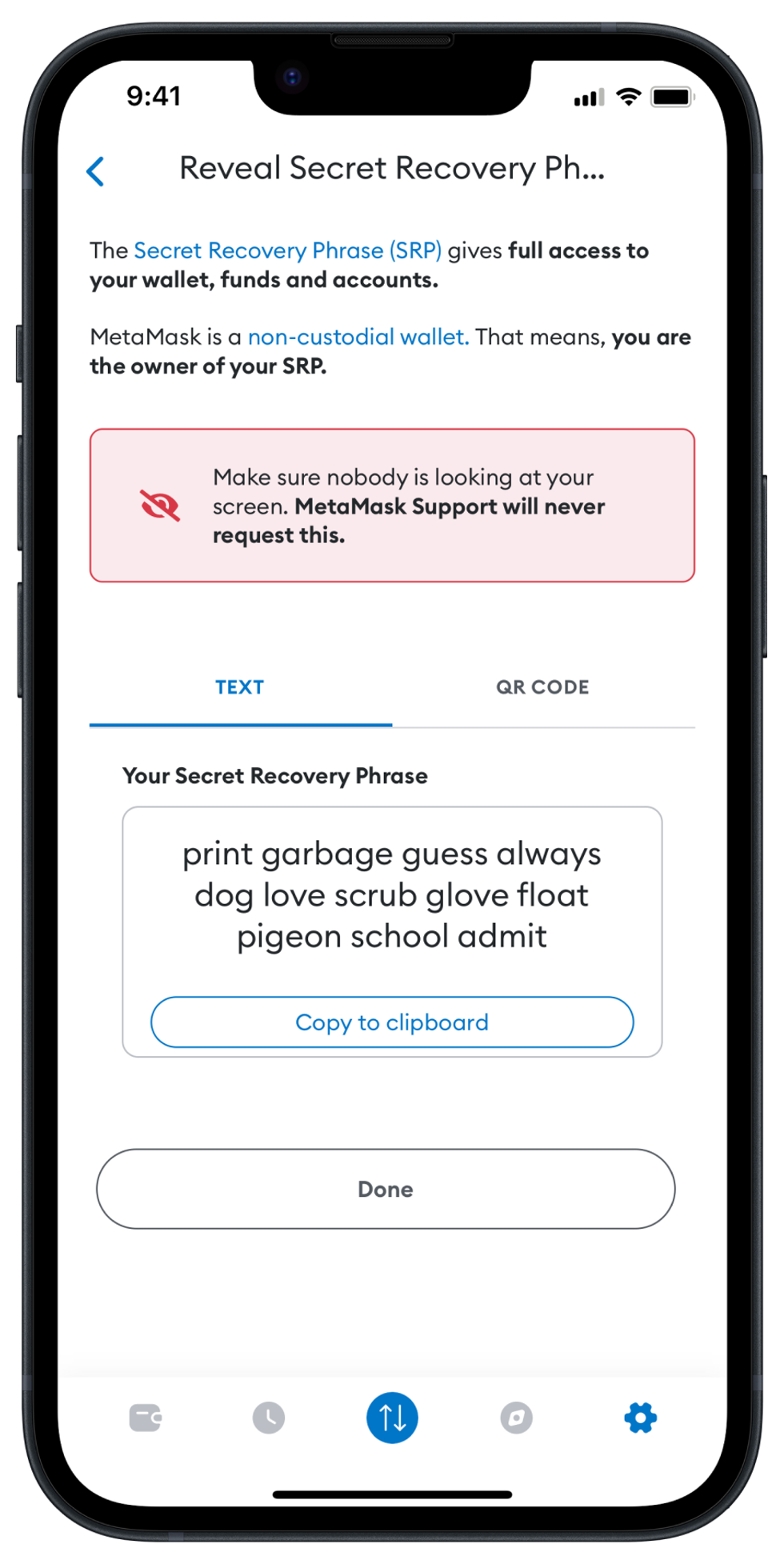

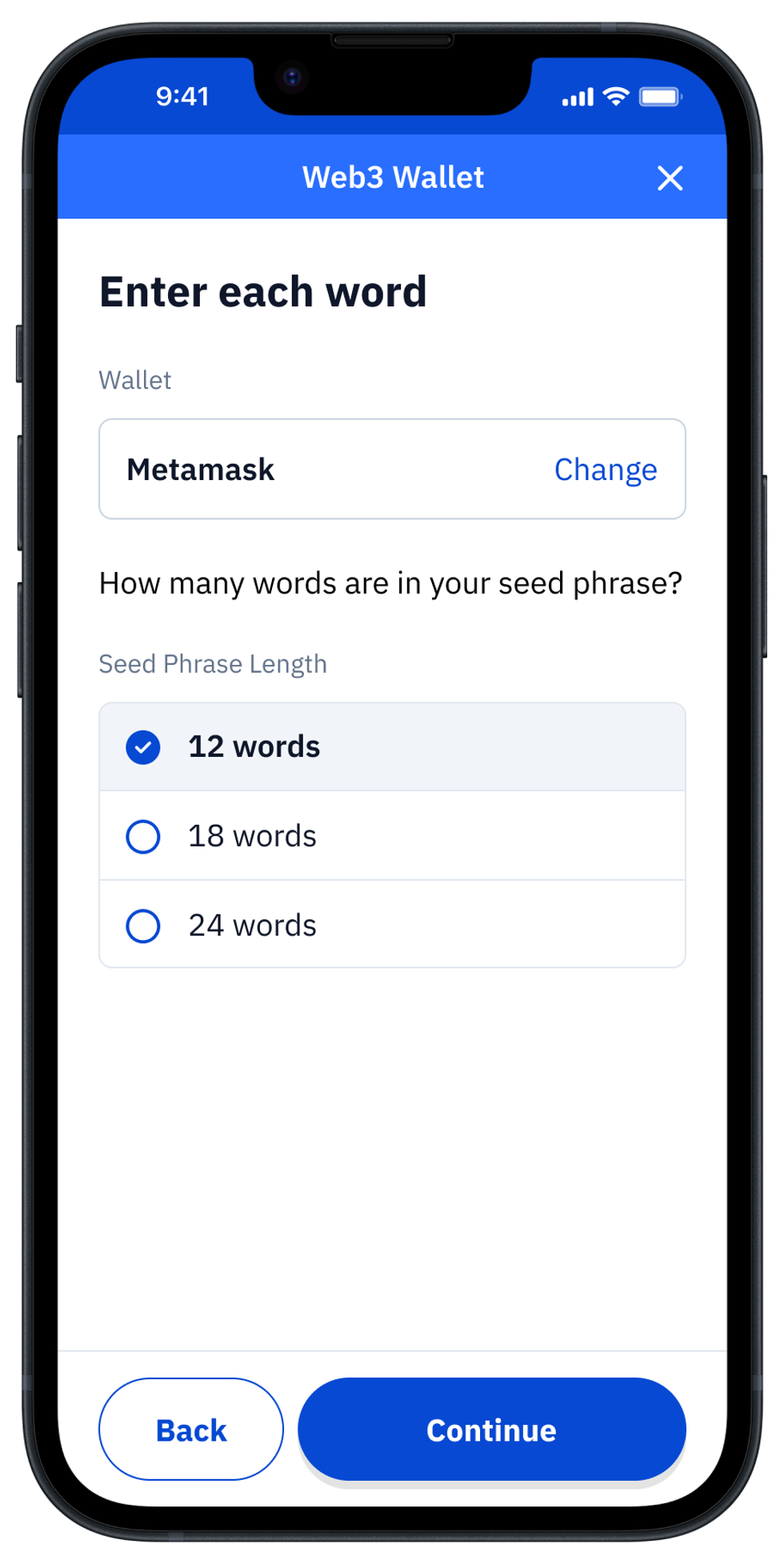

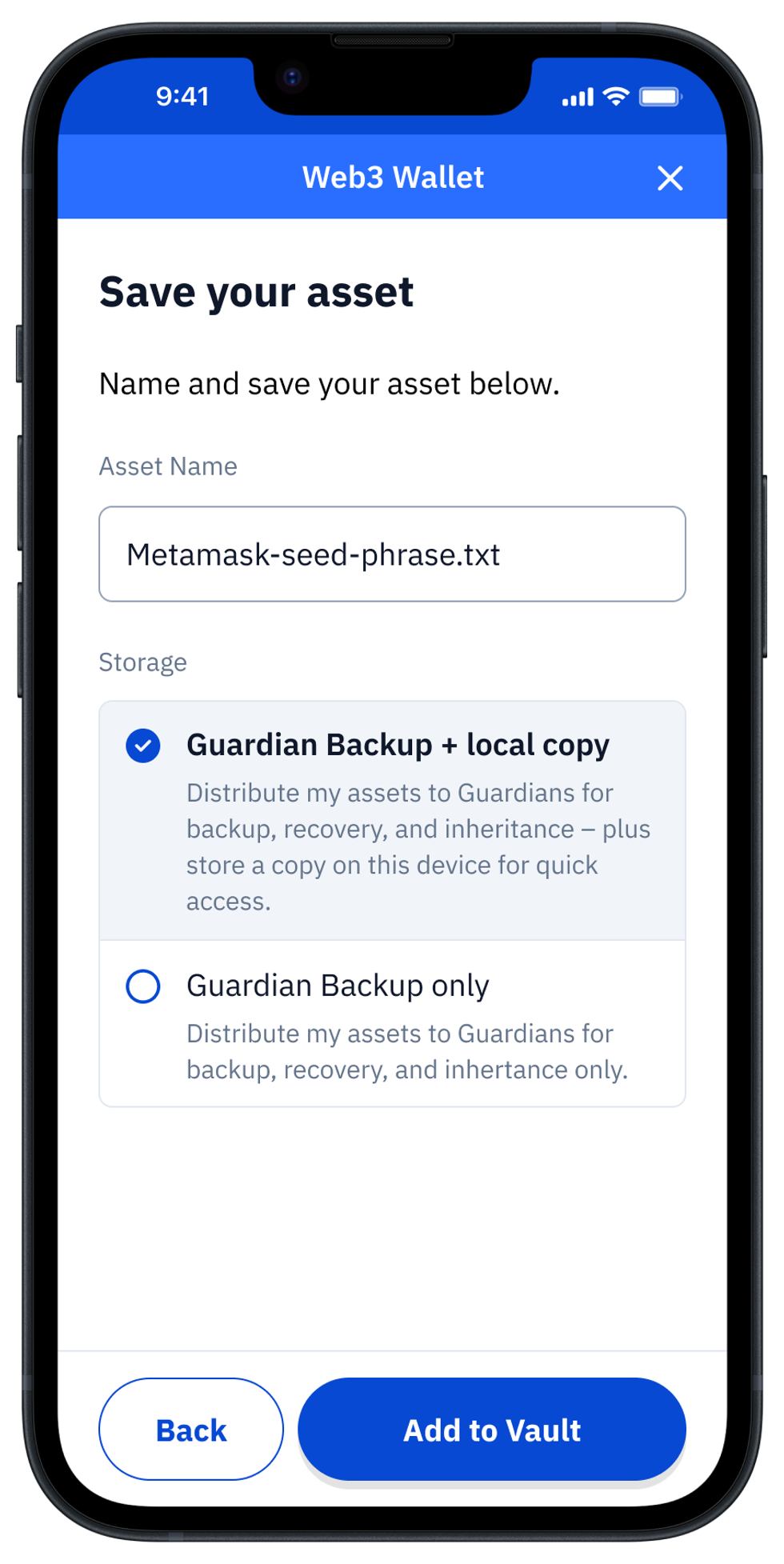

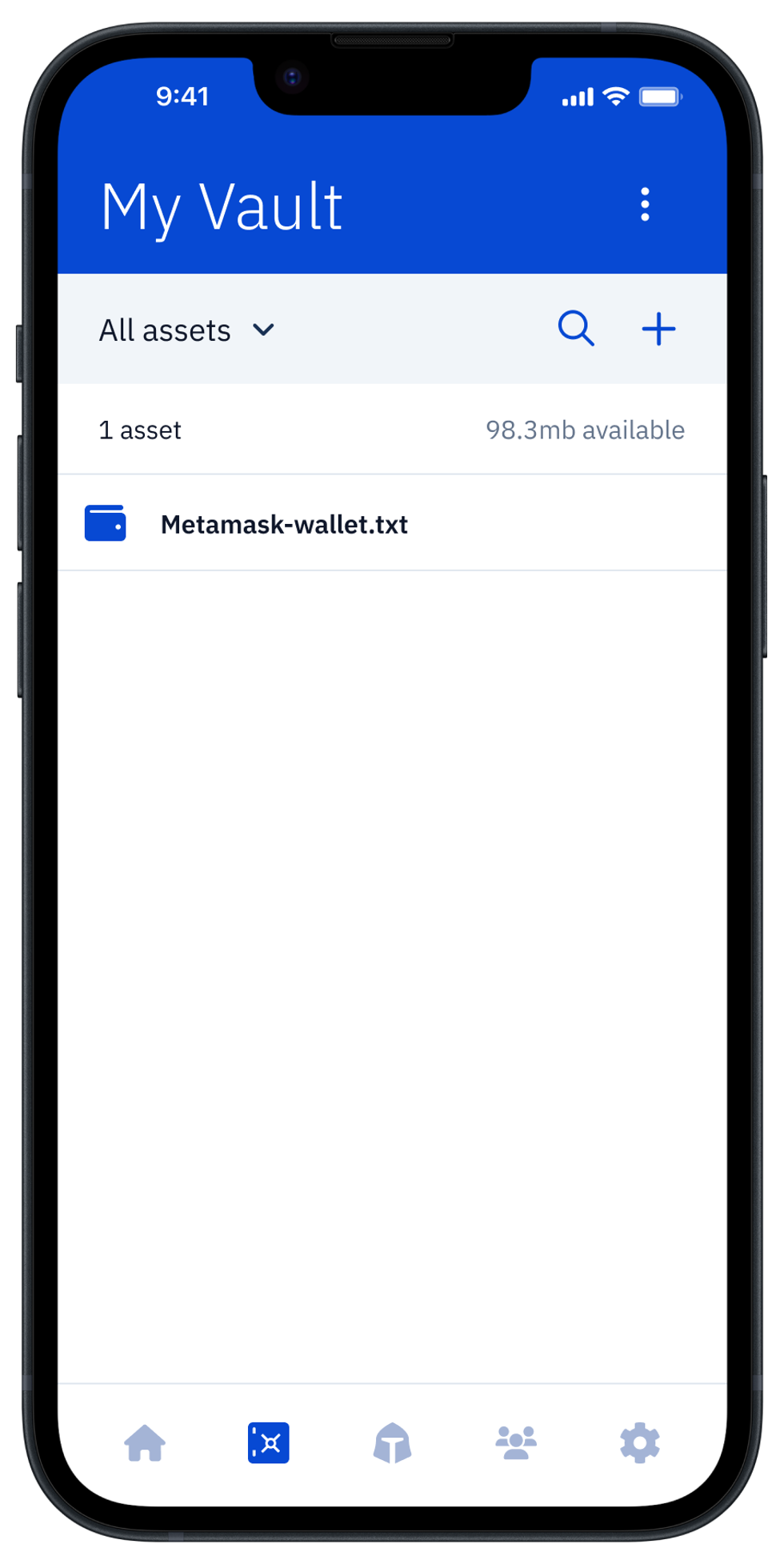

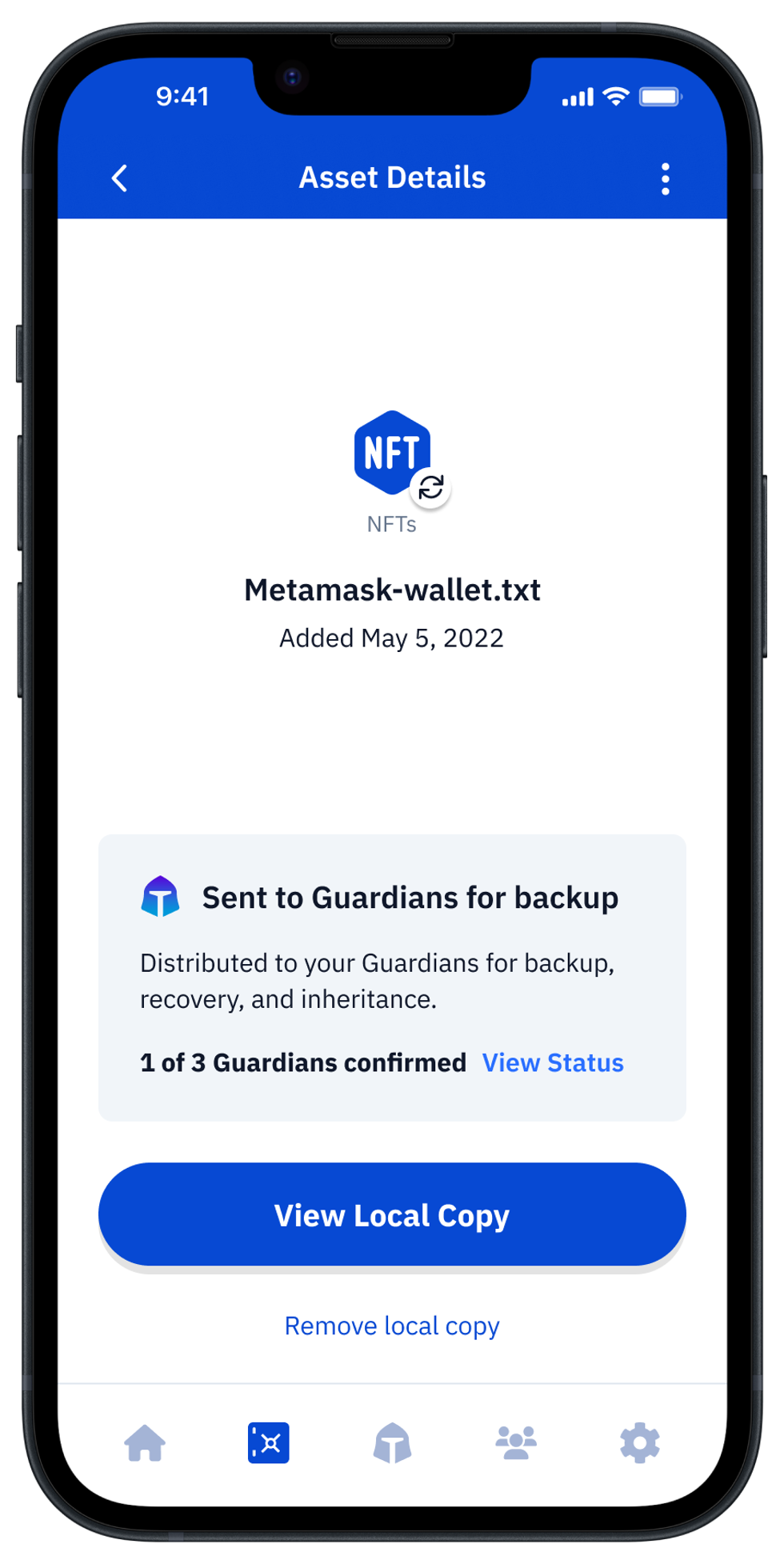

Vault12 is the pioneer in Crypto Inheritance Management, and delivers an easy-to-use and secure method for assigning a legacy contact to your crypto wallets. This enables you to pass on your wallet seed phrases and private keys for all types of digital assets to future generations. Vault12 Guard is designed for everyday people, yet strong enough for Crypto OGs.

Vault12 Guard has a uniquely-secure design. Utilizing advanced encryption and decentralized storage, it ensures that crypto assets are not only safe but also transferable under predefined conditions, filling a critical need unmet by most traditional hardware wallets. Vault12 Guard applies a hybrid approach of software fused with the hardware-based Secure Element of phone devices (The Secure Enclave for iOS devices, and Strongbox for Google devices). Vault12 Guard's decentralized design reduces possible points of failure. Nothing is stored on cloud servers or Vault12 servers, and no assets are stored on local devices, making them less of a target.

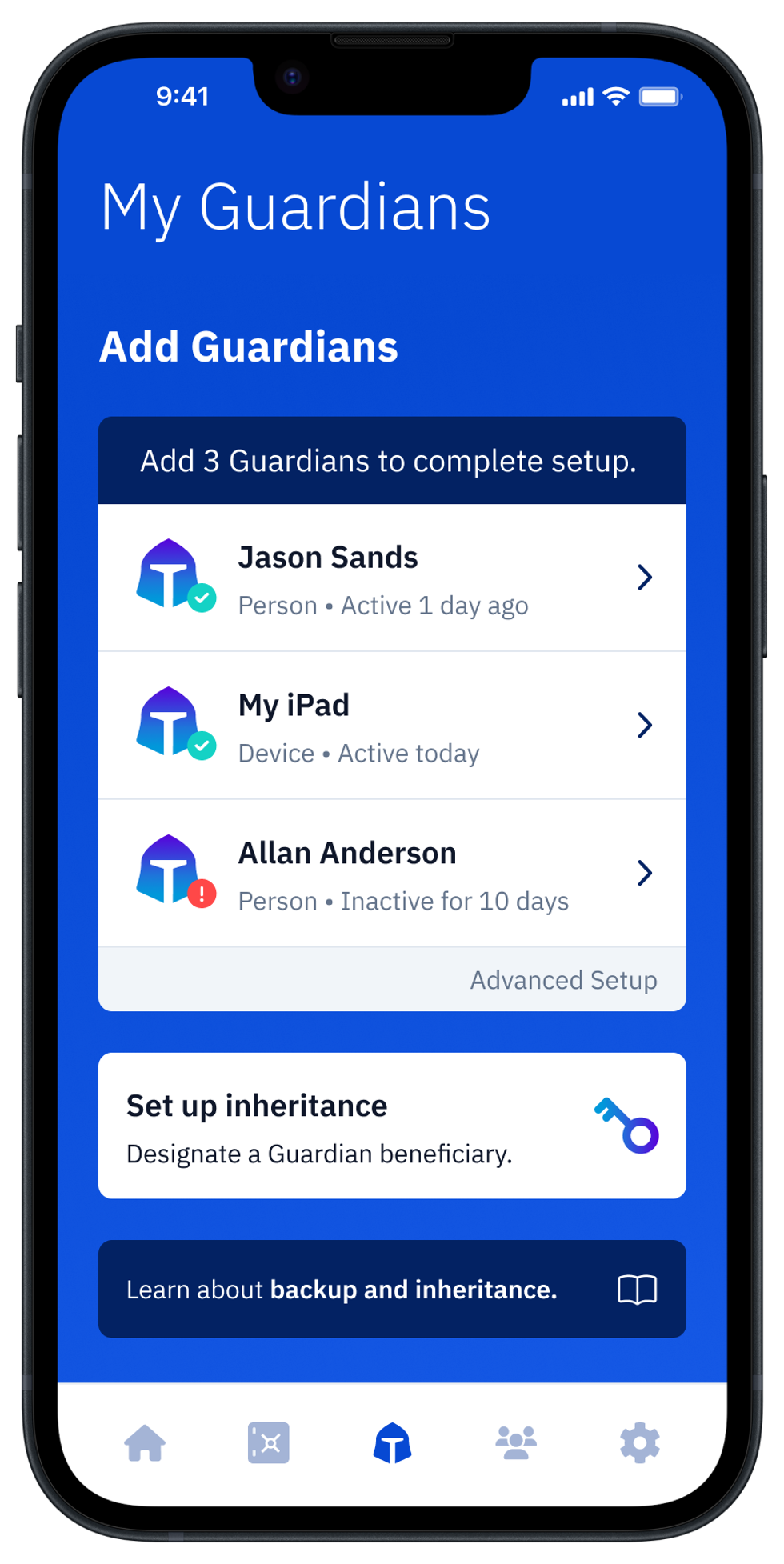

From a user perspective, the Vault12 Guard app asks users to appoint one or more people (or mobile devices) as Guardians. The designated Guardians are entrusted to protect the user's comprehensive collection of wallet seed phrases and private keys, which are safely stored within a decentralized digital Vault. Its simple, user-friendly workflow removes the necessity for regularly revising wallet inventories or modifying instructions for your lawyers — a process that otherwise could lead to privacy breaches.

Both the Ledger Nano X and Exodus are compatible with Vault12 Guard Inheritance. This addresses the seed phrase backup dilemma for any hardware wallet. It also makes less-secure backup methods, such as paper or steel plates, unnecessary.

Stablecoins' momentum builds in bridging traditional and digital assets

Include stablecoins in your digital recovery and inheritance plans

There is a lot of buzz about stablecoins. So what are they, should you have some, and how should you protect them if you do have some?

First, let's review what they are: stablecoins are blockchain-based tokens that are designed to act as stable forms of value. Their prices are synchronized to predictable external assets, such as stable currencies. But unlike currency, which can be slow to deploy or move (whether physically or via a bank electronic transaction), stablecoins instantly can be transferred or exchanged for a huge array of digital assets.

Given their stable value, stablecoins have a unique place in the crypto world: unlike more-volatile cryptocurrencies, they act as low-risk intermediaries between digital assets and other traditional forms of value.

And even though their role is intermediary, they could be held for short periods of time, or long ones. Let’s consider why so many people and institutions buy stablecoins — and sometimes hold them for long periods of time.

What are the most common use cases for stablecoins?

There are many ways that people and institutions use stablecoins:

As a mechanism for exchange between other forms of value: Some people buy stablecoins for just a short period of time to support making another transactions: for example, it may be necessary to buy stablecoins when moving fiat currency to or from a centralized exchange, or converting between two different types of cryptocurrencies if there is no direct exchange possible between them. A huge market that uses stablecoins as a medium of exchange is International remittences.

As a store of wealth: Stablecoins offer a more stable form of wealth preservation than holding cash in a country with high inflation or an otherwise-volatile currency (e.g., Argentina and Turkey).

As liquidity: Stablecoins provide ready-to-deploy financial liquidity that can be used to quickly participate in DeFi opportunities or trade for other cryptocurrencies when time is of the essence (without needing to slog through slow fiat on-ramps).

As loan collateral to avoid a taxable crypto sale: By borrowing stablecoins against their crypto assets on DeFi, holders can utilize their capital or spend some proceeds without selling crypto assets — thereby avoiding the tax consequences of a sale.

As an investment that bears yields: Stablecoins can be used to earn yield (this typically requires allowing an exchange or DeFi platform to “lock” them).

As a low-risk hedge relative to other investments: Stablecoins can be used to reduce risk as part of a balanced digital portfolio.

Stablecoins and investment risk

If you are considering investing in stablecoins, remember that:

- If you let a centralized exchange hold the keys to your coins, you are subject to third-party risks related to trusting the company, their security, and their financial health. (Remember, "Not your keys, not your coins.") Understand how to manage your keys.

- If you hold your own keys and invest via DeFi, you are subject to the risks of associated smart contracts having bugs, vulnerabilities, or otherwise behaving in unexpected ways.

Nothing is risk-free in life, especially in investing. Choose the levels and forms of risks that you are comfortable with as appropriate for your situation.

How did stablecoins evolve?

When cryptocurrencies like Bitcoin, Ethereum, and altcoins first joined the financial scene, their extreme volatility made them high-risk, speculative investments. Most coins have rollercoaster price periods! Stablecoins were introduced as a way to buffer that volatility.

But a few kinks had to be worked out first: some early attempts to build stablecoins failed because their price was not as stable as the issuers had planned. Specifically, algorithmic stablecoins, which were meant to hold a stable value based on mathematical algorithms, smart contracts, and modeled market behaviors, did not always perform as expected.

For example, the algorithmic stablecoin TerraUSD spectacularly failed in May 2022 due to faulty assumptions in the design of the algorithm about market behavior in response to unexpected events. As a result of several failed algorithmic stablecoins, these days, algorithmic stablecoins have lost much of their initial popularity.

Modern stablecoins

Most stablecoins today are backed by real-world assets (collateral), such as currency, government treasury bonds, cryptocurrencies (sufficiently over-collateralized to buffer against volatility), or baskets of commodities. Confidence is improved when tangible assets back up digital coins, not just trust in the behavior of a "pegging" algorithm.

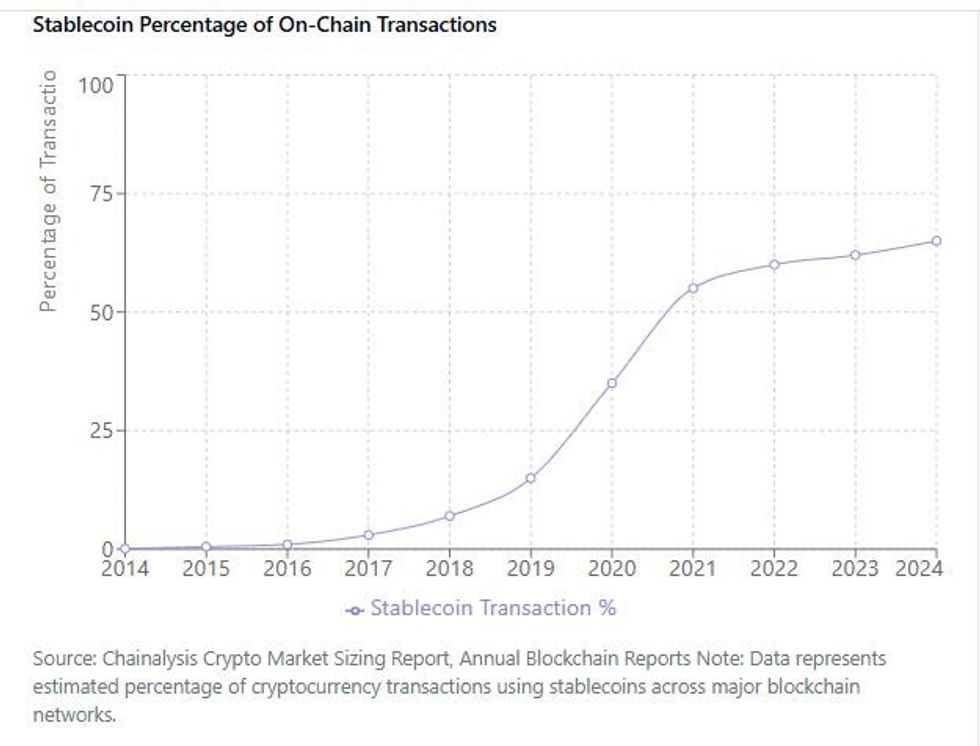

Transparency, maturity, and regulatory acceptance all lead to increased use of stablecoins. Today's largest stablecoins have made leaps and bounds towards achieving each of those ends. Reflecting this evolution, stablecoins have been making up an increasing share of on-chain transactions — more than half of all crypto transactions — as the following chart demonstrates.

Chainalysis via Claude.ai

Stablecoin successes

Several collateralized U.S. Dollar stablecoins from private corporate issuers have matured and gained popular acceptance. Among them, descending by market capitalization:

- USDT ("Tether"), from Tether

- USDC ("USDC Coin"), from Circle (until 2023, issued by the Centre Consortium, founded by both Circle and Coinbase)

- PYUSD ("PayPalUSD"), from Paxos Trust Company

- RLUSD ("Ripple USD"), from Ripple

According to the "State of Stablecoins in 2025" report by Dune and Artemis, Tether shows stablecoin leadership in volume and market penetration with a $146 billion market cap, while USDC Coin, with a $56-60 billion market cap, excels in institutional adoption and DeFi usage, driven by its regulatory compliance and on-chain activity.

If you'd like a deep dive into the differences between USDT and USDC, we recommend Coin Bureau's insightful comparison.

What financial institutions issue or transact in stablecoins?

Crypto exchanges and stablecoin issuers necessarily hold large quantities of stablecoins, but did you know that many other major financial institutions are moving into the use of stablecoins as well? Institutions like Visa, Bank of America, and Revolut are using or piloting projects to issue and accept selected stablecoins as part of their service packages and partnerships. Even Fidelity Investments is testing their own stablecoin.

How is the United States handling stablecoins?

The United States is undergoing a sea change in its stablecoin appetite, having issued new guidance in March 2025 permitting banks to engage in both crypto custody and certain stablecoin activities. And the Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025 (“GENIUS Act”), which describes a broader range of stablecoin guidance, is quickly approaching finalization as law. Further, the U.S. Treasury Secretary Scott Bessent has even announced plans to leverage stablecoins backed by U.S. Treasury bills to bolster the dollar's position as the world's dominant reserve currency.

Regulatory clarity for stablecoins is happening fast, which reduces risks for all users.

How can you protect the stablecoins in your digital wallet?

If you hold stablecoins in a digital wallet, you should include them in a secure wallet backup and an inheritance plan just as you would for your other digital assets. Don’t put off thinking about the possibility of wallet access disruptions, or about your digital inheritance.

- Back up your wallet seed phrase so that you can restore your wallet if you ever lose access to it. A decentralized Digital Vault is the most effective place to safeguard your digital assets.

- Think about who your digital asset beneficiary or beneficiaries should be, and plan your digital inheritance.

- You could also choose to keep your Centralized Exchange passwords in your Vault12 Digital Vault, as well as any other related passwords. A Digital Vault is more secure than a standard password manager.

"Failing to plan is planning to fail."— Benjamin Franklin

Vault12 Guard can protect all of the digital assets that you hold

The Vault12 Guard Digital Vault can protect the stablecoins and all other digital assets in your wallets. See how easy it can be for you to protect your digital wealth in a decentralized way using your personal choice of Vault Guardians. Simply and conveniently protect all of your digital assets today in your own Digital Vault. When you’re ready, take it a step further to secure the future of your digital wealth with Vault12 Digital Inheritance.

Ledger Stax and Trezor Model T: two strong wallets compared

The right wallet for you depends on your usage patterns and design preferences

When choosing hardware wallets, many crypto users base their decisions on day-to-day asset management needs and perceived device security. However, savvy crypto users first consider a wallet's ability to handle long-term security scenarios. Long-term security includes expected essentials like backup and recovery tools, and also often-overlooked features related to secure and fault-proof third-party recovery. You can think of third-party recovery as your ability to allow crypto assets to be inherited by successors. Successful crypto users require a comprehensive security strategy for the full life cycle of crypto assets. This article will help you achieve that.

Let's jump into helping you understand the pros and cons of the Ledger Stax and Trezor Model T for day-to-day activities, as well as their potential to safeguard the long-term security and longevity of your assets.

Overview

The Ledger Stax and Trezor Model T both provide a wide variety of reliable security features and support a broad spectrum of cryptocurrencies, making them suitable for diverse crypto portfolios. However, several differences are clear:

Ledger Stax

- Mobile-Centric Usability: Designed with mobility in mind, the

- Ledger Stax features wireless connectivity options like Bluetooth and

- NFC, making it highly compatible with mobile platforms.

- Premium Design: Its unconventionally large display enhances readability, though it comes with slower responsiveness included.

- Price Point: Positioned as a premium product, its cost reflects its advanced features and sleek design

Trezor Model T

- Mobile-Centric Usability: No Bluetooth connectivity. iOS app is view-only.

- General Usability: Smaller set of wallets, coins, and apps.

- Design: The touchscreen and input are very well-thought-out experiences.

- Price Point: More affordable.

In terms of crypto asset longevity features, such as backup, recovery, and crypto inheritance, both devices provide industry-standard and proprietary options with certain trade-offs, as well as compatibility with third-party solutions like Vault12 Guard for succession planning scenarios.

The decision between the two will likely hinge on individual preferences for the target platform (mobile or desktop), and should take into account the planned frequency of use.

Approach to comparison

When choosing the best hardware wallet for cryptocurrency security, you may wonder:

- Which is better, the Ledger Stax or the Trezor Model T?

- How easy to use are these wallets?

- How do their security features compare?

- Do these wallets have vulnerabilities, and have they been hacked?

- What happens if your wallet is lost or stolen?

- How do these wallets accomodate user errors, and complex scenarios like inheritance of crypto assets?

This article compares important characteristics for these two popular wallets. We’ll break down the strengths and weaknesses of each, focusing on security, ease of use, and backup and recovery methods.

By the end of this comparison, you’ll clearly understand which wallet is right for you, as well as how to recover your crypto assets in case of accidents.

What happens if your wallet is lost or stolen?

Wise wallet owners recognize the critical importance of crypto recovery before they find themselves in an unexpected bind! That's why it's important to understand the fundamental topic of crypto asset longevity, including features such as backup, recovery, and inheritance for crypto assets. These considerations are central to long-term planning.

Technical security is paramount, but in the world of crypto, the degree to which backup and recovery solutions are foolproof for users is at least equally important. Here are the backup and recovery options for these two wallets:

Ledger Stax | Trezor Model T | |

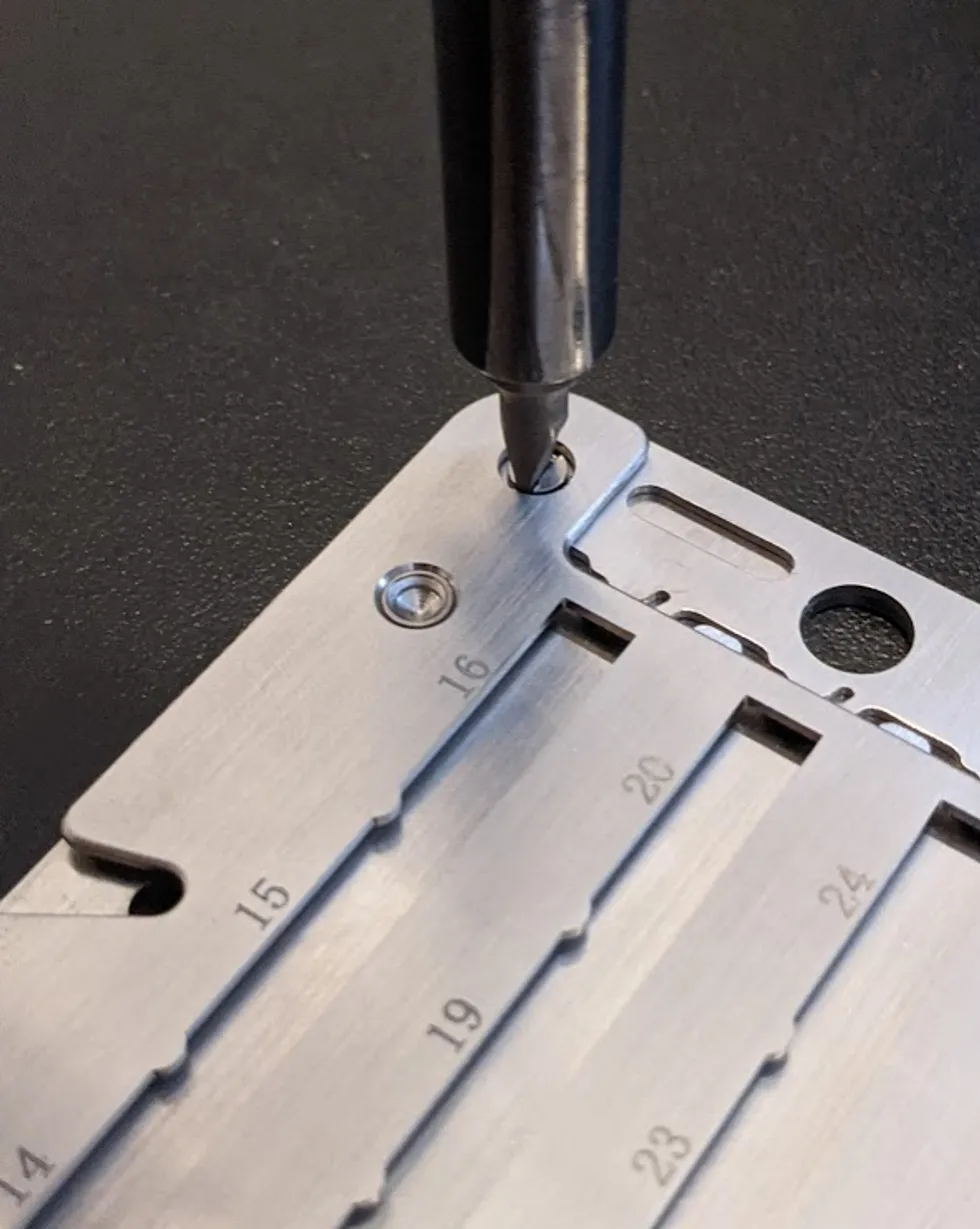

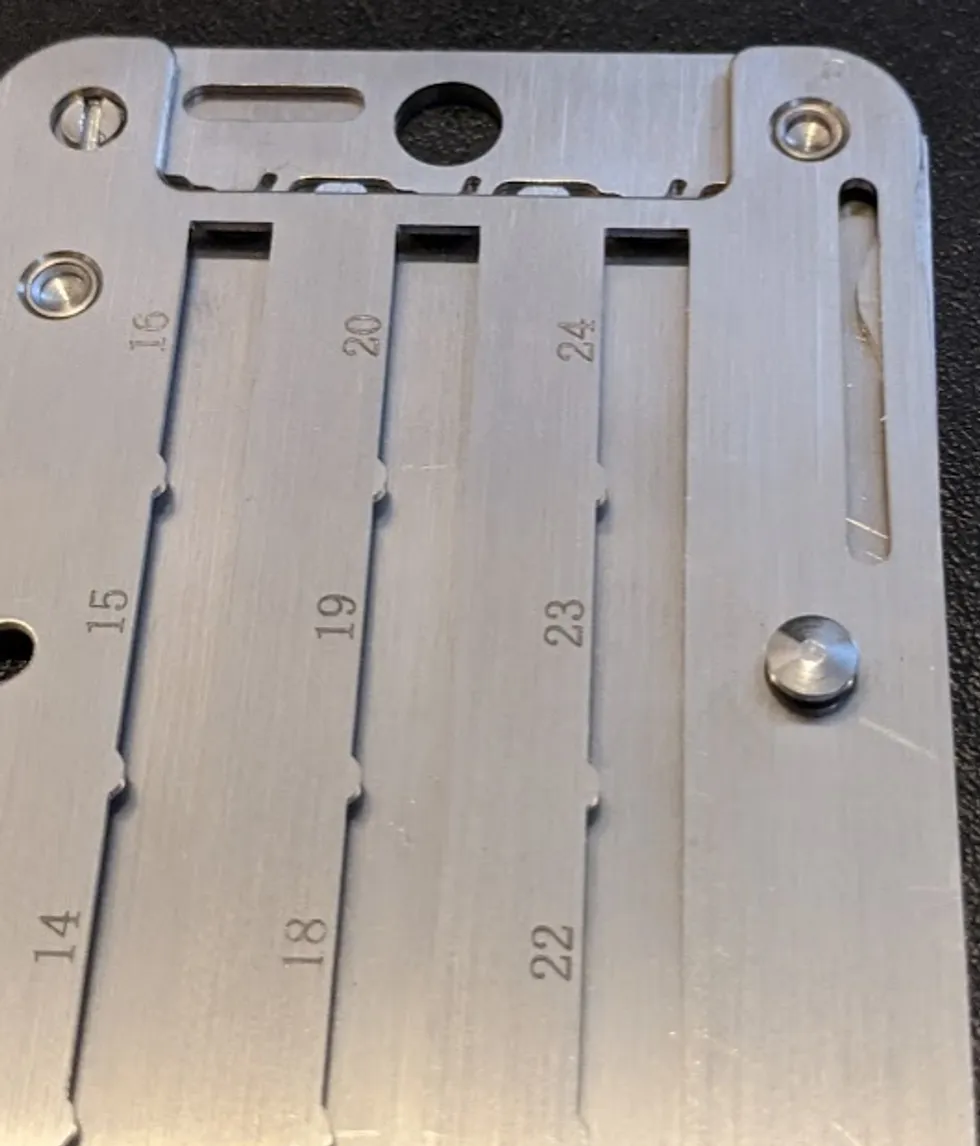

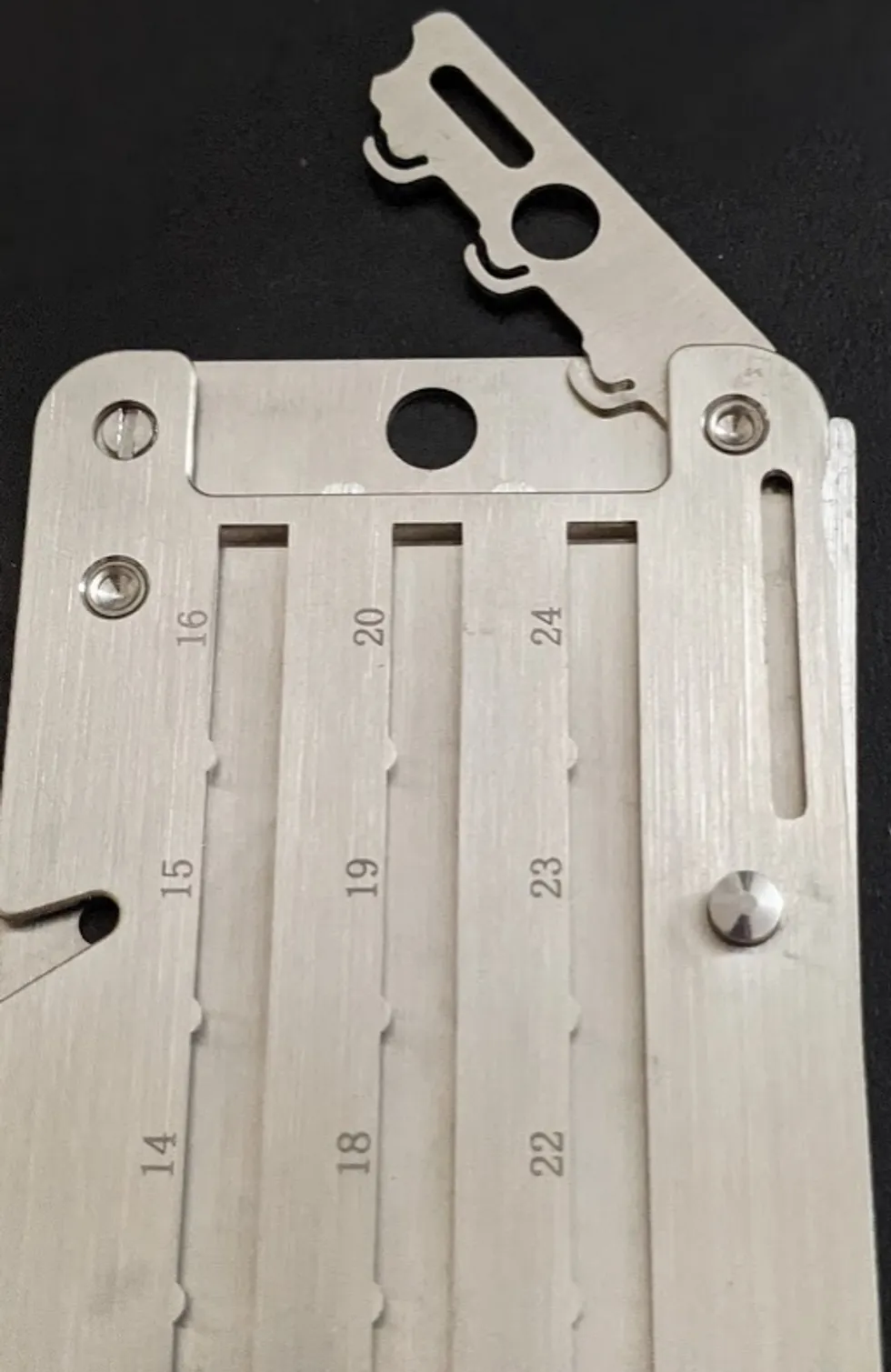

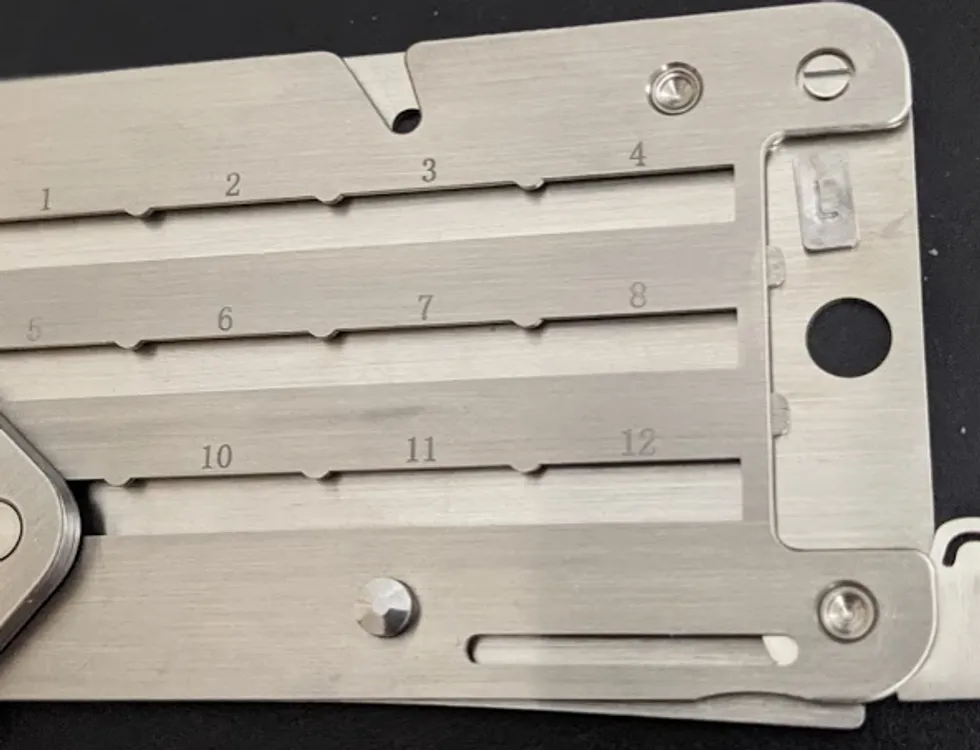

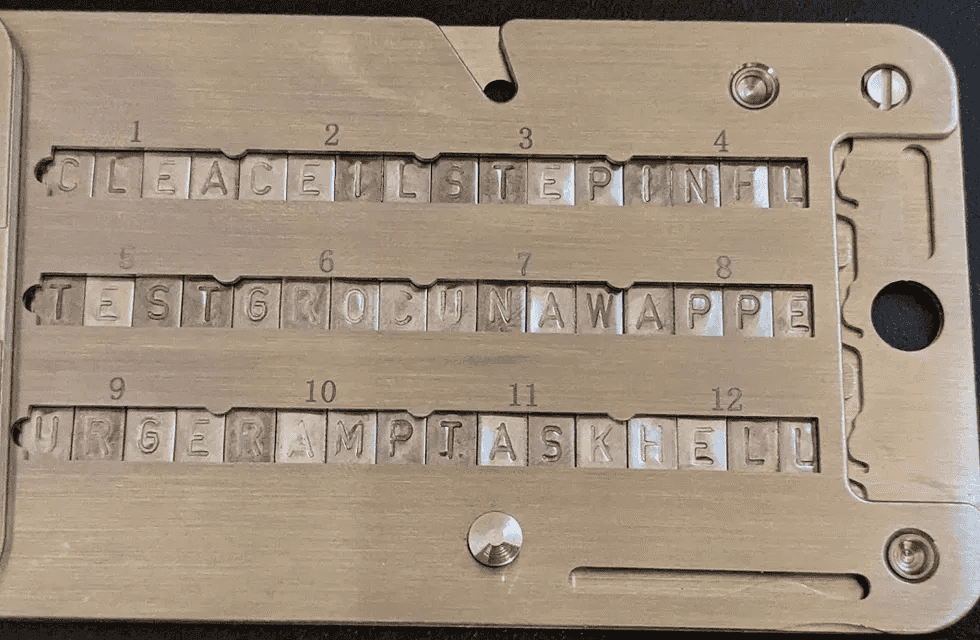

Backup & Recovery methods | Recommends Recovery Seed Phrase be written on paper, or engraved onto metallic plates. | Recommends Recovery Seed Phrase be written on paper, or engraved onto metallic plates. |

Optional paid subscription | Ledger Recover, a centralized 3rd-party cloud service, highly criticized by the crypto community. Clouds are not safe — especially when operated by multiple 3rd parties. | No. |

How do these wallets handle Crypto Inheritance?

Crypto Inheritance Features

Currently, most hardware wallets, including the Ledger Stax and Trezor Model T, lack any features for establishing and managing crypto inheritance. This gap presents a challenge for users who want to be sure that their crypto assets can be transferred to their heirs.

Ledger Stax | Trezor Model T | |

Backup |

- Written only | - Written only - Manual sharing of shards |

Inheritance | No | No |

Decentralized backup with Vault12 | Yes | Yes |

Inheritance Management with Vault12 | Yes | Yes |

Backup and recovery differentiators

Ledger Stax Recovery service Disadvantages:

- The optional Ledger Recover backup service is a paid service provided by three corporations that each hold parts of the user’s seed phrase in a Cloud. This introduces risks, as the seed phrase could potentially be accessed via subpoena; business partners could terminate agreements or become involved in lawsuits that result in locked data or resources (like, for example, Gemini and Genesis); and there are multiple potential points of failure.

- Very important detail: The terms of the optional Ledger Recover service do not mention support for inheritance, meaning any unfortunate accident related to the user will make crypto assets unrecoverable for his or her successors. Ledger itself suggests using 3rd-party crypto inheritance services for those purposes.

Ledger Stax Recovery service Advantages:

- People have different preferences. If a user is comfortable trusting a bank with their assets, they may also feel confident using Ledger Recover for securing their seed phrase backup (even though Ledger is not providing the complete cloud backup solution).

Trezor Model T backup Disadvantages:

- Trezor has a Multishare backup service, but it is fully manual, and challenging to maintain. The user is responsible for generating, distributing, and keeping track of the encrypted shards.

Trezor Model T backup Advantages:

- Trezor does offer a Multishare backup option for those who are able and willing to set it up.

How easy are these crypto wallets to use?

Let's compare the key aspects of both wallets side by side, and then summarize what really stands out for user convenience:

Ledger Stax | Trezor Model T | |

Display | 3,7” black and white E Ink, |

1.54" Color LCD, |

Input interface | Touchscreen | Touchscreen |

Cable | USB-C | USB, MicroSD card slot |

Wireless |

Bluetooth 5.2, | No |

Companion Apps | macOS, Windows, Linux, Android, iOS |

macOS, Windows, Linux, Android |

3rd party wallets and dapps support | 50+ | 9+ |

Password manager & 2FA | FIDO2 2FA & Passkeys, | FIDO2 2FA |

Product size & weight | 85 x 54 x 6 mm / 45g | 64 x 39 x 10 mm / 22g |

Convenience features |

Battery (10 hours of use), | Magnetic dock |

Number of supported coins | 5,500+ | 1,600+ |

Price | $399 | $149 |

Crypto wallet user experience differences

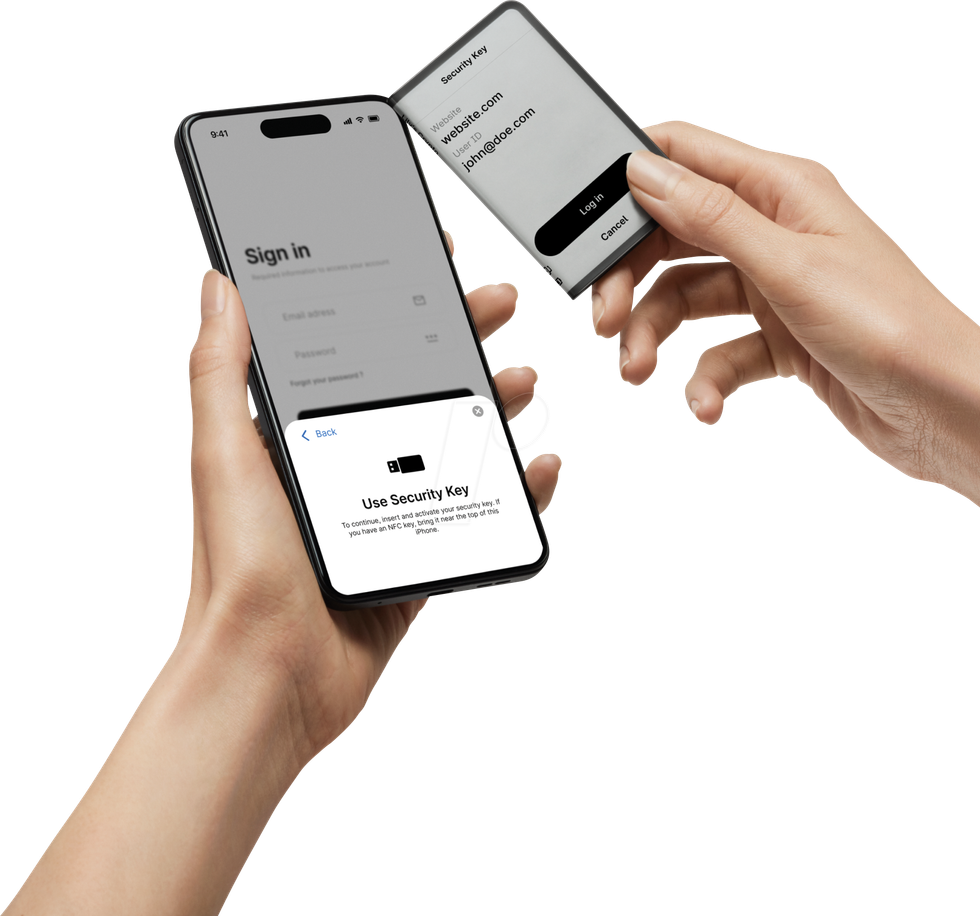

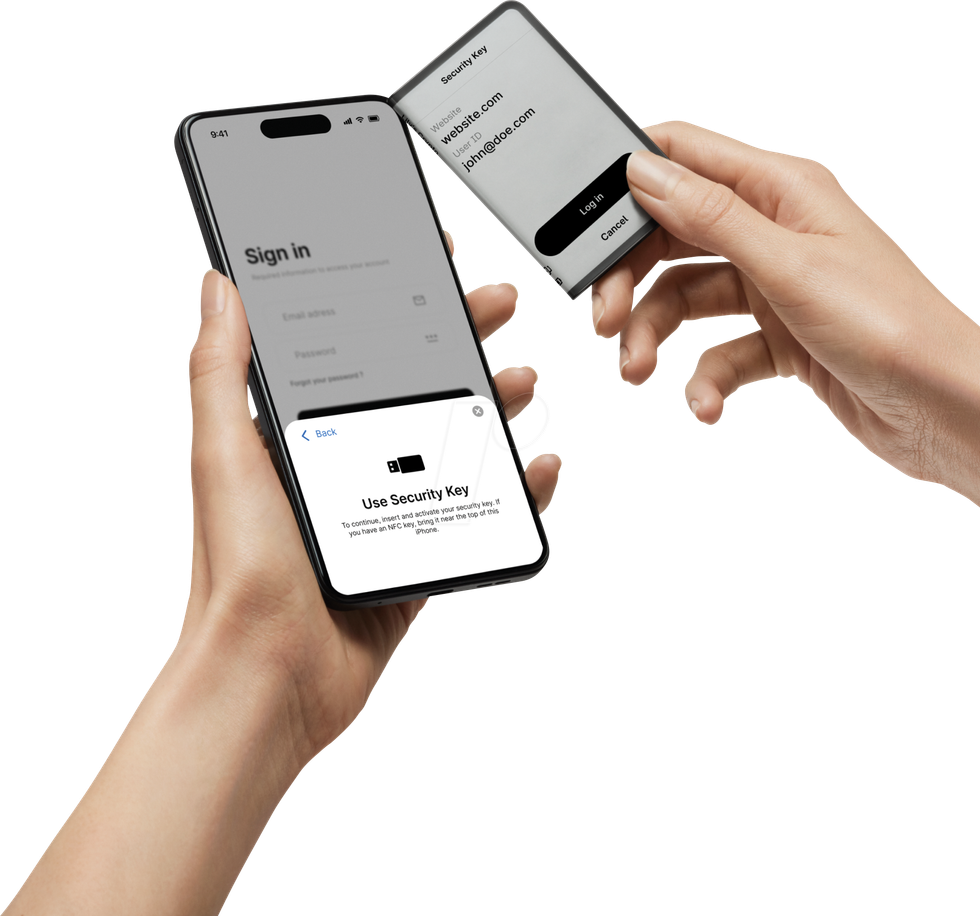

User holding a mobile phone and using Ledger Stax as FIDO U2F security key

Ledger Stax Disadvantages:

- The display has a noticeable response delay due to the "E Ink" touchscreen technology, and could be irritating.

- Not all apps are ported to Stax yet. Even the native Passwords app still has no release date identified as of this article's publish date, so check in advance whether your favorite network/coin is supported.

- Extremely expensive. The value in Stax is more about design, rather than practical aspects.

Ledger Stax Advantages:

- Huge informative display and "Clear Signing" allows you to review and confirm all transaction details directly on Ledger Stax and in a human-readable language before they are signed and sent. This enhances security and ensures that you see exactly what you are approving in a secure and tamper-proof manner.

- Offers Bluetooth connectivity as well as NFC — works with or without a cable, at least with smartphones.

- Wide support for third-party wallets and dapps, allowing the Ledger Stax to sign transactions directly in MetaMask, Uniswap, and other platforms without relying on Ledger Live software. This is a huge advantage for DeFi users.

Trezor Model T Disadvantages:

- No wireless connectivity: you always have to use a cable.

- iOS is a balance view-only app, so you can't send transactions from iOS.

Trezor Model T Advantages:

- The display is much more convenient to work with on a regular basis, and easy to read.

- The touchscreen and input are very well-thought-out experiences on Trezor Model T — you can use it without any discomfort.

How do these wallets' security features compare?

Now, we dive deeper into the core specification of every hardware wallet: security features.

| Ledger Stax | Trezor Model T | |

| PIN-code | 4 - 8 digits | up to 50 digits |

| BIP39 Passphrase | Yes | Yes |

| Open-source | Partial | Full |

| Secure Element | Yes | No |

| Multisignature | Yes | Yes |

Crypto wallet security feature differentiators

Ledger Stax security Disadvantages:

- Critical components like the Secure Element and its operating system are closed-source. This has raised concerns, especially after the controversial introduction of the Ledger Recover backup service, which challenged the assumption that the Secure Element could never transmit the recovery seed phrase outside the hardware wallet.

Ledger Stax security Advantages:

- Includes a Secure Element, giving Ledger devices a strong reputation for withstanding physical attacks. This is important for users who prefer not to complicate their security with BIP39 passphrases, prioritizing ease of use.

- Clear Signing is also a security feature.

Trezor Model T security Disadvantages:

- Lacks a Secure Element, making it resistant to physical attacks only if a BIP39 passphrase is used. This is a significant drawback in both convenience and its ability to be fault-proof.

Trezor Model T security Advantages:

- Fully open-source software and hardware. This minimizes third-party risks, and avoids any need to rely on trust.

- Allows for longer PIN codes, which might appeal to particularly cautious users.

Have there been vulnerabilities or hacks of these wallets?

There have been vulnerabilities and hacks associated with both the Ledger and Trezor products, however given Stax is very new we will cover it's manufacturer's hacks history.

Far from delivering uncompromised security, these wallets are routinely subject to malware, supply chain, and firmware vulnerabilities. Here are some recent notable incidents:

Ledger Vulnerabilities:

- The Connect Kit Attack (2023): The Connect Kit breach was discovered by the security teams of Ledger.

- Ledger User Data Breach (2020): A major data breach exposed the personal information of thousands of customers, leading to phishing attacks.

- Another User Data Breach (2021): Ledger announced on Twitter that it has been targeted by rogue Shopify team members who exported over 200 merchants’ customer databases.

- Ledger Live (2020): Users were exposed to basic double spending attacks, amplified double spending attacks, and DoS attacks without user consent.

- Potential Supply Chain Attack Vulnerability (2020): Kraken Security Labs Identifies Supply Chain Attacks Against Ledger Wallets.

Trezor Model T Vulnerabilities:

- Ability to Physically Hack Trezor T Wallet (2023): Crypto Security Firm Unciphered Claims Ability to Physically Hack Trezor T Wallet

- Five Reported Vulnerabilities in Two Models of Trezor Hardware Wallets (2019): Ledger’s Attack Lab has found five vulnerabilities in hardware wallets of its direct competitor Trezor.

- Kraken Identifies Critical Flaw in Trezor Hardware Wallets (2020): Kraken Security Labs has devised a way to extract seeds from both cryptocurrency hardware wallets offered from industry leader Trezor, the Trezor One and Trezor Model T.

Summary of Ledger Stax and Trezor Model T Comparison

The Ledger Stax and Trezor Model T both provide a respectable set of security measures, and support a broad spectrum of cryptocurrencies, making them suitable for diverse crypto portfolios.

The Ledger Stax is very mobile-friendly, and offers a balance of security and convenience features at a very premium price. It offers a big, but unconventional display and with delayed input, but with the advantages of a Secure Element and wireless connectivity options like Bluetooth.

On the other hand, the Trezor Model T, at a much lower price, boasts a fully open-source framework, larger display with colors, and touchscreen interface for enhanced user interaction, but with reduced security and convenience from not having a Secure Element and working only with USB connections the offer sounds non-attractive.

The decision between the two will likely hinge on individual preferences for the target platform (mobile or desktop), and should take into account the planned frequency of use.

Whichever you choose, remember to add crypto inheritance to your choice of wallet to ensure the long-term safety of your digital assets.

Vault12 Guard: a decentralized solution for Crypto Inheritance

Vault12 is the pioneer in Crypto Inheritance Management, and delivers an easy-to-use and secure method for assigning a legacy contact to your crypto wallets. This enables you to pass on your wallet seed phrases and private keys for all types of digital assets to future generations. Vault12 Guard is designed for everyday people, yet strong enough for Crypto OGs.

Vault12 Guard has a uniquely-secure design. Utilizing advanced encryption and decentralized storage, it ensures that crypto assets are not only safe but also transferable under predefined conditions, filling a critical need unmet by most traditional hardware wallets. Vault12 Guard applies a hybrid approach of software fused with the hardware-based Secure Element of phone devices (The Secure Enclave for iOS devices, and Strongbox for Google devices). Vault12 Guard's decentralized design reduces possible points of failure. Nothing is stored on cloud servers or Vault12 servers, and no assets are stored on local devices, making them less of a target.

From a user perspective, the Vault12 Guard app asks users to appoint one or more people (or mobile devices) as Guardians. The designated Guardians are entrusted to protect the user's comprehensive collection of wallet seed phrases and private keys, which are safely stored within a decentralized digital Vault. Its simple, user-friendly workflow removes the necessity for regularly revising wallet inventories or modifying instructions for your lawyers — a process that otherwise could lead to privacy breaches.

Both the Ledger Stax and Trezor Model T are compatible with Vault12 Guard Inheritance. This addresses the seed phrase backup dilemma for any hardware wallet. It also makes less-secure backup methods, such as paper or steel plates, unnecessary.

Vault12 is NOT a financial institution, cryptocurrency exchange, or custodian. We do NOT hold, transfer, manage, or have access to any user funds, tokens, cryptocurrencies, or digital assets. Vault12 is exclusively a non-custodial information security and backup tool that helps users securely store their own wallet seed phrases and private keys for the purpose of inheritance. We provide no legal or financial services, asset management, transaction capabilities, or investment advice. Users maintain complete control of their assets at all times.

Basics

Learn about how the risks of holding cryptocurrency are different than those of traditional investments, and how to move ahead with confidence and safety.

View all articlesDeath and Taxes… Why Tax Time Is the Perfect Time to Fix Your Crypto Inheritance

In this world nothing can be certain except Death and Taxes

“In this world nothing can be said to be certain, except death and taxes.”

Benjamin Franklin wrote that in 1789. If he were alive today, he’d probably add a third certainty:

If you don’t plan your digital inheritance, a good chunk of your wealth will simply vanish.

Every year, tax season forces us into the same ritual: pull together documents, log into accounts, reconcile statements, and finally see—clearly—what we actually own.

That’s exactly why tax time is the single best moment to get your crypto and digital inheritance sorted out. You’re already doing the hard part: creating an inventory of your assets. All you need to do is extend that thinking one step further:

“If I got hit by the proverbial bus tomorrow… who could access this, and how?”

Let’s walk through how to turn your yearly tax chore into a quiet act of love for your future heirs.

The Hidden Superpower of Tax Season: Asset Inventory

Most people think of taxes as punishment, not a planning tool. But when you look at what you actually do each year, it’s powerful:

- You list employers and income sources

- You gather bank and brokerage statements

- You track gains, losses, and cost basis

- You note property, side gigs, investments, and loans

In other words: you build a living snapshot of your financial life.

That snapshot is exactly what your heirs and executor will need one day. The gap is that:

- It usually lives in your head, scattered in email, or dumped into a folder called “2025 Taxes.”

- It rarely includes your digital footprint or crypto assets in a structured way.

So tax time becomes this moment where you almost have everything needed for a great inheritance plan—but then you hit “submit,” breathe a sigh of relief, and bury the work for another year.

Most people think of taxes as punishment, not a planning tool. But when you look at what you actually do each year, it’s powerful:

- You list employers and income sources

- You gather bank and brokerage statements

- You track gains, losses, and cost basis

- You note property, side gigs, investments, and loans

In other words: you build a living snapshot of your financial life.

That snapshot is exactly what your heirs and executor will need one day. The gap is that:

- It usually lives in your head, scattered in email, or dumped into a folder called “2025 Taxes.”

- It rarely includes your digital footprint or crypto assets in a structured way.

So tax time becomes this moment where you almost have everything needed for a great inheritance plan—but then you hit “submit,” breathe a sigh of relief, and bury the work for another year.

The Missing Column: Your Digital and Crypto Assets

Traditional estate planning is still stuck in a world of:

- House

- Bank accounts

- Brokerage

- Retirement accounts

- Insurance

But your actual life now includes:

- Bitcoin, Ethereum, and other tokens

- NFTs and digital art

- Assets on DeFi platforms and L2s

- Staked assets and yield strategies

- Exchange accounts (even the “small” ones you forgot about)

- Password managers

- Encrypted notes and backups

- 2FA apps and hardware keys

- Cloud storage with important documents, photos, and IP

For your heirs, the hardest part is not taxes—it’s discovery and access:

- Discovery – “What did they have, and where is it?”

- Access – “How do we unlock it without their passwords and keys?”

Without answers to those two questions, a perfectly legal, well-structured estate still leaks value. With crypto, “leaks” usually means “gone forever.”

The Brutal Truth: Estate Law Can’t Recover a Lost Private Key

With traditional finance, losing a password is annoying but fixable:

- There’s a helpdesk.

- There’s KYC.

- There’s a paper trail.

With crypto, if your heirs don’t have:

- The seed phrase

- The private key

- The social recovery method

- Or the hardware wallet PIN + recovery

…then the assets are effectively burned.

Death certificates, probate orders, and court documents mean nothing to a blockchain. The network doesn’t know you died; it only knows valid signatures.

That’s why crypto inheritance must be designed in advance, at the same level of care you put into optimizing your tax bill.

Turning Tax Prep Into Inheritance Prep: A Simple 6-Step Ritual

You don’t need to become a lawyer or a security engineer. You just need to add a few extra steps to what you’re already doing each year.

1. Expand Your Asset Inventory to Include Digital

While you’re gathering statements and logging into platforms for tax reporting, create one master inventory that includes:

- All exchanges you use (even “test” accounts with small balances)

- All wallets (hardware, mobile, browser, paper)

- All major on-chain positions (staking, DeFi, L2s, NFTs)

- Any custodial platforms (CeFi yield platforms, centralized staking, etc.)

- Critical digital services:

- Password manager(s)

- Cloud storage that contains important docs

- Domain registrars, app store accounts, creator platforms (where there’s IP or revenue)

Treat this like a crypto & digital asset schedule to sit alongside your traditional tax and estate documents.

2. Label the “Where” and the “How”

For each item in your inventory, add two simple pieces of information:

- Where is it?

- Exchange name, wallet type, protocol, or chain

- How is it secured?

- Hardware wallet, seed phrase in a safe, multi-sig, social recovery, etc.

You’re not putting the actual secrets in this list—just the map, not the keys.

Think of it like this: if you weren’t around, could your executor at least know which hills to dig under?

3. Decide Who Should Ultimately Inherit What

Estate planning sounds technical, but at core it’s emotional:

- Who do you want to benefit from your Bitcoin, ETH, or NFTs?

- Are there assets that are more meaningful to specific people—e.g., digital art, ENS names, in-game assets, or creator royalties?

- Do you want a portion of your crypto to go to a foundation, DAO, or non-profit?

You can formalize distribution wishes in:

- Your will

- A letter of wishes

- A separate digital asset memo that your executor knows about

The key is that tax time already has you thinking in percentages and allocations—just extend that mindset one step into “what if I wasn’t here next year?”

4. Establish a Secure Way to Pass On Secrets (Without Sharing Them Now)

This is the biggest practical challenge:

How do you make sure your heirs can access your keys only when they’re truly supposed to?

Some approaches people use:

- Multi-sig wallets where one key is held by a trusted person or entity

- Shamir’s Secret Sharing or other threshold schemes, where parts of a secret are split among multiple “guardians”

- Dedicated crypto inheritance tools that combine encryption, sharding, and social recovery

- Estate-aware password manager plans, where a trusted contact can gain access after a verified event

What you don’t want to do is:

- Put seed phrases directly in a will (it becomes public in probate in many jurisdictions)

- Email your seed phrase to yourself or someone else

- Put everything in a single safe that no one even knows exists

The ideal pattern is:

Your inventory and intentions are discoverable,

your keys and instructions are recoverable but strongly protected,

and the whole system doesn’t depend on any one person’s memory.

5. Document “How to Use This” in Human Language

Your heirs might not be crypto-native. They might be terrified of doing something wrong.

So along with your technical plan, add a plain-English guide:

- “If I’m gone, here’s who to contact first.”

- “Here’s where to find the inventory of my accounts and wallets.”

- “These people/platforms have pieces that can help unlock access.”

- “Before moving anything, get a reputable crypto-savvy lawyer or advisor to help.”

- “Do not share seed phrases in email, text, or random websites promising recovery.”

You can think of this as the “Meet Joe Black” note to your future self and your family—the part the lawyers and accountants usually skip, but the humans desperately need.

6. Make It an Annual Habit: “Death and Taxes Day”

Finally, turn this into a ritual.

Once a year—when you do your taxes:

- Update your asset inventory (including new wallets, protocols, or accounts).

- Check that your inheritance mechanism (social recovery / Shamir / multi-sig / tool of choice) still works and still involves the right people.

- Revise your instructions and wishes if relationships or holdings have changed.

You don’t need to obsess over it all year. Just pair it with something you’re legally forced to do anyway.

If death and taxes are unavoidable, you might as well hijack tax day to make death a little less chaotic for the people you love.

Why This Matters More Each Year

Every year:

- More of your net worth migrates from the physical world to the digital one.

- More platforms, protocols, and wallets come into your life.

- More of your story—photos, messages, creations, IP—lives behind encrypted logins.

Failing to plan doesn’t just mean your family may pay more tax.

In the digital world, it means they may never even know what’s missing.

A thoughtful crypto and digital inheritance plan is:

- A financial decision (don’t burn assets by neglect)

- A security decision (don’t leak secrets prematurely)

- And above all, a love decision (don’t leave a puzzle no one can solve)

Tax season hands you the raw material for this plan every year. The next step is simply deciding:

“This is the year I stop pretending I’ll live forever—and I make sure my digital life is as well-organized for my heirs as it is for the tax office.”

If you’d like, I can now:

- Add a short intro blurb about Vault12 / your product as the “how” piece

- Turn this into a shorter LinkedIn version or an email newsletter

- Or create a 5-point checklist graphic you can use as a lead magnet: “Turn Tax Time Into Crypto Inheritance Time”

Where there's a Will, there's a way

How to protect your Digital Legacy

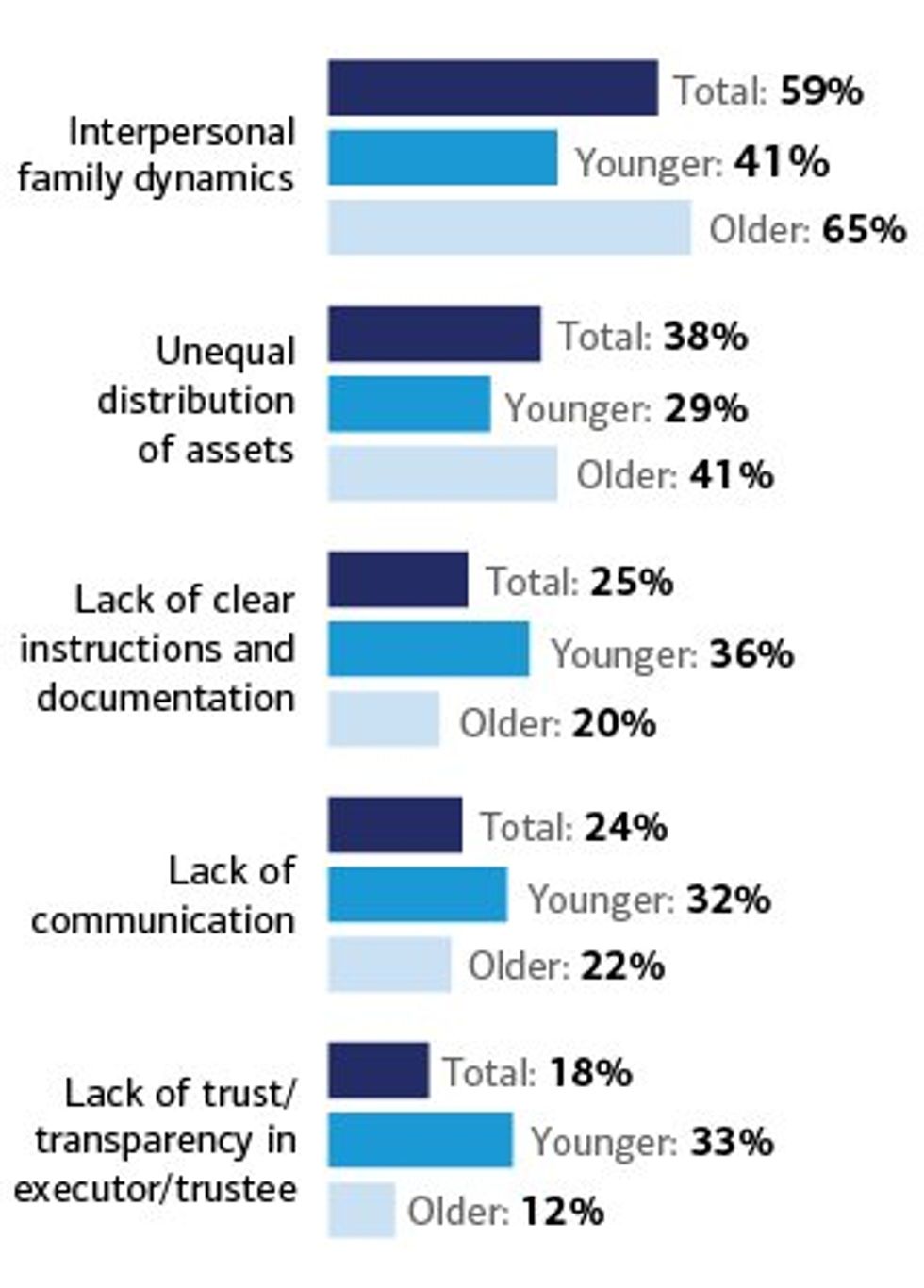

Many topics in life are difficult to discuss. Uncomfortable truths are often more easily brushed aside and ignored than discussed. The reality is that this doesn’t fix the issue. Although it can be difficult, it is essential to have open and honest conversations, especially with those closest to you. Being on the same page when it comes to these tough conversations often results in much better overall outcomes than ignoring them and hoping they go away.

One topic of particular difficulty for families to discuss is inheritance. The reasons for this are obvious. Nobody wants to think about losing their loved ones. It is one of the most painful experiences in this life. Not wanting to endure it more than one already has to in one lifetime is a completely understandable mindset.

The problem becomes that without a plan, families often find themselves in all sorts of predicaments that arise due to a lack of planning. Without having the conversation, children often don’t know what they even stand to inherit from their parents. When an inheritance comes as a surprise, it is even more difficult to know what to do with it.

Where there's a Will, there's a way

If you have never had a discussion with your core family about an inheritance plan, you probably aren’t super keen to start discussing their or your untimely demise over a casual dinner.

One major reason that people don’t set a plan is that inheritance doesn’t come up easily in conversation. It is simpler not to make others uncomfortable, as well as not to address the uncomfortable truth of one’s own mortality. Furthermore, unless someone has had the experience of having someone close to them pass away before, they likely don’t have the context for how the process of distributing assets to next of kin works and why it is so important to create a plan.

The law surrounding what happens to assets without a legally binding will from the deceased varies from one country to another, but the process of claiming assets without a will is messy at best, no matter where you go. The assets can end up getting tied up for months, sometimes years, and there are instances of people not inheriting their loved one’s wealth at all due to the lack of a will naming them the heir.

Willing assets to next-of-kin is already a painful enough process without having to combat outside parties, including the possibility of your own government, to obtain what you should have been rightfully entitled to from your loved one. As painful as it can be to think about losing a loved one, creating a legally binding will is a great first step to ensuring that there is some type of plan that can be carried out should the unthinkable happen.

Stick to the Plan

In addition to the grief that comes from losing a loved one, there are a great deal of practical expenses that come up when someone passes away. Ideally, these things are already covered through some plan in the will, allowing those closest to the departed to grieve instead of frantically coming up with thousands to cover end-of-life expenses while they’re in distress from losing their loved one to begin with.

Even with a will, there is no guarantee that the recipient of this windfall of assets is going to know what to do with them. The first step is to ensure that while expenses are covered, the family doesn’t transition their grief into a massive spending spree from receiving a windfall of assets. In many instances, inheritance is the largest individual wealth increase that a person will experience in their life, and it can be overwhelming to suddenly have significantly more money and borrowing power at your fingertips.

Fortunately, the ability to immediately access assets can vary greatly, depending on the liquidity of the asset class being inherited. It is not simple to turn around and sell a home, for example, but it can be fairly easy to unload stocks, bonds, and crypto, given the liquidity of the market. Avoiding the pitfall of liquidating everything is a step that many struggle with, and it isn’t easy to accomplish on your own, especially given the severity of emotions in this moment of life.

If this isn’t enough, there are also major tax concerns when it comes to inheritance, which vary based on geographical location. Again, unless they’ve had the great misfortune of going through the process previously, it is not very likely that the average person is an expert in tax law regarding willed assets and inheriting wealth. Without proper planning, wealth that should be going to the next of kin of the deceased can end up being paid in unnecessary taxes instead.

Inheritance management advisors can help with this issue. Not only do these experts have a lot of experience being a supportive presence for grieving families, but they also have the benefit of being well-versed in how to maximize the impact of an inheritance to help the family going forward.

Additional Considerations

An initial meeting with an expert in inheritance can make a world of difference in how solidified your plan is for when the worst happens to you or your loved ones. The professional advisor likely has years of experience in having discussions about wealth and estate planning, and can help to overcome the initial hesitancy regarding the difficult topic of death.

Your planning professional will also know local inheritance tax law and can help to create a structure that allows you or your loved one to give as much of the wealth that has been accumulated to whomever you desire, instead of having to pay an unnecessary amount to the government. Of course, it is best to follow the law and to pay the necessary taxes to avoid even further headaches when mourning a loved one, but few people would sign up for more of their wealth going to their government than to their own family, friends, or charitable causes.

In addition to tax planning, a proper plan will also help to create a route forward for the assets in question once they’ve been passed along. There is not necessarily a “right” answer to what should be done with the inheritance, but meeting short-term goals while ensuring longevity of the wealth to benefit the family without burning through it all is a balance that is easier struck by an unbiased third party than from within the familial unit.

Experts should be well-versed in the asset class or classes that are being passed on. There are so many different types of assets, especially today, that everyone can’t be an expert on every type of asset class or market. Ideally, the initial meeting with an estate planning professional can help identify what types of assets you or your loved one owns, what the plan is for those assets, and how comfortable the advisor is with planning around these types of assets. A good professional will assist in their own areas of expertise and have a network of experts in areas that they’re less familiar with to consult with or outsource management services to on behalf of clients.

With the emergence of blockchain technology, wealth has started being accumulated in digital assets over the course of the last decade and a half. While most asset custodians execute the beneficiary wishes of their customers on their behalf, digital assets can be self-custodied.

A plan for digital asset inheritance management should be conducted with a company like Vault12, who have experts in blockchain and crypto technology. This can be done in addition to planning for non-digital assets, which a traditional estate planner would likely have more experience with up to this point in their career.

If you or a loved one is involved in blockchain and digital assets, it can be too easy to misplace or lose access to wealth that exists on the blockchain without a proper plan. Instead of panicking during an already traumatizing event, consider reaching out to Vault12 for a consultation to discuss creating a wealth management plan.

Digital Inheritance with Vault12

How it Works

Vault12 Releases Open-Source Capacitor Plugin for Quantum-Safe Data Storage

Production-proven Shamir’s Secret Sharing now available for iOS, Android, and Web apps

Miami, FL – December 2, 2025 – Vault12, Inc., the pioneer of crypto inheritance, today announced the open-source release of the Shamir Secret Sharing plugin for Capacitor, a new plugin for the Capacitor framework that enables app developers to add quantum-safe data storage for iOS, Android, and web applications using Shamir’s Secret Sharing.

The Shamir Secret Sharing plugin for Capacitor plugin brings information-theoretic security—protection based on mathematical impossibility rather than computational difficulty—directly into modern, cross-platform app stacks. By splitting sensitive data into multiple cryptographic shards, developers can eliminate single points of failure and build applications that remain secure even in a post-quantum world.

This plugin has already been battle-tested in production for a decade on almost a million iOS and Android devices, as a core component of Vault12 Guard, a mobile app that provides decentralized backup, and inheritance for crypto wallets and other sensitive data.

“Developers building self-custody and high-assurance apps need tools that won’t break the moment quantum computing becomes practical. With the Shamir Secret Sharing plugin for Capacitor, we’re making the same Shamir’s Secret Sharing engine that powers Vault12 Guard available to anyone building the next generation of secure, user-controlled applications.”

— Blake Commagere, Co-founder and COO, Vault12

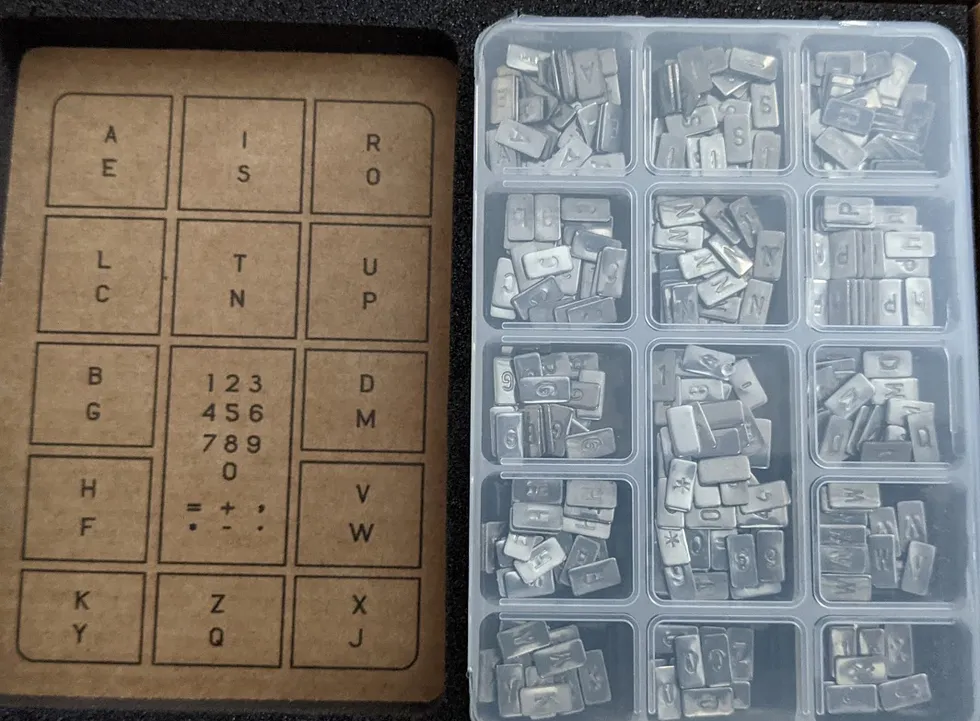

Shamir’s Secret Sharing (SSS), originally devised by Adi Shamir (the “S” in RSA), allows a secret to be mathematically split into multiple shares, with a configurable threshold required to reconstruct it. Individual shares reveal nothing about the underlying secret, ensuring that no single compromise exposes user data.

Capacitor is an open-source, cross-platform native runtime that lets developers build iOS, Android, and web apps from a single modern JavaScript/TypeScript codebase. It provides a consistent API and plugin system to bridge web frameworks (React, Vue, Angular, etc.) with native device capabilities such as secure storage, biometrics, and the filesystem.

Key features of the Shamir Secret Sharing plugin for Capacitor plugin include:

- Quantum-resistant security using Shamir’s Secret Sharing with information-theoretic guarantees

- Cross-platform support for iOS, Android, and Web via Capacitor

- Flexible storage options, including memory-based and filesystem-based operations

- Progress tracking for long-running operations and large files

- Robust recovery, supporting reconstruction of complete secrets or individual shards

- Production-proven reliability, already protecting high-value digital assets for Vault12 Guard users

Developers can access the source code, documentation, and implementation examples on GitHub: https://github.com/vault12/capacitor-shamir

About Vault12 Guard Crypto Inheritance

Video: Introducing Digital Inheritance

About Vault12

Founded in the United States over a decade ago, Vault12 is dedicated to solving crypto inheritance challenges through quantum-safe encryption and decentralized social custody. The company is venture funded, including investments from Winklevoss Capital, Naval Ravikant, Data Collective, and True Ventures. Vault12 Guard is available in the Apple App Store and Google Play store.

For media inquiries, please contact: Wasim Ahmad media@vault12.com

Quantum-safe Data Storage for App Developers with Open-Source Shamir Secret Sharing for Capacitor

Production-proven Shamir’s Secret Sharing Capacitor Plugin now available for iOS, Android, and Web apps

How to build quantum-resistant apps with the Shamir Secret Sharing plugin for Capacitor?

The future of computing is knocking at our door. Quantum computers promise to revolutionize industries, solve impossible problems, and, unfortunately, break most of the encryption that protects our digital lives today.

This is where the Shamir Secret Sharing plugin for Capacitor plugin becomes your secret weapon for building truly resilient and secure apps.

What is Capacitor by Ionic?

Capacitor is an open-source, cross-platform native runtime that lets developers build iOS, Android, and web apps from a single modern JavaScript/TypeScript codebase. Created by the team behind Ionic, it provides a consistent API layer that bridges web technologies (like React, Vue, Angular, or vanilla JS) with native device capabilities such as secure storage, biometrics, filesystems, and more. Through its plugin system, Capacitor allows both first-party and community plugins—like Shamir Secret Sharing plugin for Capacitor—to expose powerful native functionality in a way that feels natural to web developers, enabling high-performance, production-grade apps without sacrificing the speed and flexibility of a web-based stack.

What are the challenges of Self-Custody?

We're witnessing a fundamental shift in how people think about their digital assets and personal data. From crypto wallets to personal health records, users increasingly want control over their own information. They don't want to trust centralized services with their most sensitive data.

But self-custody creates a terrifying problem: what happens when someone loses their phone, forgets their password, or worse—their device gets stolen? Traditional backup solutions force users to trust third parties or create single points of failure.

The Shamir Secret Sharing plugin for Capacitor plugin solves this elegantly by eliminating the need for any single point of trust or failure.

What is the mathematics behind Shamir's Secret Sharing?

Shamir's Secret Sharing reads like something from a cryptography fairy tale. Invented by Adi Shamir (the "S" in RSA encryption), this algorithm takes any secret and mathematically divides it into pieces called shards.

Here's where it gets beautiful: you can lose some shards and still recover your secret perfectly. Need 3 shards to reconstruct your data? Generate 5 shards and distribute them to trusted friends or devices. Even if 2 shards disappear forever, you can still recover everything.

But the real magic happens in what cryptographers call "information-theoretic security." Each individual share reveals absolutely nothing about your secret. Not a single bit of information leaks, no matter how powerful the computer trying to crack it.

This isn't just computationally difficult to break—its mathematically impossible. Even with unlimited processing power, an attacker with insufficient shards learns nothing. The mathematics guarantee this, not the limitations of current technology.

How do you Future-proof against quantum threats?

Most encryption today relies on mathematical problems that are hard for classical computers to solve. Factoring large prime numbers takes classical computers thousands of years. Quantum computers could solve these same problems in hours.

Shamir's Secret Sharing takes a completely different approach. Its security doesn't depend on computational difficulty—it depends on mathematical impossibility. Think of it like trying to solve an equation with fewer values than unknowns. There are infinite equally valid solutions, making it impossible to determine which one is correct.

This information-theoretic approach means quantum computers offer no advantage to attackers. The underlying mathematics remain just as secure whether facing classical computers, quantum computers, or hypothetical super-quantum computers that might emerge decades from now.

Your applications built with the Shamir Secret Sharing plugin for Capacitor today will remain secure through whatever computing revolution comes next.

How can you Fault-proof your apps through distribution

Traditional security models create single points of failure. Lose your password manager database? Everything's gone. Company servers get compromised? Your data's exposed. Phone gets stolen? Access to your accounts vanishes.

Shamir's Secret Sharing flips this model entirely. Instead of protecting one critical thing perfectly, you distribute security across multiple independent channels. Each share can live in a different place:

- One share encrypted by your phone's secure enclave

- Another with a trusted friend or family member

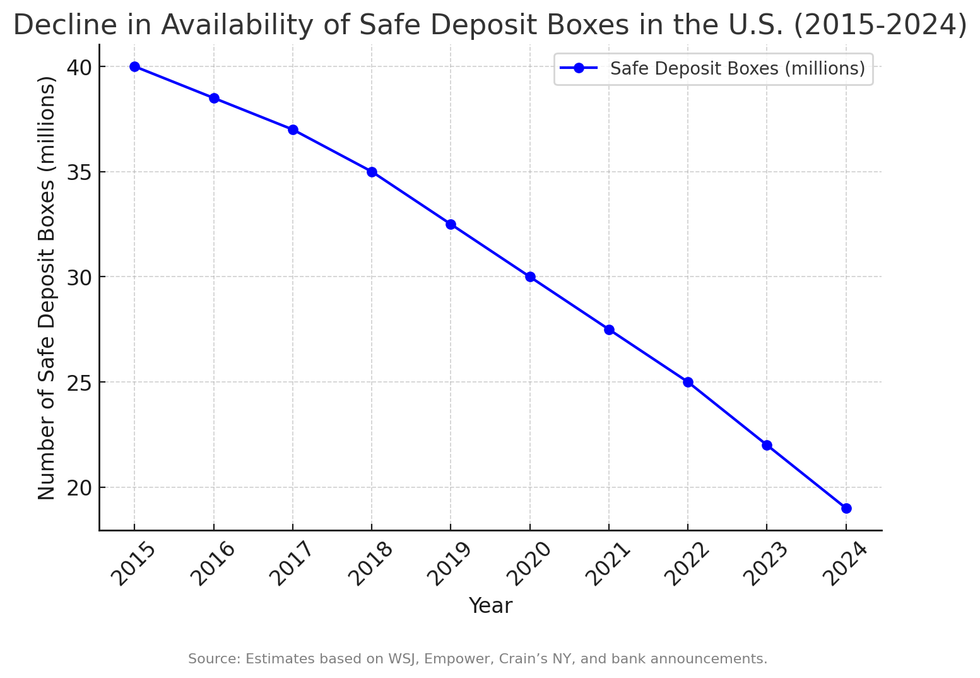

- A third is stored in a safety deposit box

- Additional shards distributed to other devices or locations

The threshold system means you're protected against multiple simultaneous failures. Device breaks? Friend moves abroad? Safety deposit box becomes inaccessible? Your system keeps working because no single failure can compromise your security.

This distributed approach creates applications that become more resilient as they scale, not more vulnerable.

What are Common Use Cases for the Shamir's Secret Sharing Capacitor Plug-in?

The Shamir Secret Sharing plugin for Capacitor plugin provides the foundation, but imagination determines the possibilities. Consider these emerging use cases:

Family digital inheritance becomes possible when crypto seeds or important documents are shared across trusted family members. Parents can ensure their digital assets transfer smoothly without exposing sensitive information during their lifetime. That's what the Vault12 Guard app does by using Shamir Secret Sharing plugin for Capacitor.

Collaborative authentication allows teams to protect shared resources without any single administrator having complete control. Critical business systems require multiple people to authorize changes, preventing both external attacks and insider threats.

Progressive disclosure enables applications that reveal information only when specific conditions are met. Legal documents that unlock automatically when multiple parties agree, or time-locked messages that require distributed consent to access early.

Redundant backup systems can store encrypted application state across multiple cloud providers, user devices, and physical locations. Users never lose access to their data, but no single provider ever has complete information.

The plugin's cross-platform nature—supporting iOS, Android, and web—means these experiences work seamlessly across all user devices and contexts.

How has the Shamir's Secret Sharing Capacitor Plug-in been tried and tested in commercial apps?

The convergence of quantum computing, increased privacy awareness, and demand for user-controlled applications creates unprecedented opportunities for developers who think ahead.

Applications built with traditional security models will face obsolescence as quantum computers emerge. Centralized platforms will struggle as users demand true ownership of their data. Single points of failure will become unacceptable as digital stakes continue rising.

But developers using Shamir Secret Sharing plugin for Capacitor can build applications that thrive in this new landscape. Your users get genuine self-custody without sacrificing usability. Your architecture becomes more resilient as it scales. Your security improves as computing power increases rather than becoming more vulnerable.

The plugin abstracts away the complex mathematics and cross-platform implementation details. You get enterprise-grade Shamir's Secret Sharing through simple TypeScript interfaces, letting you focus on creating innovative user experiences rather than cryptographic implementation.

How can you start using the Shamir's Secret Sharing Capacitor Plug-in?

Quantum computers won't wait for our applications to catch up. User expectations for data ownership and privacy continue accelerating. The developers who start building quantum-resistant, fault-proof applications today will define the next generation of digital experiences.

The Shamir Secret Sharing plugin for Capacitor plugin gives you the tools. The mathematical foundations are unshakeable. The production validation is complete. The cross-platform compatibility ensures a broad reach.

What remains is the most exciting part: imagining and building the resilient, user-empowering applications that will define computing's next chapter. The future belongs to developers who understand that true security comes not from building higher walls, but from removing single points of failure entirely.

Your users are ready for applications they can truly trust. The technology is ready to support your vision. The question is: what will you build?

Using the Shamir Secret Sharing plugin for Capacitor - Github: https://github.com/vault12/capacitor-shamir

What is Shamir's Secret Sharing?

Shamir's Secret Sharing is a cryptographic algorithm that divides a secret into multiple parts (shards), where a minimum threshold of shards is required to reconstruct the original secret. This ensures that:

- No single shard reveals any information about the secret

- Any threshold number of shards can reconstruct the secret

- Security through distribution - store shards separately for maximum security

What are the Security Concepts behind Shamir's Secret Sharing?

Shamir's Secret Sharing provides information-theoretic security, which means the algorithm is mathematically proven to be unbreakable regardless of computational power. Key security advantages:

- Quantum Resistance: Security relies on mathematical impossibility rather than computational complexity, remaining secure against quantum computers

- No Key Management: There is no single master key to rotate or protect; instead, security hinges on distributing and safeguarding the individual shards

- Mathematical Foundation: Based on polynomial interpolation over finite fields, where reconstructing the secret without sufficient shards is mathematically impossible, not just computationally difficult

What are the features of Shamir's Secret Sharing Capacitor Plug-in?

- Secure Secret Splitting: Split sensitive data into encrypted shards using Shamir's Secret Sharing

- Cross-Platform: Native support for iOS, Android, and Web

- Flexible Storage: Memory-based and filesystem-based operations

- Progress Tracking: Real-time progress callbacks for all operations

- Performance Optimized: Efficient handling of large files and data

- Recovery Options: Restore complete secrets or individual shards

What are examples of Real-World Usage?

This plugin has already been battle-tested in production for a decade on almost a million iOS and Android devices, as a core component of Vault12 Guard, a mobile app that provides decentralized backup, and inheritance for crypto wallets and other sensitive data.

More information is at Github: https://github.com/vault12/capacitor-shamir

Vault12 Guard Adds Support for Apple’s New Credential Exchange Protocol (CXP), Enabling Inheritance of your Passwords, Simply and Securely

Miami, FL – November 19, 2025 – Vault12, Inc., the pioneers of crypto inheritance and decentralized backup, today announced that Vault12 Guard™ now supports Credential Exchange Protocol (CXP), giving iPhone, iPad, and Mac users a secure, standardized way to move their passwords and passkeys into their inheritance Vault to protect their digital legacy.

With this update, anyone running iOS 26, iPadOS 26, or macOS 26 can securely import logins, passkeys, verification codes, and even Wi-Fi credentials directly from Apple Passwords, Bitwarden, and other compatible managers into Vault12 Guard—without exporting files or manually copying data. The transfer happens through an OS-controlled flow that maintains encryption between the source app and Vault12 Guard.

“Credential portability has finally arrived. By plugging into the CXP standard, Vault12 Guard becomes a neutral, long-term backup and inheritance hub for all your critical credentials—not just crypto seed phrases.”

— Wasim Ahmad, Chief Crypto Officer, Vault12

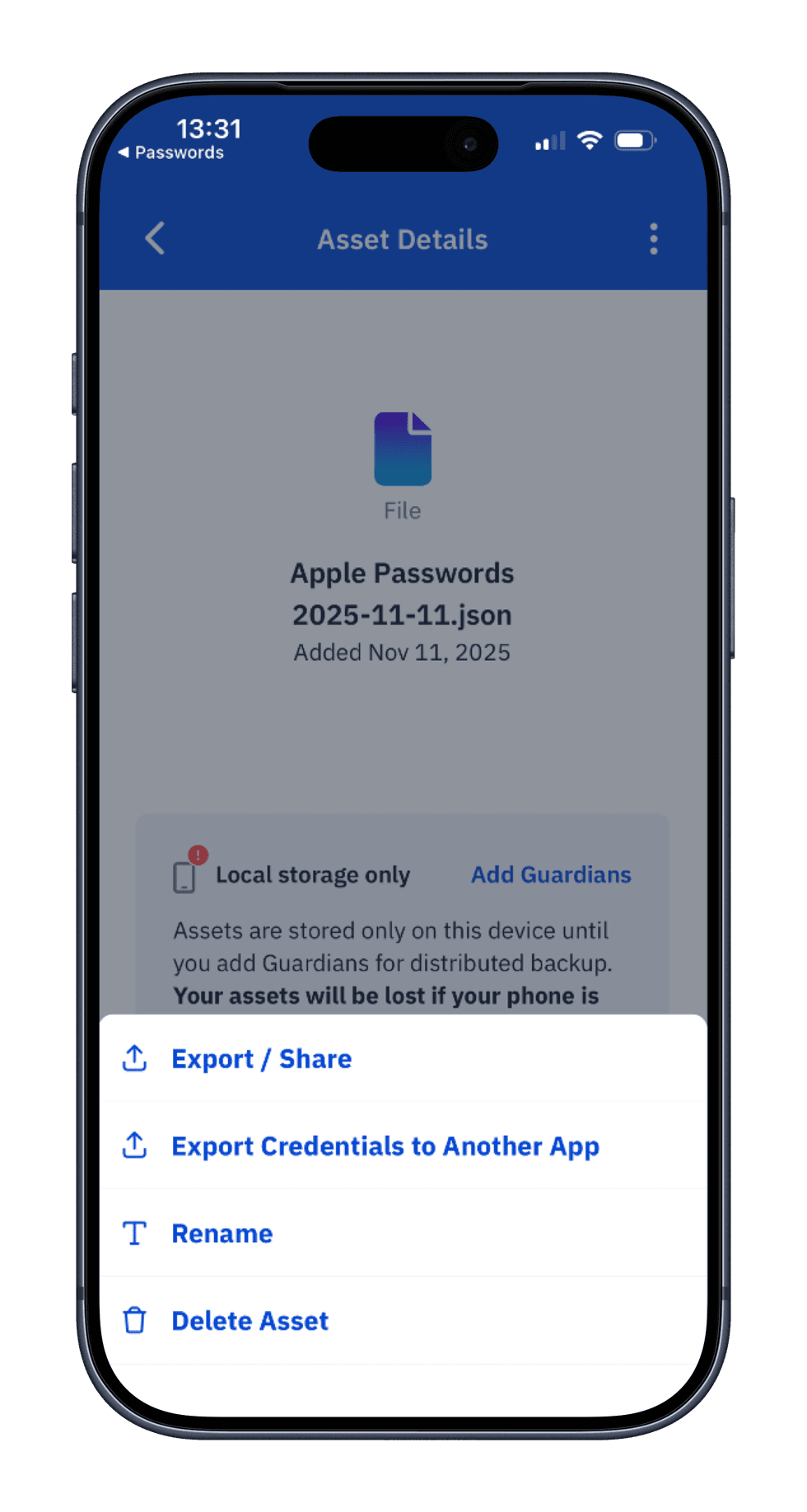

Once inside Vault12 Guard, credentials are:

- Protected by Guardians – Encrypted, split, and stored across trusted people and devices rather than a single cloud provider - even if you lose your phone.

- Inheritance-ready – Integrated with Vault12’s digital inheritance flows so beneficiaries can recover essential logins and other digital assets.

- Future-proof and portable – Users or beneficiaries can later export their credential bundle from Vault12 Guard back into any compatible password manager that supports the same standard.

A detailed walkthrough of how to import and export credentials using CXP and Vault12 Guard is available in the latest blog post on the Vault12 website (vault12.com)

About Crypto Inheritance

Video: Introducing Digital Inheritance

About Vault12

Founded in the United States over a decade ago, Vault12 is dedicated to solving crypto inheritance challenges through quantum-safe encryption and decentralized social custody. The company is venture funded, including investments from Winklevoss Capital, Naval Ravikant, Data Collective, and True Ventures. Vault12 Guard is available in the Apple App Store and Google Play store.

Media Contact: Wasim Ahmad media@vault12.com

Vault12 Guard now imports your iOS Credentials from Apple Password and other Password Managers

Vault12 Guard now supports Apple’s new Credential Exchange Protocol (CXP), making it much easier to bring your existing credentials into your inheritance Vault.

How to Move Your Passwords, Passkeys, and Codes Between Your Password Manager and Vault12 Guard?

With the latest Vault12 Guard release, effortless password backups are no longer just for crypto and seed phrases — you can now bring in your logins, verification codes, passkeys, and even Wi-Fi credentials from Apple Passwords and major third-party managers (like Bitwarden), store them in your decentralized Vault, and export them back into any compatible app later if you ever need to move or recover. This works on iPhone, iPad, and Mac running iOS 26, iPadOS 26, and macOS 26.

Vault12 Guard now supports Apple’s new Credential Exchange Protocol (CXP), making it much easier to bring your existing credentials into your inheritance Vault. CXP is a new industry standard designed for the secure transfer of passkeys and passwords between compatible apps and platforms—so instead of manually copying details or re-creating accounts, you can move them directly and safely into Vault12 Guard.

With iOS 26, Apple is the first major platform to roll out CXP, opening the door to real credential portability and user choice. Thanks to our integration, iPhone users now have a secure, standardized way to import passkeys from other password managers and platforms into Vault12 Guard, while keeping everything encrypted and under their control.

Why back up your credentials in Vault12 Guard?

When you bring credentials into Vault12 Guard, they’re protected like any other high-value asset:

- Decentralized protection with Guardians

Your credentials are encrypted, split, and stored across your chosen Guardians (trusted people or your own devices), not in a single cloud account or server. - Inheritance-ready by design

Through Vault12 Digital Inheritance, your beneficiary can recover critical logins and keys when Guardians approve an inheritance request—using the same audited restore flow already documented for other assets. - No vendor lock-in

Because Vault12 Guard uses the same system-level transfer mechanism as Apple Passwords and leading managers like Bitwarden, you can always export your credentials back into another app later.

We strongly recommend having active Guardians configured before importing, so your credential backup is both secure and recoverable.

What is needed to import your passwords into Vault12 Guard?

- Vault12 Guard updated to the latest version on iOS 26 / iPadOS 26 / macOS 26.

- A password manager that supports the new secure export flow, such as:

- Apple Passwords

- Bitwarden

- Other compatible apps as they roll out support over time.

How are Passwords transferred into and out of Vault12 Guard?

Apple’s Credential Exchange capabilities in iOS 26, iPadOS 26, and macOS 26 introduce a standardized, OS-controlled way for credential apps to talk to each other securely.

At a high level:

- The export always starts in the app that currently holds your data (Apple Passwords, Bitwarden, etc.).

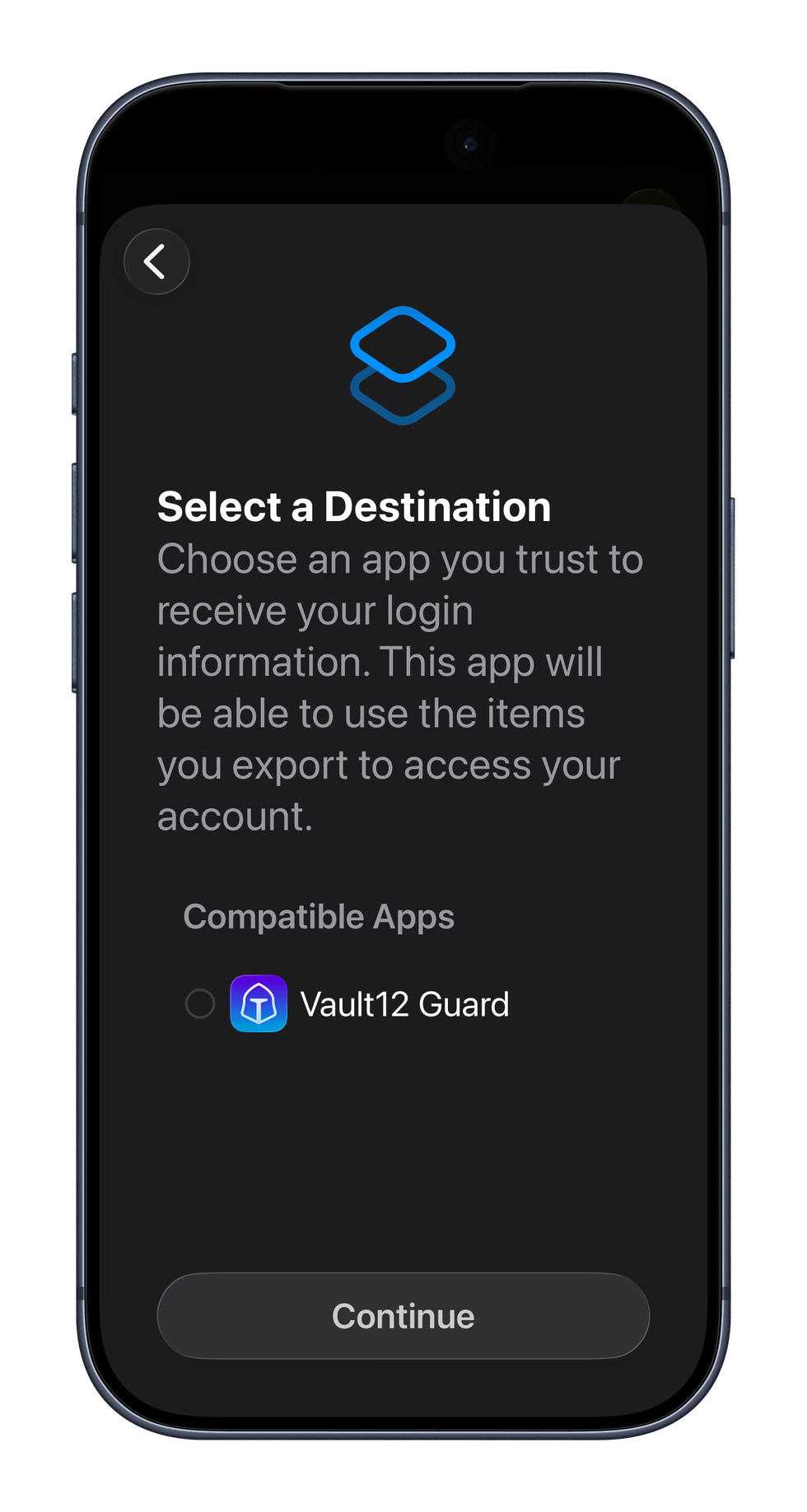

You choose an option like “Export data to another app” / “Move to another password app”. - The system shows a list of compatible destination apps (including Vault12 Guard).

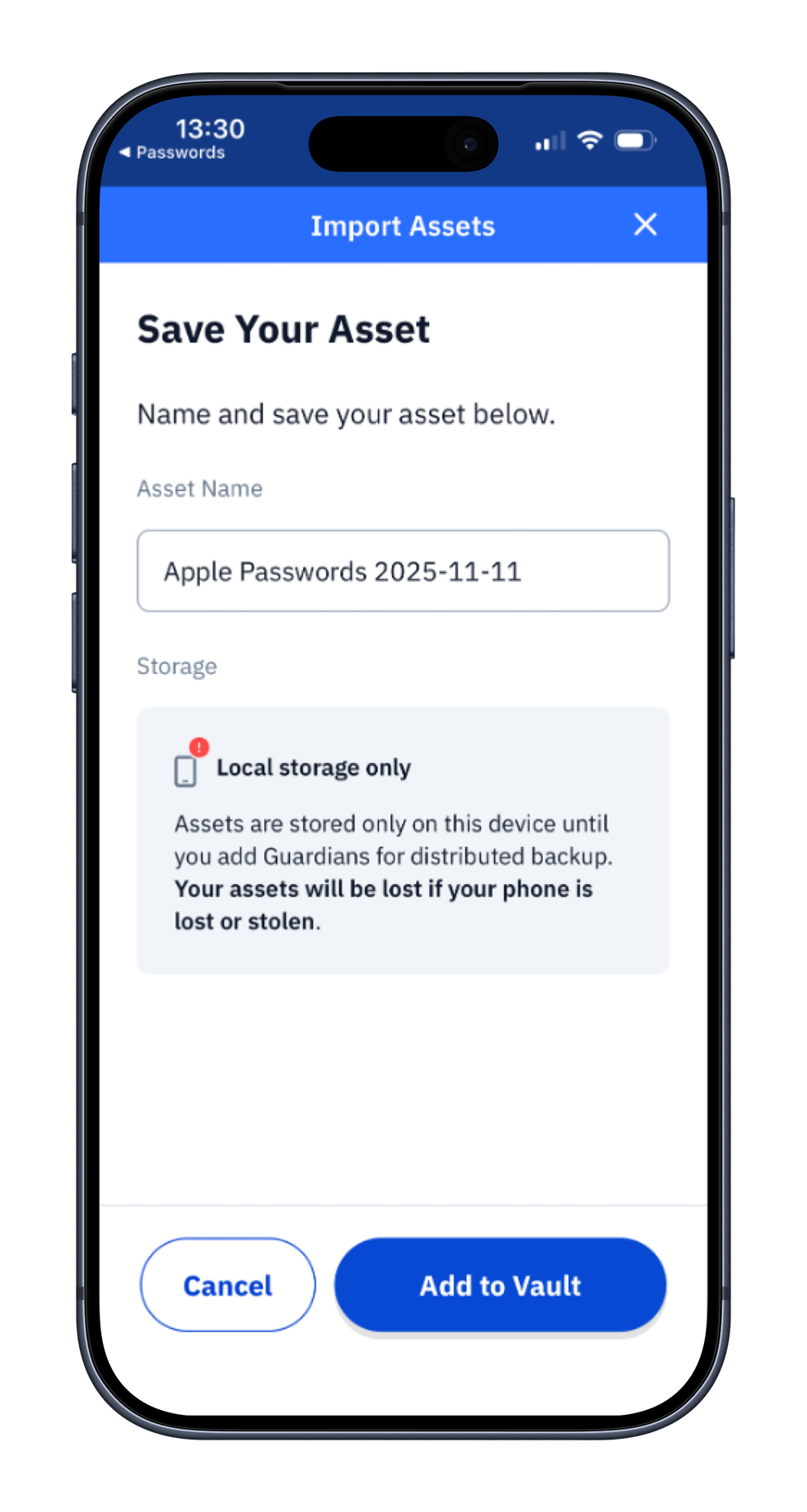

- Once you select Vault12 Guard, the OS:

- Packages the selected credentials (logins, passkeys, verification codes, and, where supported, Wi-Fi details),

- Sends them directly and securely to Vault12 Guard,

- Ensures only the chosen destination app can read them.

No manual juggling, no generic file exports in this flow—just a controlled, encrypted handoff mediated by the operating system and the participating apps.

Vault12 Guard simply plugs into this mechanism as a secure backup & inheritance destination (and as an export source), instead of inventing its own incompatible format.

How do I import passwords into Vault12 Guard?

Use this when you want Vault12 Guard to serve as your resilient backup for credentials stored elsewhere.